Buying a home is a significant milestone for many Australians, but recent trends reveal that a substantial portion of first-time home buyers regret their purchase. Understanding the reasons behind this regret is crucial, not only for prospective buyers but also for those in the real estate and financial sectors aiming to provide better guidance and solutions. Let's delve into the factors contributing to this phenomenon and explore potential remedies.

Understanding the Australian Housing Market

The Australian housing market has undergone significant changes over the past decade. According to the Australian Bureau of Statistics, property prices have increased by 23% in major cities from 2020 to 2023. This surge has been attributed to low-interest rates, foreign investments, and limited housing supply. While this might seem beneficial for sellers and investors, it poses challenges for first-time buyers who often feel pressured to enter the market before prices escalate further.

The Role of Financial Pressure

One of the primary reasons for regret among first-time home buyers is financial strain. The Reserve Bank of Australia notes that the average household debt-to-income ratio has risen to 190%, with mortgages being the significant contributor. Many buyers stretch their finances to secure a home, only to find themselves struggling with mortgage repayments amidst rising living costs.

Case Study: A Story of Buyer’s Remorse

Problem: Emily, a first-time home buyer in Sydney, purchased her dream home in 2022. Despite securing a loan, she soon faced financial difficulties due to unexpected maintenance costs and rising interest rates.

Action: Emily sought financial advice and started budgeting meticulously, cutting down on non-essential expenses.

Result: Within a year, Emily managed to stabilize her finances, but the experience left her with a sense of regret about not being fully prepared for the financial responsibilities of homeownership.

Takeaway: This case highlights the importance of comprehensive financial planning and realistic budgeting before purchasing a home.

Common Myths and Misconceptions

- Myth: Buying is always better than renting. Reality: Depending on the market, renting can sometimes be more cost-effective, especially in high-demand areas like Sydney and Melbourne.

- Myth: Once you own a home, your financial worries are over. Reality: Maintenance, taxes, and mortgage repayments can lead to ongoing financial stress.

- Myth: Property values always increase. Reality: While long-term trends show growth, market fluctuations can lead to temporary declines in property values.

Future Trends in the Australian Housing Market

Looking ahead, the Australian housing market is expected to face several challenges and opportunities. The Reserve Bank of Australia predicts that interest rates will gradually rise, impacting borrowing costs. Additionally, the Australian government's focus on increasing housing supply through new developments may stabilize price growth.

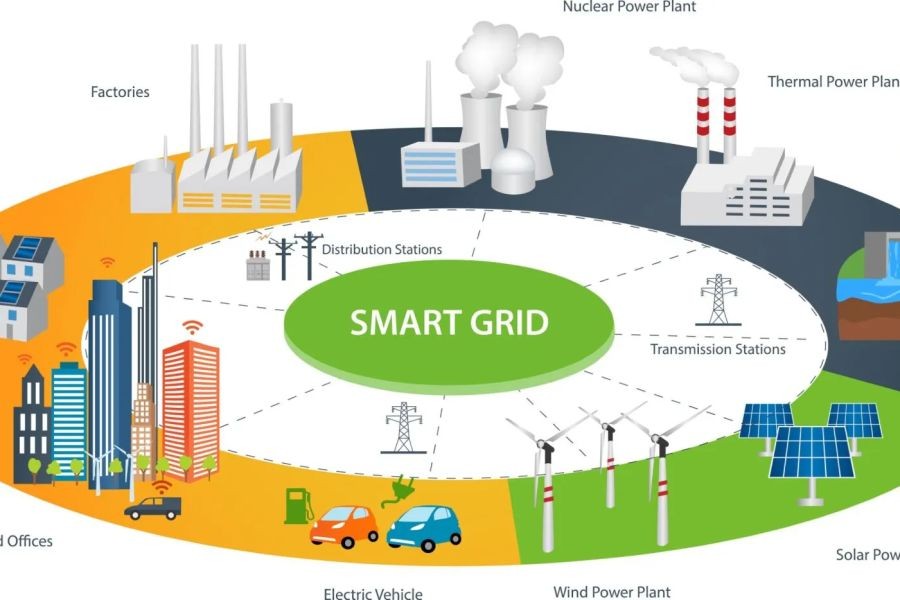

Moreover, the integration of sustainable building practices and technology-driven solutions is set to redefine the housing market. This shift is expected to attract environmentally-conscious buyers and investors, further diversifying the market landscape.

Final Takeaways

- Fact: The average debt-to-income ratio for Australian households is at a record high of 190%.

- Strategy: First-time buyers should conduct thorough market research and seek financial advice before purchasing.

- Mistake to Avoid: Underestimating ongoing costs such as maintenance and property taxes.

- Pro Tip: Consider renting in high-demand areas to save costs and invest in other financial opportunities.

Conclusion

The journey of purchasing a first home in Australia is fraught with challenges. However, with adequate preparation, financial literacy, and a clear understanding of the market, first-time buyers can make informed decisions that align with their long-term goals. As the market continues to evolve, staying informed and adaptable will be key to navigating the complexities of homeownership.

People Also Ask

- How does the housing market impact first-time buyers in Australia? The rising property prices and limited supply create financial pressure, making it challenging for first-time buyers to secure affordable homes.

- What are the biggest misconceptions about buying a home in Australia? Many believe that buying is always better than renting, but in high-demand areas, renting can be more cost-effective.

- What future changes could affect the Australian housing market? Policy updates and increased housing supply could stabilize prices, while sustainable practices may attract new buyers and investors.

Related Search Queries

- First-time home buyer regrets Australia

- Australian housing market trends 2023

- Is buying better than renting in Australia?

- Financial advice for first-time home buyers

- Future of Australian real estate market