Introduction

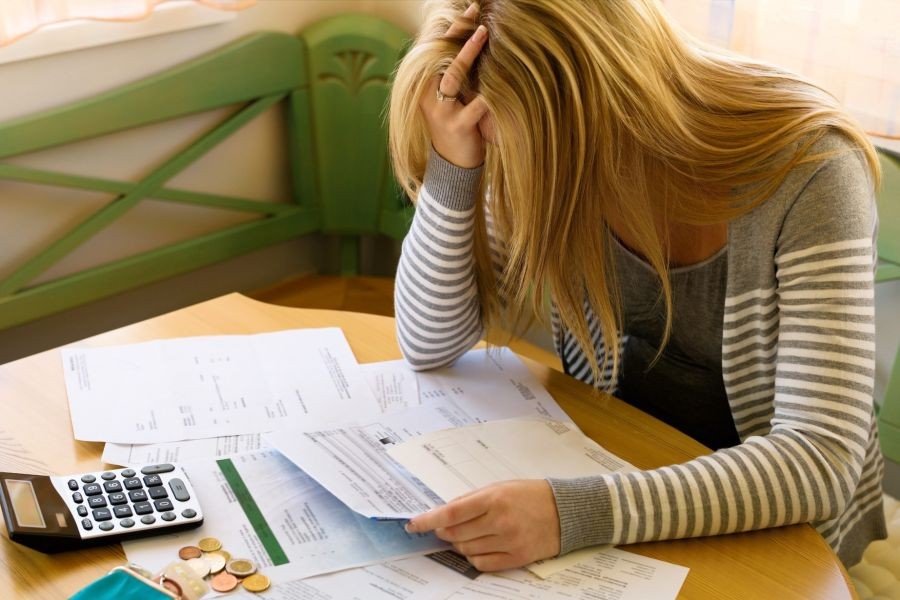

In recent years, New Zealand's housing market has become a battleground where first-home buyers find themselves besieged by escalating property prices, stringent lending criteria, and a complex regulatory landscape. Are these challenges a coincidence, or is there a clandestine struggle that makes homeownership increasingly elusive for the average Kiwi? Understanding the dynamics of this situation is crucial for prospective buyers and industry stakeholders alike.

According to data from the New Zealand Reserve Bank, residential property prices have surged by nearly 30% since 2020. This inflationary trend is exacerbated by factors such as limited housing stock and increased demand, making it significantly harder for first-time buyers to enter the market. With these barriers in place, it’s vital to explore whether systemic issues or market forces are at play, and what solutions might exist for those aspiring to own their first home in New Zealand.

Join us as we unravel the intricacies of New Zealand's housing market, examining whether there's a hidden war waged against first-time buyers and what innovative strategies could offer hope in this challenging landscape.

Understanding New Zealand's Housing Market Dynamics

New Zealand's housing market is often characterized by its volatility and the stark disparity between supply and demand. A series of factors contribute to this imbalance, including population growth, urbanization, and limited land availability. The Ministry of Business, Innovation and Employment (MBIE) reports that Auckland alone requires an additional 13,000 homes per year to meet demand, yet current construction rates fall significantly short.

Moreover, foreign investment has historically driven up property values, although recent government interventions have sought to curb this influence. The Overseas Investment Amendment Act 2018, for instance, aimed to restrict foreign buyers from purchasing existing residential properties, thereby prioritizing New Zealand residents.

Yet, despite these efforts, first-home buyers often find themselves navigating a labyrinth of financial and regulatory challenges, underscoring the need for systemic innovation and policy reform.

Case Study: KiwiBuild – A Failed Promise?

Problem:

Launched in 2018, KiwiBuild aimed to deliver 100,000 affordable homes over a decade. However, by 2022, only 1,366 homes had been completed. The initiative faced delays due to bureaucratic hurdles, land availability issues, and a lack of skilled labor.

Action:

In response to these challenges, the government revised its strategy, focusing on partnerships with private developers and local councils to expedite construction and streamline processes.

Result:

Despite these efforts, the revised approach saw limited success, with only modest increases in housing stock and ongoing criticism regarding affordability and accessibility for first-home buyers.

Takeaway:

KiwiBuild's struggles highlight the complexities of addressing housing shortages through government-led initiatives. For future success, collaboration with industry stakeholders and a focus on innovative construction methods could prove pivotal.

Pros vs. Cons of Current Housing Policies

Pros:

- Increased Scrutiny: Policies like the Overseas Investment Amendment Act reduce foreign market influence.

- Focus on Local Buyers: Government initiatives aim to prioritize New Zealand residents in the housing market.

- Public-Private Partnerships: Collaborative efforts can accelerate housing supply.

Cons:

- Limited Impact: Many policies have yet to deliver significant results in terms of affordability.

- Bureaucratic Delays: Regulatory processes often slow down project timelines.

- Market Dependence: Reliance on private developers can lead to market-driven price increases.

Debunking Myths: Is Renting Always a Poor Alternative?

Myth: Buying a home is always better than renting.

Reality: In many New Zealand regions, rental costs are significantly lower than the monthly expenses associated with homeownership, including mortgage repayments, maintenance, and property taxes. A 2024 report from Stats NZ revealed that renting can provide greater financial flexibility for individuals saving for a long-term investment.

Myth: Property values always appreciate over time.

Reality: While historical data suggests long-term appreciation, short-term fluctuations can result in unexpected losses. The Global Financial Crisis of 2008 serves as a stark reminder of how quickly property values can plummet.

Expert Insights: Innovation in Affordable Housing

To address the affordability crisis, several innovative solutions have emerged. Modular and prefabricated homes offer a promising alternative, reducing construction costs and timeframes. According to a study by the University of Auckland, these methods can cut building costs by up to 30%, making them an attractive option for first-home buyers.

Moreover, community land trusts (CLTs) provide a novel approach to land ownership, separating the cost of land from the cost of the home itself. This model has gained traction in countries like the United States and Canada, where it has successfully increased homeownership rates among lower-income individuals.

Future Trends: What Lies Ahead?

By 2030, New Zealand's housing market is expected to undergo significant transformations driven by technological advancements and policy reforms. The integration of smart home technologies and sustainable building practices could redefine affordability and accessibility. Additionally, the government's commitment to increasing transparency in property transactions might reduce the barriers first-home buyers face.

Furthermore, as remote work becomes more prevalent, demand for housing in urban centers may decrease, leading to a rebalancing of property values and opportunities for first-home buyers in regional areas.

Conclusion

While the challenges facing first-home buyers in New Zealand are substantial, they are not insurmountable. By embracing innovative construction methods, exploring alternative ownership models, and advocating for policy reforms, the dream of homeownership can become a reality for many Kiwis. As the market evolves, staying informed and adaptable will be key to navigating this complex landscape.

What steps will you take to secure your place in New Zealand's housing market? Share your thoughts and strategies below!

People Also Ask (FAQ)

How does the housing market impact first-home buyers in New Zealand?

The housing market impacts first-home buyers by increasing competition and prices, making it difficult to find affordable options. Innovative solutions and policy changes are essential to address these challenges.

What are the biggest misconceptions about buying a home in NZ?

One common myth is that buying is always better than renting. However, research from Stats NZ shows renting can offer financial flexibility and lower costs in many cases.

What are the best strategies for first-home buyers in NZ?

Experts recommend exploring modular housing, considering community land trusts, and staying informed about government initiatives to find affordable homeownership opportunities.

Related Search Queries

- New Zealand first-home buyer schemes

- KiwiBuild success rate

- Modular homes in NZ

- Community land trusts New Zealand

- NZ housing market trends 2025

- Affordable housing solutions NZ

- Overseas Investment Amendment Act impact

- First-home buyer challenges NZ

- Smart home technology New Zealand

- Remote work and housing market NZ

laural95907541

6 months ago