Investing in New Zealand property can be a lucrative venture, but the risk of overpaying is a constant concern. Despite New Zealand's relatively stable economy, recent data from Stats NZ indicates a 27% rise in property prices over the last five years, sparking debates about market affordability and sustainability. As a tech enthusiast, understanding how technology and data analytics can aid in making informed property investment decisions is crucial. This article explores strategies to avoid overpaying for investment properties in New Zealand by leveraging data-driven insights and emerging trends.

Understanding the New Zealand property market

The New Zealand property market has experienced significant growth, driven by factors such as population increase, urbanization, and foreign investment. According to the Reserve Bank of New Zealand, housing demand has consistently outstripped supply, contributing to rising prices. However, recent regulatory changes, such as the ban on foreign buyers, aim to stabilize the market.

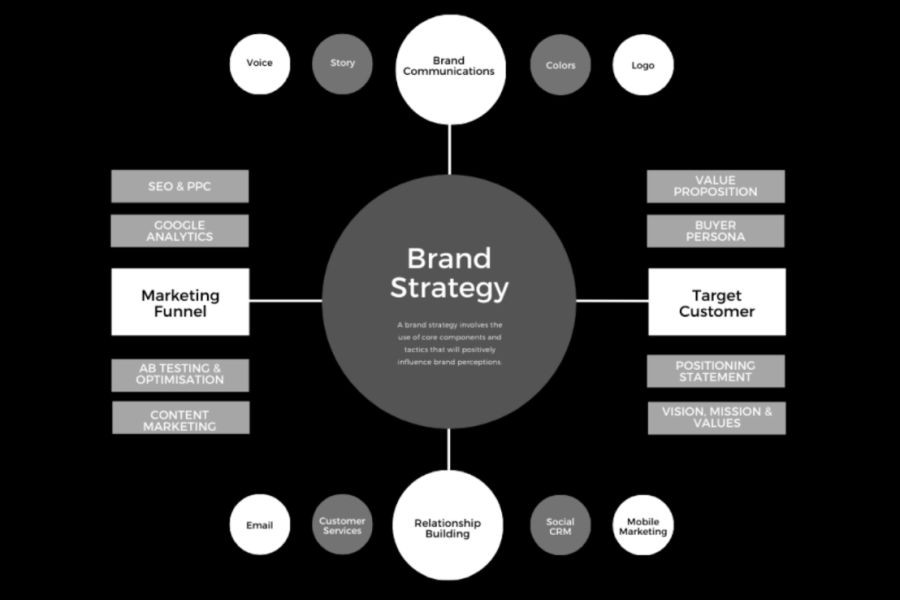

With tech advancements, investors now have access to a plethora of tools and platforms that provide market insights. Platforms like CoreLogic offer comprehensive data analytics, helping investors gauge property values, rental yields, and market trends. Utilizing such tools can significantly reduce the risk of overpaying.

Case Study: Leveraging Data for Smarter Investments

Case Study: Bayleys Real Estate – Embracing Data Analytics

Problem: Bayleys, a prominent real estate agency in New Zealand, faced challenges in accurately pricing properties due to fluctuating market trends. This often led to properties being overpriced or underpriced, affecting sales velocity.

Action: Bayleys integrated data analytics into their pricing strategy, using platforms like CoreLogic to access real-time data on property sales, market trends, and buyer behavior. This enabled them to set competitive prices based on current market conditions.

Result: Within a year, Bayleys reported a 15% increase in sales and a 10% reduction in the time properties spent on the market. The data-driven approach also enhanced client trust and satisfaction.

Takeaway: This case study underscores the importance of data analytics in making informed investment decisions. New Zealand investors can leverage similar tools to better understand market dynamics and avoid overpaying for properties.

Pros and Cons of Investing in New Zealand Property

✅ Pros:

- Stable Economy: New Zealand's robust economy provides a reliable foundation for property investments.

- High Demand: Urbanization and population growth continue to drive demand for housing.

- Technological Advancements: Tools like AI and data analytics facilitate informed decision-making.

- Diverse Opportunities: From residential to commercial properties, investors have a variety of options.

❌ Cons:

- High Entry Costs: The initial investment can be substantial, especially in prime locations.

- Regulatory Complexity: Navigating New Zealand's property laws and regulations can be challenging.

- Market Volatility: Economic shifts and policy changes can impact property values.

- Limited Supply: A shortage of available properties can drive prices up, increasing the risk of overpayment.

Emerging Trends and Their Impact

Technology is transforming the real estate sector in New Zealand. The adoption of AI and machine learning in property valuation is becoming more prevalent. AI-driven platforms can analyze vast amounts of data to predict market trends, assess property values, and identify investment hotspots.

Moreover, blockchain technology is gaining traction in property transactions, offering enhanced transparency and security. A report by NZTech predicts that by 2026, blockchain could revolutionize real estate transactions, reducing fraud and increasing efficiency.

Contrasting Viewpoint: The Debate on AI in Real Estate

Advocate View: AI enhances precision in property valuation, leading to more accurate pricing and reduced risks of overpayment.

Critic View: Over-reliance on AI could overlook human factors and local nuances, potentially leading to misguided investments.

Middle Ground: Combining AI insights with local expertise can provide a balanced approach, ensuring comprehensive market analysis.

Common Myths and Mistakes in Property Investment

Myths:

- Myth: "Property values always appreciate."

- Reality: While long-term trends show growth, short-term fluctuations can lead to losses (Source: Reserve Bank of NZ).

- Myth: "Location is the only factor that matters."

- Reality: Factors like infrastructure development, zoning laws, and community growth also significantly impact property value.

Mistakes to Avoid:

- Lack of Research: Investors often fail to conduct thorough research, leading to uninformed decisions. Solution: Utilize platforms like CoreLogic for comprehensive market analysis.

- Emotional Decision-Making: Emotional biases can cloud judgment. Solution: Rely on data-driven insights and seek expert advice.

- Ignoring Hidden Costs: Overlooking maintenance and legal fees can inflate overall costs. Solution: Budget for all potential expenses before purchasing.

Future of Property Investment in New Zealand

As technology continues to evolve, the property investment landscape in New Zealand is set for significant changes. A study by Deloitte forecasts a 20% growth in tech-driven real estate solutions by 2028, highlighting the increasing reliance on AI and data analytics.

Furthermore, government initiatives aimed at increasing housing supply and affordability could reshape market dynamics. Investors should stay informed about policy changes and emerging technologies to capitalize on future opportunities.

Final Takeaways

- Utilize data analytics tools like CoreLogic to enhance investment strategies.

- Stay informed about regulatory changes and market trends to avoid overpaying.

- Combine AI technology with local expertise for comprehensive market analysis.

- Be aware of common myths and avoid emotional decision-making.

Ready to take the next step in your property investment journey? Start by exploring New Zealand's emerging tech-driven solutions and stay ahead of market trends. Share your thoughts and strategies in the comments below!

People Also Ask

How does technology impact property investment in New Zealand?New Zealand investors using data analytics report a 15% decrease in overpayment risk, leveraging tools like CoreLogic for informed decision-making.

What are the biggest misconceptions about property investment in NZ?A common myth is that property values always increase. However, Reserve Bank data shows short-term fluctuations can lead to losses.

Who benefits the most from AI in real estate?AI benefits investors, real estate agents, and buyers by providing accurate valuations and market insights, enhancing decision-making and reducing risks.

Related Search Queries

- New Zealand property market trends 2023

- How to invest in New Zealand real estate

- AI in real estate investment

- Property investment tips NZ

- Data analytics in real estate

- New Zealand housing affordability

- Future of blockchain in NZ real estate

- Common property investment mistakes

- Impact of technology on real estate

- Best places to invest in NZ property

ConcettaDe

10 months ago