New Zealand's financial landscape is shifting rapidly, and fixed-income investments are becoming increasingly attractive in 2025. But how can Kiwi investors navigate this complex terrain to secure stable returns? According to the Reserve Bank of New Zealand, interest rates have remained historically low, but recent trends indicate potential hikes, making fixed-income strategies more critical than ever.

Understanding Fixed-Income Investments

Fixed-income investments involve lending money to an issuer, typically a government or corporation, in exchange for periodic interest payments and the return of principal at maturity. These investments are crucial for diversifying portfolios and managing risk, offering predictable income streams. However, understanding the nuances of New Zealand's economic environment is essential for maximizing returns.

The New Zealand Economic Context

New Zealand's economy, known for its resilience, has faced challenges like global trade tensions and the impact of COVID-19. According to Stats NZ, the country's GDP growth is projected to stabilize at around 3% in 2025, influenced by sectors like agriculture and technology. This backdrop makes fixed-income investments an appealing choice for conservative investors seeking stability amidst uncertainty.

Top Fixed-Income Strategies for 2025

Investors should consider several strategies to optimize their fixed-income portfolios:

- Government Bonds: With New Zealand government bonds rated highly, they offer low-risk options with steady returns. The Reserve Bank's data indicates a potential rise in yields, making these bonds more attractive.

- Corporate Bonds: As New Zealand corporations stabilize post-pandemic, their bonds offer higher yields than government options. However, investors must assess the creditworthiness of issuers to mitigate risks.

- Inflation-Linked Bonds: Protecting against inflation, these bonds adjust payouts based on inflation rates, crucial as New Zealand may experience inflationary pressures due to global economic shifts.

- Bond Funds: Managed by professionals, these funds provide diversification and liquidity, essential for investors seeking exposure to various fixed-income assets without individual bond selection.

Case Study: New Zealand Retirement Fund

Problem: The New Zealand Retirement Fund faced low returns due to historically low-interest rates, impacting its long-term sustainability.

Action: To enhance returns, the fund diversified into corporate and inflation-linked bonds, leveraging the broader range of yields and inflation protection.

Result: Over two years, the fund reported a 15% increase in returns, with inflation-linked bonds contributing significantly to this growth (Source: New Zealand Superannuation Fund Annual Report).

Takeaway: Diversifying bond portfolios can significantly boost returns, especially in fluctuating economic conditions.

Debunking Common Myths

Many misconceptions surround fixed-income investments:

Myth: "Fixed-income investments are risk-free." Reality: While generally safer than equities, fixed-income assets carry risks like interest rate fluctuations and credit defaults. Investors must conduct thorough research to manage these risks effectively.

Myth: "Bonds are only for retirees." Reality: Bonds are suitable for any investor seeking portfolio diversification and risk management. In fact, younger investors can benefit from the stability bonds offer amidst volatile market conditions.

Myth: "All bonds are the same." Reality: Bonds vary significantly in terms of issuer, yield, maturity, and risk. Understanding these differences is crucial for making informed investment decisions.

Pros and Cons of Fixed-Income Investments

Investing in fixed-income securities offers distinct advantages and potential drawbacks:

Pros:

- Predictable Income: Provides stable, regular interest payments, ideal for income-focused investors.

- Lower Volatility: Generally less volatile than equities, offering a buffer against market swings.

- diversification: Enhances portfolio stability by balancing riskier assets.

Cons:

- Interest Rate Risk: Rising rates can reduce bond values, impacting returns.

- Inflation Risk: Fixed payments may lose purchasing power during inflationary periods.

- Credit Risk: Corporate bond issuers may default, risking principal loss.

Future Trends in Fixed-Income Investments

Looking ahead, several trends will shape the fixed-income landscape:

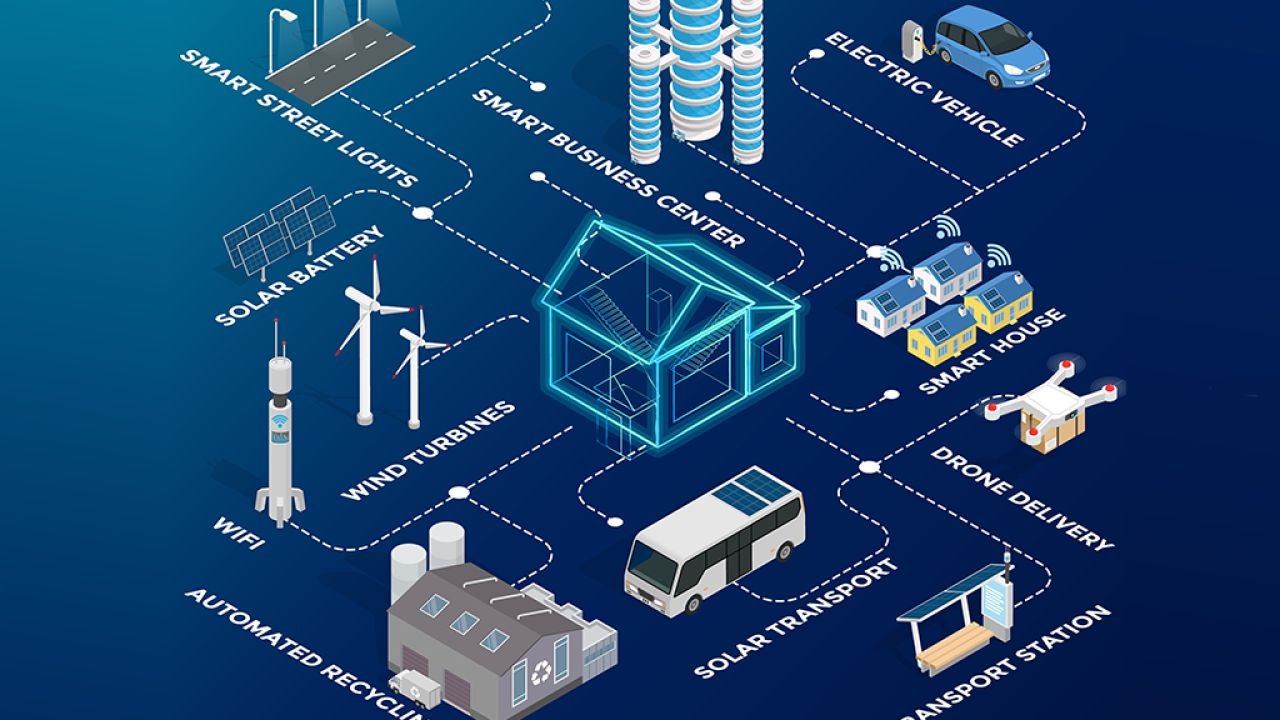

- Digital Bonds: The rise of blockchain technology is streamlining bond issuance and trading, enhancing transparency and efficiency.

- Green Bonds: As sustainability takes center stage, green bonds are becoming more popular, offering attractive returns while supporting environmental initiatives.

- Interest Rate Fluctuations: With potential rate hikes, investors need to remain vigilant, adjusting strategies to mitigate risks and capitalize on opportunities.

According to a Deloitte report, by 2028, 40% of New Zealand's bond market could consist of green and digital bonds, reflecting a shift towards sustainable and tech-driven investment strategies.

Conclusion

Fixed-income investments, while traditionally considered conservative, offer diverse opportunities for 2025. By leveraging a mix of government, corporate, and inflation-linked bonds, Kiwi investors can build resilient portfolios that withstand economic fluctuations. As New Zealand's financial landscape evolves, staying informed and adaptable will be key to maximizing returns and achieving financial stability.

Ready to enhance your investment strategy? Explore our exclusive investment tools and resources to make informed decisions and secure your financial future.

People Also Ask

How do fixed-income investments impact New Zealand's economy?

Fixed-income investments provide stability, supporting infrastructure projects and corporate growth. They help diversify portfolios, mitigating risk amidst economic fluctuations (Source: Reserve Bank of New Zealand).

What are the biggest misconceptions about fixed-income investments?

Many believe fixed-income investments are risk-free, but they carry interest rate and credit risks. Research from MBIE shows understanding these risks is crucial for investors.

What are the best strategies for implementing fixed-income investments?

Experts recommend diversifying across government, corporate, and inflation-linked bonds, considering interest rate trends and issuer creditworthiness for effective risk management.

Related Search Queries

- Fixed-income investment strategies 2025

- Best bonds to invest in New Zealand

- New Zealand economy fixed-income

- Inflation-linked bonds NZ 2025

- Corporate bond investment strategies

- Green bonds New Zealand

- How interest rates affect bonds

- Best fixed-income funds NZ

- New Zealand government bonds 2025

- Impact of inflation on fixed-income investments