Did you know that the Australian mortgage landscape is a complex web where unsuspecting borrowers might find themselves paying more than necessary? This isn't a coincidence but often the outcome of certain practices employed by some mortgage brokers. With the Reserve Bank of Australia (RBA) reporting consistent interest rate fluctuations, it's crucial for homebuyers to navigate these waters with informed caution. This article delves deep into how mortgage brokers in Australia can trick you into paying more and what you can do to safeguard your financial interests.

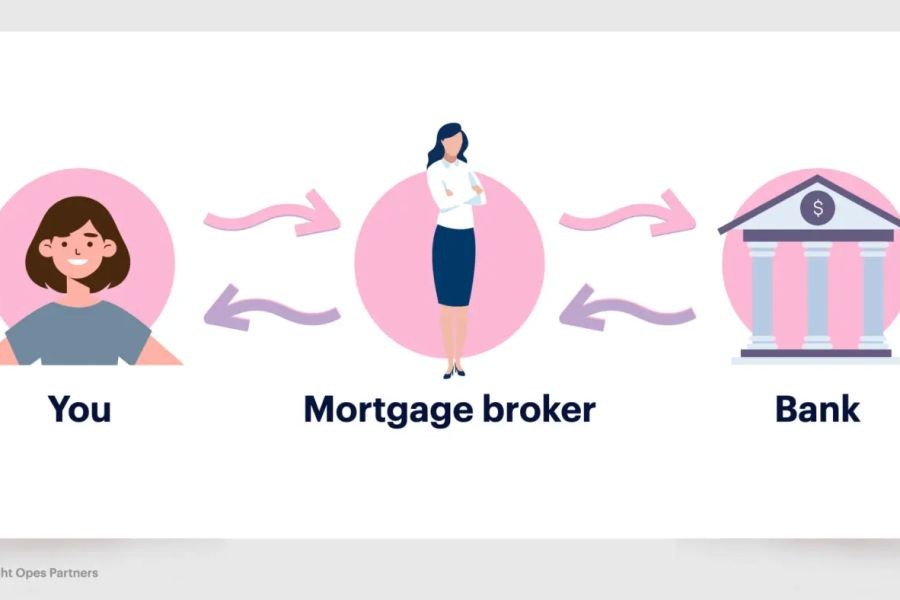

How It Works: A Deep Dive

The role of a mortgage broker is to act as an intermediary between borrowers and lenders, theoretically securing the best possible deal for their clients. However, some brokers have been known to engage in practices that benefit them financially while leaving borrowers at a disadvantage. Let's explore some common tactics:

1. Commission-Driven Advice

In Australia, mortgage brokers typically earn a commission from lenders for each loan they arrange. This can lead to a conflict of interest, where brokers might prioritize lenders that offer higher commissions over those offering better terms for the borrower. According to the Australian Securities and Investments Commission (ASIC), this commission-driven model can sometimes result in borrowers being steered towards more expensive loan products.

2. Misleading Comparisons

While brokers are supposed to present a range of options, they might highlight products with seemingly attractive features but higher long-term costs. For instance, a loan with a low introductory interest rate might seem appealing initially, but hidden fees and rate hikes can lead to increased payments over time.

3. Lack of Full Disclosure

Some brokers may not fully disclose all fees associated with a loan, including exit fees, establishment fees, or compulsory insurance. By omitting these details, borrowers can find themselves burdened with unexpected costs.

Risk and Reward Evaluation

Before engaging a mortgage broker, it's essential to weigh the potential risks and rewards. Here are some points to consider:

Pros of Using a Mortgage Broker

- Access to Multiple Lenders: Brokers have connections with a wide range of lenders, potentially offering options you might not find on your own.

- Time Savings: They handle much of the paperwork and negotiation, saving you time and hassle.

- Expertise: Brokers can provide valuable insights into the mortgage market, helping you make informed decisions.

Cons of Using a Mortgage Broker

- Potential for Bias: Some brokers may prioritize lenders offering higher commissions.

- Hidden Costs: Not all fees or loan conditions may be disclosed upfront.

- Limited Control: Relying on a broker means placing trust in their judgment, which may not always align with your best interests.

Real-World Case Study: The Pitfalls of Commission-Driven Advice

Case Study: Jane's Experience with a Mortgage Broker

Problem: Jane, a first-time homebuyer in Melbourne, was lured by a broker into a loan with an appealingly low introductory rate. However, she soon discovered that the rate would double after the first year, significantly increasing her monthly payments.

Action: Jane sought a second opinion from another broker, who provided a clearer breakdown of loan options. This time, she chose a fixed-rate loan with lower overall costs, despite a slightly higher initial rate.

Result: By switching loans, Jane saved approximately $15,000 over the loan's life. Her experience underscores the importance of understanding all loan elements before making a commitment.

Takeaway: This case illustrates the need for transparency and the value of seeking multiple opinions when dealing with mortgage brokers. It’s crucial to read the fine print and ask questions to avoid unexpected costs.

Common Myths & Mistakes

Myth vs. Reality

- Myth: All mortgage brokers have access to the same loan products. Reality: Different brokers have different lender affiliations, which can affect the range of products they offer.

- Myth: Lower interest rates always mean cheaper loans. Reality: Hidden fees and rate changes can make low-rate loans more expensive in the long run.

- Myth: Brokers are required to find the best deal for you. Reality: While brokers must act in the client’s best interest, they may still favor products that benefit them financially.

Mistakes to Avoid

- Ignoring the Fine Print: Always review loan terms, fees, and conditions thoroughly.

- Not Asking Questions: Clarify all aspects of the loan, including potential rate changes and fees.

- Relying on One Broker: Consult multiple brokers to compare options and ensure you’re getting the best deal.

Future Trends & Predictions

As the Australian mortgage market continues to evolve, several trends are emerging:

- Increased Regulation: The Australian Competition & Consumer Commission (ACCC) is likely to introduce stricter regulations to protect borrowers from misleading practices.

- Digital Platforms: The rise of digital mortgage platforms is set to offer borrowers more transparency and control over their loan choices.

- Consumer Awareness: As awareness grows, borrowers will become more discerning, demanding clearer information and better service from brokers.

Conclusion

To navigate the complexities of Australia's mortgage landscape, it's crucial to stay informed and vigilant. While mortgage brokers can be valuable allies in securing a loan, it's essential to approach each interaction with a critical eye. By understanding potential pitfalls and leveraging digital tools and multiple opinions, borrowers can ensure they’re making financially sound decisions. As the market continues to evolve, staying informed will be key to protecting your financial interests.

People Also Ask

- How can mortgage brokers in Australia affect your loan costs? Mortgage brokers may steer clients toward higher-cost loans due to commission incentives, impacting overall loan affordability.

- What are the signs of a trustworthy mortgage broker? Transparency in fees, a broad range of lender options, and a clear explanation of loan terms are indicators of a reliable broker.

- How can you ensure you're getting the best mortgage deal? Consult multiple brokers, compare loan options online, and thoroughly review all loan terms and conditions.

Related Search Queries

- Mortgage broker fees Australia

- How to choose a mortgage broker

- Best mortgage brokers in Sydney

- Mortgage broker vs. bank Australia

- Australian mortgage market trends 2025

- How to negotiate mortgage rates in Australia

- Mortgage broker commission rates Australia

- Benefits of using a mortgage broker

- Digital mortgage platforms in Australia

- Mortgage broker regulations Australia

alejandraparke

9 months ago