New Zealand's property market is a dynamic landscape, constantly evolving with economic trends, regulatory shifts, and innovative financing methods. One such method gaining traction among savvy investors is seller financing. Often misunderstood and underutilized, seller financing offers unique advantages, especially within the Kiwi context where traditional lending can be restrictive. If you’re a property development specialist looking to expand your portfolio or a newcomer eager to dive into property investment, understanding seller financing could be the key to unlocking new opportunities.

Understanding Seller Financing: A Strategic Overview

Seller financing, also known as vendor financing, allows buyers to purchase property without immediate reliance on traditional bank loans. Instead, the seller provides a loan to the buyer, who then makes installment payments directly to the seller. This method can be particularly advantageous in New Zealand, where recent data from the Reserve Bank of New Zealand indicates tightening lending criteria by traditional banks, making it harder for investors to secure financing.

Case Study: Seller Financing in Action

Consider the example of a Wellington-based developer who faced hurdles in obtaining bank financing due to stringent lending policies. By negotiating a seller financing deal, they acquired a prime property and began development without the usual red tape. Within two years, the development was completed and sold at a significant profit. This scenario underscores the potential of seller financing to bypass traditional barriers and expedite project timelines.

Data-Driven Insights: The New Zealand Context

According to Stats NZ, the median property price in New Zealand has seen a rapid increase, making it challenging for investors to enter the market without substantial capital. Seller financing can bridge this gap by providing flexible terms that are mutually beneficial. Unlike traditional loans, seller financing often allows for lower down payments and customizable repayment schedules, making it an attractive option in a high-demand market like New Zealand.

Pros and Cons of Seller Financing

Pros:

- Access to Properties: Facilitates acquisition in a competitive market by bypassing bank approval processes.

- Flexibility: Terms can be tailored to fit the buyer and seller's needs, offering creative financing solutions.

- Faster Transactions: Reduces the time to close deals compared to traditional financing.

- Potential for Lower Costs: Avoidance of high bank fees and interest rates.

Cons:

- Higher Interest Rates: Sellers may charge higher rates compared to banks to compensate for the risk.

- Risk of Default: Both parties bear the risk if the buyer defaults on payments.

- Limited Property Choices: Not all sellers are open to financing, limiting available options.

Debunking Myths Around Seller Financing

Myth: "Seller financing is only for buyers with poor credit history."

Reality: While it can be an option for those with less-than-perfect credit, seller financing is also a strategic choice for experienced investors seeking more control over their financing terms.

Myth: "Properties eligible for seller financing are usually undesirable."

Reality: Many high-value properties offer seller financing, particularly in competitive markets where sellers want to attract a diverse pool of buyers.

Expert Insight: Navigating Regulatory Changes

New Zealand's property market is subject to regulatory shifts that can impact financing options. Recent policy updates from the Reserve Bank of New Zealand, aimed at cooling the overheated market, have tightened lending restrictions. However, these changes can make seller financing even more appealing as a viable alternative. As a property development specialist, staying informed about these regulations and adapting your strategies accordingly is crucial.

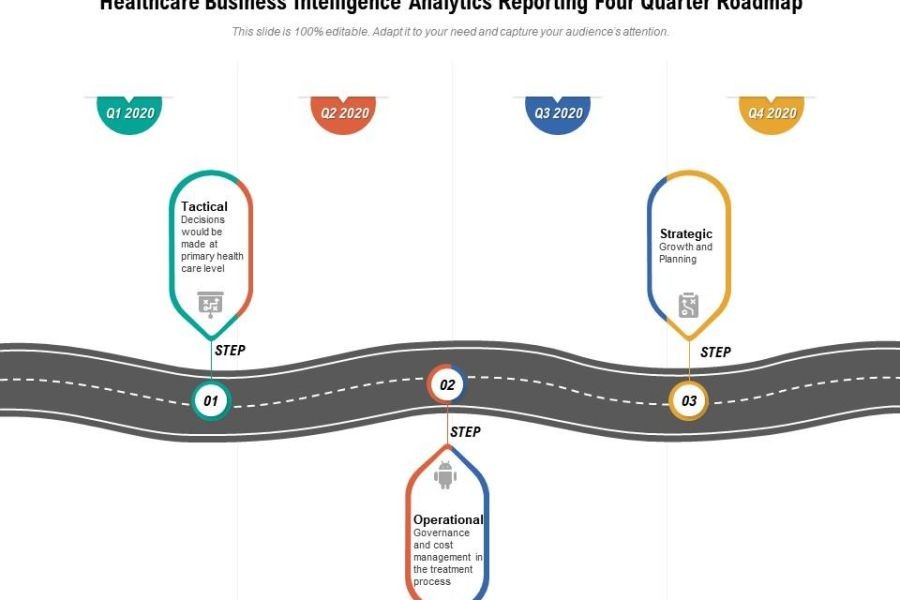

Future Trends: The Growing Popularity of Seller Financing

Looking ahead, seller financing is expected to grow in popularity as more investors seek flexible alternatives to traditional bank loans. With the Reserve Bank of New Zealand's ongoing adjustments to mortgage lending policies, expect seller financing to become an increasingly attractive option for property acquisition.

Moreover, as digital platforms continue to evolve, connecting buyers and sellers in the property market, the ease of negotiating and managing these agreements will improve, further driving their adoption.

Conclusion: Embrace Seller Financing for Strategic Growth

Seller financing offers a unique opportunity for property investors in New Zealand to navigate the challenges of a competitive market. By leveraging this method, investors can access properties that might otherwise be out of reach due to traditional lending constraints. As the landscape continues to evolve, staying informed and adaptable is key. What are your thoughts on seller financing? Share your insights below!

People Also Ask

- How does seller financing impact the New Zealand property market? Seller financing provides a flexible alternative to bank loans, allowing more investors to enter the market, potentially increasing competition and property values.

- What are the biggest misconceptions about seller financing? One common myth is that it's only for those with poor credit. However, it often serves as a strategic choice for savvy investors seeking more flexible terms.

- Who benefits the most from seller financing? Both buyers looking for flexible terms and sellers aiming to attract a broader pool of buyers benefit significantly from seller financing.

Related Search Queries

- Seller financing in New Zealand

- Property investment strategies NZ

- Real estate financing alternatives NZ

- NZ property market trends 2025

- Benefits of seller financing

christopermccl

1 month ago