In recent years, Australia has positioned itself as a burgeoning hub for technological innovation, fostering dynamic ecosystems that nurture both tech startups and deep tech ventures. With the rapid evolution of technology sectors globally, the question arises: where does Australia's future lie? Let's explore the potential trajectories of these two pivotal domains and what they mean for the nation's economic landscape.

Australia’s technology sector is entering a decisive period. After more than a decade of success producing globally competitive software startups, the nation now faces a more complex strategic question: should Australia continue optimising for fast-scaling tech startups, or should it place greater emphasis on deep tech as the foundation of its long-term economic and technological future? The answer will shape Australia’s productivity, industrial resilience, and global relevance well beyond the next economic cycle.

Tech startups and deep tech ventures are often grouped together, but they represent fundamentally different approaches to innovation. Traditional tech startups are typically focused on software-driven products, digital platforms, and scalable online services. Their strength lies in speed, market responsiveness, and the ability to reach global users with relatively low upfront capital. Deep tech companies, by contrast, are built on scientific discovery and advanced engineering. Their core value resides in intellectual property, research capability, and technologies that are difficult to replicate.

Australia has demonstrated strong capability in producing technology startups that scale internationally. Software-led businesses benefit from global distribution, predictable venture capital models, and faster feedback loops from users. These companies are effective at generating employment, attracting foreign investment, and building international brand recognition. In the short to medium term, they deliver clear economic returns and help position Australia as an entrepreneurial, innovation-friendly market.

However, most technology startups are built on top of existing global infrastructure and foundational technologies. Their competitive advantage is often execution-driven rather than invention-driven. While this model can produce large outcomes, it leaves Australia dependent on external platforms, supply chains, and core technologies that are controlled elsewhere. As global competition intensifies, this dependency becomes a structural vulnerability rather than a neutral trade-off.

Deep tech presents a different value proposition. These ventures focus on creating entirely new technological capabilities, often in areas such as advanced materials, clean energy systems, quantum technologies, space infrastructure, biotechnology, and next-generation manufacturing. Deep tech companies are slower to mature, require significant capital, and carry higher technical risk. Yet when successful, they generate enduring competitive advantages that can anchor entire industries within a national economy.

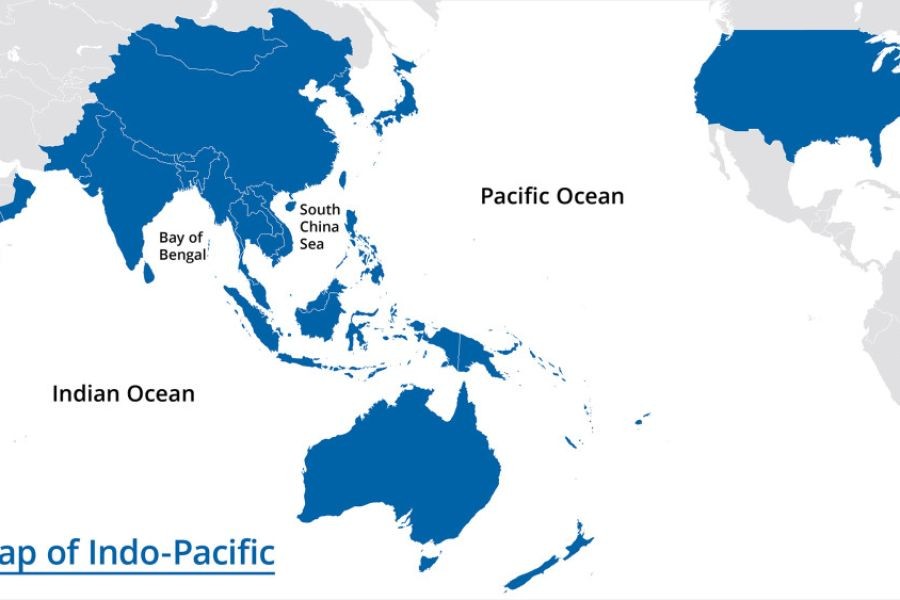

For Australia, deep tech aligns closely with long-term national interests. The country possesses world-class research institutions, strong scientific talent, and natural advantages in energy, resources, and geographic positioning. Deep tech enables Australia to convert these strengths into sovereign capabilities rather than exporting raw inputs and importing finished technologies. It shifts the economy from price-based competition toward knowledge-based leadership.

The economic impact of deep tech is not always immediate, but it is structurally powerful. Deep tech companies tend to create high-skill, high-wage jobs and foster complex supply chains that remain domestic for longer periods. They generate intellectual property that can be licensed globally and form the basis for future waves of innovation. Importantly, deep tech also strengthens national resilience by reducing reliance on external technologies in critical sectors such as energy, healthcare, communications, and defence.

One of the primary reasons deep tech has historically lagged behind software startups in Australia is the mismatch between innovation timelines and available capital. Venture capital models favour rapid validation, early revenue, and relatively short exit horizons. Deep tech, by its nature, requires patient investment, extended research phases, and longer pathways to commercialisation. This has often pushed founders toward simpler startup models, even when deeper technological potential exists.

Despite these challenges, the future of Australia’s innovation ecosystem is not a choice between tech startups and deep tech. The strongest global ecosystems integrate both. Tech startups excel at market discovery, user experience, and rapid scaling. Deep tech provides the foundational breakthroughs that make entirely new markets possible. When these two models are connected, scientific innovation can move more efficiently from the laboratory to global adoption.

Australia’s opportunity lies in deliberately designing this integration. Research translation must be treated as a core economic function rather than an afterthought. Capital frameworks need to recognise long-term value creation, not just speed to exit. Public procurement can play a catalytic role by acting as an early customer for emerging technologies. Talent pipelines must support advanced engineering and applied science alongside entrepreneurship.

Looking forward, Australia’s future competitiveness will depend less on how many startups it creates and more on what those startups are built upon. Economies that lead the next technological era will be those that own critical technologies, shape global standards, and control key intellectual property. Deep tech is the pathway to that ownership, while tech startups provide the mechanisms for scale and global reach.

Australia does not need to abandon its successful startup culture to pursue this future. Instead, it must evolve it. By aligning entrepreneurial energy with scientific depth, Australia can move beyond incremental innovation and become a creator of foundational technologies with global impact. The long-term future belongs not to speed alone, but to those who combine speed with substance.

Understanding the Landscape: Tech Startups vs. Deep Tech

While both tech startups and deep tech ventures play critical roles in Australia's innovation economy, they are inherently different in their approach, impact, and potential. Tech startups often focus on software and digital services, rapidly bringing consumer-focused solutions to market. In contrast, deep tech involves groundbreaking research and development in fields such as biotechnology, quantum computing, and advanced materials, typically requiring significant time and investment to mature.

Market Trends and Economic Factors

According to the Australian Bureau of Statistics, the tech sector contributes approximately 6.6% to the nation's GDP, underscoring its significance. Within this, tech startups have shown robust growth, particularly in fintech and SaaS (Software as a Service) industries, where Australia boasts a thriving ecosystem. However, deep tech is gaining momentum, driven by government initiatives like the National Innovation and Science Agenda, which aims to bolster R&D investment.

Case Study: Canva - A Tech Startup Success Story

Problem: Canva, a now-iconic Australian tech startup, initially faced challenges in democratizing design software for non-designers.

- They struggled with scalability and user engagement in their early days.

- Industry data indicated a growing demand for accessible design tools, but market penetration was a hurdle.

Action: Canva embraced a freemium model, allowing users to access basic tools for free while offering premium features for a fee.

- This strategy attracted a vast user base, while partnerships with key players like Dropbox and Google further expanded their reach.

Result:

- Canva’s user base soared to over 75 million monthly active users.

- The company achieved a valuation of $40 billion, making it one of the most successful tech startups globally.

Takeaway: The success of Canva highlights the potential for tech startups to achieve exponential growth through strategic market positioning and innovative business models.

Regulatory Insights and Opportunities

The Australian Competition & Consumer Commission (ACCC) and the Australian Prudential Regulation Authority (APRA) play pivotal roles in regulating the tech landscape. For startups, understanding these regulatory frameworks is crucial for compliance and strategic growth. Furthermore, government grants and incentives for R&D, especially in deep tech, present lucrative opportunities for entrepreneurs to innovate without the burden of initial financial constraints.

The Deep Tech Advantage: Long-Term Impact and Innovation

Deep tech ventures, though often slower to market, offer transformative potential. Consider the work being done in quantum computing at the University of Sydney, where researchers are pioneering advancements that could revolutionize industries from cybersecurity to pharmaceuticals. The Reserve Bank of Australia (RBA) notes that such innovations may lead to significant productivity gains, potentially adding billions to the economy.

Case Study: Sydney Quantum Academy - Pioneering Deep Tech

Problem: The Sydney Quantum Academy (SQA) sought to position Australia as a leader in quantum technology.

- They faced challenges in attracting talent and securing funding for extensive research endeavors.

Action: SQA established partnerships with leading universities and tech companies, creating a collaborative ecosystem.

- They implemented programs to train the next generation of quantum scientists and engineers.

Result:

- SQA has attracted over $100 million in funding.

- The academy is producing world-class research, positioning Australia at the forefront of quantum innovation.

Takeaway: The SQA exemplifies how strategic collaboration and investment in deep tech can yield significant long-term benefits, potentially redefining industries on a global scale.

Balancing Risk and Reward: Investment Considerations

For investors, the choice between tech startups and deep tech involves weighing risk against reward. Tech startups often offer quicker returns but with higher volatility. Deep tech, while riskier and requiring patience, promises substantial rewards through disruptive innovations. Diversification across both sectors can be a prudent strategy, leveraging the dynamism of startups and the groundbreaking potential of deep tech.

Pros and Cons Analysis

Pros of Tech Startups:

- Rapid market entry and scalability.

- Potential for high short-term returns.

- Strong ecosystem support and mentorship opportunities.

Cons of Tech Startups:

- High competition and market saturation.

- Vulnerability to market shifts and consumer trends.

Pros of Deep Tech:

- Long-term value creation and industry transformation.

- Significant economic impact and productivity gains.

Cons of Deep Tech:

- High capital requirements and longer development timelines.

- Complex regulatory landscapes and ethical considerations.

Common Myths and Mistakes

Myth: "All tech startups are high-risk investments."

Reality: While startups inherently carry risk, those in supportive ecosystems like Australia’s often benefit from mentorship and funding opportunities, mitigating potential downsides.

Myth: "Deep tech takes decades to see returns."

Reality: Advances in fields like biotechnology and quantum computing are accelerating, with some ventures achieving breakthroughs in significantly shorter timeframes.

Future Trends and Predictions

With continued government support and private investment, Australia is poised to become a global leader in both tech startups and deep tech by 2030. The integration of AI, IoT, and quantum computing into everyday applications will likely drive this growth, fostering a robust, diversified economy. As noted in a Deloitte report, embracing these innovations could lead to a 10-15% increase in GDP over the next decade.

Conclusion: Shaping Australia’s Technological Frontier

The future of Australia's tech landscape is rich with potential, balancing the dynamism of startups with the transformative power of deep tech. For financial advisors, the message is clear: diversifying investments across these sectors can yield substantial rewards. As Australia continues to innovate and adapt, the nation’s economic future looks promising.

What strategies are you implementing to stay ahead in this evolving tech landscape? Share your thoughts and join the conversation!

People Also Ask

- How does deep tech impact the Australian economy? Deep tech innovations, like quantum computing and biotechnology, have the potential to significantly boost productivity and GDP, according to the Reserve Bank of Australia.

- What are the biggest misconceptions about tech startups? One common myth is that all tech startups are high-risk investments. However, many startups in Australia benefit from strong support systems, reducing potential risks.

- What are the best strategies for investing in tech? Experts recommend diversifying across both tech startups and deep tech, leveraging the rapid growth potential of startups and the long-term gains of deep tech innovations.

Related Search Queries

- Tech startups in Australia 2024

- Deep tech investments Australia

- Australian tech industry trends

- Quantum computing Australia

- Fintech startups in Australia

- Government support for tech startups Australia

- Future of technology in Australia

- Investment opportunities in Australian tech

- Deep tech innovations 2025

- Canva success story

For the full context and strategies on Tech Startups vs. Deep Tech: Where Is Australia’s Future? – (And How It Impacts Aussie Consumers), see our main guide: Australia.