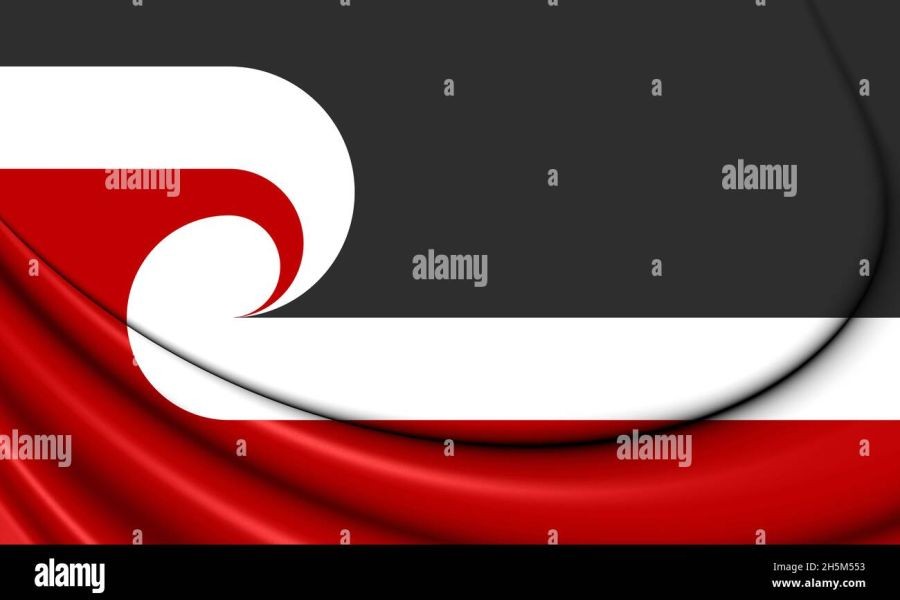

In recent years, New Zealand's real estate market has undergone significant transformation, with property values in the most expensive suburbs doubling over the last decade. This dramatic rise has profound implications for local business owners, investors, and residents alike. Understanding these changes is crucial, not only for those directly involved in real estate but also for businesses and policymakers aiming to navigate this evolving landscape effectively. This article delves into the factors driving these shifts, backed by data from authoritative sources like Stats NZ and the Reserve Bank of New Zealand, offering actionable insights for local business owners.

Understanding the Real Estate Boom

New Zealand's property market has become a focal point for both domestic and international investors, driven by a combination of economic factors, policy shifts, and global trends. According to Stats NZ, property values in Auckland, Wellington, and other high-demand areas have surged by over 100% since 2013. This increase is attributed to low interest rates, foreign investment, and limited housing supply.

Case Study: Auckland's Property Ascent

Auckland, New Zealand's largest city, serves as a prime example of this growth. The suburb of Herne Bay, for instance, has seen its median property price soar from NZD 1.5 million in 2010 to over NZD 3 million in 2020. This escalation is not merely a result of organic demand but is also influenced by international buyers seeking stable investments.

Problem: Many local businesses in Auckland struggled with rising rental costs, impacting profitability and sustainability.

Action: To mitigate these challenges, businesses adapted by renegotiating leases, seeking co-working spaces, or relocating to less expensive suburbs.

Result: Businesses that embraced flexible workspaces reported a 20% reduction in overhead costs, allowing for reinvestment in growth initiatives.

Takeaway: Business owners must remain agile, exploring alternative office solutions to sustain competitive advantages in high-cost areas.

Economic and Policy Drivers

Several economic and policy factors have contributed to this property boom. The Reserve Bank of New Zealand's decision to maintain low interest rates has made borrowing more attractive, thus fueling housing demand. Moreover, government policies aimed at controlling foreign ownership have inadvertently increased competition among local buyers, further driving up prices.

Data Analysis: The Role of Interest Rates

According to the Reserve Bank of New Zealand, the official cash rate has remained at historically low levels, currently set at 0.25%. This environment encourages borrowing, as low interest rates reduce the cost of mortgages, subsequently increasing buyers' purchasing power.

Pros:

- Increased affordability for first-time homebuyers.

- Stimulated demand, leading to robust economic activity.

- Enhanced investment opportunities for property developers.

Cons:

- Potential for a housing bubble if demand outpaces supply.

- Increased financial strain on borrowers if rates rise unexpectedly.

- Speculative investments could destabilize the market.

Real-World Implications for Businesses

For local business owners, these property trends present both challenges and opportunities. High property values can lead to increased lease costs, impacting operational budgets. However, they also present opportunities for businesses in related sectors such as construction, real estate services, and home improvement.

Businesses can capitalize on these trends by aligning their services with the evolving needs of property owners. For instance, offering renovation services that enhance property value or providing financial advisory services to navigate investment complexities can yield significant returns.

Case Study: Wellington's Adaptive Strategies

Wellington, another key player in New Zealand's property market, has witnessed similar trends. Local businesses have adapted by diversifying their offerings to cater to the affluent clientele moving into the area.

Problem: Retail businesses faced declining foot traffic as high property values drove residents to suburban areas.

Action: Retailers expanded their online presence and introduced delivery services to maintain customer engagement.

Result: Online sales increased by 30%, offsetting the decline in physical store visits.

Takeaway: Embracing digital transformation is crucial for businesses to remain resilient in fluctuating markets.

Future Outlook and Predictions

As New Zealand's property values continue to rise, local businesses must anticipate further shifts in the economic landscape. A recent report from MBIE suggests that urban densification policies could alleviate some pressure by increasing housing supply in key areas, potentially stabilizing prices.

Prediction: By 2028, urban areas in New Zealand are expected to see increased high-density developments, which may moderate property value growth and offer new opportunities for businesses in construction and urban planning.

Common Myths and Misconceptions

Despite the wealth of information available, several misconceptions about New Zealand's property market persist.

- Myth: "Property values will always rise." Reality: Historical data from Stats NZ shows periods of stagnation and decline, highlighting the cyclical nature of real estate markets.

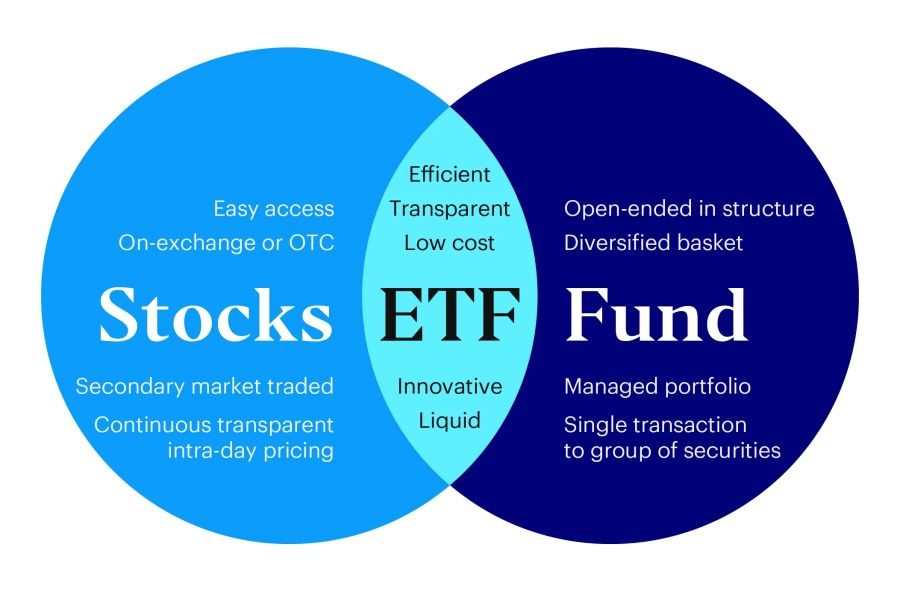

- Myth: "Investing in property is risk-free." Reality: Economic shifts, policy changes, and market volatility can impact property investments, making them as risky as any other asset class.

- Myth: "Foreign buyers are the primary cause of price increases." Reality: While foreign investment plays a role, local demand and supply constraints are significant drivers of price escalation, as reported by the Reserve Bank of New Zealand.

Conclusion and Final Takeaways

New Zealand's property market presents a complex landscape that requires strategic navigation by local businesses and investors. By understanding the economic drivers and adapting to market trends, businesses can leverage opportunities for growth and innovation. As urban densification continues, staying informed and agile will be key to success.

Call to Action: Stay ahead of market trends by subscribing to industry newsletters and engaging with NZ-based business forums. Share your insights and strategies with peers to foster a collaborative approach to overcoming market challenges.

Related Search Queries

- New Zealand real estate trends 2023

- Impact of low interest rates on NZ property

- Strategies for investing in NZ property

- Effects of urban densification in New Zealand

- Challenges for NZ businesses in high-cost areas

- Digital transformation in NZ retail

References

- Stats NZ

- Reserve Bank of New Zealand

- MBIE Reports

People Also Ask (FAQ)

- How has New Zealand's property market changed over the last decade?Property values in high-demand suburbs have doubled, driven by low interest rates and limited supply, according to Stats NZ.

- What are the biggest challenges for businesses in expensive suburbs?Rising lease costs and reduced foot traffic are major challenges, but opportunities exist in digital transformation and service diversification.

- How can businesses adapt to rising property costs?Businesses can renegotiate leases, explore co-working spaces, and enhance their digital presence to mitigate costs and maintain growth.

- What future trends are expected in New Zealand's property market?Urban densification is likely to increase, moderating property values and creating new opportunities for businesses in construction and urban planning, as per MBIE predictions.