In recent years, New Zealand's property market has been a hot topic among investors, economists, and policymakers. As house prices have surged, concerns about a potential market crash have become increasingly prevalent. But what role could the New Zealand government play in triggering such a crash, and what would be the implications for the country's economy and tech industry? Let's delve into the factors, strategies, and potential consequences.

Understanding New Zealand's Property Market Dynamics

New Zealand's property market has experienced significant growth over the past decade, driven by factors such as population growth, low-interest rates, and foreign investment. According to the Reserve Bank of New Zealand, house prices increased by over 27% from 2020 to 2021, raising concerns about affordability and sustainability. Could government intervention in this volatile environment lead to a market crash?

Government Intervention: A Double-Edged Sword

Government policies can significantly influence the property market. In New Zealand, recent measures like the Bright-line Test extension and restrictions on foreign buyers have aimed to cool the market. However, these interventions could also have unintended consequences. For instance:

- Policy Tightening: Increasing mortgage lending restrictions could lead to reduced buyer demand, potentially destabilizing the market.

- Taxation Changes: Implementing new property taxes could deter investors, leading to a slowdown in market activity.

While these actions are intended to prevent overheating, they could inadvertently trigger a market correction if not carefully managed.

Case Study: New Zealand's Bright-line Test

The Bright-line Test, introduced in 2015, was designed to curb property speculation by taxing gains on residential properties sold within a specific timeframe. In 2021, the timeframe was extended from five to ten years. This change aimed to reduce speculative purchases but also impacted investor sentiment.

Problem: Investors were concerned about the decreased profitability of short-term property investments.

Action: Some investors shifted focus to long-term holding strategies, while others exited the market entirely.

Result: The policy led to a temporary cooling of the market, with a noticeable decline in property transactions.

Takeaway: Government interventions need to be balanced to avoid unintended market destabilization.

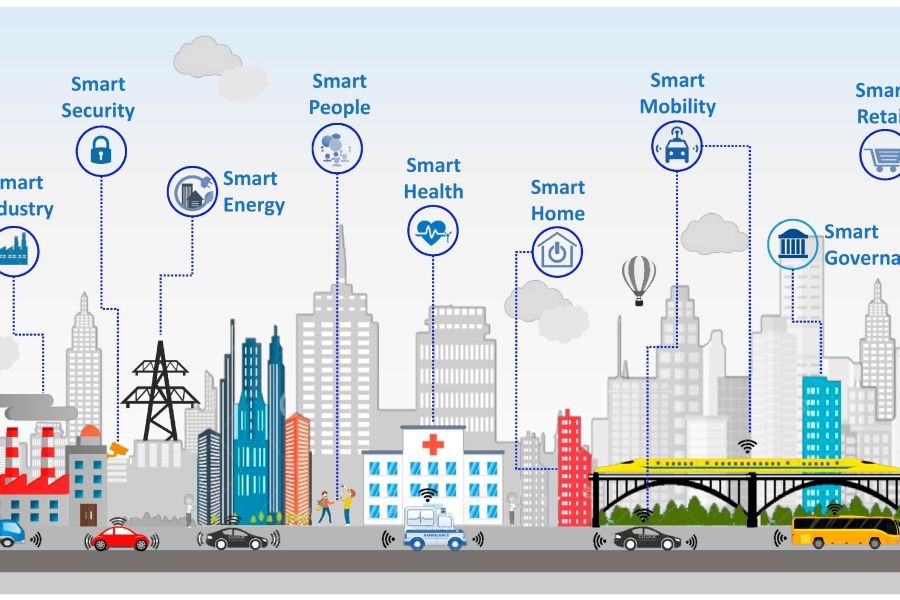

Data-Driven Insights: The Role of Technology

Technology can play a crucial role in navigating the complexities of property market dynamics. For instance, AI-driven analytics and predictive modeling can help stakeholders make informed decisions. According to Stats NZ, integrating technology into real estate processes can enhance market transparency and reduce risks associated with speculative investments.

Pros and Cons of Government Intervention

✅ Pros:

- Stability: Well-planned interventions can stabilize market fluctuations.

- Affordability: Policies can improve housing affordability for first-time buyers.

- Long-term Planning: Encourages sustainable growth and investment.

❌ Cons:

- Market Volatility: Missteps can lead to sudden market corrections.

- Investor Impact: Restrictive policies may deter investment.

- Economic Ripple Effects: A crash could affect related industries, including technology.

Debunking Common Myths

- Myth: Government intervention always prevents market crashes. Reality: While it can help, poorly timed or excessive intervention can exacerbate problems.

- Myth: High property prices mean inevitable crashes. Reality: Prices reflect supply and demand dynamics; crashes depend on underlying economic factors.

- Myth: Only property investors are affected by market changes. Reality: A crash affects the broader economy, impacting jobs, technology, and consumer spending.

Future Trends & Predictions

The future of New Zealand's property market will likely be shaped by a combination of government policy, technology, and global economic trends. A report by the Ministry of Business, Innovation and Employment (MBIE) suggests that digital transformation in real estate could lead to more resilient market structures. By 2026, we may see an increase in tech-driven property solutions, aiding both investors and policymakers in making data-backed decisions.

Conclusion

While the New Zealand government has the power to influence the property market, the effects of their actions depend on the balance between intervention and market forces. As technology strategists, understanding these dynamics and leveraging technology can help navigate potential challenges and opportunities. What are your thoughts on the future of New Zealand's property market? Share your insights below!

People Also Ask

- How can technology help New Zealand's property market? AI-driven tools enhance transparency and reduce speculative risks, fostering a more stable market environment.

- What are the biggest misconceptions about government intervention? Many believe it always prevents crashes, but excessive intervention can sometimes exacerbate issues.

- What is the impact of government policy on real estate investment? Policies like the Bright-line Test influence investor strategies, affecting market stability and transactions.

Related Search Queries

- New Zealand property market crash

- Government intervention in real estate

- Bright-line Test impact

- AI in real estate

- Technology in property investment

- Future of NZ housing market

- New Zealand property trends 2026

- Real estate technology solutions

- Investment strategies in NZ

- New Zealand government policies on housing