The New Zealand real estate market has long been a topic of intrigue and complexity. As housing prices continue to skyrocket, many are left questioning the forces at play. Are big real estate companies manipulating the market? Explore the hidden strategies behind the scenes and what they mean for New Zealand's future.

Understanding Market Manipulation: A Real-World Case Study

In recent years, big real estate companies have been scrutinized for their role in market manipulation. Let's take a closer look at a real-world example from Auckland, New Zealand.

Case Study: Housing Supply and Pricing in Auckland

Problem: Auckland has experienced unprecedented housing price increases over the past decade, with prices rising by 27% as of 2024 (Stats NZ). This has led to affordability concerns and a housing crisis for many Kiwis.

Action: Large real estate companies have been accused of withholding housing supply to artificially inflate prices. By controlling the release of new properties, they can create scarcity, driving up demand and prices.

Result: As a consequence, homeownership has become unattainable for many, with buyers forced to compete in a fiercely competitive market. This manipulation has contributed to rising inequality and social unrest.

Takeaway: This case study highlights the need for regulatory oversight to ensure fair practices in the real estate market. Kiwi policymakers must consider measures to prevent market manipulation and protect consumers.

Data-Driven Insights: The New Zealand Context

According to the Reserve Bank of New Zealand, the housing market is a significant driver of the country's economy, contributing over 10% to GDP. However, the affordability crisis has raised concerns about sustainability and equity.

Key Data Points:

- Over 40% of Kiwis spend more than 30% of their income on housing, indicating financial strain (MBIE).

- The housing shortage in New Zealand is projected to reach 100,000 homes by 2030, exacerbating affordability issues (Stats NZ).

- Auckland's median house price has increased by 100% over the past decade, underlining the severity of the crisis (NZ Property Report).

Common Myths & Mistakes in Real Estate Investing

As real estate remains a popular investment avenue, it's essential to debunk common myths and avoid costly mistakes.

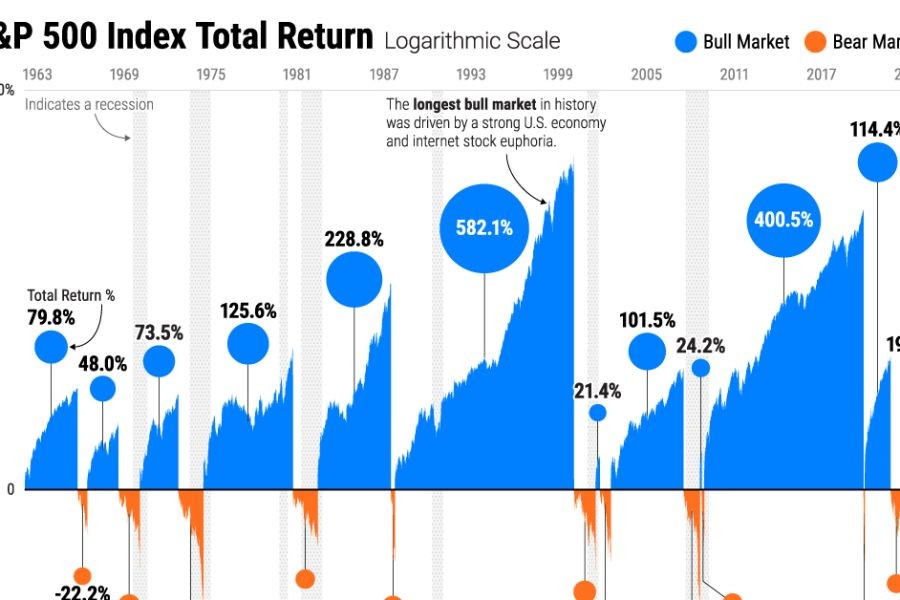

Myth: "Real estate is a guaranteed safe investment."

Reality: While historically stable, real estate markets can be volatile. The 2008 financial crisis is a stark reminder that property values can plummet unexpectedly.

Myth: "House prices will always rise."

Reality: Economic downturns and market manipulations can lead to stagnation or decline. Diversification is key to mitigating risk.

Myth: "You should always buy property with the highest potential for appreciation."

Reality: High appreciation potential often comes with higher risk. Consider cash flow and location when making investment decisions.

Debunking Industry Myths: Pros and Cons

The real estate market is rife with myths and misconceptions. Let's explore the pros and cons of some common beliefs.

Pros:

- Potential for High Returns: Real estate can offer significant appreciation and rental income.

- Tangible Asset: Property is a physical asset that can be leveraged or improved.

- Tax Benefits: Investors can benefit from deductions and depreciation.

Cons:

- Market Volatility: Property values can fluctuate significantly.

- Illiquidity: Real estate is not easily sold or converted into cash.

- High Entry Costs: Initial investments and maintenance can be costly.

Future Trends & Predictions for New Zealand's Real Estate Market

Looking ahead, several trends are expected to shape New Zealand's real estate landscape.

By 2028, a Deloitte report predicts that 40% of New Zealand banks will adopt blockchain-based cross-border payments, increasing transparency and reducing transaction costs. Policymakers are also exploring zoning reforms to address the housing shortage, potentially reshaping urban development.

Moreover, sustainability is becoming a focal point, with eco-friendly buildings gaining popularity. The NZ Green Building Council estimates that green buildings will make up 20% of new developments by 2030.

Conclusion: Navigating the Real Estate Landscape in New Zealand

The influence of big real estate companies on the market is undeniable, but understanding their strategies can empower investors. By staying informed and vigilant, Kiwis can navigate the complexities of the housing market and make informed decisions.

Ready to explore investment opportunities? Research New Zealand's property markets and consider diversifying your portfolio for long-term success.

People Also Ask (FAQ)

How do big real estate companies manipulate the market?

Big real estate companies often manipulate the market by controlling housing supply, creating artificial scarcity to drive up prices and increase profits.

What impact do these manipulations have on New Zealand's housing market?

These manipulations contribute to affordability issues and economic inequality, making homeownership unattainable for many Kiwis.

Are there regulatory measures in place to address market manipulation?

New Zealand is exploring regulatory measures to prevent market manipulation and ensure fair practices in the real estate sector.

Related Search Queries

- Real estate market trends in New Zealand

- How to invest in New Zealand property

- Impact of foreign investment on NZ housing

- housing affordability crisis in New Zealand

- Strategies to prevent market manipulation