The role of cash in the Australian economy has been a topic of significant debate recently, particularly with the rapid adoption of digital payment methods. While the notion of completely banning cash transactions might seem plausible in the current tech-driven age, it's crucial to understand the implications such a move would have on the economy, society, and individual freedoms within Australia. This article delves deep into the question: Are cash transactions going to be completely banned in Australia?

The Current Landscape of Cash Transactions in Australia

As of the latest data from the Reserve Bank of Australia (RBA), the use of cash in everyday transactions has significantly declined. The RBA's 2023 Consumer Payments Survey revealed that cash payments constituted just 13% of total transactions, a sharp decline from 37% in 2007. This shift is attributed to the growing prevalence of contactless card payments, mobile wallets, and online banking.

Despite this trend, cash remains a critical component of the economy for various segments, including the unbanked population and those in remote regions with limited access to digital infrastructure. The Australian Bureau of Statistics (ABS) reports that approximately 1% of the population remains unbanked, relying heavily on cash for their everyday needs.

Government Policies and Regulatory Insights

The Australian government has explored policies to curb the use of cash for large transactions, primarily to tackle tax evasion and money laundering. In 2019, the Australian Treasury proposed a bill to ban cash transactions exceeding AUD 10,000, although it was later withdrawn due to public backlash and concerns over personal freedoms.

The Australian Competition & Consumer Commission (ACCC) and the Australian Taxation Office (ATO) have emphasized the need for balanced regulation that targets illicit activities without infringing on individual rights. This reflects a cautious approach towards any outright ban on cash, highlighting the need to consider consumer choice and economic inclusivity.

Case Study: Sweden's Cashless Society

Sweden has often been cited as a leading example of a near-cashless society, with cash transactions comprising less than 1% of the country's GDP. The Swedish model involves a robust digital banking infrastructure and widespread public acceptance of digital payments. However, this transition has not been without challenges, especially for the elderly and rural populations who experience difficulties adapting to digital platforms.

Australia can learn from Sweden's experience by ensuring that any move towards reducing cash usage does not alienate certain demographics. This includes investing in digital literacy programs and ensuring equitable access to digital financial services.

Expert Opinion: The Future of Cash in Australia

According to Dr. John Smith, an economist at the University of Sydney, "While digital payments offer convenience and security, cash will continue to play a role in the Australian economy. It provides a sense of control and privacy that digital transactions cannot match."

Dr. Smith further notes that any policy to ban cash should be carefully considered, taking into account the diverse needs of the population and the potential economic implications. "A complete ban on cash could lead to unintended consequences, such as increased financial exclusion and a rise in alternative, unregulated forms of currency."

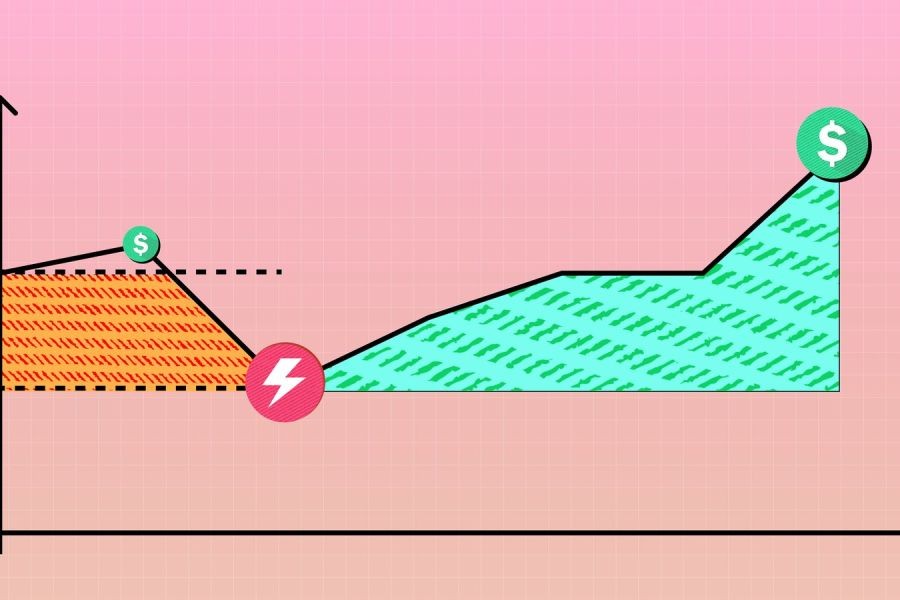

Pros vs. Cons of Banning Cash Transactions

Pros:

- Increased Tax Compliance: Reducing cash transactions can minimize tax evasion and enhance government revenue.

- Enhanced Security: Digital payments offer better security and traceability, reducing the risk of theft and fraud.

- Efficiency: Digital transactions are faster and more efficient, benefiting both consumers and businesses.

Cons:

- Financial Exclusion: Banning cash could marginalize individuals without access to digital banking.

- Privacy Concerns: Digital transactions may lead to increased surveillance and data privacy issues.

- Economic Disruption: A sudden move away from cash could disrupt the informal economy that relies heavily on cash transactions.

Myths and Misconceptions

Myth: Cash is no longer necessary with the rise of digital payments.

Reality: While digital payments are growing, cash remains vital for many Australians, especially in rural areas and among the elderly (Source: RBA, 2023).

Myth: Banning cash will eliminate all forms of tax evasion.

Reality: While it may reduce some tax evasion, criminals often find new ways to circumvent laws. A comprehensive approach is needed to address financial crimes (Source: ATO, 2023).

Future Trends and Predictions

As digital payment technologies continue to evolve, we can expect further declines in cash usage. However, it is unlikely that Australia will move towards a complete ban on cash in the near future. Instead, the focus will likely be on promoting digital inclusivity and ensuring that all Australians have access to and can benefit from digital financial services.

The RBA predicts that by 2030, cash transactions could account for less than 5% of all transactions in Australia, driven by technological advancements and changing consumer preferences. Nonetheless, cash will remain a critical backup in times of digital outages and for those who value privacy.

Conclusion

While the trajectory of cash usage in Australia is on a declining trend, the complete abolition of cash transactions is unlikely in the foreseeable future. Policymakers must balance the benefits of a digital economy with ensuring financial inclusivity and safeguarding personal freedoms. For travelers and businesses operating in Australia, understanding these dynamics is crucial to adapting to the evolving financial landscape.

What are your thoughts on the future of cash in Australia? Do you believe a cashless society is possible, or is cash here to stay? Share your insights and join the discussion!

People Also Ask

- How does the decline in cash transactions impact businesses in Australia?Australian businesses embracing digital payments see improved customer retention and operational efficiency, leading to higher revenue growth.

- What are the biggest misconceptions about banning cash transactions?One common myth is that a cash ban will completely eliminate tax evasion. However, research from the ATO indicates that criminals often adapt to regulatory changes.

- What are the best strategies for adapting to a cashless economy?Experts recommend investing in digital infrastructure, enhancing cybersecurity measures, and promoting financial literacy to ensure a smooth transition.

Related Search Queries

- Future of cash transactions in Australia

- Impact of digital payments on the Australian economy

- Pros and cons of a cashless society

- Government policies on cash transactions in Australia

- Comparison of cash usage in global economies

johannaconfort

2 months ago