In Australia's rapidly evolving job market, the traditional 9-to-5 employment structure is facing an unprecedented challenge from the gig economy and freelancing opportunities. As more Australians seek financial freedom, the choice between freelancing and traditional employment becomes a pivotal decision. This article delves into the intricacies of both paths, providing a comprehensive analysis to help agribusiness consultants and other professionals make informed career choices.

Understanding the Australian Job Market

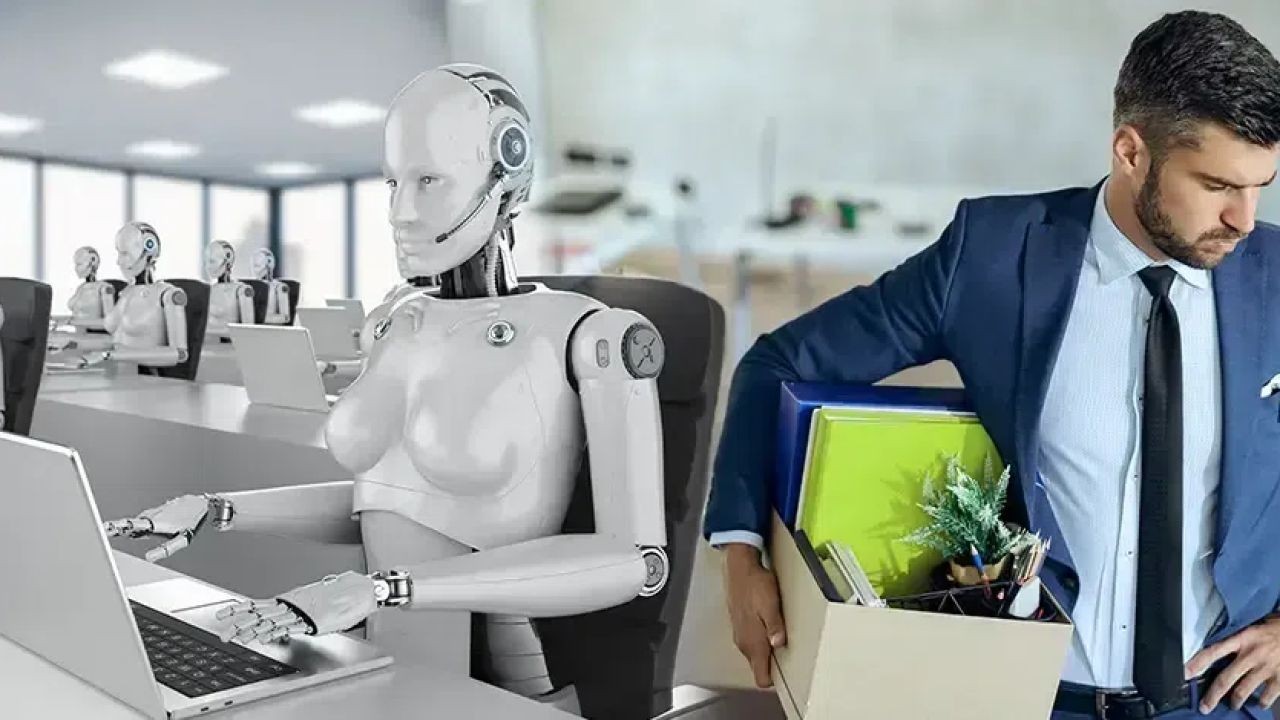

The Australian job market has undergone significant changes over the past decade. According to the Australian Bureau of Statistics (ABS), the freelance economy has grown by 68% since 2010, with more than 2.5 million Australians now engaged in some form of freelancing. Meanwhile, traditional employment continues to dominate, accounting for approximately 75% of the workforce.

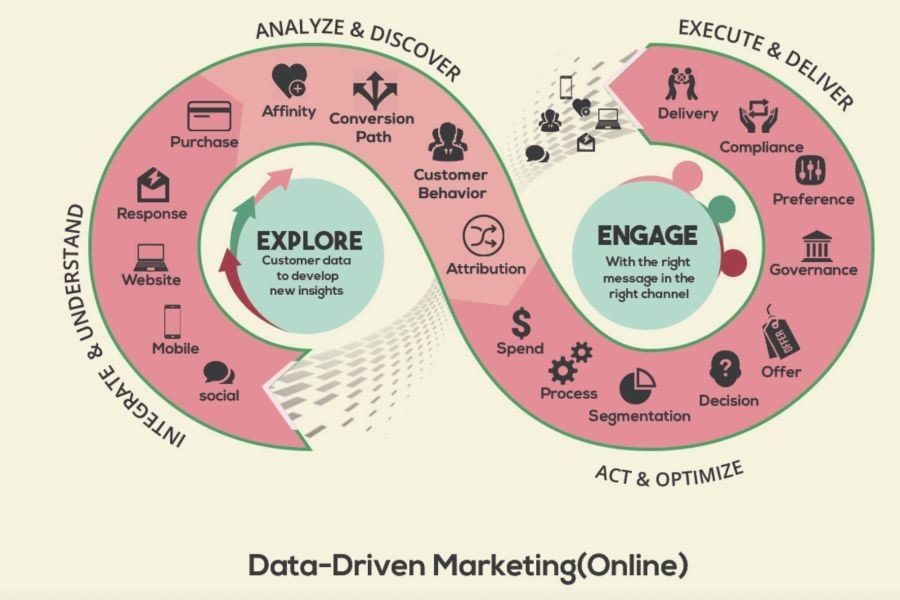

This shift is driven by several factors, including technological advancements, changing work preferences, and economic conditions. The Reserve Bank of Australia (RBA) notes that digital platforms have played a crucial role in facilitating gig work, offering flexibility and diverse income streams.

Freelancing vs. Traditional Employment: A Financial Perspective

Pros of Freelancing

- Flexibility and Autonomy: Freelancers have the freedom to choose their projects, work hours, and clients, aligning their work-life balance according to personal preferences.

- Increased Earning Potential: High-demand skills in fields such as IT, digital marketing, and design can command premium rates, allowing freelancers to potentially earn more than their traditionally employed peers.

- Diverse Income Streams: Freelancers can work with multiple clients, reducing dependency on a single income source and mitigating financial risk.

Cons of Freelancing

- Income Instability: Freelancers often face fluctuations in income, with periods of high earnings followed by lean phases.

- Lack of Benefits: Unlike traditional employees, freelancers do not receive benefits such as superannuation, paid leave, or health insurance.

- Administrative Burden: Freelancers must manage their own taxes, invoicing, and client communications, which can be time-consuming.

Pros of Traditional Employment

- Job Security: Traditional employment offers a stable income and job security, especially in industries with low turnover rates.

- Employee Benefits: Access to benefits such as health insurance, retirement plans, and paid leave enhances financial stability.

- Structured Career Path: Employees often have clear career advancement opportunities and professional development support.

Cons of Traditional Employment

- Lack of Flexibility: Fixed schedules and limited autonomy can lead to work-life imbalance.

- Limited Income Growth: Salary increments are often predetermined and may not match potential freelance earnings.

- Dependency on Employer: Employees rely on their employer for job security, which can be precarious in volatile industries.

Case Study: The Freelancing Success Story of an Australian Agribusiness Consultant

Problem: Jane, an agribusiness consultant in Sydney, faced limited growth opportunities and dissatisfaction in her traditional role at a large agricultural firm. Her salary was capped, and her work-life balance suffered due to rigid office hours.

Action: Jane transitioned to freelancing, leveraging her expertise to consult for various agricultural startups. She used platforms like Upwork and LinkedIn to connect with potential clients, offering her services in supply chain optimization and sustainable farming practices.

Result: Within a year, Jane's income increased by 40%, and she gained the freedom to choose projects that aligned with her values. She also benefited from a flexible schedule, improving her work-life balance.

Takeaway: Jane's story highlights the potential for financial growth and personal satisfaction through freelancing, especially for professionals with niche expertise.

Regulatory Insights: Navigating the Gig Economy in Australia

The Australian Taxation Office (ATO) plays a crucial role in regulating the gig economy. Freelancers must adhere to tax obligations, including registering for an Australian Business Number (ABN) and paying Goods and Services Tax (GST) if their income exceeds the threshold. Additionally, the Australian Competition & Consumer Commission (ACCC) ensures fair competition within the gig economy, protecting freelancers from unfair treatment by digital platforms.

For traditional employees, the Fair Work Commission oversees workplace rights, ensuring fair wages and conditions. Understanding these regulatory frameworks is essential for both freelancers and employees to navigate the complexities of the Australian job market.

Financial Impact Metrics: Freelancing vs. Traditional Employment

According to a report by Deloitte, freelancers in Australia have experienced a 28% higher average income growth compared to traditional employees over the past five years. This growth is attributed to the ability to scale services, set competitive rates, and access global markets.

In contrast, traditional employees benefit from steady annual salary increments, typically ranging from 2-5%. However, these increments may not keep pace with inflation and rising living costs, impacting long-term financial freedom.

Industry Insight: The Future of Work in Australia

Experts predict that the future of work in Australia will be characterized by a hybrid model, blending elements of freelancing and traditional employment. The rise of remote work, accelerated by the COVID-19 pandemic, has blurred the lines between these two approaches. Businesses are increasingly adopting flexible work arrangements to attract and retain talent, offering employees the benefits of both worlds.

In the next decade, technological advancements and changing workforce dynamics are expected to reshape job roles and industries. The demand for digital skills will continue to grow, with opportunities for freelancers to thrive in areas such as data analysis, software development, and digital marketing.

Common Myths About Freelancing and Traditional Employment

- Myth: "Freelancers cannot achieve financial stability." Reality: With proper financial planning and diverse income streams, freelancers can achieve financial stability and even surpass traditional employment income levels.

- Myth: "Traditional employment guarantees job security." Reality: In volatile industries, job security is not guaranteed, and employees may face layoffs due to economic downturns or company restructuring.

- Myth: "Freelancers lack career advancement opportunities." Reality: Freelancers can advance by building a strong portfolio, networking, and continuously upgrading their skills to attract high-profile clients.

Conclusion: Charting Your Path to Financial Freedom

Deciding between freelancing and traditional employment is ultimately a personal choice that depends on individual goals, risk tolerance, and lifestyle preferences. While freelancing offers flexibility and potential for higher earnings, traditional employment provides stability and benefits. For Australian professionals, understanding the regulatory landscape, market trends, and financial implications is crucial in pursuing financial freedom.

As the job market continues to evolve, staying informed and adaptable will empower professionals to navigate challenges and seize opportunities. What path will you choose to achieve financial freedom? Share your thoughts and experiences in the comments below!

People Also Ask (FAQ)

- How does freelancing impact financial freedom in Australia? Freelancing offers flexibility and potential for higher earnings, allowing Australians to diversify income streams and achieve financial freedom, according to a Deloitte report.

- What are the biggest misconceptions about freelancing? A common myth is that freelancers cannot achieve financial stability. However, research from the Australian Bureau of Statistics shows freelancers can earn competitive incomes with proper planning.

- What are the best strategies for transitioning to freelancing? Experts recommend starting with a niche skill, building a strong online presence, and continuously upgrading skills to attract high-profile clients.

Related Search Queries

- Freelancing vs. traditional employment in Australia

- How to achieve financial freedom through freelancing

- Australian gig economy trends 2023

- Regulations for freelancers in Australia

- Benefits of traditional employment in Australia

- Freelancing income potential in Australia

- Future of work in Australia

- How to start freelancing in Australia

- Tax obligations for Australian freelancers

- Success stories of Australian freelancers

JudiRobey

11 months ago