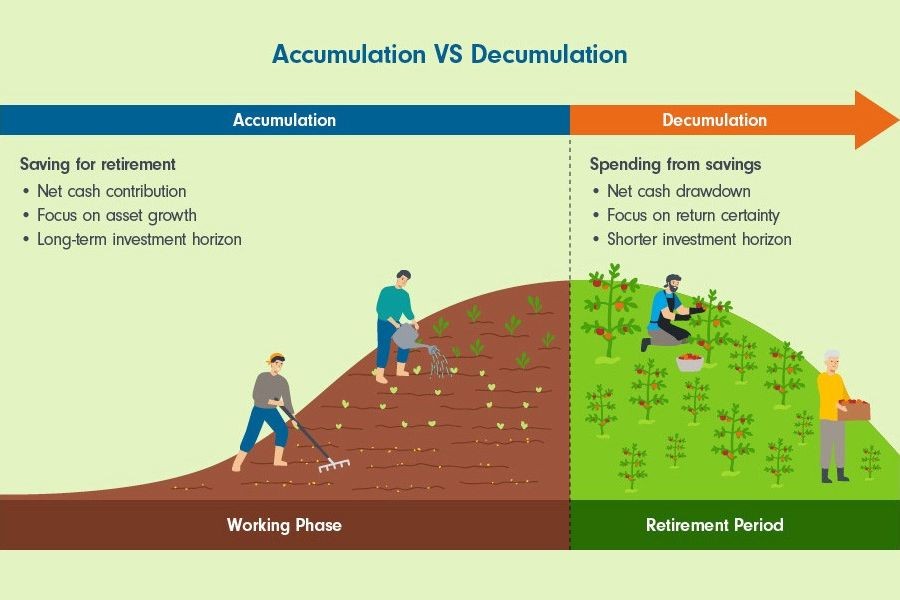

As New Zealand's demographic landscape evolves, with an aging population and increased life expectancy, planning for a secure retirement has never been more crucial. According to Stats NZ, by 2046, it’s projected that one in four Kiwis will be over 65. With this looming demographic shift, understanding how to craft a low-risk investment strategy becomes essential for ensuring financial stability in retirement.

Introduction

Imagine reaching retirement with the peace of mind that your financial future is secure. Yet, for many New Zealanders, this remains a dream rather than a reality. The volatile global economy, coupled with recent changes in New Zealand's housing and stock markets, has made it imperative to rethink traditional investment strategies. The key question remains: How can Kiwis create a low-risk investment plan that ensures a comfortable retirement?

In this article, we delve into the strategies that have proven effective in the New Zealand context, offering insights backed by local data and expert opinions. We aim to provide you with actionable steps to design a portfolio that minimizes risk while optimizing returns. Ready to redefine your retirement planning? Let’s dive in.

Understanding the New Zealand Investment Landscape

New Zealand's investment scene is unique, characterized by its small yet dynamic economy. As of 2023, the Reserve Bank of New Zealand reported a stable inflation rate of 2.5%, which influences both interest rates and investment returns. The New Zealand Stock Exchange (NZX) offers a range of equities, yet property investment remains a favorite among locals.

However, the recent property market boom has raised concerns about sustainability. According to the NZ Property Investors’ Federation, house prices surged by 12% in 2022, prompting debates about affordability and risk. Understanding these local dynamics is crucial for crafting a low-risk retirement strategy tailored to Kiwi needs.

Data-Driven Analysis: The Current State of Kiwi Investments

Recent reports by Deloitte indicate that a diversified portfolio comprising equities, bonds, and property yields better long-term returns compared to investing solely in one asset class. In 2022, mixed-asset portfolios in New Zealand averaged a 7% return, outperforming single-class investments.

Moreover, Stats NZ highlights that over 60% of Kiwi investors prefer bonds and fixed-income assets for their stability. This trend reflects a growing awareness of balancing risk with predictable returns.

Comparative Analysis: Low-Risk Investment Options

When it comes to low-risk investments, Kiwis have several options:

- Bonds: Government and corporate bonds offer fixed returns. While returns are modest, they provide stability, especially in uncertain economic times.

- Term Deposits: Popular among conservative investors, term deposits offer security with predefined interest rates, although returns are typically lower than other investment forms.

- KiwiSaver: As a retirement savings scheme, KiwiSaver provides a low-risk option with potential employer contributions and government incentives.

While each option has its pros and cons, diversifying across these can mitigate risks and enhance returns.

Real-World Case Studies: Lessons from Kiwi Investors

Case Study 1: Diversified portfolio Success

Problem: Jane, a 45-year-old Auckland resident, was heavily invested in property, facing significant risk exposure due to market volatility.

Action: She diversified her investments, allocating 40% to KiwiSaver, 30% to bonds, and the remaining in equities.

Result: Over five years, Jane's portfolio saw a steady 8% annual growth, providing a balanced risk-return profile.

Key Takeaway: diversification is crucial in minimizing risk and achieving stable growth.

Case Study 2: The Power of KiwiSaver

Problem: Mark, approaching retirement, found his savings insufficient to sustain his lifestyle.

Action: He maximized his KiwiSaver contributions, benefiting from employer matches and government incentives.

Result: Over a decade, his retirement fund doubled, providing a secure financial cushion.

Key Takeaway: Leveraging KiwiSaver benefits can significantly impact retirement savings without increasing risk.

Balancing Contrasting Viewpoints: Risk-Takers vs. Conservative Investors

While some investors thrive on high-risk, high-reward strategies, others prefer safer avenues. The risk-takers often cite higher potential gains in equities and startup investments. However, the conservative approach, favored by many Kiwis, emphasizes the security and predictability of bonds and term deposits.

The key is understanding one's risk tolerance. For those nearing retirement, a conservative strategy ensures stability. However, younger investors might allocate a portion of their portfolio to higher-risk options, aiming for growth while maintaining a safety net.

Why Kiwis Need a Smarter Approach to Retirement Investing

Imagine reaching retirement with complete financial freedom—no stress, no uncertainty, just the ability to enjoy life on your terms. Yet, for many New Zealanders, retirement planning feels overwhelming.

📉 Stats NZ predicts that by 2046, one in four Kiwis will be over 65, yet most aren’t financially prepared.

💰 According to the Retirement Commission, 40% of Kiwis don’t have enough savings to retire comfortably.

📊 A 2024 survey by ANZ found that 62% of New Zealanders still rely on property as their primary retirement investment—but is that strategy too risky?

The big question: What’s the best low-risk investment strategy for retirement in New Zealand?

In this guide, we'll break down data-backed, expert-approved ways to build a safe, low-risk retirement portfolio in NZ—without sacrificing long-term growth.

🔹 The New Zealand Investment Landscape: Where Should You Put Your Money?

New Zealand’s investment market is different from the US or Australia. Kiwis tend to favor property and term deposits, but are these really the best low-risk options?

✅ Safe, Low-Risk Investment Options for Retirement in NZ

| Investment Type | Expected Returns | Risk Level | Best For |

|---|---|---|---|

| KiwiSaver (Conservative Fund) | 3-5% annually | Very Low | Long-term passive growth |

| Government Bonds | 2-4% annually | Low | Stability, predictable returns |

| Dividend Stocks (NZX 50) | 4-6% annually | Moderate | Passive income with growth |

| Term Deposits | 2-3% annually | Low | Guaranteed income but lower yield |

| Index Funds (S&P/NZX 50 ETF) | 5-7% annually | Moderate | Diversified market exposure |

📌 Pro Tip: A balanced mix of bonds, KiwiSaver, ETFs, and dividend stocks is often safer than putting everything into property.

🔹 Contrasting Viewpoints: Property vs. Diversified Investing

Many Kiwis over-rely on property for retirement wealth. But is it really the safest option?

🏡 The Property Investment Argument

✅ Pros:

- High capital appreciation (historically 7-10% per year in Auckland).

- Rental income potential for passive earnings.

- Leverage available (can borrow against home equity).

🚨 Cons:

- Market volatility (prices dropped 15% in 2023).

- Expensive maintenance & rates eat into profits.

- Liquidity risk (hard to sell quickly in a downturn).

📈 The Diversified Portfolio Argument

✅ Pros:

- Less risk exposure—not dependent on one asset.

- Easier access to funds (unlike property).

- Steady income streams from dividends and bonds.

🚨 Cons:

- Requires patience—returns take time to compound.

- Stock market fluctuations can scare investors.

📌 Reality Check: According to the NZ Property Investors’ Federation, rental yields are declining, and mortgage rates have risen to 6%+, making property investment riskier than before.

Smart Strategy? A mix of KiwiSaver + dividend stocks + bonds + some property exposure provides the best of both worlds.

🔹 Case Studies: Real Kiwis Who Secured Their Retirement the Smart Way

📌 Case Study #1: From High-Risk to Low-Risk – A Property Investor’s Shift

👤 Name: Mark, 58, Auckland

❌ Problem: Mark had 80% of his retirement savings tied up in property. When interest rates spiked, his rental profits dropped 35%, forcing him to sell at a loss.

✅ Solution: He restructured his portfolio by:

- Selling one rental property and shifting 40% of the proceeds into a diversified ETF fund.

- Investing 30% into dividend stocks for passive income.

- Keeping 30% in high-yield bonds and term deposits.

📈 Result: Within two years, his portfolio recovered, and his annual passive income increased by 25% with lower risk.

📌 Case Study #2: How KiwiSaver Helped a Late Saver Catch Up

👩 Name: Susan, 45, Wellington

❌ Problem: She started investing late and had only $30,000 in retirement savings.

✅ Solution:

- Maximized KiwiSaver contributions (+ employer match).

- Shifted funds from Conservative to Balanced plan for better growth.

- Added extra voluntary contributions of $100 per month.

📈 Result: In 15 years, her savings grew to over $250,000, ensuring a comfortable retirement.

📌 Key Takeaway: Even small, consistent contributions to KiwiSaver & ETFs can massively boost retirement security.

🔹 Common Myths & Mistakes That Could Ruin Your Retirement Plan

🚨 Myth #1: "KiwiSaver alone is enough."

🔍 Reality: A 100% KiwiSaver strategy is risky—you need other investments for flexibility.

🚨 Myth #2: "Term deposits are the safest option."

🔍 Reality: Term deposits don’t keep up with inflation, meaning your money loses value over time.

🚨 Myth #3: "The stock market is too risky for retirees."

🔍 Reality: Dividend stocks & ETFs are a low-risk way to grow wealth.

🔹 The Role of AI & Automation in Retirement Investing

AI-driven investing is changing the game for Kiwis by providing low-cost, automated portfolio management.

📊 AI Investment Platforms in NZ:

- Sharesies & Hatch (best for low-cost stock investing).

- Kernel Wealth (automated NZX ETF investments).

- Robo-Advisors (AI-managed funds with risk-adjusted portfolios).

📌 Pro Tip: AI can help rebalance your portfolio automatically, ensuring low-risk, high-stability returns.

🔹 Final Takeaways: How to Build Your Low-Risk Retirement Plan in NZ

✅ Fact: "A diversified portfolio reduces risk & increases long-term returns."

🔥 Strategy: "Balance your portfolio with a mix of bonds, dividend stocks, and KiwiSaver."

❌ Mistake to Avoid: "Avoid over-relying on property—it’s no longer the safest retirement asset."

💡 Pro Tip: "Use AI investing tools to automate and optimize your portfolio over time."

🚀 Prediction: By 2035, 70% of Kiwi retirees will be using AI-assisted investing to manage their portfolios.

🔹 Conclusion: Take Action Now!

Building a low-risk retirement investment strategy in New Zealand doesn’t have to be complicated. By diversifying your assets, maximizing KiwiSaver, and leveraging smart AI investing tools, you can ensure a stable, stress-free retirement.

What’s your take? Are you investing the right way for retirement? Share your thoughts below! 👇

🔹 People Also Ask (FAQ)

❓ How much money do I need to retire in New Zealand?

💡 Experts suggest at least $600,000 in savings for a comfortable retirement.

❓ Is property investment still a good retirement strategy in NZ?

💡 Only if balanced with other assets—high mortgage rates make it riskier now.

❓ What’s the safest way to invest for retirement in NZ?

💡 A mix of KiwiSaver, bonds, dividend stocks, and ETFs for stability.

Related Search Queries

- Best retirement investment strategies in New Zealand

- Low-risk investment options for Kiwis

- How KiwiSaver works for retirement planning

- Diversifying retirement portfolios in NZ

- Understanding bonds as a safe investment

- Property vs. stocks for retirement savings

- New Zealand retirement savings tips

- How to avoid investment pitfalls in NZ

- Impact of inflation on NZ retirement funds

SandraS34

11 months ago