Investing is often seen as a pathway to financial freedom, yet most investors fail to achieve their desired results. In New Zealand, where economic factors, market volatility, and global influences shape financial opportunities, understanding why most investment strategies fail is crucial for long-term success. This article explores the key pitfalls Kiwi investors face and what strategies can drive success in today’s ever-changing financial landscape.

Why Most Investment Strategies Fail

1. Lack of a Clear Investment Plan

Many investors jump into the market without a well-defined plan. They may chase the latest trend or make emotional decisions, leading to inconsistent and poor returns. A structured investment plan, aligned with financial goals and risk tolerance, is essential for success.

2. Failing to Diversify Investments

Putting all your money into a single asset class, stock, or sector is a recipe for disaster. Diversification across different assets—such as stocks, bonds, real estate, and commodities—helps spread risk and enhances long-term stability.

3. Emotional Investing: Fear & Greed

Investors often fall into the trap of emotional decision-making. Fear can lead to panic selling during market downturns, while greed can drive investors to chase unrealistic returns. Both behaviors result in poor timing and significant losses.

4. Ignoring Market Cycles & Economic Trends

Financial markets move in cycles, influenced by economic conditions, inflation, and government policies. Many investors fail to recognize these cycles, making decisions based on short-term gains rather than understanding broader market trends.

5. Overconfidence & Herd Mentality

Many investors believe they can beat the market or follow what everyone else is doing. This herd mentality leads to bubbles and crashes, as seen in cryptocurrency and housing market booms and busts. Blindly following the crowd without research is a risky strategy.

6. High Fees & Poor Asset Management

Hidden fees, transaction costs, and poor management by financial advisors can erode returns over time. Many Kiwi investors do not fully understand the impact of fees on their long-term gains, reducing their overall profitability.

7. Lack of Patience & Long-Term Perspective

Investing is a long-term game, but many people expect quick results. Frequent buying and selling lead to higher taxes and fees, diminishing potential gains. Building wealth requires patience, discipline, and a long-term perspective.

How Kiwi Investors Can Succeed

1. Develop a Solid Investment Strategy

A strong investment strategy should include clear financial goals, risk assessment, and an asset allocation plan. Kiwi investors should focus on a mix of growth and income-producing assets to build wealth sustainably.

2. Focus on Diversification

Instead of concentrating investments in one sector, investors should diversify across asset classes such as:

- NZX-listed stocks and international equities

- Real estate investments (REITs or property)

- Fixed-income assets (bonds, term deposits)

- Alternative assets (commodities, private equity, cryptocurrency in small portions)

3. Adopt a Long-Term Mindset

Market fluctuations are inevitable. Investors who stay the course and invest with a long-term view are more likely to achieve financial success than those who react to short-term market movements.

4. Control Emotions & Stick to a Plan

Using automated investment strategies, such as dollar-cost averaging (DCA), can remove emotional decision-making and ensure disciplined investing. Regular contributions to diversified portfolios reduce the risk of market timing errors.

5. Keep Costs Low & Choose the Right Investment Platforms

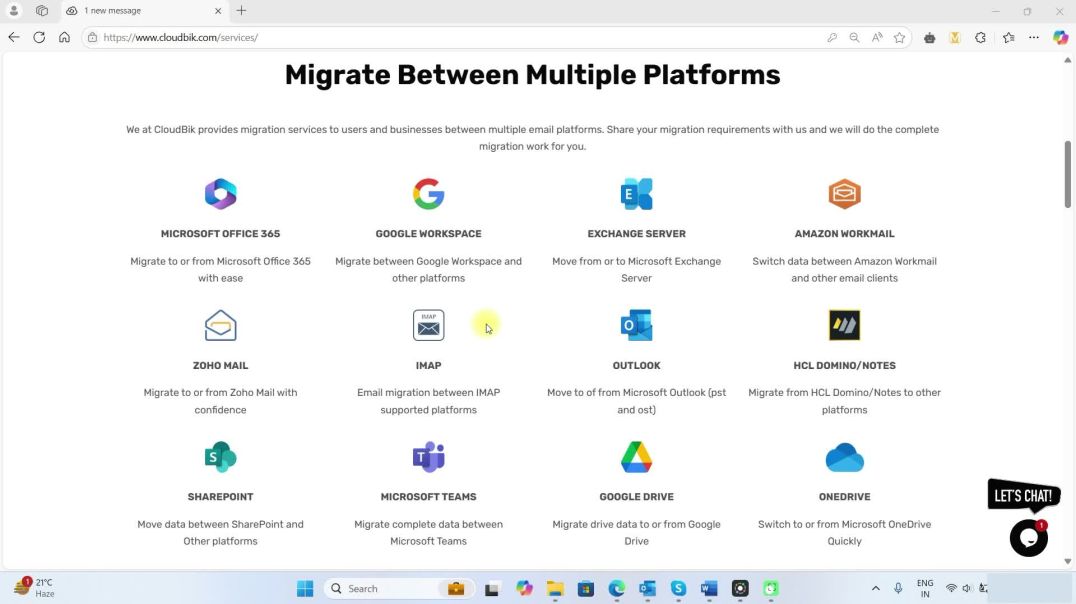

Kiwi investors should be aware of fees associated with managed funds, ETFs, and investment platforms. Platforms like Sharesies, Hatch, and InvestNow offer low-cost investment opportunities with access to global markets.

6. Stay Informed & Keep Learning

Successful investors continuously educate themselves. Reading financial news, understanding economic trends, and learning from experienced investors can help Kiwis make informed decisions. Following the Reserve Bank of New Zealand (RBNZ) policies and global economic shifts is also crucial.

7. Seek Professional Advice When Needed

For complex financial planning, working with a trusted financial advisor can provide valuable insights. However, it’s essential to choose advisors with transparent fees and a strong track record.

Conclusion

Most investment strategies fail because of emotional investing, lack of planning, overconfidence, and ignoring key market principles. Kiwi investors who take a disciplined approach, focus on diversification, and adopt a long-term mindset will be better positioned for success. By avoiding common pitfalls and implementing sound investment practices, New Zealand investors can secure their financial future and build sustainable wealth in today’s dynamic economic environment.

bonnycheeke471

3 months ago