New Zealanders are known for their adventurous spirit, whether it’s exploring the great outdoors or venturing into the world of investments. However, the financial landscape is fraught with pitfalls that can lead even the most seasoned investors astray. In this article, we’ll delve into some of the most dangerous investment myths that could potentially cost Kiwis their hard-earned money. By understanding these misconceptions, investors can make more informed decisions and safeguard their financial future.

The Myth of Real Estate as a Guaranteed Investment

Real estate has long been considered a safe bet for many New Zealanders, with property values historically on the rise. However, the assumption that property investment is a surefire way to make money is a myth that needs debunking. According to Stats NZ, while property prices have surged by 27% in recent years, this trend is not guaranteed to continue indefinitely. Market fluctuations, interest rate hikes, and regulatory changes can all impact property values.

Case Study: Auckland’s Housing Market

In Auckland, property prices skyrocketed by 40% between 2016 and 2020. However, the market has since cooled, with prices dropping by 10% in 2022, as reported by the Real Estate Institute of New Zealand (REINZ). This correction left many investors with properties worth less than their purchase price, highlighting the risks of assuming continuous growth.

The Allure of High-Yield Investments

High-yield investments promise significant returns, often luring investors with the prospect of quick profits. However, these investments come with increased risk and volatility. The Reserve Bank of New Zealand warns against chasing high yields without understanding the underlying assets or the potential for loss.

Pros and Cons of High-Yield Investments

- Pros: Potential for high returns, diversification of portfolio, excitement of rapid growth.

- Cons: High risk of loss, lack of liquidity, potential for scams and misleading offers.

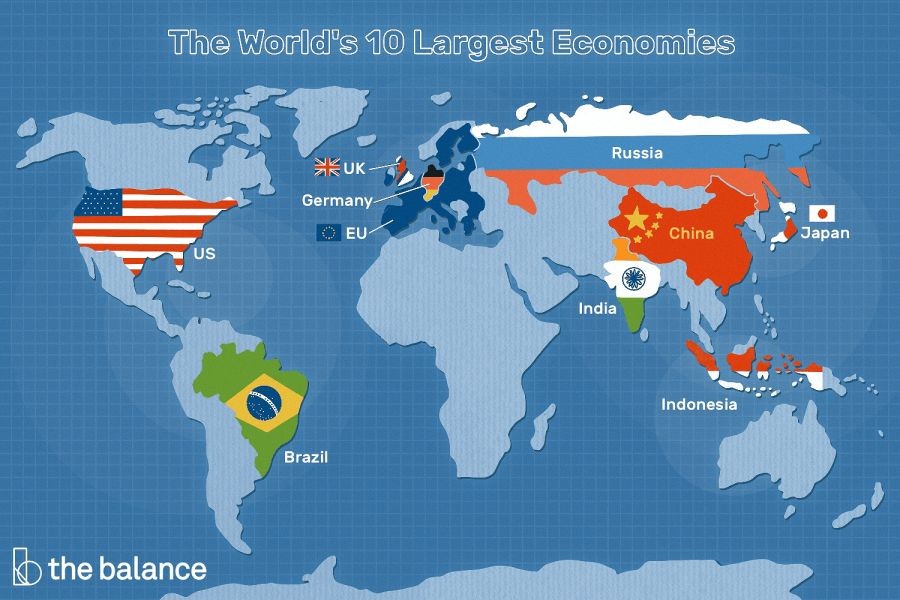

The Misconception of diversification

diversification is often touted as the key to risk management in investing. While it’s true that spreading investments across different asset classes can reduce risk, many investors misunderstand what true diversification entails. Simply owning multiple stocks or assets is not sufficient. diversification should include a mix of asset types, industries, and geographical locations to effectively mitigate risk.

Contrasting Viewpoints: Active vs. Passive Investing

The debate between active and passive investing continues to divide the financial community. Active investors aim to outperform the market through strategic stock picking, while passive investors rely on index funds to track market performance.

Advocate for Active Investing: Proponents argue that skilled investors can achieve higher returns through market analysis and timing.

Critics of Active Investing: Critics point out that active investing often incurs higher fees and taxes, and studies show that many active funds underperform the market over time.

Middle Ground: A balanced approach that combines both strategies may offer the best of both worlds, allowing for cost-effective growth with occasional strategic plays.

Myths and Realities: Common Misconceptions

- Myth: "Investing is only for the wealthy." Reality: With platforms like Sharesies and Hatch, Kiwis can start investing with as little as $5.

- Myth: "The stock market is a gamble." Reality: Long-term investments in diversified portfolios historically yield positive returns, according to research from the University of Auckland.

- Myth: "Gold is the ultimate safe haven." Reality: While gold can hedge against inflation, its price can be volatile and influenced by market sentiment.

Future Trends and Predictions

Looking ahead, New Zealand’s investment landscape is poised for significant changes. The Ministry of Business, Innovation and Employment (MBIE) predicts increased adoption of digital currencies and blockchain technology, which could revolutionize the way Kiwis invest. By 2028, it is anticipated that 40% of New Zealand banks will implement blockchain-based solutions for secure transactions.

Conclusion

Understanding and dispelling investment myths is crucial for anyone looking to build a strong financial future in New Zealand. By recognizing these misconceptions and approaching investments with a well-rounded strategy, Kiwis can avoid costly mistakes and make informed decisions. As you consider your next investment move, remember to question common assumptions and seek advice from trusted financial experts.

Call to Action: Ready to take control of your financial future? Explore our resources on smart investing strategies and sign up for our newsletter to stay updated on the latest trends in New Zealand’s investment landscape.

People Also Ask

- How does diversification impact investment risk? diversification reduces investment risk by spreading assets across various sectors, minimizing the impact of a poor-performing investment.

- What are the biggest misconceptions about real estate investment in NZ? One common myth is that property values always rise. However, market corrections can lead to significant losses, as seen in Auckland's recent downturn.

- What future trends will affect NZ’s investment landscape? The adoption of blockchain and digital currencies is expected to redefine investment strategies, offering enhanced security and efficiency.

Related Search Queries

- Real estate investment myths NZ

- High-yield investment risks

- Active vs passive investing NZ

- diversification strategies for Kiwis

- Future of digital currencies in New Zealand

- Blockchain investment trends NZ

- Common investment myths debunked

- Pros and cons of real estate investing

- Impact of interest rates on NZ property

- Smart investing strategies for beginners

fixedpricedental

1 month ago