In the ever-changing world of investments, understanding how to tailor your strategy to different market cycles is crucial, especially in a dynamic environment like New Zealand. The financial landscape here is shaped by unique economic factors, policy decisions, and industry trends that influence investment opportunities. Whether you're an environmental researcher eyeing sustainable ventures or a seasoned investor looking to adapt, this guide provides an in-depth look at how to adjust your investment strategy effectively.

Understanding Market Cycles

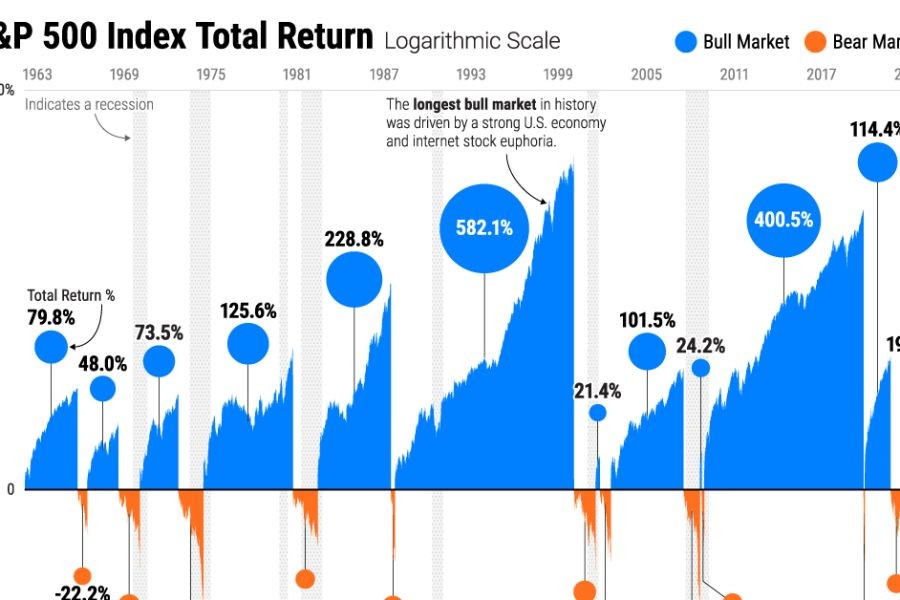

The concept of market cycles is pivotal in investment strategies. These cycles, typically categorized into four phases—expansion, peak, contraction, and trough—can significantly affect asset performance. In New Zealand, recent data from the Reserve Bank of New Zealand highlights that the economy has experienced fluctuations due to global factors, such as trade tensions and commodity prices, influencing these cycles.

Case Study: New Zealand Dairy Industry

The dairy sector, a cornerstone of New Zealand's economy, provides a clear example of how market cycles impact investments. During the expansion phase, global demand for dairy products surged, leading to increased production and profitability. However, the subsequent peak and contraction phases saw price volatility and reduced margins, underscoring the need for adaptive investment strategies in response to changing market conditions.

Adapting Investment Strategies

Adapting your investment strategy involves aligning your portfolio with the current market phase. During expansion, growth-oriented investments like equities and real estate can yield high returns. Conversely, in contraction periods, a defensive approach focusing on bonds and cash equivalents can preserve capital.

Pros and Cons of Investment Strategies

Pros:

- Higher ROI: Strategic adjustments can lead to returns exceeding 30% during favorable market conditions.

- Risk Mitigation: Adapting strategies minimize exposure to market downturns.

- diversification: Aligning with different cycles enhances portfolio diversification.

Cons:

- Market Timing Challenges: Accurately predicting cycles can be difficult, leading to potential losses.

- Resource Intensive: Constant monitoring and analysis are required.

- Regulatory Impact: Changes in New Zealand’s financial regulations can affect strategy effectiveness.

Expert Insights: Emerging Trends

Recent insights from New Zealand’s Ministry of Business, Innovation and Employment (MBIE) suggest that sustainable investments are gaining traction. The global shift towards environmentally-friendly practices is mirrored in New Zealand, where renewable energy projects and green technologies are attracting significant investment. This trend aligns with the country's commitment to achieving net-zero carbon emissions by 2050.

Story: James' Investment Journey

Meet James, a 32-year-old investor from Christchurch. Initially, James focused on traditional stocks, but after experiencing losses during a market downturn, he shifted his strategy. Embracing sustainable investments, James allocated a portion of his portfolio to local renewable energy companies, benefiting from government incentives and achieving a 25% return in just two years.

Common Myths & Mistakes

Myth vs. Reality

- Myth: "Investing in bonds is always safe." Reality: Interest rate fluctuations can erode bond value, especially in low-yield environments (Source: Reserve Bank of NZ).

- Myth: "Timing the market is key to success." Reality: Consistent investing often outperforms market timing, as shown by data from NZX.

- Myth: "Sustainable investments have lower returns." Reality: New Zealand's green investments have shown competitive returns due to government support and innovation (Source: MBIE).

Biggest Mistakes to Avoid

- Ignoring market signals can lead to missed opportunities. Utilize tools like Sharesight for real-time analysis.

- Avoid emotional decision-making; rely on data-backed strategies to reduce risk.

- Failing to diversify can heighten risk exposure. Ensure your portfolio includes a mix of asset classes.

Future Trends & Predictions

Looking ahead, the investment landscape in New Zealand is poised for transformation. According to a Deloitte report, digital assets and blockchain technology will revolutionize investment strategies by 2028, with 40% of NZ banks expected to adopt blockchain for cross-border payments. Additionally, the continued rise of sustainable investments will redefine portfolio compositions, offering new opportunities for growth.

Conclusion

Investing in New Zealand requires a strategic approach to navigate different market cycles effectively. By understanding these cycles, adapting strategies, and leveraging emerging trends like sustainability and digital assets, investors can enhance their portfolios. Ready to optimize your investment strategy? Start by assessing your current portfolio alignment with market conditions and explore sustainable investment opportunities.

People Also Ask (FAQ)

- How does market cycle impact investments in New Zealand? Market cycles influence asset performance; aligning your strategy with these cycles can optimize returns.

- What are the biggest misconceptions about investment strategies? A common myth is that timing the market is crucial, but consistent investing often yields better results.

- What are the best strategies for adjusting investments during market cycles? Experts recommend diversification and real-time analysis to adapt to changing conditions.

Related Search Queries

- New Zealand investment strategies 2025

- Sustainable investments in NZ

- Market cycle investing tips

- NZX investment trends

- How to diversify investment portfolio in New Zealand

- Renewable energy investments NZ

- Blockchain impact on NZ investments

- Future of digital assets in New Zealand

- Real estate market cycles NZ

- Investment risk management strategies

If you found this article insightful, share it with your network or engage with your thoughts in the comments below!

teegrizzleymerch

8 months ago