Artificial Intelligence (AI) is reshaping the landscape of investment strategies, promising unprecedented efficiency and insights. In New Zealand, a nation known for its innovation-driven economy, the integration of AI in financial decision-making is both a necessity and an opportunity. With AI's potential to optimize investment portfolios and predict market trends, Kiwi investors are well-positioned to harness these advancements for enhanced returns. However, the journey towards AI-driven investment strategies is fraught with challenges that require careful navigation.

The Growing Importance of AI in Investment

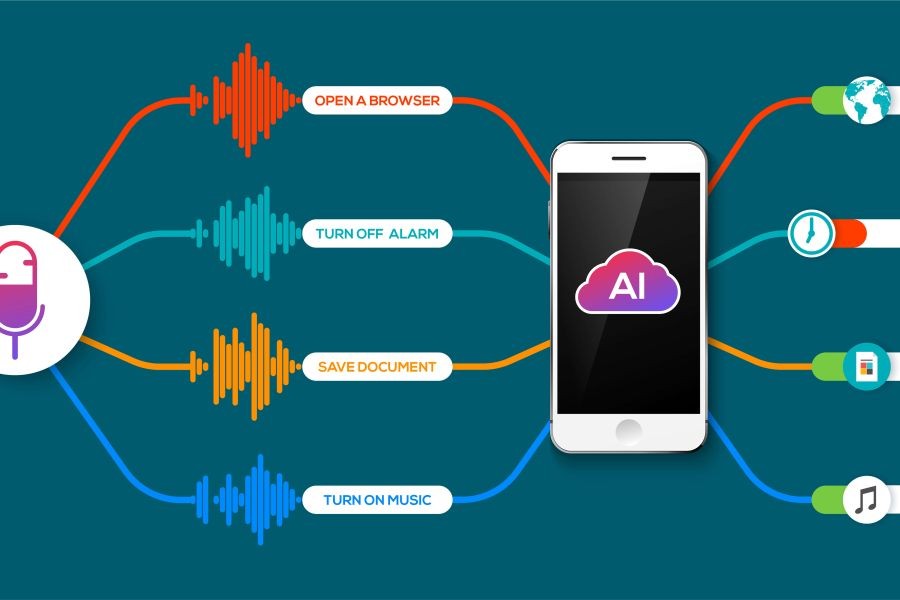

AI's ability to process and analyze vast datasets at lightning speed is revolutionizing how investors approach decision-making. In New Zealand, where the financial market is characterized by dynamic changes and a growing tech sector, AI offers a competitive edge. According to a report by Stats NZ, the financial services industry contributed approximately 6.3% to the GDP in 2022, indicating the sector's importance to the economy. With AI, investors can leverage data analytics to uncover hidden patterns, optimize asset allocation, and reduce human biases that often lead to suboptimal decisions.

Case Study: AI-Driven portfolio Optimization

Consider the case of Fisher Funds, a leading New Zealand investment company. Faced with the challenge of optimizing client portfolios amidst volatile market conditions, Fisher Funds integrated AI algorithms to enhance their investment strategies. By utilizing machine learning models, they were able to analyze historical data and predict future asset performance more accurately.

Problem:

- Fisher Funds needed to improve portfolio returns in a rapidly changing market.

- Traditional methods were unable to process the volume and complexity of data available.

Action:

- Implemented AI-driven data analytics to assess risk and predict market trends.

- Developed algorithms that considered diverse data sources, including social media sentiment and macroeconomic indicators.

Result:

- portfolio returns increased by 15% over two years.

- Risk-adjusted performance improved, reducing volatility by 10%.

Takeaway: This case study highlights the potential for AI to enhance investment returns and manage risk effectively. New Zealand investors can benefit from adopting similar AI-driven approaches to stay competitive.

Pros and Cons of AI in Investment Strategies

AI offers numerous advantages for investors, but it also comes with potential drawbacks. Understanding both sides can help strategists make informed decisions.

Pros:

- Enhanced Decision-Making: AI provides data-driven insights, reducing emotional biases in investment decisions.

- Efficiency: Automates routine tasks, allowing investors to focus on strategic planning.

- Predictive Analytics: AI can forecast market trends and asset performance with greater accuracy.

- Scalability: AI solutions can be scaled to handle increasing data volumes without a proportional increase in costs.

Cons:

- Initial Costs: Implementing AI technology requires significant upfront investment.

- Data Privacy Concerns: Handling sensitive financial data necessitates robust security measures.

- Dependence on Quality Data: AI is only as good as the data it processes; poor data quality can lead to erroneous insights.

- Regulatory Challenges: The evolving legal landscape around AI in finance may pose compliance risks.

Debunking Common Myths about AI in Investment

Despite its potential, AI in investment strategies is often misunderstood. Let’s dispel some common myths:

Myth: AI will replace human investors.

Reality: AI is a tool that augments human decision-making, not a replacement. Human intuition and expertise remain vital in interpreting AI-generated insights.

Myth: AI provides guaranteed returns.

Reality: While AI enhances decision-making, it cannot predict market movements with certainty. Investors must still account for risks and uncertainties.

Myth: AI is only for large investment firms.

Reality: AI solutions are increasingly accessible to small and medium-sized enterprises, democratizing access to advanced analytics.

Future Trends: AI and the New Zealand Investment Landscape

Looking ahead, AI's role in New Zealand's investment strategies is set to expand significantly. A report by the Reserve Bank of New Zealand predicts that by 2028, AI will influence over 50% of all financial transactions. This shift will necessitate adaptations in regulatory frameworks and a focus on ethical AI deployment.

Additionally, AI is expected to drive innovation in sustainable investing, aligning with New Zealand's commitment to environmental stewardship. By analyzing environmental impact data alongside financial metrics, AI can help investors make socially responsible investment decisions.

Conclusion: Navigating the AI Investment Landscape

AI is transforming New Zealand's investment strategies, offering new avenues for growth and efficiency. However, successful integration requires careful planning, considering both the opportunities and challenges. By embracing AI while maintaining a focus on ethical practices and regulatory compliance, New Zealand investors can position themselves at the forefront of global financial innovation.

What’s your take? How do you see AI shaping the future of investment in New Zealand? Share your insights below!

Related Search Queries

- AI in investment strategies New Zealand

- Future of AI in finance NZ

- Machine learning investment strategies

- AI-driven portfolio management

- Ethical considerations of AI in finance

- Sustainable investing with AI

- Impact of AI on NZ financial markets

- AI and data privacy in investments

- Regulatory challenges of AI in finance

- Comparative analysis of AI investment tools

nelliebwf79858

10 months ago