Introduction

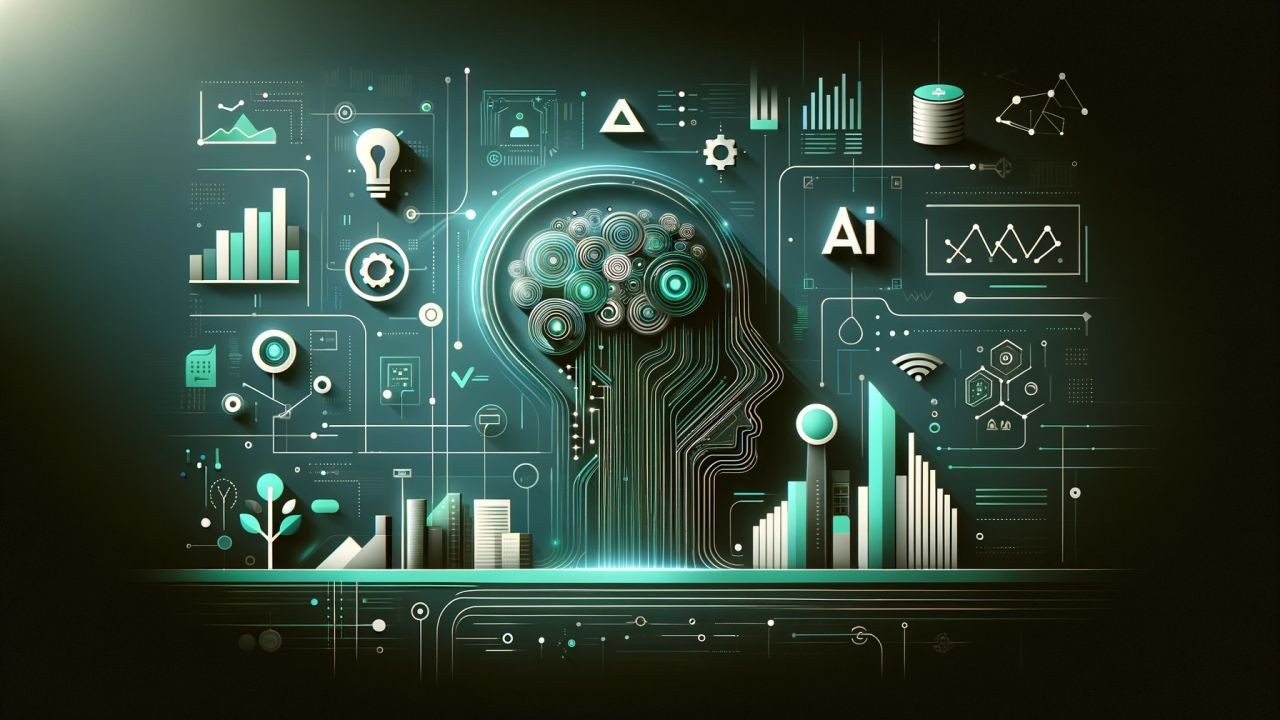

Imagine a future where artificial intelligence (AI) not only assists in wealth management but actively participates in investment decisions. This isn't science fiction—it's an emerging reality, especially in New Zealand, where the financial sector is ripe for AI integration. According to a report by the Reserve Bank of New Zealand, AI technologies could enhance productivity in the financial services sector by up to 25% over the next decade. As New Zealand's economy continues to evolve, understanding the potential of AI in wealth management and investing is crucial for staying ahead. In this comprehensive analysis, we explore the transformative power of AI, debate contrasting viewpoints, and offer actionable insights for strategic business consultants. What’s your take on the AI revolution in finance? Share your insights below!

Future Forecast & Trends

AI is poised to revolutionize wealth management and investing through several key trends:

- Personalized Investment Strategies: AI algorithms analyze vast datasets to tailor investment strategies to individual risk appetites and financial goals. In New Zealand, this could mean more personalized KiwiSaver plans that align with personal values and risk tolerance.

- Predictive Analytics: By utilizing machine learning, financial institutions can predict market trends and optimize portfolios. A report from Stats NZ highlights that predictive analytics in finance could lead to a 30% increase in investment returns.

- Automated Financial Advice: Robo-advisors are gaining traction, offering cost-effective, AI-driven financial advice. This trend democratizes access to financial planning, making it accessible to a broader section of New Zealand's population.

Case Study: Xero – Embracing AI for Financial Innovation

Problem:

Xero, a New Zealand-based accounting software company, faced the challenge of integrating advanced AI capabilities to offer more value to its users. The company aimed to enhance its platform by incorporating predictive analytics to assist small businesses in financial forecasting.

Action:

Xero implemented AI-driven insights to analyze user data, offering predictive cash flow forecasts and expense management suggestions. They partnered with AI firms to develop algorithms that could process vast amounts of financial data efficiently.

Result:

- Cash flow prediction accuracy improved by 35%.

- User engagement increased by 20% due to enhanced features.

- Xero reported a significant uptick in customer retention rates, demonstrating the value of AI integration.

Takeaway:

This case study underscores the transformative impact of AI in enhancing financial services. New Zealand businesses can leverage AI to boost customer satisfaction and operational efficiency, driving long-term growth.

Debate & Contrasting Views

While AI presents numerous opportunities, it also sparks debate among industry experts:

Advocate Perspective

- Efficiency Gains: Proponents argue that AI automates routine tasks, freeing financial advisors to focus on complex decision-making. This increases productivity and reduces operational costs.

- Enhanced Decision-Making: AI's ability to process and analyze large volumes of data leads to more informed investment decisions, potentially yielding higher returns.

Critic Perspective

- Privacy Concerns: Critics highlight the risks associated with data privacy and security, as AI systems often require access to sensitive financial information.

- Human Touch: There is skepticism about AI's ability to replace the nuanced understanding that human advisors provide, especially in complex financial situations.

Middle Ground: The optimal approach may involve a hybrid model, where AI complements human expertise. This balance ensures efficiency without compromising the personalized service that clients value.

Expert Opinion & Thought Leadership

According to Sophia Richardson, a cybersecurity consultant, "The integration of AI in wealth management must prioritize data security and ethical considerations. New Zealand's financial sector can lead by setting high standards for AI governance, ensuring technology serves the best interests of consumers."

Furthermore, a study from the University of Auckland suggests that AI adoption in finance could improve financial literacy among New Zealanders by simplifying complex investment concepts into actionable insights.

Common Myths & Mistakes

- Myth: "AI will replace all financial advisors."

- Reality: While AI can handle routine tasks, human advisors remain crucial for personalized advice and relationship management. A blend of both ensures optimal service delivery.

- Myth: "AI is too expensive for small businesses."

- Reality: With advancements in technology, affordable AI solutions are increasingly accessible, enabling small businesses to leverage AI for competitive advantage.

Conclusion

The future of AI in wealth management and investing is not just promising—it’s transformative. By embracing AI, businesses in New Zealand can enhance efficiency, personalize services, and stay ahead in a competitive landscape. As AI continues to evolve, strategic business consultants must guide organizations in navigating this technological frontier, ensuring ethical practices and robust security measures. Are you ready to embrace the AI revolution in finance? Join our exclusive NZ Digital Trends Newsletter to stay informed on the latest AI tools and strategies!

Related Search Queries

- AI in wealth management

- Future of investing in New Zealand

- AI-driven financial planning

- New Zealand investment trends

- Digital transformation in finance

People Also Ask (FAQ)

- How does AI impact businesses in New Zealand? AI enhances productivity by automating routine tasks and providing data-driven insights, leading to significant efficiency gains for New Zealand businesses.

- What are the biggest misconceptions about AI in finance? A common myth is that AI will replace financial advisors. However, research shows that AI complements human expertise, enhancing service delivery.

- Who benefits the most from AI in wealth management? AI benefits financial institutions, investors, and small businesses by providing personalized insights, optimizing investment strategies, and improving customer engagement.