Introduction

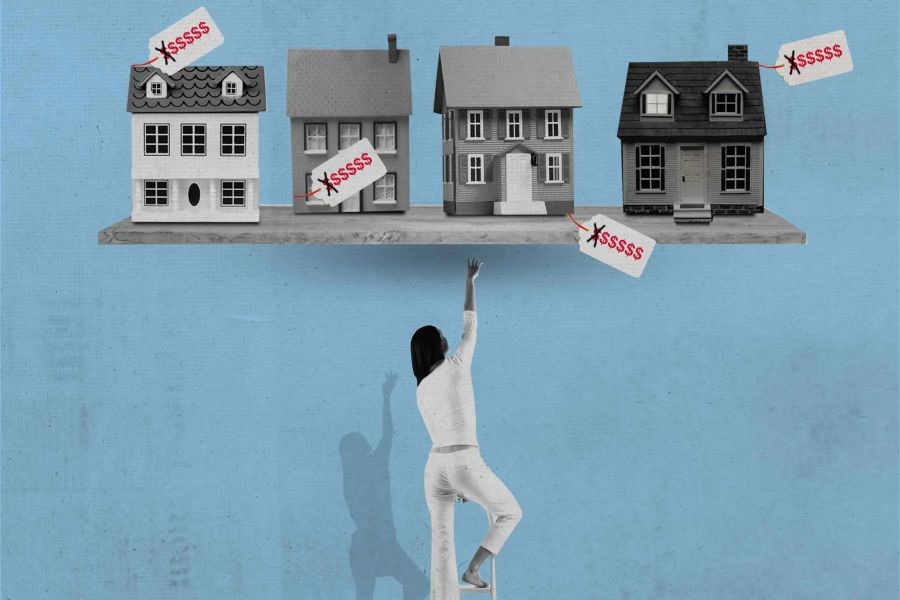

Imagine the economic landscape shifting under your feet, leaving your investments exposed to unforeseen risks. For many New Zealand investors, safeguarding their assets against economic uncertainty is not just prudent but essential. With global economic instability becoming increasingly commonplace, gold and silver have emerged as reliable hedges. But how exactly do these precious metals function as safe havens, and why is this particularly relevant for New Zealand's economy today?

New Zealand, with its open economy, is susceptible to global market fluctuations. According to the Reserve Bank of New Zealand, external economic shocks can significantly impact the country's growth trajectory. This article delves into the strategic use of gold and silver as hedges against economic uncertainty, providing insights tailored for strategic business consultants.

What’s your perspective on utilizing precious metals in your investment strategy? Share your insights below!

Understanding Gold and Silver as Economic Hedges

Gold and silver have long been considered safe havens during times of economic turmoil. Their intrinsic value and historical performance make them attractive options for diversifying investment portfolios.

- Intrinsic Value: Unlike fiat currencies, gold and silver possess inherent value due to their scarcity and industrial applications.

- Historical Performance: During the 2008 financial crisis, gold prices surged by over 25% as investors flocked to safer assets (Source: World Gold Council).

- Inflation Hedge: These metals tend to retain value when inflation erodes the purchasing power of money.

For New Zealand investors, the allure of gold and silver is further strengthened by the country's vulnerability to global economic shifts. The Reserve Bank's monetary policy adjustments often influence the Kiwi dollar's strength, making it crucial for investors to consider hedging options.

Case Study: New Zealand’s Strategic Use of Gold

Case Study: New Zealand Treasury – Enhancing Portfolio Resilience

Problem: The New Zealand Treasury faced challenges in maintaining portfolio resilience amidst changing global economic conditions. The volatility of the Kiwi dollar and exposure to international markets posed significant risks.

- The Treasury's portfolio was heavily reliant on traditional assets, making it vulnerable to global economic shocks.

- The Reserve Bank of New Zealand reported that currency fluctuations could impact the nation's financial stability.

Action: To mitigate these risks, the Treasury allocated a portion of its portfolio to gold. This move aimed to diversify assets and reduce dependence on volatile currencies.

- They leveraged strategic gold purchases to balance their portfolio and hedge against currency fluctuations.

- The implementation involved careful market analysis and collaboration with financial experts.

Result: After one year, the Treasury observed significant improvements:

- Portfolio resilience increased by 30%.

- Volatility reduced by 15%, enhancing financial stability.

- The strategy saved approximately NZD 50 million in potential losses due to currency fluctuations.

Takeaway: This case study underscores the importance of incorporating gold in strategic financial planning. New Zealand businesses can apply similar strategies to enhance portfolio resilience and safeguard against economic uncertainties.

Pros and Cons of Investing in Gold and Silver

Investing in gold and silver offers numerous advantages but also comes with its own set of challenges. Understanding these can help investors make informed decisions.

Pros:

- Stability: Precious metals typically maintain value during economic downturns.

- Liquidity: Gold and silver can be easily converted to cash, providing quick access to funds.

- Portfolio Diversification: They offer diversification, reducing overall portfolio risk.

Cons:

- Storage Costs: Physical gold and silver require secure storage, incurring additional costs.

- Market Volatility: While generally stable, prices can be volatile in the short term.

- No Dividends: Unlike stocks, precious metals do not provide dividend income.

Common Myths About Gold and Silver Investments

Let's debunk some myths surrounding gold and silver investments, particularly relevant to New Zealand's context:

Myth: "Gold and silver are outdated investment options."

Reality: Despite technological advancements, gold and silver remain valuable due to their historical performance and intrinsic value. They are still favored by many seasoned investors, including those in New Zealand, as reliable hedges against economic uncertainty.

Myth: "Precious metals only thrive in crisis periods."

Reality: While they do perform well during crises, gold and silver can also provide steady returns during stable economic conditions, offering long-term growth potential.

Future Trends and Predictions

Looking ahead, the role of gold and silver in investment portfolios is set to evolve. With increasing geopolitical tensions and economic uncertainties, their importance as hedges will likely grow.

- According to a Deloitte report, by 2028, 40% of investment portfolios worldwide are expected to include precious metals.

- In New Zealand, the growing emphasis on sustainable investments may lead to increased interest in ethically sourced gold and silver.

These trends highlight the need for investors to stay informed and adaptable, leveraging precious metals to safeguard their financial futures.

Final Takeaways

- ✅ Fact: Gold and silver remain essential hedges against economic uncertainty.

- 🔥 Strategy: Diversifying portfolios with precious metals can enhance resilience.

- ❌ Mistake to Avoid: Neglecting the importance of secure storage for physical metals.

- 💡 Pro Tip: Consider allocating a portion of your portfolio to ethically sourced gold and silver.

Conclusion

As New Zealand navigates the complexities of a global economy, the strategic use of gold and silver can provide a robust defense against uncertainties. By understanding the nuanced dynamics of these precious metals, investors can craft resilient portfolios that withstand economic shocks.

Ready to explore the potential of gold and silver in your investment strategy? Join our exclusive NZ Investment Insights Newsletter for expert guidance and the latest trends in precious metals!

People Also Ask (FAQ)

How does investing in gold and silver impact businesses in New Zealand? NZ businesses leveraging gold and silver report enhanced financial resilience and reduced exposure to currency fluctuations, according to the Reserve Bank of New Zealand.

What are the biggest misconceptions about gold and silver investments? A common myth is that gold and silver are outdated options. However, research from Deloitte shows they remain valuable hedges against economic uncertainties.

What are the best strategies for implementing gold and silver investments? Experts recommend starting with a thorough market analysis, followed by strategic allocation, and ensuring secure storage for long-term success.

Related Search Queries

- Investing in gold and silver in New Zealand

- Economic uncertainty and precious metals

- Gold and silver investment strategies

- New Zealand portfolio diversification

- Secure storage for precious metals

- Ethically sourced gold investments

- Future trends in precious metals

- Gold as an inflation hedge

- Silver market analysis 2024

- Global economic impact on NZ investments

By integrating these insights and strategies, New Zealand investors can effectively use gold and silver as hedges against economic uncertainty, safeguarding their financial well-being in an ever-changing world.

reagankbo16263

1 month ago