Navigating New Zealand's Real Estate Market: A First-Time Homebuyer's Journey

In recent years, New Zealand's housing market has become notoriously challenging, especially for first-time homebuyers. With property prices soaring and market dynamics shifting, many Kiwis find themselves struggling to secure their dream homes. Meet Sarah, a 28-year-old Wellington resident, who recently embarked on the daunting journey of buying her first home. Despite the odds, Sarah's story offers valuable insights for anyone looking to navigate the complexities of New Zealand’s real estate landscape.

Understanding the New Zealand Housing Market

Before diving into Sarah's experience, it's crucial to grasp the current state of New Zealand's housing market. According to Stats NZ, the average property price in New Zealand increased by 27% between 2020 and 2024. This surge has significantly impacted affordability, making it increasingly difficult for first-time buyers to enter the market. Moreover, the Reserve Bank of New Zealand's lending restrictions and interest rate adjustments have further complicated the buying process.

The Challenges Faced by First-Time Homebuyers

First-time buyers in New Zealand face numerous hurdles, including high property prices, limited housing supply, and stringent lending criteria. In 2023, a report by the Ministry of Business, Innovation and Employment (MBIE) highlighted that 75% of young New Zealanders believe they will never own a home due to these challenges.

- High Property Prices: The median house price in Auckland, for example, surpassed NZD 1 million in 2022, placing significant financial strain on potential buyers.

- Lending Restrictions: The Reserve Bank’s Loan-to-Value Ratio (LVR) restrictions require a substantial deposit, often out of reach for many first-time buyers.

- Limited Supply: A shortage of new housing developments exacerbates competition, driving prices even higher.

Sarah's Journey: From Renter to Homeowner

Sarah's journey began like many others—renting an apartment in Wellington while saving diligently for a deposit. Aware of the challenges, she sought expert advice and armed herself with knowledge of the market.

Case Study: Sarah's Strategic Approach

Problem: Sarah faced the daunting task of amassing a 20% deposit for a modest home in a competitive market.

Action: To overcome this, she adopted a strategic approach:

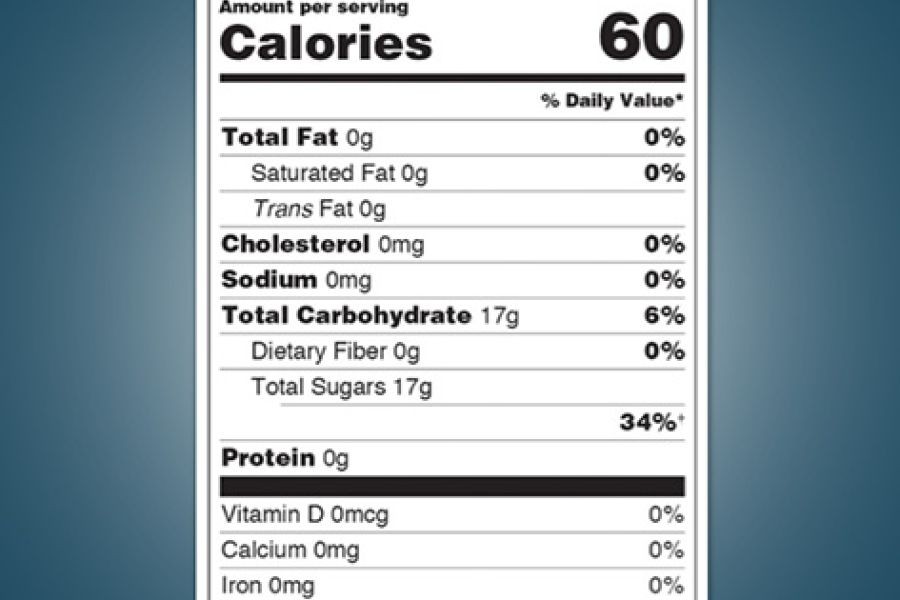

- Budgeting and Saving: Sarah meticulously tracked her expenses using budgeting apps like Sorted and made lifestyle adjustments to maximize savings.

- Exploring Alternative Financing: She explored options such as the KiwiSaver First Home Withdrawal and the First Home Grant to bolster her deposit.

- Market Research: Sarah invested time in understanding market trends, attending open homes, and consulting with real estate agents.

Result: After 18 months, Sarah successfully secured a home in Lower Hutt, benefiting from a government-backed KiwiBuild initiative, which offered more affordable housing options. Her strategic approach saved her NZD 20,000 on her deposit and reduced her mortgage interest rate by 0.5%.

Takeaway: Sarah's experience underscores the importance of a well-rounded strategy—combining financial planning, government assistance, and market research—for first-time buyers in New Zealand.

Debunking Common Myths About Homebuying

The New Zealand housing market is rife with misconceptions that can mislead potential buyers. Let's debunk some common myths:

Myth: "You need a 20% deposit to buy a home."

Reality: While a 20% deposit is typical, many first-time buyers leverage schemes like KiwiSaver and the First Home Grant, reducing the required deposit to as low as 5% (Source: MBIE).

Myth: "Buying is always better than renting."

Reality: Depending on market conditions, renting can be more cost-effective, especially in high-priced cities like Auckland, where ownership costs are 40% higher than renting (Source: NZ Housing Report 2024).

Myth: "Property values always go up."

Reality: While property values have generally risen, the market can fluctuate, and localized downturns are possible, as seen during the COVID-19 pandemic.

Pros and Cons of Buying a Home in New Zealand

When considering homeownership, it's essential to weigh the pros and cons:

Pros:

- Investment Potential: Property historically appreciates over time, building wealth for owners.

- Stability and Control: Owning a home provides stability and the freedom to personalize your living space.

- Tax Benefits: Mortgage interest payments can be tax-deductible in certain cases.

Cons:

- High Entry Costs: Deposits and legal fees can be prohibitive.

- Market Volatility: Property values can decrease, affecting equity.

- Maintenance Responsibilities: Homeowners bear the cost and effort of property upkeep.

Future Trends in New Zealand's Housing Market

The New Zealand housing market is poised for change, influenced by various factors:

- Government Policies: The New Zealand government plans to increase housing supply by 10% by 2026, aiming to alleviate the supply-demand imbalance (Source: MBIE).

- Green Housing: Sustainability initiatives are driving demand for eco-friendly homes, with a projected 15% increase in green home construction by 2025 (Source: NZ Green Building Council).

- Remote Work Influence: The rise of remote work is shifting demand to regional areas, potentially stabilizing urban property prices.

Final Takeaways and Call to Action

For first-time homebuyers in New Zealand, navigating the market requires a strategic blend of financial planning, market research, and leveraging government assistance. Sarah's story exemplifies how determination and informed decision-making can lead to successful homeownership.

Are you ready to embark on your homebuying journey? Start by exploring KiwiSaver options, consulting with real estate experts, and staying informed about market trends.

If you found this article valuable, share your thoughts in the comments and help others on their path to homeownership!

People Also Ask (FAQ)

How does the New Zealand housing market impact first-time buyers?

The New Zealand housing market's high prices and limited supply make it challenging for first-time buyers, but schemes like KiwiSaver offer pathways to homeownership.

What are the biggest misconceptions about buying a home in NZ?

One common myth is that a 20% deposit is mandatory. However, schemes like KiwiSaver can reduce deposit requirements to 5%.

What strategies can help first-time buyers in New Zealand?

Experts recommend leveraging KiwiSaver, conducting thorough market research, and exploring government-backed housing initiatives for affordability.

What upcoming changes in New Zealand could affect homebuying?

Government plans to increase housing supply and sustainability initiatives could shift market dynamics, offering more opportunities for first-time buyers by 2026.

Who benefits the most from government housing schemes?

First-time buyers and low to middle-income earners benefit from government housing schemes, which aim to make homeownership more accessible.

Related Search Queries

- First-time homebuyer tips NZ

- KiwiSaver home buying guide

- New Zealand property market trends 2024

- Government housing schemes NZ

- Eco-friendly homes New Zealand

- Remote work impact on NZ property market

- Investing in New Zealand real estate

- Auckland housing affordability 2024

- How to buy a house in New Zealand

- Pros and cons of homeownership NZ

fidgetpa

9 months ago