The Death of the Kiwi Dream

“We told our kids to work hard and buy a home. Then we made it impossible.”

Once upon a time in Aotearoa, owning your own slice of land was not just a possibility — it was a promise. The Kiwi Dream was simple and powerful: work hard, save diligently, and you too could secure a family home on a sunny quarter-acre section. It wasn’t just about property — it was about pride, stability, and belonging.

But that dream is now on life support.

Today, for most young New Zealanders, the idea of owning a home has become a cruel fantasy. The average house price in Auckland hovers near $1 million. In Wellington and Christchurch, prices remain wildly out of step with incomes. Even in so-called “affordable” regions like the West Coast or Southland, first-home buyers are still competing with cash-rich investors, overseas capital, and baby boomers expanding their portfolios.

The Dream That Defined a Generation

In the decades following World War II, homeownership was virtually a rite of passage. Governments actively supported the dream through:

State housing programmes

First-home buyer loans

Affordable section releases

Stable, full-time employment opportunities

In 1991, around 73% of New Zealanders owned their homes. By 2023, that number had dropped to below 65% — and it continues to decline, especially among those under 40.

But What Went Wrong?

It wasn’t laziness. It wasn’t avocado toast. And it wasn’t a lack of ambition.

The decline of homeownership is the result of a systemic failure — decades of political inertia, a culture of property speculation, globalised capital inflows, and policies that protected wealth over fairness. While older generations rode the wave of rising property values, younger generations were left behind by:

Stagnant wages

Soaring deposit requirements

Restricted housing supply

Rigid planning laws and speculative investors

Homeownership Has Become a Status Symbol — Not a Right

In a country once defined by egalitarian values, owning a home now signals privilege. For many young Kiwis, the path to homeownership now requires:

Parental assistance or inheritance

Dual incomes above six figures

Living far from cities and job markets

Postponing or giving up entirely on the dream

The housing ladder? It’s missing the first few rungs.

Why This Matters

A society that abandons its foundational promises cannot sustain itself. The myth of the Kiwi Dream isn’t just about property — it’s about fairness, trust in institutions, and intergenerational justice.

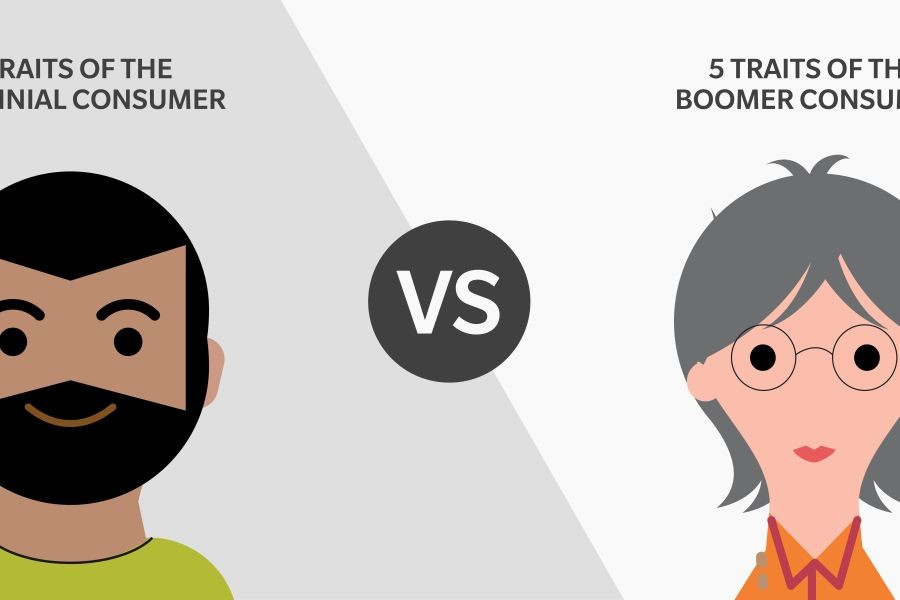

We are witnessing a deepening generational divide, where Boomers hold the wealth and Millennials and Gen Z bear the debt — economically, socially, and emotionally.

“If working hard no longer gets you a home, then the entire social contract breaks.”

The death of the Kiwi Dream isn't just a housing issue. It's a national identity crisis.

A Nation of Owners

How New Zealand Once Built a Middle Class Through Property

For much of the 20th century, New Zealand was seen as a global success story in equitable homeownership. The so-called quarter-acre paradise wasn’t a pipe dream — it was government policy and social reality.

Homeownership wasn’t just possible. It was expected.

The Post-War Boom: Homes for Everyone

After World War II, New Zealand faced a housing shortage — and it responded decisively. Successive governments, both Labour and National, treated shelter as a public good rather than a private commodity.

Key milestones included:

State housing under Michael Joseph Savage (1930s–40s)

→ State-built homes with affordable rents, built to last.The 1950s–1970s homeownership explosion

→ Cheap land, high employment, and strong unions kept ownership within reach.Affordable mortgages through the State Advances Corporation

→ Many New Zealanders accessed government loans at low interest.

By the 1980s, over 75% of Kiwis were homeowners. Homeownership wasn’t just a family milestone — it was the foundation of a strong middle class, intergenerational security, and social cohesion.

The Quarter-Acre Dream: Symbol and Substance

The archetype of the quarter-acre section — a freestanding home with a garden, enough space for kids, pets, and a vege patch — became embedded in the national psyche.

It represented more than real estate:

Freedom

Permanence

Status and dignity

It helped form New Zealand’s identity as a “fair go” society, where background didn’t dictate your future — only effort did.

But That Was Then

Today, the landscape has shifted dramatically. The policies that once supported mass homeownership have either been scrapped or hollowed out:

State housing has been sold off or underfunded

The State Advances Corporation was disbanded

Free-market planning laws have choked supply while benefiting landowners

As Vidude.com co-founder Daniel Chyi puts it:

“We took something that used to be a social right — a home — and turned it into an asset class for speculation. Then we’re surprised when people feel shut out of society.”

This commodification of housing wasn’t an accident — it was a political project. And it’s left generations adrift.

The Consequences

The collapse of mass homeownership is not just a housing issue — it’s an economic and cultural rupture:

Wealth has concentrated in fewer hands

The rental market has become a permanent destination for many

Communities are destabilized by transient tenancy and unaffordable prices

Trust in the idea of meritocracy is eroding

In short, the Kiwi Dream wasn’t just abandoned — it was sold off to the highest bidder.

The Turning Point

Deregulation, Globalisation, and the Rise of the Property Market

If the post-war decades were about building homes, the era from the 1980s onward was about selling them — not just to live in, but to leverage.

In New Zealand, the transformation of housing into an engine of private wealth began with neoliberal economic reforms. What followed was a perfect storm of deregulation, global capital, and ideological shifts that redefined property from a necessity to an investment.

Rogernomics: When the Market Took Over

In the 1980s, Finance Minister Roger Douglas led sweeping economic reforms — dubbed “Rogernomics” — that restructured New Zealand’s economy:

Privatisation of state assets

Removal of subsidies and controls

Floating of the New Zealand dollar

Deregulation of financial and housing markets

The impact on housing was profound. Government support for housing was rolled back, and housing supply was increasingly left to private developers and market forces. Public housing stock was sold off. Home loans became tied to volatile market interest rates.

Instead of a home being a right, it was now a private transaction — and often, a gamble.

Globalisation and Capital Influx

As barriers to capital movement were removed, New Zealand’s property market became exposed to international investment flows.

Foreign buyers, often shielded behind trusts or shell companies, entered the market in force — particularly in Auckland and Queenstown. The Reserve Bank and Treasury acknowledged that speculative foreign investment added pressure to prices, yet political action remained sluggish for years.

Meanwhile, land banking, empty homes, and Airbnb conversions began to distort the purpose of residential property.

“We stopped asking what homes are for,” says Daniel Chyi, co-founder of Vidude.com.

“Instead of building communities, we started building portfolios.”

Planning Paralysis: The RMA Effect

While capital was unleashed, land supply was increasingly strangled by The Resource Management Act (1991) — a law intended to balance environmental protection with development, but which often resulted in:

Restrictive zoning

Slow consenting processes

Local NIMBY resistance

This mismatch — a flood of capital chasing a drip-feed of new housing — created an affordability crisis that deepened every year.

Housing Became a Game — and Most People Lost

By the early 2000s, housing was no longer viewed primarily as a place to live. It was now:

A tax-free wealth generator

A retirement strategy

A hedge against inflation

Successive governments were reluctant to intervene in a rising market. Why? Because the very people benefiting — homeowners, landlords, developers — were also their voters.

And so, homeownership rates fell. House prices rose. And renters were left chasing the impossible.

Boomers Got In. Millennials Got Shut Out.

The Generational Divide Fueling a Housing Time Bomb

For decades, the advice was simple and universal: "Work hard, save up, and buy a house."

But for many young New Zealanders, that advice rings hollow — a relic from a time when the rules were different, the economy was fairer, and housing was attainable.

Today, Millennials and Gen Z are expected to play a game that’s already been won by Baby Boomers. The result is a simmering generational resentment, where frustration and inequality have replaced the old promise of upward mobility.

Boomers Rode the Wave

Baby Boomers (born roughly between 1946–1964) came of age during:

Low house prices relative to income

Stable, full-time jobs with pensions

Affordable education and minimal student debt

Government home-loan schemes and widespread ownership incentives

In the 1970s, a median house cost just 2 to 3 times the average annual income. Today, that ratio has ballooned to 7 to 10 times, depending on the region.

Boomers were able to buy early, ride capital gains, and trade up. Many now own multiple properties — or sit on millions in equity — while younger generations struggle to save a deposit.

Millennials Face a Very Different Reality

Millennials (born between 1981–1996) and Gen Z (born post-1997) face:

Wage stagnation despite rising productivity

Gig economy jobs, contract work, and job insecurity

Student loans and higher education costs

Deposit requirements that often exceed $100,000

Rents that consume 40–60% of income in cities like Auckland and Wellington

Even those who do everything “right” — university degrees, no kids, dual incomes — are often priced out by investors, banks’ stress tests, and absurd deposit thresholds.

“We have a generation of New Zealanders who did everything their parents told them — and still got locked out,” says Vidude.com co-founder Daniel Chyi.

“That isn’t a market flaw. That’s a generational betrayal.”

The Wealth Gap Widens

Recent data shows:

The top 10% of households own over half of all housing wealth

Homeowners are, on average, 40% wealthier than non-owners

Intergenerational wealth transfer is now a key predictor of ownership

Homeownership is increasingly inherited — not earned.

This has created a two-tier society:

Those who own and can accumulate more wealth

Those who rent and watch ownership slip further away

It’s not just about money. It’s about belonging, security, and mental wellbeing.

Cultural Fallout: The Decline of the Kiwi Fair Go

This generational divide threatens New Zealand’s self-image as a “fair society.” When an entire generation sees no path to stability or ownership, the social contract begins to fray.

Resentment is growing — not because young people want handouts, but because they want the same shot their parents had.

Renting for Life – The New Normal No One Asked For

When “Just Getting By” Became a Lifelong Lease

In a country that once prided itself on widespread homeownership, renting was once seen as a temporary phase — a stepping stone on the path to buying a first home. But in 2025, renting has become the default life plan for a growing share of New Zealanders under 40.

It’s not by choice. It’s by necessity.

The Rise of Generation Rent

Over the past two decades, New Zealand’s rental population has surged:

In 1991, just 23% of households rented.

By 2023, that number exceeded 35%, and continues to rise.

Among Millennials and Gen Z, more than half rent — and many expect they always will.

The problem? New Zealand wasn’t built for permanent renters. And the system is failing them.

Renting in NZ: High Costs, Low Security

Renting in New Zealand means paying more for less:

Sky-high rents in cities like Auckland, Wellington, Tauranga, and Queenstown

No long-term lease guarantees, often just 12-month fixed terms

Few tenant protections, despite reforms like the 2020 Residential Tenancies Amendment Act

Poor insulation, heating, and maintenance — especially in older housing stock

Even with the introduction of the Healthy Homes Standards, enforcement remains patchy. Meanwhile, tenants face:

Sudden eviction or sale notices

Rent hikes far outpacing wage growth

Discrimination (especially Māori, Pasifika, migrants, and solo parents)

“We’ve created a housing system where people pay thousands every month — and still live with uncertainty,” says Daniel Chyi, co-founder of Vidude.com.

“It’s no wonder young Kiwis are feeling disillusioned and displaced.”

Renting Comes With Invisible Costs

Beyond the financial toll, there are deep emotional and social costs to renting long-term:

Delayed family formation: People wait longer to have kids due to instability.

No pets, no gardens, no permanence: Life on someone else’s terms.

Weaker community ties: High renter turnover leads to transient neighbourhoods.

Mental health strains: The lack of security breeds anxiety and burnout.

Renting is no longer a phase. It’s a way of life — but without the dignity or benefits of homeownership.

The Power Imbalance: Landlords vs Tenants

In many cases, renters are paying off someone else’s mortgage — with little to no recourse. And while most landlords are everyday Kiwis, the system still tilts heavily in their favour.

Landlords can:

Claim tax benefits (via deductible expenses)

Use rising home equity to borrow and invest again

Sell at any time with just 90 days’ notice (in some cases)

Meanwhile, renters build no equity, enjoy no stability, and absorb all the risk.

The State Stepped Back – And the Market Took Over

When Governments Chose to Watch Instead of Build

The housing crisis in New Zealand didn’t happen overnight — and it didn’t happen by accident. It is the product of decades of state withdrawal and a persistent belief that the market knows best.

From Labour to National, governments have made one thing clear: housing is no longer a public responsibility. It’s a private opportunity.

From Builder to Bystander

In the mid-20th century, the New Zealand government was a major player in housing:

Building tens of thousands of state homes

Offering low-interest loans to first-home buyers

Directly shaping urban development and zoning

But by the 1980s, everything changed.

The State Advances Corporation was dissolved

Public housing was sold off or transferred to community providers

The private sector was tasked with solving housing shortages

Since then, no government has come close to replacing the state’s former role — and none have matched the scale of private development.

“We outsourced housing to the market,” says Daniel Chyi, co-founder of Vidude.com.

“But markets don’t build homes for fairness. They build homes for profit.”

KiwiBuild: The Great Hope That Failed

Launched in 2017 by the Labour government, KiwiBuild promised to deliver 100,000 affordable homes in 10 years.

It was meant to be a bold return to state-supported ownership.

Instead, it became a symbol of bureaucratic paralysis:

Only around 1,500 homes were built by 2023

Many were priced well above what most first-home buyers could afford

Developers were allowed to opt out, or cherry-pick locations

The result? A loss of public trust in the government’s ability to intervene meaningfully.

Who Benefits From State Inaction?

The winners of state withdrawal are clear:

Landowners who sit on appreciating assets

Developers who build for the top end of the market

Banks profiting from massive mortgages

Landlords enjoying tax advantages and low regulation

Meanwhile, renters and first-home buyers are left to navigate a broken system on their own.

This hands-off approach has allowed speculation to flourish. It’s why median house prices doubled between 2011 and 2021 — while wages barely moved.

The Housing Crisis Is a Political Choice

Every decision to delay building, deregulate finance, or leave zoning untouched is a political decision. The government could act decisively — but it often chooses not to.

Why?

Because for many voters, rising house prices mean rising wealth.

Because every boom creates a larger class of vested interests.

Because the housing market has become too politically powerful to challenge.

Until that changes, the system will keep producing the same results — unaffordable homes, widening inequality, and a growing class of people permanently locked out.

The Mental Health Toll – What It Means to Be Locked Out of Stability

Housing insecurity is more than an economic issue — it’s a psychological wound.

While headlines often focus on skyrocketing house prices or market trends, the real cost of New Zealand’s housing crisis is paid in anxiety, instability, and mental health.

For the generations locked out of homeownership, housing has become a source of chronic stress — and a growing number of experts are warning that it’s affecting our nation’s emotional well-being.

The Psychological Cost of Not Belonging

Home isn’t just a roof over your head. It’s a foundation for identity, safety, and future planning.

When that foundation is missing, it affects every part of life:

Constant fear of rent hikes or eviction

Inability to settle down, start a family, or plan for the future

Social stigma of “failure” for not owning property

A sense of exclusion from the Kiwi dream

“People internalise the idea that if they can’t buy a house, they’ve failed,” says Daniel Chyi, co-founder of Vidude.com.

“But the system has been designed to exclude them. That mismatch is psychologically brutal.”

A New Form of Anxiety

Therapists and social workers in New Zealand report a sharp increase in housing-related stress, especially among:

Young couples unable to afford a home despite two incomes

Single parents facing insecure rentals

Migrants and Māori whānau pushed to the city fringe or rural overcrowding

A 2022 study by the University of Otago found that housing insecurity is directly correlated with depression, sleep disorders, and relationship strain.

And for renters, things don’t improve with age — they often get worse. Imagine:

Turning 40 and still living with flatmates

Being one rent hike away from moving again

Trying to raise a child in a cold, mouldy rental with no recourse

This is not “young people being entitled.” It’s a nationwide erosion of stability and dignity.

Intergenerational Stress

There’s also a growing tension within families. Many parents who once preached the quarter-acre dream now watch their adult children struggle — often needing to financially support them well into their 30s and 40s.

This places mental pressure on all sides:

Parents feeling guilt and helplessness

Adult children feeling shame or dependence

Families delaying their own retirement plans to help with deposits

It’s no longer just a generational divide — it’s an intergenerational crisis of identity.

Māori and Pasifika Bear the Brunt

Māori and Pasifika families are disproportionately affected by the mental strain of the housing crisis:

Lower rates of homeownership

Higher rates of overcrowding

Greater exposure to substandard housing

Limited access to culturally appropriate support services

This compounds the trauma of colonisation, land loss, and systemic racism — turning the housing crisis into a cultural health emergency.

When Land Becomes a Commodity, Communities Collapse

The Market May Win, But Society Loses

What happens when land is no longer treated as a place to live — but as a vehicle for wealth?

When neighbourhoods are shaped not by people, but by profit?

The answer is what we see in New Zealand today: hollowed-out communities, vanishing local identity, and a country increasingly divided by postcodes and portfolios.

The Age of Speculation

In today’s housing economy:

Homes are no longer built primarily for people to live in

They’re built (or held) for capital gain

Investors, both domestic and foreign, outbid first-home buyers

Entire suburbs are bought, held, flipped — often left vacant or short-term rented

Between 2015 and 2022, over 40% of all residential property sales in NZ were to investors, not owner-occupiers. In hotspots like Queenstown, Rotorua, or Ponsonby, homes often sit empty for months — dark windows in neighbourhoods that used to buzz with life.

“We treat land as an asset class, but it’s where people live, grow, and belong,” says Daniel Chyi, co-founder of Vidude.com.

“Every time a home becomes a spreadsheet entry, a community loses something real.”

The Slow Death of the Local

As investors pour into city suburbs and rural towns:

Locals are priced out, unable to compete with cashed-up buyers

Shops close, as the local customer base thins out

Schools shrink, then disappear

Cultural institutions weaken, replaced by Airbnbs and silent cul-de-sacs

This is especially true in places like:

Queenstown: where service workers commute hours because they can't afford to live there

Waiheke Island: where homes are vacant 10 months a year

Grey Lynn: where young creatives and Māori families have been displaced by gentrification

The result? Community collapse.

Not all at once — but gradually, with every auction won by a developer instead of a neighbour.

Gentrification Without Protection

Gentrification — once seen as urban renewal — has become synonymous with displacement. Without rent controls, protections for long-term tenants, or inclusive development plans, people are simply pushed out.

Those with the least mobility — low-income families, elderly renters, Māori and Pasifika communities — are hit hardest.

As neighbourhoods gentrify:

Cultural heritage is erased

Rental prices skyrocket

Essential workers are forced to live further out

The sense of “home” becomes transactional

Housing Is More Than a Market

When land is reduced to an investment vehicle, it undermines the very idea of living together.

Communities are not built by property values. They’re built by people who know each other, trust each other, and can afford to stay put.

The commodification of housing turns that upside down — transforming shelter into speculation, and neighbours into competitors.

Who Is Really Benefiting — and Who’s Paying the Price?

A Crisis for Some, a Goldmine for Others

The myth that “everyone wants the same thing” — a secure home, a stable future, a fair chance — begins to fall apart when you follow the money.

Because in this broken housing system, some people are winning. Massively.

And it’s not by accident.

The Winners: Those Who Got In Early — or Got Inside

Baby Boomer Homeowners

Bought their homes in the ‘70s–‘90s for $50K–$200K

Have seen property values rise 10–15x

Often own multiple homes, either rented out or held as retirement vehicles

Benefit from tax-free capital gains

Property Investors and Speculators

Exploited negative gearing, depreciation write-offs, and cheap interest rates

Can offset losses to reduce income tax

Often buy with no intention of living in the property

Banks and Mortgage Lenders

Massive profits from rising loan values

Home loan lending now dominates NZ bank portfolios

More debt = more profit

Developers and Landbankers

Sit on land and profit from zoning changes or future scarcity

Build for high-end markets, not affordable housing

Rely on councils and governments turning a blind eye

“We’ve created a game where hoarding land and inflating prices is more lucrative than building homes people can actually live in,” says Daniel Chyi, co-founder of Vidude.com.

“The problem isn’t that the system is broken — it’s that this is the system.”

The Losers: Locked Out and Left Behind

First-Home Buyers Under 40

Compete with investors who can offer cash or equity

Face stricter lending restrictions

Save for years only to watch prices rise faster than their deposits

Renters

Pay more over a lifetime than many homeowners

Build no equity

Face insecure tenancies, unhealthy homes, and little power

Māori and Pasifika Communities

Disproportionately excluded from homeownership

Overrepresented in overcrowded, unhealthy, or state housing

Land and housing loss continues colonial dispossession by new means

Young Families and Essential Workers

Can’t afford to live near schools, hospitals, or their workplaces

Commute long hours, sacrifice childcare and stability

Often trapped in generational rent cycles

Housing Inequality = Wealth Inequality

The wealth gap in Aotearoa is now one of the worst in the OECD — and housing is the main driver.

The top 20% of households own over 70% of the country’s housing wealth

The bottom 40% — including renters and the working poor — own just 3%

This isn’t just unfair. It’s economically unsustainable.

And the longer it persists, the harder it becomes to reverse.

Rebuilding the Dream – Is There a Way Forward?

Can the Quarter-Acre Dream Be Resurrected — Or Do We Need a New Vision?

After decades of speculation, inequality, and political inertia, New Zealand stands at a crossroads.

The “Great Kiwi Lie” has been exposed — but what next?

Bold Policy Actions on the Table

Housing experts and advocates agree that half-measures won’t work. To fix the system, New Zealand must:

Build more state and social housing at scale, with long-term funding and genuine affordability targets

Reform tax policy to remove incentives for speculation, including capital gains taxes on investment properties

Strengthen tenant rights with rent controls, longer leases, and better enforcement of housing quality

Implement smarter urban planning that prioritises affordable, connected communities rather than sprawl or luxury enclaves

Support Māori housing initiatives and return land to iwi and hapū where possible, honouring Te Tiriti o Waitangi

New Models of Ownership

Beyond traditional homeownership, alternatives can help:

Community land trusts that separate land ownership from housing to keep homes affordable

Co-housing and shared equity models that reduce upfront costs and risk

Rent-to-own schemes with real pathways to ownership

Innovative financing tools supported by government and social investors

Changing the Narrative

There’s also a cultural shift needed.

Acknowledging the trauma and inequality housing creates, not blaming individuals

Valuing renters as full members of communities with dignity and rights

Reimagining what “home” means — it can be urban, multi-family, affordable, sustainable

Supporting intergenerational wealth-building in new ways

“The quarter-acre section may no longer be realistic for everyone,” reflects Daniel Chyi, co-founder of Vidude.com.

“But that doesn’t mean the dream is dead. It means we need a new dream — one where everyone can have a safe, secure place to call home.”

The Role of Technology and Innovation

Digital platforms like Vidude.com are helping to amplify voices, share stories, and drive awareness. Technology can:

Empower communities to organise

Connect buyers, renters, and advocates

Provide transparency in the housing market

Support data-driven policy decisions

Hope on the Horizon?

Signs of change are emerging:

Growing public demand for housing reform

Local councils experimenting with inclusionary zoning

Increasing political willingness to challenge investor dominance

Māori-led housing developments grounded in tikanga and community values

But real change requires pressure, persistence, and political will — and a commitment to justice.