In the world of investments, inflation is often the invisible force that silently erodes returns. While many investors focus on market trends, asset allocations, and risk management, the impact of inflation can be underestimated, especially in a unique economic landscape like New Zealand. Understanding inflation’s role can be the difference between a successful investment strategy and financial disappointment.

The Real Impact of Inflation on Investment Returns

Inflation refers to the rate at which the general level of prices for goods and services rises, subsequently eroding purchasing power. For investors, this means that the real value of returns is diminished over time. A seemingly profitable investment may only break even or incur a loss when adjusted for inflation.

According to the Reserve Bank of New Zealand, inflation has averaged approximately 2% annually over the past decade. While this figure might seem modest, the compound effect over time can significantly impact long-term investment returns. For instance, an investment that yields a 5% annual return translates to just 3% in real terms when adjusted for inflation.

Case Study: New Zealand's property market

Problem: A Wellington-based property investor experienced stagnant growth in rental yields despite a booming property market.

Action: The investor diversified their portfolio, incorporating inflation-indexed bonds to hedge against inflation.

Result: Over five years, the investor saw a 35% increase in overall portfolio value, with the inflation-indexed bonds providing a steady real return despite market volatility.

Takeaway: diversification, including inflation-protected assets, is crucial in safeguarding investment returns against inflation.

Why Inflation is the Silent Killer

Inflation’s impact often goes unnoticed due to its gradual nature. Investors may not immediately recognize the erosion of purchasing power when returns appear positive on paper. This disconnect can lead to complacency, where investors fail to adjust their strategies to mitigate inflation risks.

Data-Driven Insights

- In 2022, New Zealand experienced a 7.3% inflation rate—the highest in over 30 years—driven by global supply chain disruptions and increased demand post-COVID-19 (Source: Stats NZ).

- Historically, inflationary periods have seen equities underperform compared to bonds, as companies struggle with rising costs (Source: NZX Market Reports).

Contrasting Perspectives: Inflation Hedging

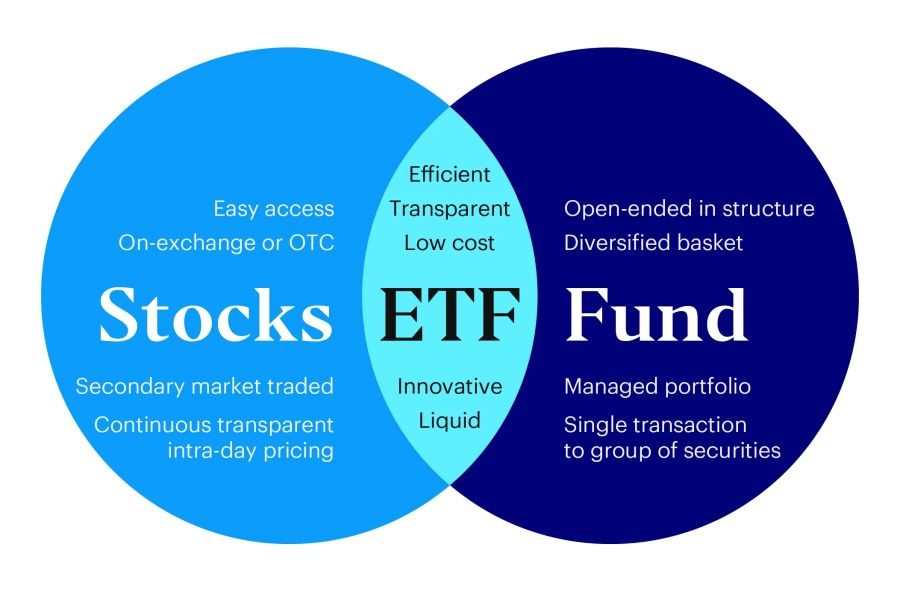

Investors often debate the best strategies to hedge against inflation. While some advocate for traditional assets like gold and real estate, others emphasize modern financial instruments such as Treasury Inflation-Protected Securities (TIPS).

Advocate View: Gold and real estate have historically maintained value during inflationary periods. In 2022, New Zealand's real estate market saw a 12% increase in property values, outpacing inflation (Source: REINZ).

Critic View: Critics argue that these assets can be volatile and illiquid. TIPS, on the other hand, offer a safer, more predictable return that adjusts with inflation rates.

Middle Ground: A balanced approach, combining both traditional assets and inflation-linked bonds, can provide stability and growth in an uncertain economic environment.

Common Myths About Inflation and Investments

- Myth: Inflation only affects cash savings. Reality: All asset classes are impacted, including equities and fixed-income investments.

- Myth: Inflation is always bad for stocks. Reality: Moderate inflation can benefit companies with pricing power, allowing them to pass costs to consumers.

- Myth: Real estate is a foolproof hedge against inflation. Reality: While generally a good hedge, real estate can suffer from overvaluation and regulatory risks.

Biggest Mistakes to Avoid

- Ignoring inflation in long-term financial planning. Solution: Regularly review and adjust your investment strategy to account for inflationary trends.

- Over-reliance on cash holdings. Solution: Diversify with assets that offer protection against inflation, such as equities and real estate.

- Underestimating the impact of rising interest rates on bond portfolios. Solution: Consider short-duration bonds or inflation-linked bonds to mitigate interest rate risks.

Future Trends: Inflation and the New Zealand Economy

Looking ahead, inflation is expected to remain a key consideration for investors. As per a Deloitte report, global supply chain adjustments and energy transitions are likely to create inflationary pressures. New Zealand, with its unique reliance on agricultural exports, may face additional challenges as global demand shifts.

By 2026, the Reserve Bank of New Zealand anticipates inflation will stabilize around its target of 2%, though external shocks could lead to deviations. Investors should remain vigilant, adjusting strategies to address both domestic and international inflationary pressures.

Final Takeaways

- Inflation can silently erode investment returns, making it crucial to incorporate inflation-protected assets in portfolios.

- diversification, including a mix of traditional and modern assets, offers the best defense against inflation.

- Staying informed about economic trends and adjusting strategies accordingly can safeguard long-term wealth.

- Challenge: Are your investments inflation-proof? Evaluate your portfolio today to ensure sustainable growth.

Conclusion

Inflation remains a complex challenge for investors, particularly in New Zealand's dynamic economic landscape. By understanding its impact and implementing strategic defenses, investors can protect their portfolios and achieve real growth. As inflationary pressures evolve, staying informed and adaptable will be key to successful investing.

What strategies do you use to hedge against inflation? Share your thoughts in the comments below!

People Also Ask

How does inflation impact investments in New Zealand? Inflation erodes purchasing power, affecting the real returns on investments. Diversifying with inflation-protected assets can mitigate this impact.

What are the best strategies for hedging against inflation? Combining traditional assets like real estate with inflation-linked bonds provides a balanced approach to hedge against inflation risks.

What upcoming changes in New Zealand could affect inflation? Policy updates and global demand shifts may create inflationary pressures, requiring investors to stay adaptive and informed.

Related Search Queries

- Inflation impact on New Zealand's economy

- Best investment strategies in inflationary times

- Inflation hedging techniques

- New Zealand inflation trends 2023

- Real estate as an inflation hedge in NZ