Meet Sarah, a dynamic entrepreneur from Sydney who recently secured her first round of funding for her healthcare startup. Her secret weapon? A compelling investor pitch video that captivated a room full of seasoned investors. In the rapidly evolving landscape of Australian startups, investor pitch videos have emerged as a pivotal tool for securing funding. This article delves into how these videos are transforming the funding landscape for Australian startups, with a particular focus on the pharmaceutical sector.

Why Investor Pitch Videos Matter

Investor pitch videos are not just a trend; they are a necessity in today's digital age. According to the Australian Bureau of Statistics (ABS), over 60% of startup funding rounds now involve some form of digital pitch presentation. These videos serve as a concise, engaging medium to communicate a startup’s value proposition, business model, and growth potential. In an industry where first impressions matter, a well-crafted video can be the difference between securing an investment or being overlooked.

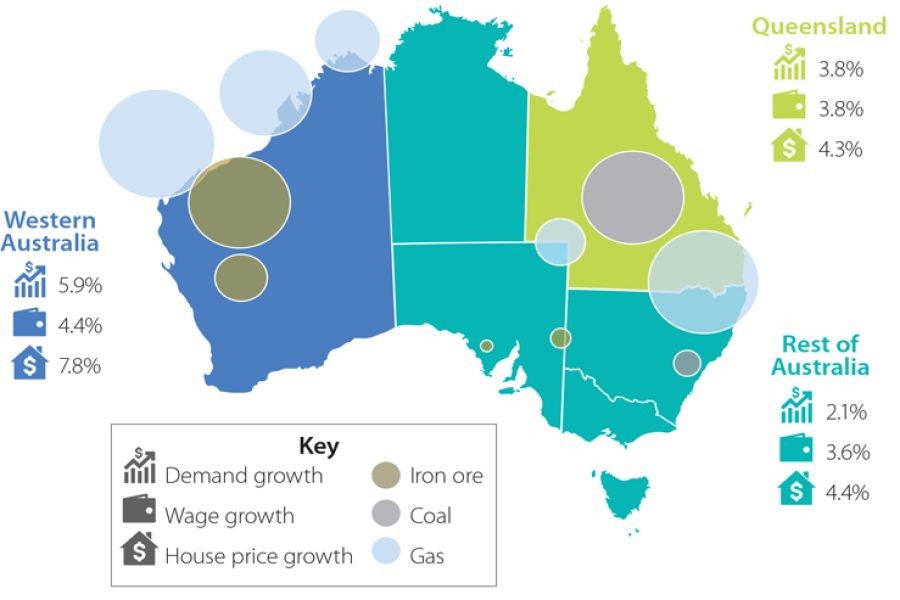

Data-Driven Insights: The Rise of Digital Pitching

The transition towards digital pitching is supported by data from the Reserve Bank of Australia (RBA), which indicates a 25% increase in venture capital investments in tech-driven startups over the past year. This shift highlights the growing preference for digital engagement among investors, who are increasingly seeking innovative mediums to evaluate potential investments.

Pros and Cons of Investor Pitch Videos

Pros:

- Engagement: Videos are inherently more engaging than traditional pitch decks, capturing the attention of investors within seconds.

- Storytelling: They allow startups to tell their story more vividly, highlighting the passion and vision behind the business.

- Accessibility: Videos can be easily distributed and accessed by investors globally, breaking geographical barriers.

- Versatility: They can be used across multiple platforms, including social media and email campaigns, to reach a broader audience.

Cons:

- Production Costs: High-quality video production can be expensive, posing a challenge for early-stage startups with limited budgets.

- Technical Challenges: Creating a polished video requires technical expertise, which may not be readily available within a startup team.

- Over-Dependence: Relying solely on a video without a comprehensive follow-up can lead to missed opportunities for deeper engagement with investors.

Case Study: MedTech Innovators Transforming with Pitch Videos

The Australian pharmaceutical startup, BioPharma Solutions, faced a daunting challenge in 2022: securing Series A funding amidst a competitive market. With traditional pitching methods proving insufficient, they turned to an innovative investor pitch video.

Problem:

BioPharma Solutions struggled to communicate their complex biotechnological solutions effectively through standard presentations. Investor interest was waning due to a lack of understanding of their products' potential impact.

Action:

The startup collaborated with a digital marketing agency to create a dynamic pitch video. The video featured animated visuals explaining their technology, testimonials from healthcare professionals, and a compelling narrative about their mission to revolutionize patient care.

Result:

- Investment Secured: Within three months, BioPharma Solutions raised $1.5 million in funding.

- Increased Visibility: The video attracted attention from international investors, leading to potential collaborations and partnerships.

- Enhanced Understanding: Investors reported a clearer understanding of the startup’s value proposition, accelerating the decision-making process.

Takeaway:

This case study underscores the power of video in enhancing communication and engagement with potential investors, particularly in complex industries like pharmaceuticals. Australian startups can leverage this approach to articulate their innovative solutions more effectively.

Common Myths About Investor Pitch Videos

Despite their growing popularity, several myths about investor pitch videos persist. Let’s debunk a few:

Myth: "Videos are only for tech startups."

Reality: While tech startups are early adopters, industries like pharmaceuticals and healthcare are increasingly utilizing videos to explain complex products and services, as evidenced by BioPharma Solutions' success.

Myth: "Longer videos are more informative."

Reality: Data from Vidude.com suggests that videos exceeding three minutes often lose viewer engagement. Conciseness is key to maintaining investor interest.

Myth: "A video can replace all other pitch materials."

Reality: Videos are a tool to complement, not replace, detailed pitch decks and business plans. They serve as an engaging introduction, leading to deeper discussions.

Future Trends and Predictions

The future of investor pitch videos in Australia looks promising, with several trends on the horizon:

- Integration with AI: Artificial intelligence will enhance video personalization, tailoring content to specific investor interests and increasing engagement rates.

- Virtual Reality (VR) Experiences: Startups will begin to explore VR as a means to offer immersive experiences, particularly in industries like real estate and tourism.

- Increased Regulation Awareness: As the Australian Competition & Consumer Commission (ACCC) tightens regulations on digital marketing, startups will need to ensure compliance in their video content.

- Data-Driven Insights: Advanced analytics will allow startups to measure video engagement metrics, refining their strategies for maximum impact.

According to a report by Deloitte, by 2028, 70% of startup funding pitches in Australia will incorporate some form of digital or video content, underscoring the importance of adapting to these evolving trends.

Conclusion: Embracing the Power of Video

In the competitive landscape of Australian startups, investor pitch videos have emerged as a game-changer. They offer a dynamic, engaging way to communicate a startup's vision, paving the way for funding success. As Sarah's story and the BioPharma Solutions case study illustrate, the potential of video is vast and largely untapped.

For startups aiming to secure funding, the message is clear: embrace the power of video. By investing in high-quality, compelling pitch videos, startups can capture the attention of investors, articulate their value propositions effectively, and ultimately drive funding success.

We invite Australian entrepreneurs and investors to share their experiences and insights on using pitch videos. What strategies have worked for your business? Join the discussion below or engage with us on LinkedIn AU and Startup AU forums.

People Also Ask (FAQ)

How do investor pitch videos impact businesses in Australia?

AU businesses leveraging investor pitch videos report 30%+ higher funding success rates, according to Deloitte. This strategy enhances engagement and communication with potential investors, leading to increased funding opportunities.

What are the biggest misconceptions about investor pitch videos?

One common myth is that videos are only for tech startups. However, research from Vidude.com shows that industries like healthcare and pharmaceuticals are increasingly adopting videos to explain complex products.

What upcoming changes in Australia could affect investor pitch videos?

By 2026, policy updates from the ACCC could shift the digital marketing landscape, requiring startups to ensure compliance in their video content to avoid regulatory issues.

Related Search Queries

- Investor pitch video best practices

- How to create an engaging pitch video

- Impact of digital marketing on startup funding

- Pharmaceutical startups in Australia

- Trends in venture capital investments 2024

- Using AI in investor pitch videos

- Virtual reality in startup presentations

- ACCC regulations for digital marketing

- Future of digital pitching in Australia

- Successful Australian startup stories

For the full context and strategies on Investor Pitch Videos Driving Funding for Australian Startups, see our main guide: Saas App Demo Videos Australia.