In New Zealand, where property prices have soared in recent years, a growing number of people are re-evaluating the traditional dream of homeownership. Instead, they are considering whether renting might be a smarter financial move. With the Reserve Bank of New Zealand reporting a significant rise in property prices, the debate between renting and buying has become more relevant than ever. This article explores why renting could be a more financially savvy option in the current New Zealand market.

Understanding New Zealand's Real Estate Landscape

New Zealand's real estate market has been characterized by rapid price increases, with Stats NZ noting a 29% increase in house prices over the past three years. This surge has made it increasingly difficult for many Kiwis to enter the property market, leading to a growing interest in renting as a viable alternative.

Pros of Renting in New Zealand

- Financial Flexibility: Renting offers more financial freedom, allowing individuals to invest their savings elsewhere, potentially yielding higher returns.

- Lower Upfront Costs: Unlike buying, renting does not require a large deposit, which can be a significant barrier to entry in New Zealand's housing market.

- Reduced Maintenance Costs: Renters are not responsible for property maintenance, which can save thousands annually.

Cons of Renting in New Zealand

- Lack of Ownership: Renting means you do not build equity in a property, which can be a disadvantage if property prices continue to rise.

- Rental Increases: Renters may face periodic increases, potentially making renting more expensive over time.

- Limited Personalization: Renters may have restrictions on how they can modify their living space.

Case Study: Auckland's Rental Market

In Auckland, a city notorious for its high property prices, renting has become an increasingly attractive option. According to a report by the Ministry of Business, Innovation and Employment (MBIE), Auckland's rental prices, while high, still offer a more affordable monthly expenditure compared to the costs associated with buying a home in the city. This is particularly true for young professionals who prioritize mobility and financial flexibility.

Data-Driven Insights: Renting vs. Buying

According to the Reserve Bank of New Zealand, the average mortgage rate in New Zealand is currently around 4.5%. For a median-priced home in Auckland, this translates to a monthly mortgage payment significantly higher than the average rent. Furthermore, a study by the University of Auckland found that investing the difference in the stock market could lead to higher returns over a 10-year period.

Myth Busting: Common Misconceptions About Renting

- Myth: "Renting is throwing money away." Reality: Renting offers flexibility and the opportunity to invest savings elsewhere, potentially yielding higher returns.

- Myth: "Buying is always a better investment." Reality: With NZ housing prices at an all-time high, the financial burden of owning can outweigh potential gains.

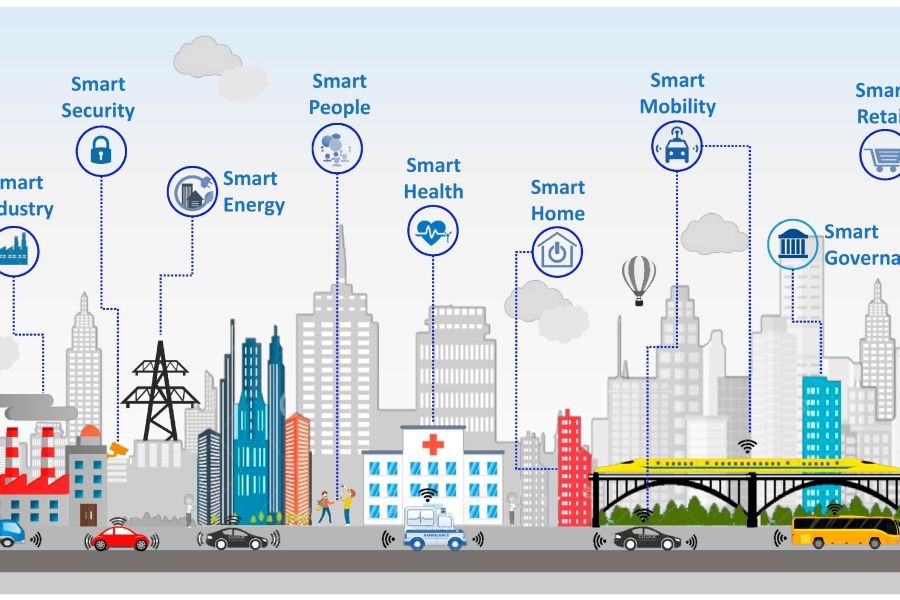

Industry Insight: Emerging Trends

As technology continues to advance, new trends are emerging in the rental market. For instance, co-living spaces are gaining popularity in urban areas like Wellington and Auckland, providing affordable and flexible housing solutions for young professionals. According to NZTech, the demand for these spaces is expected to grow by 20% over the next five years.

Future Predictions

Looking ahead, the real estate market in New Zealand is expected to experience further changes. With government initiatives aimed at increasing housing supply, property prices may stabilize, making renting an even more attractive option. Additionally, advancements in technology are likely to make renting more convenient and cost-effective.

Conclusion: Final Takeaways

- Renting offers financial flexibility and lower upfront costs compared to buying a home in New Zealand.

- The current economic landscape and high property prices make renting a viable alternative for many Kiwis.

- Investing savings from renting into other ventures could potentially yield higher returns.

Whether you choose to rent or buy, it's essential to consider your financial goals and lifestyle needs. What's your take on this debate? Share your insights below!

People Also Ask

- How does renting impact the New Zealand economy? Renting provides financial flexibility, allowing residents to allocate funds to other investments, which can stimulate economic growth.

- What are the biggest misconceptions about renting in New Zealand? A common myth is that renting is money wasted. However, with current market conditions, renting can be a strategic financial decision.

- What are the best strategies for investing savings from renting? Experts recommend diversifying investments into stocks, bonds, and other assets to maximize returns.

Related Search Queries

- Is renting better than buying in New Zealand?

- Benefits of renting a house in NZ

- Property market trends in New Zealand 2025

- Financial advantages of renting over buying

- Co-living spaces in Auckland