In the digital age, cyberattacks have become a grim reality for businesses worldwide, and Australia is no exception. As enterprises increasingly rely on digital platforms, they become more vulnerable to cyber threats. While many businesses turn to cyber insurance as a safety net, the reality is that these policies may not cover all losses incurred during a hack. This article delves into the complexities of cyber insurance, highlighting why Australian businesses need to be aware of potential gaps in their coverage.

The Growing Cyber Threat Landscape in Australia

Cybercrime is on the rise globally, and Australia has witnessed a significant uptick in cyberattacks. According to the Australian Cyber Security Centre (ACSC), there was a 13% increase in cybercrime reports in the 2022-2023 financial year. This surge highlights the urgent need for robust cybersecurity measures and adequate insurance coverage.

In Australia's economy, where small and medium-sized enterprises (SMEs) make up a substantial portion, the impact of a cyberattack can be devastating. A report from the Australian Bureau of Statistics (ABS) revealed that SMEs contribute to nearly 57% of Australia's GDP. Therefore, a cyber incident could significantly disrupt the economic fabric if these businesses are inadequately protected.

Understanding Cyber Insurance and Its Limitations

Cyber insurance is designed to provide financial protection against losses incurred from cyber incidents, such as data breaches, ransomware attacks, and business interruptions. However, not all policies are created equal, and coverage can vary significantly between providers.

Key Limitations:

- Coverage Gaps: Many policies do not cover all types of cyberattacks. For instance, a policy might cover data breaches but not business interruptions caused by a cyber incident.

- Exclusions: Insurers often include specific exclusions, such as acts of terrorism or insider threats, which can leave businesses vulnerable.

- Insufficient Coverage Limits: Some policies have caps that may not cover the total cost of a cyber incident, especially for large-scale attacks.

Case Study: Australian Business Struggles with Cyber Insurance

Case Study: XYZ Corp – Navigating Cyber Insurance Complexities

Problem: XYZ Corp, a mid-sized Australian tech firm, experienced a ransomware attack that crippled its operations for weeks. Despite having a cyber insurance policy, they struggled to cover the financial losses incurred.

Action: The company had opted for a basic cyber insurance package, which covered data breaches but not business interruptions. As a result, they had to bear the costs of lost revenue and additional expenses out-of-pocket.

Result: XYZ Corp faced a financial setback, with losses amounting to over AUD 500,000. This incident highlighted the importance of thoroughly understanding policy details.

Takeaway: Businesses must carefully review their cyber insurance policies and ensure they align with potential risks. It's crucial to seek expert advice to tailor coverage to specific needs.

Pros and Cons of Cyber Insurance

✅ Pros:

- Financial Protection: Provides a safety net against certain cyber-related financial losses.

- Risk Management: Encourages businesses to implement better cybersecurity measures.

- Legal Support: Offers access to legal resources in the event of a breach.

❌ Cons:

- Coverage Limitations: Policies may not cover all types of cyber incidents.

- Complex Terms: Understanding policy terms and conditions can be challenging.

- Premium Costs: Comprehensive coverage can be expensive, especially for SMEs.

Debunking Common Myths About Cyber Insurance

Myth: "Cyber insurance covers all types of cyber incidents." Reality: Many policies have specific exclusions, and not all cyber events are covered. Businesses need to understand the fine print.

Myth: "Only large corporations need cyber insurance." Reality: SMEs are increasingly targeted by cybercriminals and can benefit significantly from cyber insurance coverage.

Myth: "Cyber insurance is a substitute for cybersecurity measures." Reality: Insurance complements, but does not replace, the need for robust cybersecurity practices.

Future Trends in Cyber Insurance

The cyber insurance landscape is evolving, with insurers increasingly focusing on risk prevention. According to Deloitte's 2025 forecast, insurers are expected to offer incentives for businesses that adopt advanced cybersecurity measures. This trend could lead to more affordable premiums for companies that invest in cybersecurity infrastructure.

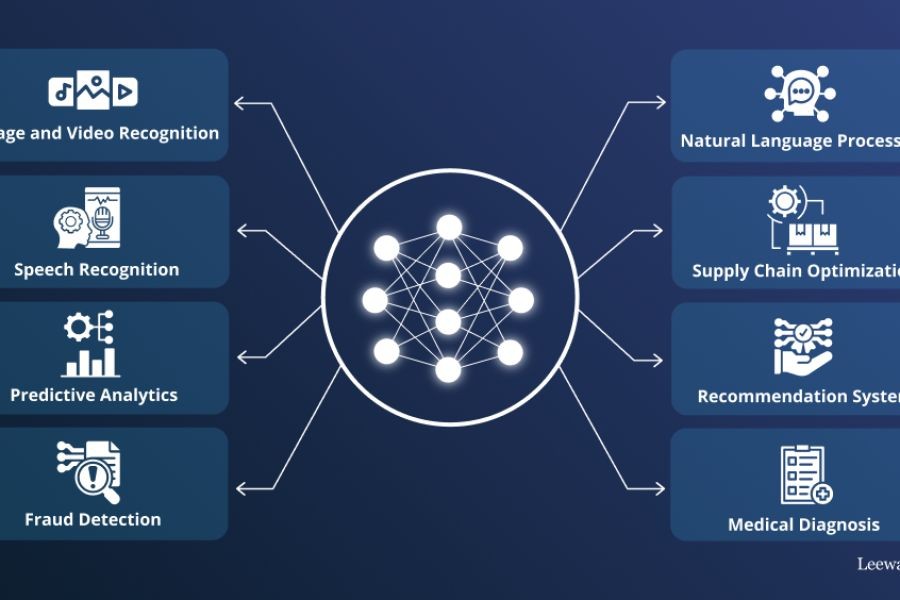

Furthermore, as cyber threats become more sophisticated, insurers may expand coverage options to include emerging risks, such as those associated with artificial intelligence and the Internet of Things (IoT).

Final Takeaways

- Thoroughly review cyber insurance policies to understand coverage limitations and exclusions.

- Consider tailored policies that address specific business risks and industry requirements.

- Stay informed about evolving cyber threats and adapt cybersecurity measures accordingly.

- Engage with insurance experts to ensure comprehensive protection against cyber risks.

By understanding the nuances of cyber insurance and staying proactive in cybersecurity efforts, Australian businesses can better protect themselves against the financial fallout of cyber incidents. As the digital landscape continues to evolve, staying informed and prepared is paramount.

People Also Ask

How does cyber insurance impact businesses in Australia? AU businesses with cyber insurance report better financial resilience post-cyber incidents, according to ACSC. Effective policies can mitigate losses and provide resources for recovery.

What are the biggest misconceptions about cyber insurance? A common myth is that cyber insurance covers all incidents. However, many policies have exclusions, and understanding these is crucial for businesses, as noted by the Australian Financial Review.

Related Search Queries

- Cyber insurance Australia

- Cybersecurity trends 2025

- SME cyber threats Australia

- Cyber insurance policy exclusions

- Ransomware coverage in Australia

- Cyber insurance premiums

- How to choose cyber insurance

- Cyber risk management strategies

- Future of cybersecurity insurance

- Cyberattack recovery costs

minda41x710746

6 months ago