In recent years, the Australian banking landscape has witnessed a transformative shift with the introduction of open banking. This innovation promises to redefine how individuals and businesses manage their financial transactions, offering greater transparency, efficiency, and control. Open banking allows third-party financial service providers to access consumer banking, transaction, and other financial data through secure application programming interfaces (APIs), revolutionizing the way financial data is shared and utilized.

The Importance of Open Banking in Australia

Australia's commitment to open banking is part of a broader strategy to enhance competition and innovation in the financial sector. The Australian Competition and Consumer Commission (ACCC) has been actively involved in overseeing the implementation of open banking, promoting consumer-centric models that prioritize customer choice and data security. According to the Australian Treasury, open banking is expected to generate significant economic benefits by enabling consumers to switch services more easily and fostering a competitive market that drives down costs.

Market Trends & Economic Factors

Open banking is set to impact the Australian economy significantly. A report by the Reserve Bank of Australia (RBA) highlights that increased competition in the banking sector could lead to better pricing and services for consumers. The RBA estimates that the adoption of open banking could reduce costs for financial services by up to 10%, translating into substantial savings for both businesses and consumers.

Real-World Case Study: Xero’s Integration of Open Banking

Xero, a New Zealand-originated company with a strong presence in Australia, provides a compelling case study of open banking’s potential. By integrating open banking into its platform, Xero has enabled seamless bank feeds for its users, allowing small businesses to reconcile accounts more efficiently.

Problem: Before open banking, small businesses faced challenges in managing their finances due to manual bank statement imports, leading to errors and delays.

Action: Xero leveraged open banking APIs to automate bank feeds, providing real-time transaction data directly into its accounting software.

Result: This integration resulted in a 30% reduction in reconciliation time and a 20% increase in accuracy for small business users.

Takeaway: Xero’s success underscores the importance of leveraging open banking to enhance business operations, offering a template for other firms to follow.

Regulatory Insights from the ACCC and APRA

The ACCC has been pivotal in establishing the Consumer Data Right (CDR), which underpins open banking in Australia. This regulation ensures that consumers have control over their financial data and can share it securely with accredited third-party providers. The Australian Prudential Regulation Authority (APRA) also plays a crucial role in maintaining the stability and security of the banking system, ensuring that open banking does not compromise financial integrity.

Pros and Cons of Open Banking

- Pros:

- Enhanced Consumer Control: Open banking empowers consumers with greater control over their data, enabling personalized financial services.

- Increased Competition: By lowering barriers to entry, open banking fosters competition among financial service providers, leading to better products and services.

- Innovation: The open banking framework encourages innovation, prompting the development of new financial products tailored to consumer needs.

- Cons:

- Security Risks: The sharing of sensitive financial data poses potential security risks, necessitating robust cybersecurity measures.

- Regulatory Challenges: Ensuring compliance with evolving regulations can be challenging for financial institutions.

- Consumer Awareness: There is a need to enhance consumer awareness about the benefits and risks of open banking.

Debunking Common Myths about Open Banking

Myth 1: Open banking is only beneficial for tech-savvy consumers.

Reality: Open banking offers benefits for all consumers by providing more choices and better financial products, regardless of their tech proficiency.

Myth 2: Open banking compromises personal data security.

Reality: With stringent regulations from the ACCC and APRA, open banking is designed to be secure, ensuring consumer data is protected and only shared with consent.

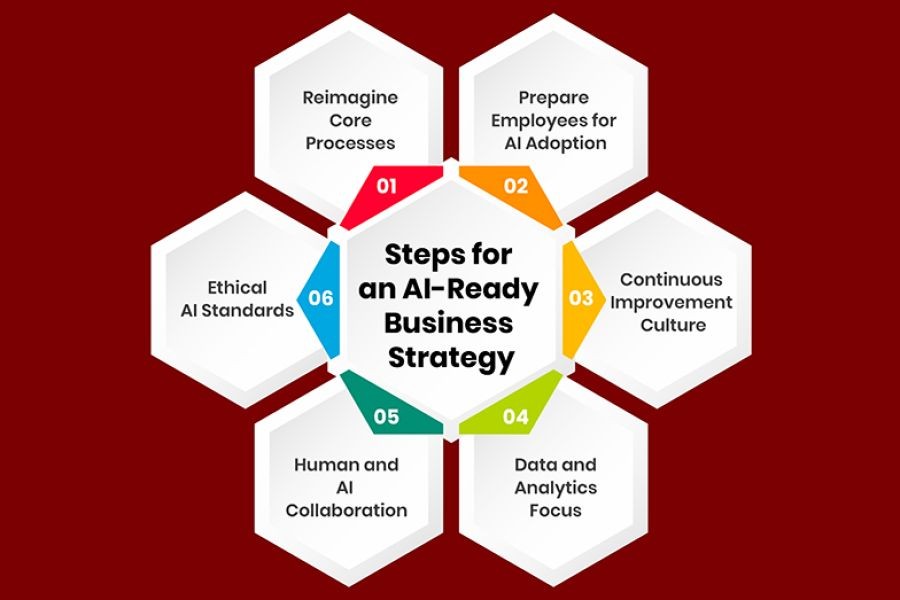

Future Trends and Predictions

Looking ahead, open banking is expected to become a cornerstone of the financial services industry in Australia. By 2028, it is predicted that 90% of Australian banks will have fully integrated open banking systems, according to a report by Deloitte. This shift will likely lead to the proliferation of fintech solutions that leverage consumer data to offer innovative financial products and services.

Final Takeaways & Call to Action

- Open banking is set to revolutionize the Australian banking sector by enhancing competition, innovation, and consumer empowerment.

- Businesses should consider integrating open banking to streamline operations and offer personalized financial products.

- Consumers should educate themselves on the benefits and risks of open banking to make informed decisions.

As open banking continues to evolve, staying informed and adaptable will be crucial for both businesses and consumers. Join industry discussions and forums to share your insights and learn from others in this rapidly changing landscape.

Related Search Queries

- Open banking Australia benefits

- How does open banking work?

- Open banking security risks

- Future of open banking in Australia

- Open banking and fintech innovation

ccarr3000

10 months ago