In the intricate world of finance, the role of a financial advisor is often perceived as essential. With their expertise, advisors guide clients through investment decisions, retirement planning, and wealth management. However, recent trends and regulatory insights suggest that your financial advisor might not always have your best interests at heart. This article delves into the reasons why, with a focus on the Australian context, industry trends, and regulatory frameworks.

The Australian Financial Advising Landscape

The financial advising sector in Australia is a significant component of the broader financial services industry. According to the Australian Securities and Investments Commission (ASIC), there were over 20,000 financial advisors registered in Australia as of 2023. Despite this, there have been ongoing concerns about the integrity and transparency of financial advice provided to clients.

How It Works: A Deep Dive

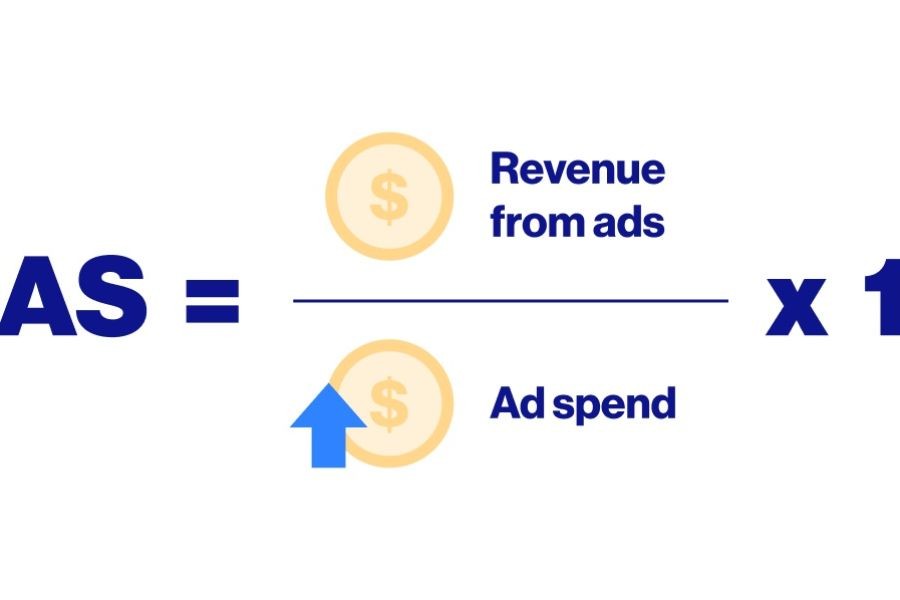

Financial advisors are typically compensated through a combination of fees and commissions. These commissions can create conflicts of interest, as advisors might promote products that offer higher commissions rather than those that are in the best interest of the client. Additionally, the complexity of financial products often means that clients are heavily reliant on their advisors' guidance, which can be influenced by these financial incentives.

Pros & Cons Evaluation

✅ Pros:

- Expert Guidance: Financial advisors possess specialized knowledge that can help clients navigate complex financial landscapes.

- Time-Saving: By delegating financial planning to an advisor, clients save time and can focus on other priorities.

- Personalized Strategies: Advisors can tailor investment strategies to align with individual financial goals and risk tolerance.

❌ Cons:

- Conflict of Interest: Commission-based compensation can lead to biased advice.

- Lack of Transparency: Some clients find it difficult to fully understand the fees and commissions involved.

- Variable Quality: The quality of advice can vary significantly between advisors.

Regulatory Insights: Protecting Australian Consumers

The Australian Competition & Consumer Commission (ACCC) and ASIC have implemented several measures aimed at enhancing transparency and accountability within the financial advising industry. For instance, the introduction of the Financial Planners Register allows consumers to verify the credentials and history of financial advisors, adding a layer of protection.

Case Study: Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry

The Royal Commission, which concluded in 2019, identified widespread misconduct in the financial services industry, including issues related to financial advice. This led to significant reforms, including the banning of conflicted remuneration structures and the introduction of stricter compliance requirements. These changes were designed to align the interests of financial advisors with those of their clients.

Common Myths & Mistakes

Myth vs. Reality

- Myth: Financial advisors always act in your best interest. Reality: Financial incentives can influence advice, leading to potential conflicts of interest.

- Myth: Higher fees mean better service. Reality: There is no direct correlation between fees and the quality of advice.

- Myth: All financial advisors are equally qualified. Reality: The level of expertise and experience can vary significantly.

Biggest Mistakes to Avoid

- Failing to verify the credentials of a financial advisor. Solution: Use the Financial Planners Register to check qualifications and history.

- Not understanding fee structures. Solution: Request a detailed breakdown of all fees and commissions before engaging an advisor.

- Ignoring conflicts of interest. Solution: Ask about how the advisor is compensated and whether they receive commissions from third parties.

The Future of Financial Advising in Australia

The financial advising industry is poised for transformation, driven by technological advancements and regulatory changes. By 2030, it's projected that digital financial advising platforms will capture a significant market share, offering more transparent and cost-effective solutions to consumers. Additionally, ongoing regulatory reforms are expected to further enhance consumer protection and align advisor incentives with client outcomes.

Final Takeaways & Call to Action

- Understand the compensation model of your financial advisor to identify potential conflicts of interest.

- Utilize regulatory tools like the Financial Planners Register to verify advisor credentials.

- Stay informed about industry trends and regulatory changes to make informed decisions.

Are you considering hiring a financial advisor? What steps will you take to ensure they have your best interests at heart? Share your thoughts and experiences below!

Frequently Asked Questions (FAQ)

How does the financial advising landscape impact Australians? Australian consumers benefit from increased transparency and protection due to regulatory reforms, ensuring advisors act in clients' best interests.

What are common misconceptions about financial advisors? A prevalent myth is that all advisors are equally qualified, but expertise and experience vary widely across the industry.

What should clients do to protect themselves? Clients should verify advisor credentials, understand fee structures, and be aware of potential conflicts of interest.

Related Search Queries

- Financial advisor fees Australia 2025

- How to choose a financial advisor in Australia

- Financial advisor vs. financial planner

- Australian financial advisor regulations

- Impact of technology on financial advising

darrinmcclanah

1 month ago