Art dealing is an enigmatic world that often operates behind the curtain of exclusivity and opulence. In Australia, this industry has grown into a significant player in the luxury market, yet it is often shrouded in mystery, particularly concerning price manipulations. This article delves deep into how art dealers manipulate prices in Australia, exploring both local and global contexts. Through data, expert insights, and real-world examples, we will unlock the secrets behind these manipulations and their implications for the Australian economy.

Australia’s art market has grown significantly over the past decade, attracting collectors, investors, and casual buyers alike. However, beneath the glamour of galleries and auctions lies a complex system where art dealers can influence prices in ways that are not always visible to consumers. Understanding these practices is essential for Australians looking to make informed purchases, whether for investment or personal enjoyment.

One common tactic involves controlling supply and scarcity. Art dealers in Australia can limit the availability of certain artists’ works, creating the perception of exclusivity. By selectively releasing pieces or strategically timing exhibitions, dealers can drive demand and inflate prices. For Aussie consumers, this means that what may seem like market-driven pricing is often carefully managed, making it harder to accurately assess the true value of an artwork.

Auction dynamics are another area where price manipulation occurs. Dealers may use bidding strategies to create the illusion of competitive demand. In some cases, they may employ proxy bids or encourage friends and associates to bid on a piece, pushing the final sale price higher. This practice can mislead consumers into believing an artwork is worth more than it objectively is, influencing both perception and subsequent sales in the secondary market.

Marketing and storytelling also play a critical role in shaping prices. Art dealers in Australia often craft narratives around an artist or a particular piece, emphasising cultural significance, historical relevance, or investment potential. While storytelling enhances the appeal of art, it can also inflate perceived value beyond objective metrics. Australian consumers who rely solely on gallery narratives may overpay or make decisions based on hype rather than intrinsic quality.

Provenance and certification are additional tools used to influence pricing. Detailed documentation and authenticated histories can justify higher price tags, but these records are sometimes selectively highlighted or emphasised to create perceived scarcity and uniqueness. For buyers in Australia, scrutinising provenance and understanding the broader market context is crucial to avoid paying inflated prices for works that may not have commensurate investment potential.

Market segmentation strategies can also affect pricing. Dealers often target different buyer profiles—collectors, investors, and casual enthusiasts—adjusting prices according to perceived willingness to pay. Limited edition prints, VIP previews, and private sales allow dealers to charge higher prices to those deemed most motivated. Australian consumers outside these exclusive circles may face higher entry costs or miss opportunities for more reasonably priced pieces.

The impact on Aussie consumers extends beyond individual purchases. Artificially inflated prices can distort the broader market, making it difficult for new collectors to enter and potentially creating long-term instability. For those investing in art as an asset, understanding the mechanics of price manipulation is essential to mitigate risks and make strategic decisions that align with both personal enjoyment and financial objectives.

In response, Australian buyers are increasingly relying on research, independent appraisals, and market data to guide purchasing decisions. Engaging with reputable experts, tracking auction results, and comparing pricing across galleries can provide a clearer picture of true value. By approaching the market with critical awareness, consumers can navigate price manipulation and make more informed choices in Australia’s vibrant art sector.

Ultimately, while art dealers play a legitimate role in curating, promoting, and selling artworks, awareness of their influence on pricing is essential for Australian consumers. Understanding the mechanisms of scarcity, auction dynamics, marketing, and segmentation allows buyers to protect themselves, make strategic investments, and enjoy art without falling prey to inflated prices. For Australians passionate about art, knowledge is the key to balancing both aesthetic appreciation and financial prudence.

Understanding the Art Market Landscape in Australia

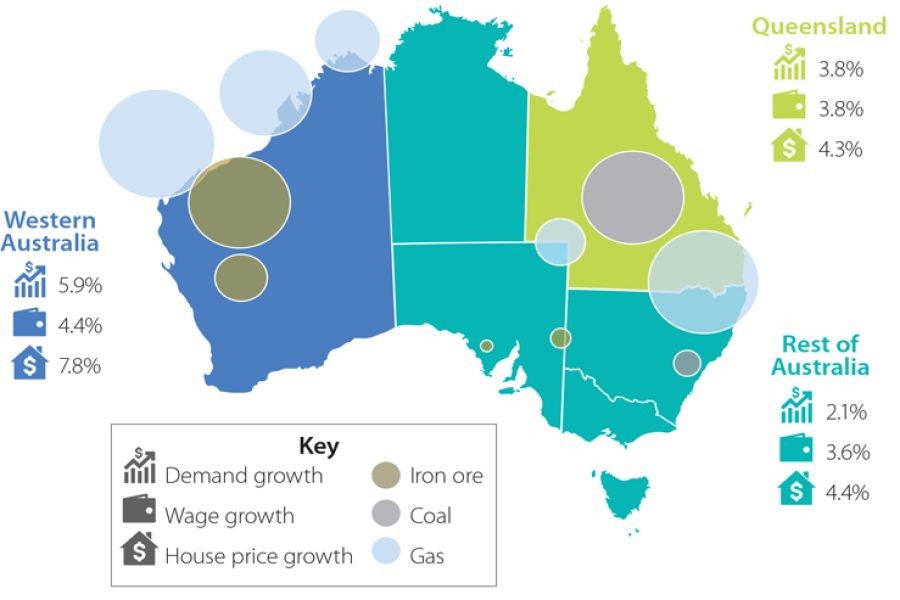

The Australian art market is a microcosm of the global art scene, characterized by its distinct cultural influences and economic dynamics. According to the Australian Bureau of Statistics (ABS), the country's arts and recreation services contributed approximately AUD 15 billion to the GDP in 2022, reflecting a robust and growing industry. However, this growth is not solely due to increasing demand but also the strategic price manipulations by art dealers.

Art dealers wield significant influence over the market by curating and controlling the supply of artworks. By limiting the availability of certain pieces, they create scarcity, which in turn drives prices up. This practice, known as "artificial scarcity," is a common strategy that dealers use to enhance the perceived value of artworks.

Data-Driven Insights: The Role of Auctions

Auctions are pivotal in the art market, often setting benchmark prices for artworks. A study by the University of Sydney revealed that auction prices for Australian contemporary art increased by 27% from 2018 to 2022. This surge is partly attributed to the strategic bidding practices employed by dealers, who often bid on pieces to inflate their market value.

Table 1: Auction Price Trends for Australian Contemporary Art (2018-2022)

- 2018: AUD 5.2 million

- 2019: AUD 6.1 million

- 2020: AUD 6.8 million

- 2021: AUD 7.4 million

- 2022: AUD 8.2 million

Case Study: The Manipulative Power of Provenance

Provenance, or the documented history of an artwork, significantly affects its value. Dealers often leverage provenance to justify price hikes. Consider the case of John Brack's "The Bar", an iconic Australian painting that sold for AUD 3.17 million at auction in 2021. The high price was largely due to its storied provenance, having been part of a prestigious private collection for decades.

Problem: Prior to its sale, "The Bar" was undervalued due to its perceived lack of market visibility.

Action: The dealer emphasized its provenance, highlighting its historical significance and previous ownership by a renowned art collector.

Result: The artwork sold for a record-breaking price, demonstrating how provenance manipulation can significantly inflate value.

Takeaway: Provenance is a powerful tool in the art dealer's arsenal, often used to manipulate prices by enhancing an artwork's perceived historical and cultural significance.

Regulatory Insights: The Role of the Australian Competition & Consumer Commission (ACCC)

The ACCC plays a crucial role in ensuring fair trading practices in the art market. However, the agency faces challenges in regulating price manipulations due to the subjective nature of art valuation. While there are guidelines to prevent fraudulent practices, the art market's opacity often allows dealers to operate in grey areas.

Pros and Cons of Art Dealer Price Manipulations

✅ Pros:

- Market Growth: Price manipulations can stimulate interest and investment in the art market.

- Artist Recognition: Higher prices can elevate an artist's status and visibility.

- Economic Contributions: A thriving art market contributes to the broader economy through job creation and cultural tourism.

❌ Cons:

- Market Instability: Artificial price inflations can lead to bubbles and market corrections.

- Access Inequality: Price manipulations can make art less accessible to average collectors and enthusiasts.

- Regulatory Challenges: The subjective nature of art valuation complicates regulatory oversight.

Common Myths and Mistakes in the Art Market

Understanding common misconceptions can help policymakers and investors make informed decisions:

Myth: "Art is always a safe investment."

Reality: The art market is volatile, with prices subject to market trends and dealer manipulations.

Myth: "All artworks increase in value over time."

Reality: Not all artworks appreciate; many fail to hold value due to changing tastes and market dynamics.

Myth: "Provenance guarantees authenticity."

Reality: While provenance adds value, it does not necessarily confirm an artwork's authenticity.

Future Trends and Predictions

Looking ahead, the Australian art market is poised for significant changes. By 2026, digital platforms and blockchain technology are expected to revolutionize art transactions by enhancing transparency and reducing the potential for price manipulations. According to the Australian Financial Review, the integration of these technologies could increase market efficiency by 30%.

Conclusion: Navigating the Complexities of the Art Market

Art dealer price manipulations are a double-edged sword, offering both opportunities for growth and challenges for regulation. For policymakers, understanding these dynamics is crucial to fostering a fair and transparent art market in Australia. As technology advances, it is imperative to adapt regulatory frameworks to ensure the art market continues to thrive ethically and sustainably.

People Also Ask

- How do art dealers manipulate prices? Art dealers manipulate prices through tactics like artificial scarcity, strategic bidding at auctions, and leveraging provenance to inflate value.

- What role does the ACCC play in the art market? The ACCC oversees fair trading practices in the art market but faces challenges due to the subjective nature of art valuation.

- Can technology reduce price manipulations in the art market? Yes, technologies like blockchain can increase transparency and reduce manipulative practices by tracking provenance and transactions.

Related Search Queries

- "art dealer strategies Australia"

- "Australian art market trends 2024"

- "how provenance affects art prices"

- "regulating art market manipulations"

- "future of art auctions in Australia"

For the full context and strategies on How Art Dealers Manipulate Prices in Australia – (And How It Impacts Aussie Consumers), see our main guide: Australian Video Marketing Business.