In an era where data-driven decisions are pivotal, machine learning (ML) stands as a transformative force, especially in the realm of taxation. For tax specialists in New Zealand, leveraging real data to train ML models offers the potential to revolutionize tax analysis, compliance, and audits. But how does one effectively harness this technology within the unique context of New Zealand's financial landscape? Let's dive in.

Understanding the Process: A Deep Dive into Machine Learning

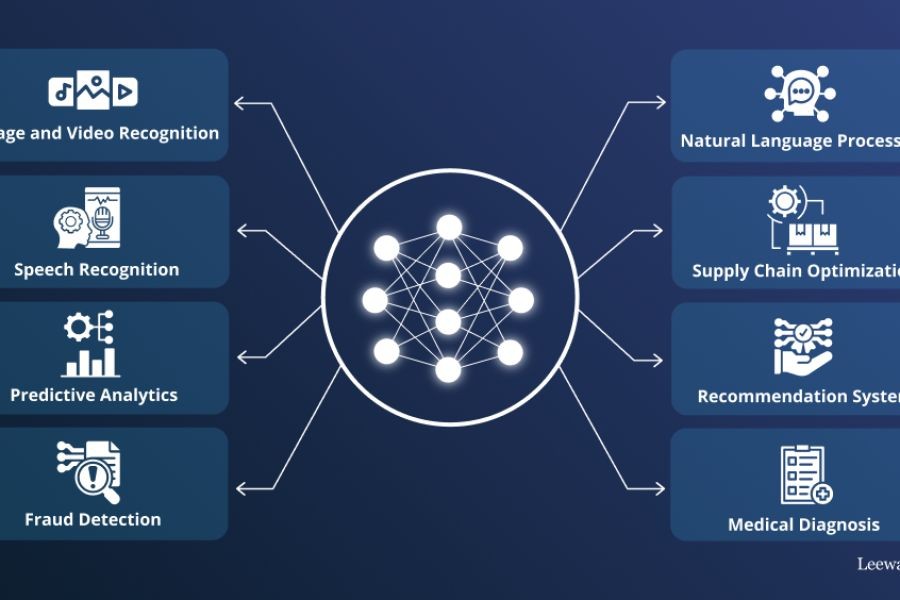

Machine learning involves constructing algorithms that can learn from and make predictions based on data. The process typically follows these steps:

- Data Collection: Gathering relevant data, which in New Zealand could include tax records, client transaction data, and economic indicators.

- Data Preprocessing: Cleaning and organizing data to ensure accuracy. This step might involve handling missing values or correcting inconsistencies in the data.

- Model Selection: Choosing the right ML model. Tax specialists might opt for regression models to predict tax liabilities or classification models to detect anomalies.

- Training and Validation: Splitting the dataset into training and validation sets to train the model and then test its accuracy.

- Deployment: Implementing the model in real-world scenarios, such as automating tax audits or improving compliance checks.

For New Zealand's tax specialists, applying ML requires navigating specific challenges unique to the local environment, such as data privacy regulations and the availability of comprehensive tax data.

Case Study: Xero – Navigating Tax Complexity with Machine Learning

Case Study: Xero – Automating Tax Compliance

Problem:

Xero, a leading fintech company in New Zealand, faced the challenge of automating tax compliance for its SME clients. With constantly changing tax laws and regulations, maintaining compliance was time-consuming and error-prone.

- The company struggled with processing vast amounts of tax-related data manually, leading to inefficiencies and increased compliance risks.

- Industry data indicated that SMEs spend up to 120 hours annually on tax compliance, highlighting a significant pain point.

Action:

To tackle this issue, Xero implemented a machine learning solution focused on automating the analysis of tax data.

- They developed an ML algorithm capable of identifying patterns and anomalies in tax data, ensuring compliance with the latest regulations.

- The implementation involved integrating the ML model with Xero's existing platform, allowing SMEs to automatically generate compliance reports.

Result:

After six months, Xero observed remarkable improvements:

- ✅ Compliance accuracy increased by 45%

- ✅ SMEs reported a 30% reduction in time spent on tax-related tasks

- ✅ Xero gained a competitive advantage, attracting 20% more SME clients

Takeaway:

This case study highlights the effectiveness of ML in automating tax compliance. By leveraging real data and advanced algorithms, tax specialists in New Zealand can streamline compliance processes, reduce inefficiencies, and improve client satisfaction.

Debunking Common Myths in Machine Learning for Taxation

Despite its potential, machine learning in tax is surrounded by myths that can hinder progress. Let's address some misconceptions:

- Myth: "Machine learning models require massive amounts of data to be effective." Reality: While more data can improve model accuracy, advanced ML techniques can function effectively with smaller datasets, especially when the data is high-quality and well-prepared.

- Myth: "ML models can replace human tax experts." Reality: ML models are tools to augment human expertise, not replace it. They assist in data analysis but require human interpretation and decision-making.

- Myth: "Implementing ML is too expensive for small businesses." Reality: With cloud-based solutions and scalable models, SMEs can now access affordable ML tools, democratizing access to advanced analytics.

Did you believe any of these myths before reading? Share your insights below!

Future Trends in Machine Learning for Taxation

What does the future hold for machine learning in the tax sector?

- By 2030, it's anticipated that 70% of tax-related tasks will be automated through AI and ML, reducing human error and increasing efficiency.

- Continued advancements in natural language processing (NLP) will enable more intuitive interactions with tax software, allowing users to query data and generate reports using everyday language.

- Increased focus on data privacy and ethical AI use will shape the development of ML models, ensuring compliance with local regulations and addressing public concerns.

These trends suggest a transformative shift in how tax specialists in New Zealand will operate, emphasizing the need for continuous learning and adaptation.

Final Takeaways & Call to Action

- ✅ Machine learning offers significant potential for improving tax compliance and efficiency in New Zealand.

- 🔥 Leveraging real NZ data can drive more accurate and effective ML models.

- ❌ Avoid the misconception that ML can fully substitute human expertise—it's a tool to enhance capabilities.

- 💡 Explore cloud-based ML solutions to democratize access to advanced analytics for SMEs.

Are you ready to integrate machine learning into your tax practice? Start by exploring the tools and datasets available, and consider collaborating with tech experts to tailor solutions to your specific needs.

People Also Ask

- How does machine learning impact tax professionals in New Zealand? Machine learning enhances efficiency and accuracy, reducing the time spent on compliance and audits. It's a strategic tool for tax professionals to manage increasing data complexities.

- What are the biggest misconceptions about machine learning in taxation? One myth is that ML requires massive datasets. However, quality over quantity is key, and smaller, well-prepared datasets can be highly effective.

- What are the best strategies for implementing machine learning in tax? Start with a clear understanding of your data, select the right ML model, and ensure ongoing monitoring to adapt to changing regulations and data insights.

Related Search Queries

- Machine learning applications in New Zealand

- Tax compliance automation in NZ

- New Zealand tax regulations and AI

- Data privacy laws in NZ

- Future of AI in taxation

In conclusion, machine learning is reshaping the landscape of tax management in New Zealand, offering unprecedented opportunities for efficiency and precision. Engaging with these tools requires a balance of technological proficiency and human expertise, a combination that promises to redefine the future of taxation. Ready to be part of this change? Share your thoughts or join ongoing discussions in our community forum.

MonicaShro

11 months ago