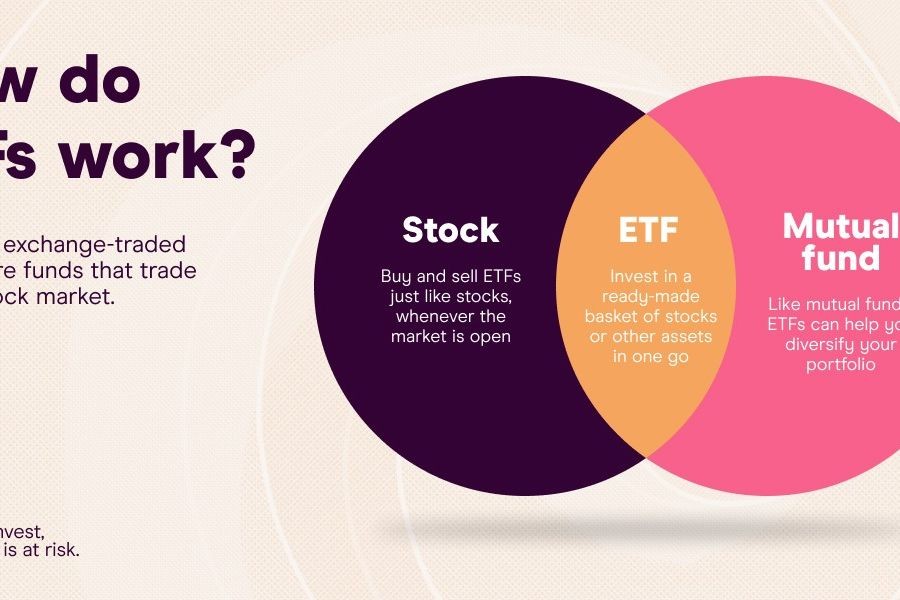

Exchange-Traded Funds (ETFs) have long been heralded as a safe, low-cost entry point for investors looking to diversify their portfolios. However, as we approach 2025, it might be time for Australian superannuation specialists and investors to reconsider this strategy. This article delves into the potential pitfalls of investing in ETFs, offering a nuanced analysis of why they might not be the golden ticket they once were.

The ETF Boom: A Double-Edged Sword

ETFs have surged in popularity over the past decade, with their assets under management ballooning globally. In Australia, the ETF market has mirrored this trend, growing from AUD 30 billion in 2020 to over AUD 130 billion by 2023, according to the Australian Securities and Investments Commission (ASIC). While this growth signifies trust and widespread adoption, it also raises questions about market saturation and diminishing returns.

Market Saturation and Diminishing Returns

The exponential growth of ETFs has led to increased competition among fund providers, often resulting in a race to the bottom in terms of fees. While lower fees are advantageous for investors, they can also lead to reduced innovation and quality in fund management. In a saturated market, the distinction between ETFs becomes blurred, potentially leading to suboptimal investment choices for those not meticulously analyzing their options.

Regulatory Challenges and Risks

As the ETF market continues to grow, regulatory bodies like the Australian Prudential Regulation Authority (APRA) have intensified their scrutiny. New regulations aimed at protecting investors might inadvertently create challenges. For instance, increased disclosure requirements could lead to higher operational costs for ETF providers, costs that might eventually be passed on to investors.

Liquidity Concerns

One often overlooked risk is liquidity. While ETFs are generally considered highly liquid, this assumption hinges on normal market conditions. During market stress, the liquidity of ETFs can evaporate, leading to significant price deviations from their underlying assets. The Reserve Bank of Australia (RBA) has highlighted these liquidity concerns, noting that in times of financial instability, ETFs could exacerbate market volatility.

Contrasting Risk vs. Reward

Investing in ETFs is not without its merits, but the risk-reward balance is shifting. With interest rates at historic lows and market volatility on the rise, the traditional safety net that ETFs once provided is under threat. An analysis by Deloitte indicates that the average return on Australian ETFs is expected to be lower in 2025 than in previous years, driven by increased market competition and economic uncertainty.

Pros and Cons of ETFs

Pros:

- Diversification: ETFs offer exposure to a wide range of sectors and asset classes.

- Cost-Effectiveness: Generally lower fees compared to mutual funds.

- Transparency: Daily disclosure of holdings provides transparency for investors.

Cons:

- Market Volatility: ETFs can amplify market fluctuations.

- Hidden Costs: Transaction costs and bid-ask spreads can erode returns.

- Complexity: The increasing complexity of ETF products can confuse less experienced investors.

Real-World Case Study: The Australian Experience

Let’s examine a real-world example to illustrate the potential pitfalls of investing in ETFs. Consider the case of an Australian superannuation fund that heavily invested in sector-specific ETFs focused on the Australian technology sector. While initially promising, the fund faced significant losses when the tech bubble burst in 2023, highlighting the risk of sector concentration within ETFs.

Problem: The fund's heavy reliance on tech ETFs exposed it to high volatility and risk.

Action: The fund managers decided to diversify their holdings by incorporating more balanced ETFs and other asset classes.

Result: By 2024, the fund had recovered 70% of its losses, demonstrating the importance of diversification beyond sector-specific ETFs.

Takeaway: This case underscores the need for strategic diversification and careful sector analysis when investing in ETFs.

Common Myths and Mistakes

There are several misconceptions about ETFs that continue to mislead investors. Let's debunk a few:

Myth: "ETFs are always low-risk."

Reality: While diversified, ETFs are subject to market risks and can experience significant volatility.

Myth: "All ETFs are created equal."

Reality: The performance and risk profile of ETFs can vary widely depending on their underlying assets.

Myth: "ETFs are the cheapest investment option."

Reality: Hidden fees and costs such as bid-ask spreads can erode the cost benefits of ETFs.

Future Trends and Predictions

Looking ahead, the landscape for ETFs in Australia is poised for change. With increasing regulatory scrutiny and evolving market dynamics, investors must adapt to new realities. According to a report by PwC, the Australian ETF market will likely see a shift towards more thematic and ESG-focused ETFs, reflecting broader global investment trends.

By 2028, it is predicted that 50% of new ETF launches in Australia will be ESG-focused, aligning with the global push towards sustainable investing. This shift presents both opportunities and challenges, as investors must carefully evaluate the long-term viability and impact of these thematic investments.

Conclusion: Rethinking the ETF Strategy

In conclusion, while ETFs have been a staple in the investment landscape, 2025 presents new challenges and considerations. Australian investors and superannuation specialists must remain vigilant, critically assessing the risks and rewards associated with ETF investments. By staying informed and adapting to market changes, investors can make more strategic choices that align with their financial goals.

What's your take on the future of ETFs in Australia? Share your insights below and join the conversation!

People Also Ask (FAQ)

How does investing in ETFs impact Australian superannuation funds?

Australian superannuation funds investing in ETFs benefit from diversification and cost-effectiveness; however, they must manage market volatility and sector-specific risks to protect long-term returns.

What are the biggest misconceptions about ETFs?

A common myth is that all ETFs are low-risk. In reality, market volatility and sector concentration can significantly impact ETF performance, demanding careful analysis from investors.

What upcoming changes in Australia could affect ETFs?

By 2026, regulatory updates focusing on transparency and ESG factors may reshape the ETF landscape, with an increased emphasis on sustainable investment options.

Related Search Queries

- Are ETFs a good investment in 2025?

- Risks of investing in ETFs in Australia

- Future of ETFs in the Australian market

- Best alternatives to ETFs in 2025

- Impact of regulatory changes on Australian ETFs

- How to diversify beyond ETFs

- ESG-focused ETFs in Australia

- Superannuation funds and ETF investments

- Sector-specific ETF risks

- Case studies of ETF investments in Australia