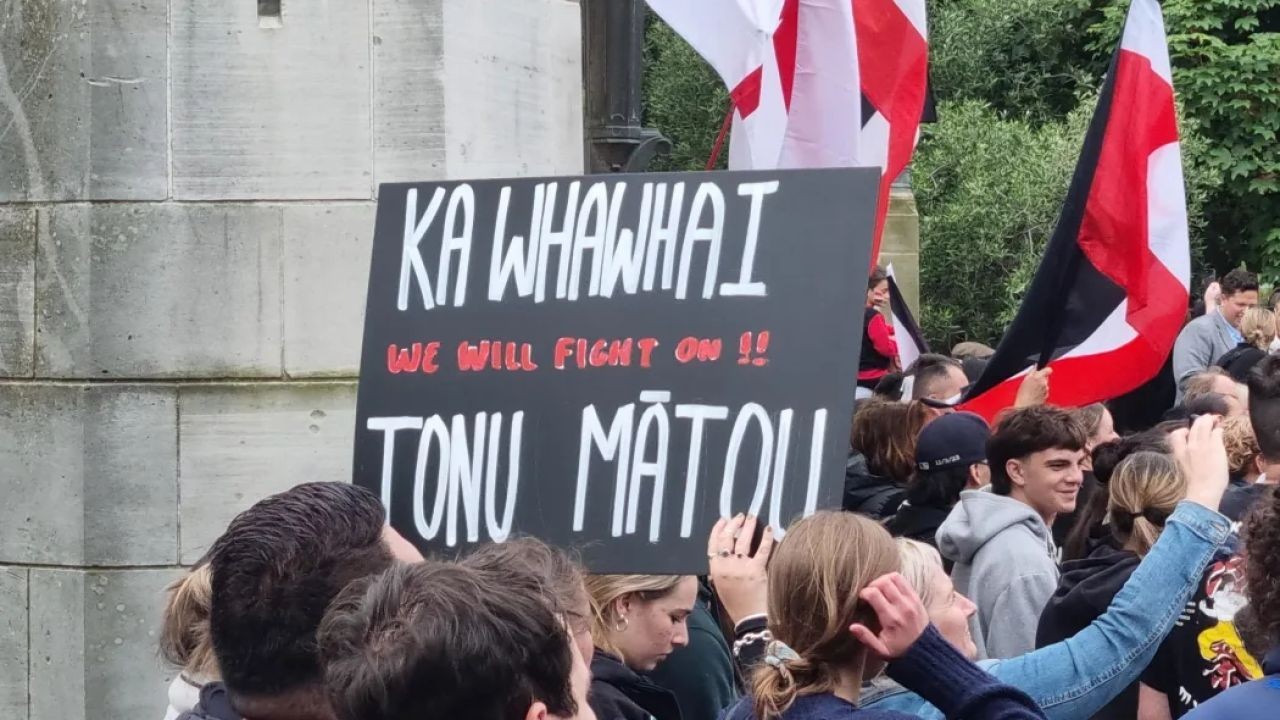

In the serene landscapes of New Zealand, a storm is brewing within its housing market. For years, the country’s real estate sector has experienced unprecedented growth, leaving many to wonder: Is this a sustainable trend, or are we on the brink of a housing bubble burst? This question resonates deeply with economic strategists, investors, and homeowners who are trying to navigate the uncertainties of the current market dynamics.

The Dynamics of New Zealand's Housing Market

New Zealand’s housing market has been a topic of intense debate among economists and policymakers. According to Stats NZ, the median house price in New Zealand reached a staggering $925,000 in 2023, a 25% increase from just two years prior. This surge has been fueled by low interest rates, limited housing supply, and an influx of international buyers.

However, the Reserve Bank of New Zealand (RBNZ) has raised concerns about the sustainability of this growth. Rising household debt levels, primarily driven by mortgages, have reached alarming heights, increasing the risk of financial instability should the market correct itself. The bank has already implemented loan-to-value ratio (LVR) restrictions to temper the market, but questions remain about their effectiveness in the long term.

Is New Zealand's Housing Market a Bubble?

The term "bubble" is often used to describe a market that experiences unsustainable growth, followed by a sudden crash. In New Zealand's case, several factors resemble those of past housing bubbles globally, such as the U.S. market crash in 2008. High property valuations, speculative buying, and relaxed lending standards are all present to some degree.

However, there are contrasting opinions. Experts like Dr. Michael Reddell, an independent economist, argue that while prices are high, the market is supported by strong demand and limited supply, especially in urban areas like Auckland and Wellington. He suggests that government intervention in increasing housing supply could stabilize prices and reduce the risk of a bubble burst.

Case Study: The Auckland Housing Boom

Problem: In 2022, Auckland's housing market was in a frenzy, with properties often selling above asking prices. This was driven by a combination of low interest rates and high demand.

Action: To address the rapid price escalation, the New Zealand government introduced new measures, including tax changes for property investors and incentives for first-time homebuyers.

Result: By mid-2023, data from Barfoot & Thompson showed a stabilization in Auckland's house prices, with a modest 5% year-on-year increase, compared to 15% in the previous year.

Takeaway: This case study underscores the importance of regulatory interventions in moderating housing markets and preventing speculative bubbles.

Pros and Cons of New Zealand's Current Housing Market

Pros:

- Investment Opportunity: New Zealand's housing market remains attractive to investors seeking capital appreciation.

- Low Interest Rates: Make mortgages more affordable for first-time buyers.

- Strong Demand: Driven by population growth and urbanization.

Cons:

- Affordability Issues: High prices make homeownership unattainable for many Kiwis.

- Rising Debt Levels: Increasing household debt poses a risk to economic stability.

- Potential Market Correction: A sudden drop in prices could lead to negative equity for homeowners.

Common Myths and Misconceptions

Myth: "The housing market will continue to grow indefinitely."

Reality: History has shown that markets are cyclical, and corrections are a natural part of the process.

Myth: "High property prices are solely due to foreign buyers."

Reality: While international investment plays a role, domestic factors like supply constraints and low interest rates are significant contributors.

Myth: "Buying property is always a safe investment."

Reality: Property investments come with risks, including market volatility and potential value depreciation.

Future Trends and Predictions

Looking ahead, the New Zealand housing market may face several challenges. According to a report by Deloitte, a potential interest rate hike could dampen demand and lead to a gradual price correction. Additionally, government policies aimed at increasing housing supply, such as the Urban Development Act, could help alleviate pressure on prices.

Moreover, technological advancements in construction, like prefabricated homes, could reduce building costs and increase affordability. By 2028, it is predicted that these innovations might become mainstream, reshaping the housing landscape in New Zealand.

Conclusion

While the New Zealand housing market currently showcases signs of a bubble, several factors could mitigate a potential burst. Understanding these dynamics is crucial for investors, policymakers, and homeowners who must navigate this complex environment. By staying informed and adapting to market changes, they can make strategic decisions that align with their long-term goals.

What’s your take on the future of New Zealand’s housing market? Share your insights in the comments below!

People Also Ask

How does the housing market impact New Zealand's economy?

The housing market significantly influences New Zealand's economy by affecting consumer spending, investment levels, and financial stability. High property prices can lead to increased household debt, impacting economic growth.

What are the biggest misconceptions about New Zealand's housing market?

A common myth is that foreign buyers are the primary drivers of high property prices. However, local factors like supply constraints and low interest rates play a more substantial role.

What are the best strategies for investing in New Zealand's housing market?

Experts recommend focusing on areas with strong population growth and infrastructure development. Diversifying investments and staying informed about regulatory changes are also crucial for success.

Related Search Queries

- New Zealand housing market trends 2023

- Is the NZ housing market a bubble?

- Future of New Zealand real estate

- Impact of interest rates on NZ housing

- Strategies for investing in NZ property

- New Zealand property market forecast

- Government policies on NZ housing

- Urban development in New Zealand

- Housing affordability in New Zealand

- Foreign investment in NZ real estate