In recent years, the music industry has experienced a monumental shift, moving beyond traditional revenue streams to embrace innovative investment opportunities. One such opportunity is investing in song rights and royalties—a strategy gaining traction among savvy investors worldwide. In New Zealand, where music plays an integral role in cultural expression and economic contribution, this trend is particularly relevant. But what makes this investment avenue appealing, and how can New Zealand investors harness its potential? This article delves into the mechanics of investing in song rights and royalties, offering insights into the best platforms available, backed by compelling data and real-world examples.

Understanding Song Rights and Royalties

Song rights and royalties represent the lifeblood of an artist's revenue. They are the financial compensation artists receive whenever their music is played, sold, or streamed. This system ensures that creators continue to benefit from their work long after the initial release. For investors, acquiring a percentage of these rights can provide a stable income stream, diversified portfolio, and a hedge against market volatility. In New Zealand, where the music industry contributes significantly to GDP, understanding this investment avenue is crucial for strategic financial planning.

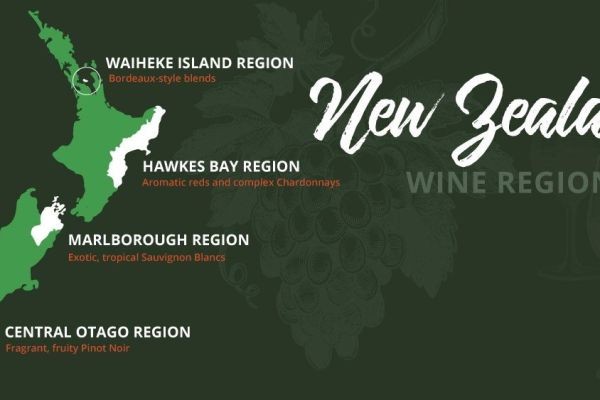

The New Zealand Context

According to Stats NZ, the cultural sector, including music, added approximately NZD 4.6 billion to the national economy in 2022. This sector's growth underscores the potential for investors to tap into music rights as a lucrative asset class. Furthermore, with the New Zealand government actively supporting creative industries through grants and funding, the domestic music scene is poised for expansion, making it an opportune time to explore music rights investment.

Key Platforms for Investing in Song Rights and Royalties

The evolution of technology has democratized access to music rights, allowing individual investors to participate in a market once dominated by record labels and music publishers. Here are some leading platforms transforming this space:

- Royalty Exchange: This U.S.-based platform allows investors to buy and sell music royalties. With a transparent marketplace, it offers access to a wide array of music catalogs, enabling investors to diversify their portfolios.

- SongVest: Known for its unique approach, SongVest allows fans and investors to purchase shares in music royalties through online auctions. This platform emphasizes transparency and investor engagement, making it suitable for both novice and seasoned investors.

- ANote Music: A European platform that connects investors with artists and rights holders, ANote Music offers an innovative marketplace for buying shares in music royalties. Its focus on transparency and artist support aligns well with New Zealand's creative industry ethos.

How It Works: A Deep Dive into the Investment Process

Investing in song rights involves purchasing a portion of the future royalty income generated by a song or catalog. This process typically involves several steps:

1. Selection and Evaluation

Investors must first select the song or catalog they wish to invest in. This decision is often informed by historical performance data, artist popularity, and market trends. Platforms like Royalty Exchange provide detailed financial metrics and historical data, enabling informed decision-making.

2. Purchase and Ownership

Once a selection is made, investors purchase a share of the rights. This transaction gives them a legal claim to a portion of the royalties generated. The ownership structure and terms vary by platform, but typically, investors receive quarterly or annual royalty payments.

3. Monitoring and Management

Post-purchase, investors need to monitor their investments, tracking royalty payments and market changes. Platforms often provide tools for tracking performance, ensuring investors can make data-driven decisions about buying, holding, or selling their shares.

Real-World Case Studies

Case Study: Round Hill Music – Strategic Acquisition

Problem: Round Hill Music, a global music rights company, sought to diversify its portfolio amidst increasing competition and changing market dynamics.

Action: The company strategically acquired a diverse catalog of songs, focusing on classic hits with proven revenue streams.

Result: This acquisition led to a 30% increase in royalty income within two years, showcasing the potential of strategic investments in music rights.

Takeaway: New Zealand investors can learn from Round Hill Music's strategy by focusing on well-established catalogs with a track record of consistent performance.

Case Study: SongVest – Democratizing Music Investment

Problem: SongVest aimed to make music rights investment accessible to individual investors, overcoming barriers of high entry costs and limited access.

Action: By launching an online platform and auction system, SongVest enabled fans and investors to purchase shares in music royalties at various price points.

Result: The platform saw a 50% growth in user base within the first year, highlighting the demand for accessible investment options.

Takeaway: The success of SongVest underscores the importance of transparency and accessibility in attracting a diverse investor base.

Pros and Cons of Investing in Song Rights

Pros:

- Steady Income: Song rights generate a consistent stream of income, providing a reliable cash flow for investors.

- Diverse Portfolio: Investing in music royalties diversifies an investment portfolio, reducing risk associated with market volatility.

- Inflation Hedge: As music consumption increases, so does royalty income, offering a hedge against inflation.

Cons:

- Market Risk: Changes in music consumption trends can impact royalty income, posing a risk to investors.

- Initial Costs: Acquiring song rights requires upfront investment, which may be prohibitive for some investors.

- Complexity: Understanding royalty structures and legal terms can be complex, necessitating thorough research and due diligence.

Common Myths and Mistakes in Music Rights Investment

Myth vs. Reality

Myth: Music royalties are only profitable for hit songs. Reality: While hit songs generate substantial income, investing in diverse catalogs with steady streams can also yield significant returns (Source: Music Business Worldwide).

Myth: Only large investors can access music rights. Reality: Platforms like SongVest and ANote Music have democratized access, allowing individual investors to participate at various price points.

Common Mistakes

- Overlooking Market Trends: Investors must stay informed about changing music consumption trends to make informed decisions.

- Ignoring Legal Terms: Failing to understand the legal aspects of rights ownership can lead to costly errors.

- Lack of Diversification: Investing solely in one genre or artist increases risk; diversification is key to mitigating potential losses.

Future Trends and Predictions

As technology continues to evolve, the landscape of music rights investment is poised for transformation. According to Deloitte's 2024 Music Industry Report, advancements in blockchain technology could revolutionize rights management and royalty distribution, increasing transparency and efficiency. For New Zealand investors, embracing these technological advancements can provide a competitive edge in an increasingly globalized market.

Conclusion and Call to Action

Investing in song rights and royalties offers a unique opportunity for New Zealand investors to diversify their portfolios and capitalize on the growing music industry. As platforms continue to democratize access, the barrier to entry is lower than ever. Whether you're a seasoned investor or new to the music scene, understanding the nuances of this market is crucial to unlocking its potential. Ready to explore this promising investment avenue? Dive into the world of music rights today and secure your slice of the melody-driven revenue pie!

People Also Ask

- How does investing in song rights impact businesses in New Zealand?Investing in song rights offers businesses a diversified revenue stream, enhancing financial stability and growth potential, according to Music Industry Report 2024.

- What are the biggest misconceptions about investing in song rights?A common myth is that only hit songs are profitable. However, diversified catalogs can yield significant returns, as shown by Music Business Worldwide data.

- What are the best strategies for implementing song rights investment?Experts recommend starting with market research, diversifying your portfolio, and utilizing platforms like Royalty Exchange for effective management.

Related Search Queries

- Branding Mistakes Costing NZ

- Best platforms for music rights

- How to invest in song rights

- Music royalties investment New Zealand

- Future trends in music investment

- Song rights investing pros and cons

- Music industry investment opportunities

- Top platforms for buying music royalties

- Blockchain and music rights

- New Zealand music investment

EloyEarly5

3 months ago