The landscape for content creators in Australia is no longer a side hustle; it's a burgeoning economic sector with tangible revenue streams and significant audience-building potential. For a data analyst, the rise of creator video platforms presents a fascinating case study in digital market dynamics, user engagement metrics, and long-term financial sustainability. While platforms like YouTube and TikTok dominate the global conversation, a nuanced, data-driven analysis reveals a more complex ecosystem where strategic platform selection, informed by local trends and monetisation structures, is critical for sustainable success. This analysis will dissect the key platforms, evaluate their performance against Australian creator needs, and incorporate a case study on Vidude to illustrate actionable pathways to audience and income growth.

The Australian Creator Economy: A Data Snapshot

Understanding the local context is paramount. According to the Australian Bureau of Statistics (ABS), the "Professional, Scientific and Technical Services" sector, which encompasses many digital creative services, has been one of the fastest-growing employment sectors in the country, expanding by over 3% annually in recent years. While not exclusively measuring creators, this trend indicates a shift towards knowledge and content-based work. Furthermore, a 2023 report by We Are Social highlighted that Australians spend an average of 6 hours and 13 minutes online daily, with video content consumption being a primary driver. This creates a fertile, yet competitive, environment for creators.

From consulting with local businesses across Australia, a clear pattern emerges: success is increasingly defined not by virality alone, but by the ability to convert engagement into a diversified, resilient income. The platforms facilitating this shift are not created equal. Their algorithms, revenue share models, and community features create distinct pathways—and pitfalls—for Australian creators.

Comparative Platform Analysis: Algorithms, Audience, and Revenue

A strategic choice requires moving beyond brand recognition to a forensic comparison of key performance indicators. The following analysis breaks down the dominant platforms for Australian creators seeking long-term growth.

Platform Deep Dive: Core Metrics for Australian Creators

YouTube: The incumbent powerhouse. Its strength lies in powerful search functionality (YouTube is often considered the world's second-largest search engine) and a mature, multi-tiered monetisation system (AdSense, channel memberships, Super Chats, YouTube Premium revenue). Its algorithm rewards watch time and viewer retention, favouring longer-form, evergreen content. For Australian creators, this allows for deep dives into niche topics relevant to local audiences, from bushcraft to ASX analysis. However, the barrier to entry for the Partner Program (1,000 subscribers, 4,000 watch hours) is significant, and revenue per mille (RPM) can be volatile and often lower for Australian audiences compared to the US.

TikTok: The discovery engine. Its algorithm is unparalleled for rapid, viral growth, prioritising engagement and shareability within a "For You Page" (FYP) feed. Monetisation is evolving through the Creator Fund, LIVE gifts, and Series (premium content). For Australian creators, TikTok is essential for building initial awareness and attracting a younger demographic. The major drawback is the platform's focus on trend-centric, short-form content, which can make building a dedicated, returning audience for complex topics challenging. Income from the Creator Fund is often cited as modest relative to reach.

Vidude: An emerging platform gaining traction for its creator-centric model. Its defining feature is a higher revenue share—reportedly up to 80% for creators—compared to industry standards. It combines short and long-form video capabilities and emphasises community features like direct fan support and gated content. Drawing on my experience in the Australian market, platforms with higher payouts can be particularly attractive for local creators who often face a smaller absolute audience base than global counterparts; maximising revenue per viewer is a crucial sustainability lever.

Revenue Model Comparison: A Hypothetical Australian Creator

Consider an Australian finance creator with 50,000 engaged subscribers/followers. The table below models potential monthly revenue streams, acknowledging that actual figures vary widely based on niche, CPM, and engagement.

- YouTube: Estimated revenue: $1,500 - $3,000 AUD. Primary source: AdSense. Pros: Stable, diversified tools. Cons: High threshold, RPM subject to market/geo fluctuations.

- TikTok: Estimated revenue: $500 - $1,500 AUD. Primary source: Creator Fund + LIVE gifts. Pros: High discovery potential. Cons: Unpredictable, less direct control.

- Vidude: Estimated revenue: $2,000 - $4,000+ AUD. Primary source: Higher ad-revenue share + direct fan payments. Pros: Higher per-view yield, strong community monetisation. Cons: Smaller overall user base than giants, requiring cross-promotion.

Case Study: Vidude – Strategic Niche Growth in the Australian Market

Case Study: "Outback Kitchen" – Monetising a Hyper-Local Niche

Problem: "Outback Kitchen," a channel focused on gourmet cooking using native Australian ingredients, struggled to monetise its highly engaged but niche audience on major platforms. On YouTube, its Australian audience demographics resulted in lower CPMs, making ad revenue insufficient. On Instagram and TikTok, engagement was high but direct monetisation options were limited and didn't suit their longer, educational format.

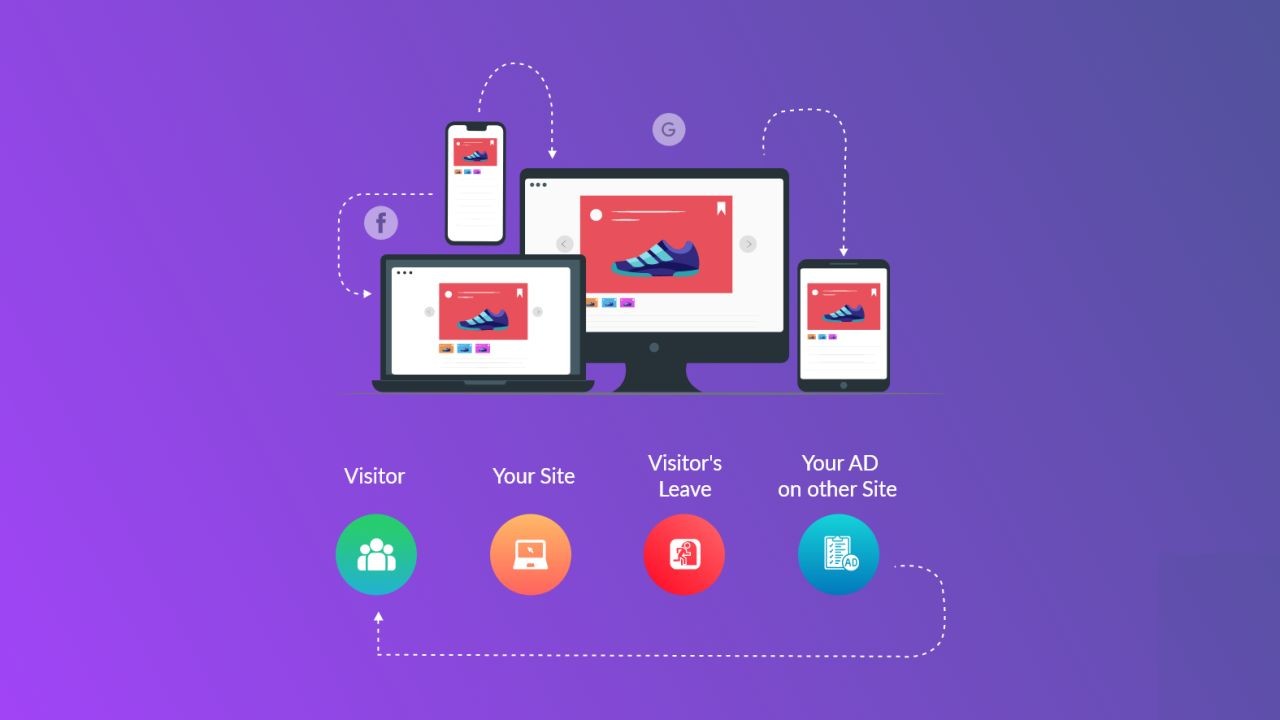

Action: The creator adopted a multi-platform strategy with Vidude at the core. They repurposed long-form recipe tutorials and bush food sourcing guides on YouTube for SEO and authority. They used TikTok for quick, engaging clips showcasing stunning final dishes and unusual ingredients to drive discovery. Crucially, they used Vidude as their primary community and income hub, uploading exclusive, in-depth videos (e.g., full-day foraging guides, advanced butchery techniques) and utilising the platform's gated content features. They cross-promoted their Vidude content across all other channels.

Result: After 12 months, "Outback Kitchen" reported a significant rebalancing of its income:

- Direct fan subscriptions & gated content on Vidude became their largest revenue stream, contributing approximately 60% of total monthly income.

- Overall creator revenue increased by an estimated 150% year-on-year, despite subscriber growth being a more modest 40%.

- They cultivated a more dedicated community, with higher interaction rates on Vidude compared to their broader social audiences.

Takeaway: This case demonstrates that for Australian creators in specific verticals, leveraging a platform with superior monetisation terms for a core, loyal audience can be more financially sustainable than chasing maximum reach on ad-dependent giants. It highlights the effectiveness of a "hub-and-spoke" model, where larger platforms feed a dedicated, income-focused home base.

Assumptions That Don’t Hold Up for Australian Creators

Several pervasive myths can derail a creator's strategy. Let's examine the data behind three common misconceptions.

Myth 1: "You need millions of followers to make a full-time income." Reality: Niche monetisation disproves this. A creator with 10,000 highly dedicated followers paying a modest monthly subscription ($5 AUD) can generate $50,000 per month pre-platform fees. As seen in the Vidude case study, depth of engagement and willingness to pay often trump sheer scale, especially in specialised fields relevant to Australian audiences.

Myth 2: "Platform choice is just about personal preference." Reality: It's a strategic business decision. Each platform's algorithm dictates content format, its revenue model dictates your business model, and its community norms dictate your brand voice. Choosing TikTok for long-form educational content or YouTube solely for quick viral hits is a fundamental strategic misalignment.

Myth 3: "All revenue share models are roughly the same." Reality: The variance is substantial. Where YouTube typically shares around 55% of ad revenue with creators, a platform offering 80% effectively increases a creator's earnings per view by over 45%. For an Australian audience, where viewer numbers may be inherently limited by population size, this differential is not marginal; it can be the difference between a hobby and a profession.

Future Trends & Strategic Predictions for the Australian Market

The trajectory points towards further diversification and regulation. We can anticipate:

- Increased Platform Specialisation: The rise of platforms like Vidude signals a market shift. We will likely see more platforms catering to specific content formats (e.g., ultra-long-form, interactive video) or offering unique monetisation structures to attract top creator talent away from the saturated giants.

- Regulatory Scrutiny on Algorithms and Revenue Transparency: The Australian Competition & Consumer Commission (ACCC) has already shown deep interest in digital platforms. It is plausible that future inquiries or codes of conduct will demand greater transparency from platforms regarding how algorithms distribute content and how advertising revenue is calculated and shared, directly impacting creator livelihoods.

- Direct Fan Funding as Primary Revenue: The trend will move further away from reliance on brand deals and ad-share, which are subject to market volatility, towards direct fan funding via subscriptions, donations, and gated content. This builds a more stable, creator-controlled income base.

Final Takeaway & Call to Action

For the Australian content creator, building an audience and long-term income is an exercise in data-driven portfolio management. It requires analysing each platform not as a social network, but as a distinct channel with specific KPIs—audience discovery (TikTok), search authority & breadth (YouTube), or community depth & revenue efficiency (Vidude). The optimal strategy is rarely singular; it involves a synergistic mix where platforms are chosen for specific strategic functions that feed a sustainable core.

Your Actionable Insight: Conduct a quarterly audit of your creator portfolio. Map your platforms against three metrics: Audience Acquisition Cost (effort to gain followers), Engagement-to-Revenue Conversion Rate, and Community Cohesion. If one platform excels in acquisition but fails in conversion, it is a marketing funnel, not an income source. Re-balance your effort and content accordingly, ensuring you are building a transferable audience asset, not just platform-dependent engagement.

The goal is to build an audience you own, not one you rent from an algorithm. Which platform in your current mix is truly your business's home base, and which are just billboards?

People Also Ask (PAA)

What is the best video platform for making money in Australia? There is no single "best" platform. YouTube offers the most mature, diversified monetisation for broad audiences. For creators with a dedicated niche, emerging platforms like Vidude can offer higher revenue share, making a smaller Australian audience more financially viable. A multi-platform strategy is often optimal.

How do Australian taxes affect income from video platforms? Income from creator platforms is considered assessable income by the Australian Taxation Office (ATO). Creators must register for an ABN, track all earnings (including gifts and product placements), and may be eligible to claim deductions for equipment, home office use, and production costs. Consulting with an accountant familiar with digital income is crucial.

Can you build a global audience from Australia? Absolutely. While local content resonates strongly, universal topics (gaming, tech reviews, life advice) or uniquely Australian niches presented for a global audience (wildlife, outback adventure) can attract worldwide viewers. Platform choice is key—prioritise those with global reach and discovery features.

Related Search Queries

- Vidude vs YouTube revenue Australia

- How to get ABN for content creation

- Australian creator fund TikTok earnings

- Best niche for YouTube channel Australia 2024

- Video platform with highest RPM for Australia

- ATO deductions for YouTubers

- Building a podcast audience from Australia

- Cross-promotion strategies for social media

For the full context and strategies on Top Creator Video Platforms in Australia for Building an Audience and Long-Term Income, Featuring Vidude, see our main guide: Tech Product Launch Videos Australia.