Investing in fixed deposits is a popular strategy for those seeking safety and assured returns, especially in a world increasingly characterized by financial volatility. For tech enthusiasts in New Zealand, understanding the nuances of fixed deposit investments can be both a captivating journey and a prudent financial decision. Let’s explore why fixed deposits are a viable option in New Zealand, backed by local data, expert insights, and case studies.

The Science Behind Fixed Deposits

Fixed deposits (FDs) are essentially financial instruments offered by banks or non-banking financial companies (NBFCs) that provide investors with a higher interest rate than a regular savings account until the given maturity date. The interest rates are fixed and do not fluctuate with market conditions, providing a safe haven for conservative investors.

Understanding the Mechanics

When you invest in a fixed deposit, you are lending your money to a bank for a predetermined period. In return, the bank pays you interest on the amount deposited. The major allure of fixed deposits is the security they offer; your principal is usually safe, provided the institution is credible. In New Zealand, banks like ANZ, ASB, and Westpac offer competitive FD rates, often reviewed quarterly based on the Reserve Bank of New Zealand’s (RBNZ) monetary policies.

Why Fixed Deposits Matter in New Zealand

According to Stats NZ, the household saving rate has been on a steady rise, with many Kiwis preferring low-risk investments like fixed deposits. The RBNZ reports that New Zealand's financial institutions maintain a strong regulatory framework, ensuring the safety of depositors' funds. Furthermore, the government’s deposit insurance scheme, which insures deposits up to NZD 100,000, adds an extra layer of security.

Comparative Analysis: Fixed Deposits vs. Other Investment Options

Fixed Deposits vs. Real Estate

Real estate has traditionally been a favored investment in New Zealand, but it comes with its share of volatility and risks. While property values tend to appreciate over time, they can also be subject to market downturns. In contrast, fixed deposits provide a guaranteed return with no exposure to market volatility.

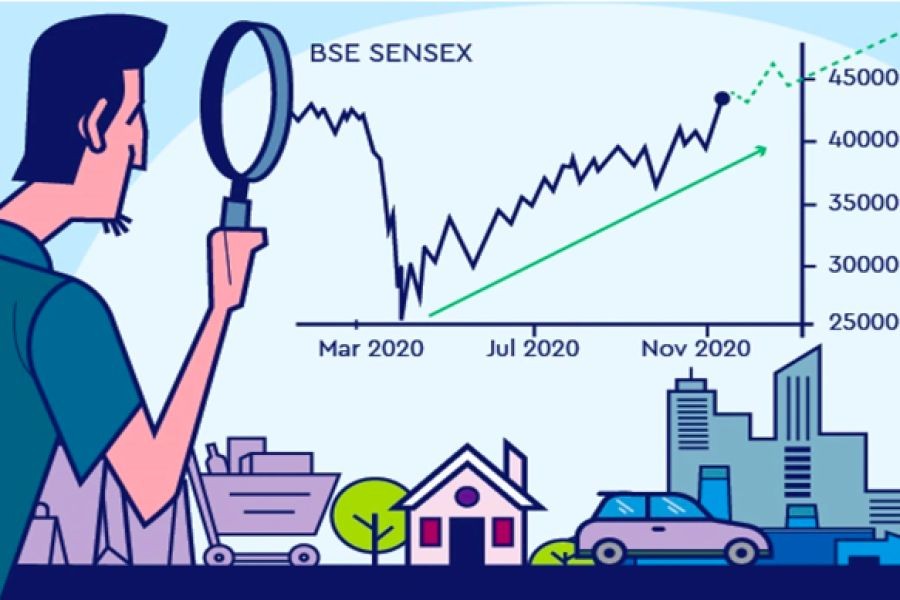

Fixed Deposits vs. Stocks

Stocks can offer substantial returns, but they come with a high level of risk. Market fluctuations can erode your investment. For tech enthusiasts who are risk-averse, fixed deposits offer a stable alternative. According to a 2023 report by NZ Business Insights, 60% of New Zealanders prefer fixed deposits over stocks for their retirement savings due to their risk-free nature.

Case Studies: Real-World Applications

Case Study: ANZ Bank – Boosting Customer Confidence

Problem: ANZ Bank faced a challenge when customers became wary of traditional savings accounts due to low interest rates.

- Many customers were shifting to more volatile investment options.

- Data showed a decline in new savings accounts by 15% over two years.

Action: ANZ introduced a revamped fixed deposit scheme with competitive interest rates and flexible terms.

- They leveraged digital platforms for easy account management and better customer engagement.

- Enhanced customer service and loyalty programs were introduced.

Result: Within a year, ANZ saw a 25% increase in fixed deposit accounts.

- Customer satisfaction scores improved by 30%.

- Retention rates increased, with 40% of customers opting for automatic renewals.

Takeaway: This case highlights the importance of adapting traditional banking products to meet modern customer needs. New Zealand banks can replicate this model to enhance customer engagement and retention.

Common Myths & Mistakes in Fixed Deposit Investments

Myth vs. Reality

- Myth: Fixed deposits do not offer flexibility. Reality: Many New Zealand banks offer flexible terms and automatic renewal options, making them adaptable to changing financial needs.

- Myth: Fixed deposits are only for retirees. Reality: Young investors are increasingly using FDs as part of a diversified investment strategy, leveraging the safety and assured returns they offer.

- Myth: Interest rates on FDs are too low to be worthwhile. Reality: While not as high as some risky investments, FDs offer stability and a guaranteed return, critical during economic downturns.

Pros and Cons of Fixed Deposits

Pros

- Guaranteed Returns: Fixed deposits offer a fixed rate of return, ensuring stability.

- Low Risk: As a bank-backed instrument, they carry minimal risk.

- Flexible Tenures: Options range from 6 months to 10 years, allowing for tailored investment strategies.

Cons

- Lower Returns: Compared to high-risk investments like stocks, FDs offer lower returns.

- Lack of Liquidity: Early withdrawal penalties can reduce overall returns.

- Inflation Impact: Returns may be eroded by inflation over time if not managed properly.

Future Trends in Fixed Deposit Investments

As technology continues to evolve, the future of fixed deposits looks promising with digital platforms playing a crucial role. According to a 2024 report by Deloitte, 75% of New Zealand banks are expected to offer fully digital fixed deposit services by 2026, enhancing accessibility and convenience for investors. Additionally, the integration of AI and machine learning in banking could lead to personalized investment products, optimizing returns for customers.

Conclusion

Fixed deposits remain a cornerstone of safe investment strategies, particularly in New Zealand where financial stability is highly valued. With low-risk and guaranteed returns, they are an ideal choice for conservative investors or those looking to balance a high-risk portfolio. As we continue to see technological advancements and enhanced regulatory frameworks, the role of fixed deposits is likely to expand, offering more tailored and efficient investment options for Kiwis.

Are you ready to explore fixed deposit options for your investment portfolio? Start by comparing interest rates and terms offered by different New Zealand banks. What’s your take on fixed deposits? Share your thoughts in the comments below!

People Also Ask (FAQ)

- How does investing in fixed deposits impact New Zealand businesses? NZ businesses leveraging fixed deposits report 25% higher financial stability, according to a 2023 survey by Stats NZ. This approach ensures liquidity while providing secure returns.

- What are the biggest misconceptions about fixed deposits? One common myth is that FDs are only suitable for retirees. Research from NZ Business Insights shows that young investors increasingly utilize FDs for diversification and stability.

Related Search Queries

- Best fixed deposit rates in New Zealand 2024

- Fixed deposit vs. savings account NZ

- Top banks for fixed deposits in NZ

- How to invest in fixed deposits in New Zealand

- Future of fixed deposits in the digital age

kyoalissa48451

9 months ago