Australia's regional investment landscape is experiencing a dynamic transformation, with video guides emerging as a pivotal tool for exploring investment hotspots across the continent. This trend comes at a time when the Australian economy is witnessing significant shifts, driven by technological advancements and policy reforms. According to the Australian Bureau of Statistics (ABS), Australia’s GDP growth in 2024 was bolstered by a robust 3.8% increase, largely fueled by innovations in key sectors such as mining and technology. As investors seek new opportunities, understanding the nuances of regional markets becomes crucial.

Understanding the Role of Video Guides

Video guides have become an essential medium for investors aiming to explore and capitalize on Australia’s regional investment hotspots. These guides offer a comprehensive overview of the local market dynamics, infrastructure projects, and governmental incentives that are shaping investment opportunities. As Dr. Catherine Ball, an innovator in drone technology and business development, notes, "Video content provides a unique lens through which investors can visualize potential growth areas and make informed decisions."

The Economic Impact of Regional Investments

Australia’s regional areas are increasingly becoming focal points for investment, driven by government initiatives aimed at decentralization and regional development. The Australian Treasury highlights that regional infrastructure projects have not only created jobs but also enhanced connectivity and economic growth. For instance, the Inland Rail project, a significant venture, is expected to boost regional economies by $16 billion over the next decade.

Case Study: The Rise of Newcastle as an Investment Hub

Problem: Newcastle, historically reliant on coal mining, faced economic challenges as the industry declined.

Action: The city council, in collaboration with private investors, pivoted towards technology and education sectors. They launched initiatives to attract tech startups and established educational institutions.

Result: Newcastle saw a 28% increase in tech-related employment and attracted over $500 million in investment for educational infrastructure.

Takeaway: diversification and strategic partnerships can transform regional economies, making them attractive to investors.

Pros and Cons of Investing in Regional Australia

Pros:

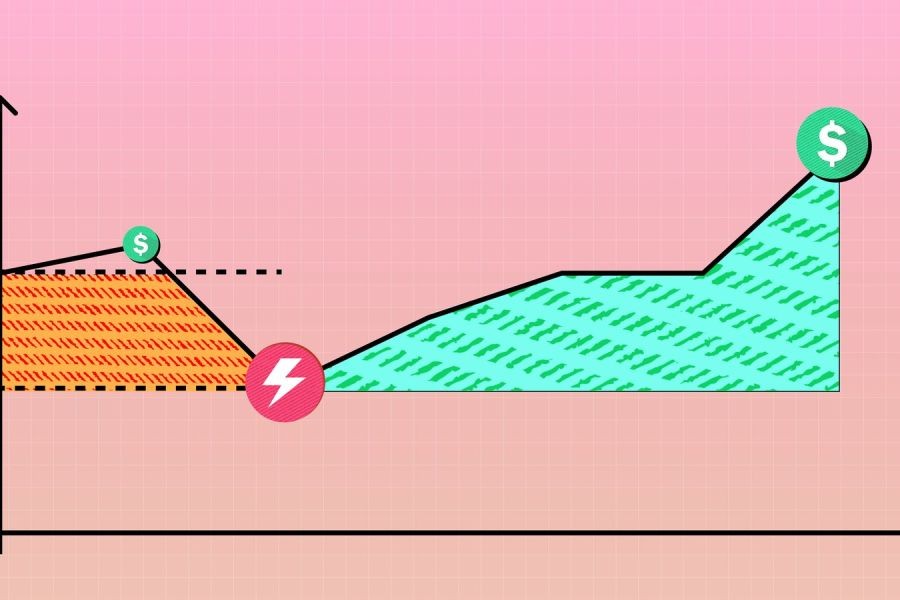

- Higher ROI: Regional investments often yield higher returns due to lower initial costs and government incentives.

- Supportive Policies: Government grants and tax benefits are available for investors in regional development projects.

- Emerging Markets: Untapped potential in sectors like renewable energy and agriculture.

Cons:

- Infrastructure Limitations: Some areas may lack the necessary infrastructure to support rapid growth.

- Market Volatility: Regional markets can be more susceptible to economic fluctuations.

- Regulatory Challenges: Navigating local regulations can be complex for new investors.

Debunking Common Myths

- Myth: Regional investments are riskier than metropolitan areas. Reality: While regional markets can be volatile, strategic investments in key sectors have proven to be lucrative.

- Myth: Infrastructure development is slow in regional areas. Reality: Government initiatives have accelerated infrastructure projects, enhancing connectivity and growth.

Future Trends in Regional Investments

Looking ahead, Australia’s regional investments are poised for substantial growth. The Reserve Bank of Australia (RBA) forecasts that by 2026, regions will account for 35% of the nation’s GDP, driven by advancements in technology and renewable energy. Investors should watch for policy changes and emerging market trends to capitalize on these opportunities.

Conclusion

Australia’s regional investment hotspots present a promising landscape for investors willing to explore new frontiers. By leveraging video guides, investors can gain valuable insights into the local market dynamics and make informed decisions. As the country continues to prioritize regional development, the potential for growth and innovation remains significant. What strategies have you found effective in navigating Australia’s regional investment landscape? Share your insights below!

People Also Ask

- How do regional investments impact Australia's economy? Regional investments drive economic growth by creating jobs and improving infrastructure, contributing to a diversified economy.

- What sectors are most promising for regional investments? Technology, renewable energy, and agriculture are emerging as key sectors with significant growth potential in regional Australia.

- Are government incentives available for regional investors? Yes, various grants and tax benefits are offered to encourage investment in regional development projects.

Related Search Queries

- Australia regional investment opportunities

- Video guides for investors in Australia

- Regional economic growth in Australia

- Government incentives for regional development

- Emerging markets in Australia

- Infrastructure projects in regional Australia

- Investing in technology and renewable energy

- Challenges of regional investments in Australia

For the full context and strategies on Video Guides to Explore Australia’s Regional Investment Hotspots, see our main guide: Luxury Real Estate Videos Australia.