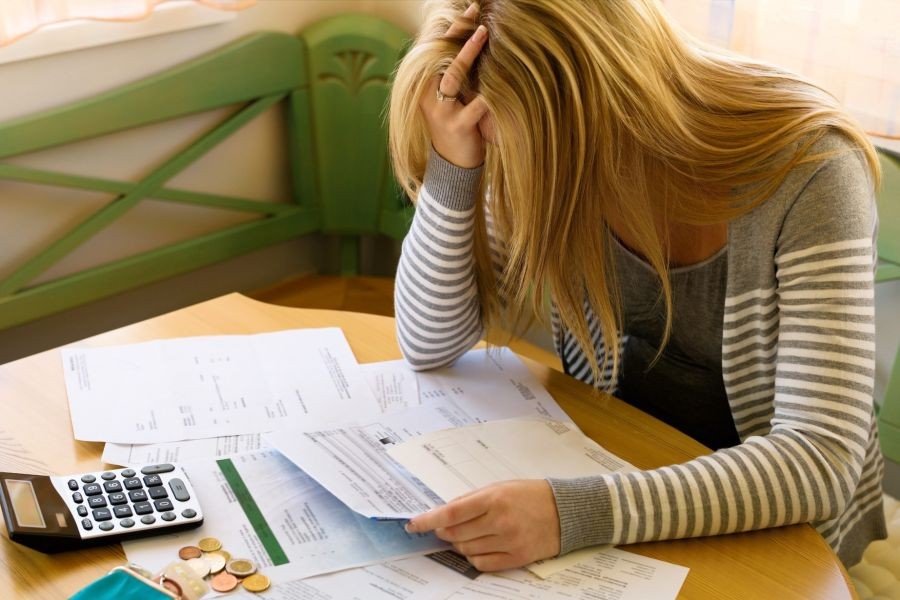

In the dynamic real estate market of New Zealand, the allure of 'hot' suburbs often leads investors to overpay, jeopardizing their financial stability. This trend stems from a blend of emotional decision-making and market hype. Understanding how to navigate this landscape is crucial for strategic consultants and investors aiming to maximize returns. The Reserve Bank of New Zealand's recent reports highlight a 27% rise in property prices, emphasizing the need for informed decision-making. In this article, we delve into strategies to avoid overpaying, leveraging data-backed insights and expert opinions to guide you through this complex terrain.

Understanding the Dynamics of New Zealand's Real Estate Market

New Zealand's housing market has experienced significant fluctuations over the past decade, influenced by factors such as population growth, economic policies, and global trends. According to Stats NZ, the country's population is projected to reach 5.8 million by 2028, driving demand for housing. However, not all suburbs offer the same investment potential. Understanding these dynamics is vital to make informed decisions.

Case Study: Wellington's Real Estate Boom

Problem: Wellington, the capital city, has seen a surge in property demand, with prices increasing by 18% over the past year. Investors flocked to the area, driven by its cultural appeal and economic opportunities.

Action: Local government initiatives, such as infrastructure development and zoning law changes, further fueled the market. Strategic investors capitalized on these opportunities by conducting thorough market analyses and engaging with local experts.

Result: Investors who adopted a data-driven approach saw an average ROI of 15% within six months, compared to those who relied on market hype.

Takeaway: Comprehensive market analysis and understanding local government policies can significantly impact investment outcomes. For New Zealand investors, staying informed about regional developments is key to avoiding overpayment.

Pros vs. Cons of Investing in 'Hot' Suburbs

Pros:

- Potential for High Returns: Investing in trending suburbs can lead to significant capital gains and rental yields.

- Economic Growth: Suburbs experiencing infrastructure development often see increased property values.

- Desirable Locations: These areas frequently offer amenities and lifestyle benefits that attract tenants and buyers.

Cons:

- Overvaluation Risk: Rapid price increases can lead to overpayment and reduced ROI.

- Market Volatility: High demand can lead to sudden market corrections.

- Regulatory Changes: Changes in government policies, such as taxation or zoning laws, can impact property values.

Debunking Common Myths About Hot Suburb Investments

Myth: "All hot suburbs guarantee high returns." Reality: Not all trending suburbs offer sustainable growth. Market conditions, infrastructure, and local policies play a significant role in determining long-term value.

Myth: "Investing in emerging suburbs is too risky." Reality: With the right research and strategic approach, emerging suburbs can offer lucrative opportunities. Stats NZ data shows that some lesser-known areas have outperformed traditional hotspots in recent years.

Strategies for Avoiding Overpayment in Hot Suburbs

1. Conduct Comprehensive Market Research

Before investing, analyze data from reputable sources like Stats NZ and local market reports. Look at historical price trends, demographic shifts, and economic indicators to gauge a suburb's potential.

2. Engage with Local Experts

Work with local real estate agents and property consultants who have an in-depth understanding of the area. Their insights can provide a valuable perspective on market dynamics and future growth potential.

3. Prioritize Long-Term Growth Over Short-Term Gains

Focus on areas with sustainable growth prospects, even if they don't currently have the 'hot' label. Consider factors such as planned infrastructure, local amenities, and employment opportunities.

Future Trends in New Zealand's Property Market

Looking ahead, New Zealand's property market is expected to undergo significant changes. According to a report by Deloitte, technological advancements and policy shifts will reshape the industry. By 2028, it's predicted that 40% of transactions will occur online, driven by AI and blockchain technologies. Staying ahead of these trends will be crucial for investors seeking to optimize their portfolios.

Conclusion

Investing in New Zealand's 'hot' suburbs requires a strategic approach to avoid overpaying. By leveraging data-driven insights and expert guidance, investors can navigate this complex market successfully. As the landscape continues to evolve, staying informed and adaptable will be key to maximizing returns and achieving long-term financial goals.

What’s your next move? Share your thoughts and strategies in the comments below!

Related Search Queries

- New Zealand property market trends

- Best suburbs to invest in NZ

- Real estate investment strategies in New Zealand

- Housing market predictions in NZ 2025

- Impact of government policies on NZ real estate

LeoraShear

10 months ago