In recent years, Australia's property market has seen unprecedented growth, turning real estate into a lucrative investment for many. But as we edge closer to 2030, questions arise about the sustainability of this boom. Will Australia's property market continue to surge, or are we nearing the end of this prosperous era? This article delves into expert opinions, data-backed insights, and the economic factors influencing Australia's real estate trajectory.

Understanding Australia’s Property Boom

Since the early 2000s, Australia has experienced a significant property boom driven by factors such as population growth, urbanization, and foreign investment. According to the Australian Bureau of Statistics (ABS), house prices in major cities like Sydney and Melbourne have more than doubled in the past decade. The Reserve Bank of Australia (RBA) notes that low interest rates have further fueled this growth, making borrowing more attractive and accessible.

Key Drivers of the Boom

- Low Interest Rates: The RBA's monetary policy has kept interest rates at historic lows, encouraging homebuyers and investors to enter the market.

- Population Growth: Australia’s population has been growing steadily, increasing demand for housing, particularly in urban centers.

- Foreign Investment: Australia remains a popular destination for international investors, particularly from China, due to its stable economy and strong property rights.

- Government Incentives: Schemes like the First Home Owner Grant have made it easier for Australians to purchase homes.

Is a Market Correction Inevitable?

Despite the boom, some experts warn of a potential market correction. CoreLogic data indicates a cooling in the market, with a slight decline in auction clearance rates and slower price growth in recent months. Dr. Shane Oliver, Head of Investment Strategy and Economics at AMP Capital, suggests that while a crash is unlikely, a plateau or mild correction could occur due to affordability issues and potential interest rate hikes.

Factors That Could Trigger a Correction

- Increasing Interest Rates: As the economy recovers, the RBA may raise interest rates, increasing mortgage costs and cooling demand.

- Affordability Crisis: The gap between wage growth and property prices has widened, making homeownership less attainable for many Australians.

- Regulatory Changes: Potential tightening of regulations by the Australian Prudential Regulation Authority (APRA) could impact lending practices and investor activity.

Case Study: Sydney’s Property Market

Let's examine Sydney, a city that epitomizes Australia's property boom. In 2021, Sydney's property prices surged by 25% (CoreLogic), largely driven by demand and limited supply. However, the city is now experiencing a stabilization phase.

Problem: With soaring prices, affordability has become a significant concern, leading to a decrease in first-time homebuyers.

Action: The New South Wales government introduced measures such as stamp duty concessions to assist first-time buyers and increase market accessibility.

Result: These measures have helped stabilize the market, with a moderate increase in first-home purchases and a slight cooling in price growth.

Takeaway: Policy interventions can mitigate the effects of rapid price increases, creating a more sustainable market environment.

Expert Predictions for 2030

Looking ahead, experts are divided on whether the property boom will continue. While some predict sustained growth due to ongoing demand and limited supply, others foresee a market correction. According to the RBA, a gradual increase in interest rates and tighter lending standards could temper market exuberance by 2030.

Future Trends:

- urban development and infrastructure projects will continue to drive demand in major cities.

- Regional areas may see increased interest as remote work trends persist.

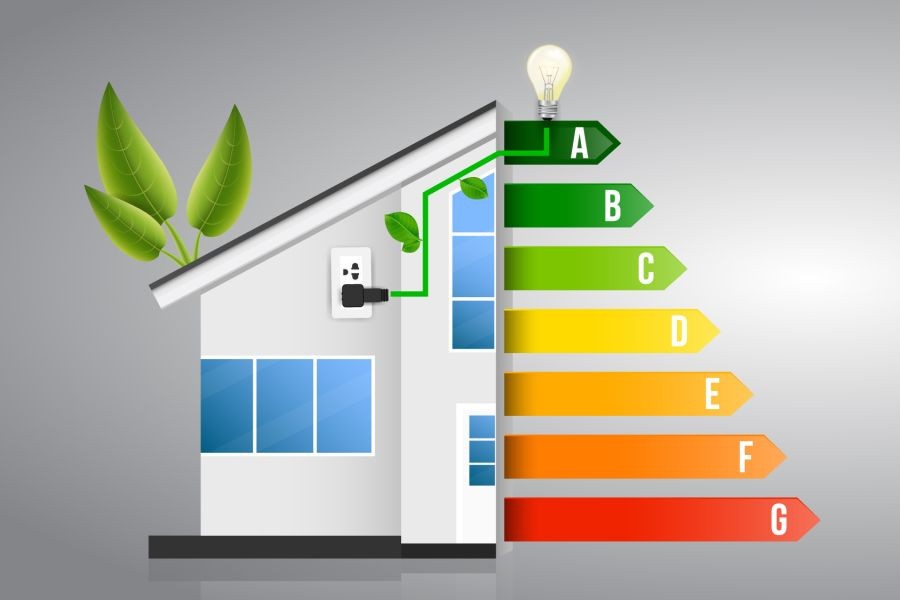

- Environmental and sustainability considerations will become more prominent in property development.

Myths and Misconceptions

Several myths surround Australia's property market. Let's debunk some of them:

- Myth: The property market will always go up.

- Reality: While historical data shows long-term growth, markets are cyclical and can experience downturns.

- Myth: Foreign buyers dominate the market.

- Reality: While foreign investment is significant, it constitutes only a portion of the overall market, according to the Foreign Investment Review Board.

Conclusion

The future of Australia's property market is shrouded in uncertainty, with potential for both continued growth and market correction. As we approach 2030, investors, policymakers, and homeowners must remain vigilant and adaptable to changing conditions. Understanding the factors driving the market, as well as potential risks, will be crucial for making informed decisions.

Final Takeaway: Australia's property market offers opportunities and challenges. Staying informed and prepared for potential shifts will be key to navigating the landscape successfully.

People Also Ask (FAQ)

- Will property prices keep rising in Australia?

Experts predict moderate growth, but factors like interest rate hikes and regulatory changes could slow the pace.

- What are the signs of a market correction?

Indicators include declining auction clearance rates, reduced buyer demand, and potential interest rate increases.

- How can investors prepare for a market shift?

Diversifying investments, staying informed about market trends, and considering long-term strategies are recommended.

Related Search Queries

- Australia property market forecast 2030

- Impact of interest rates on Australian housing

- Sydney property market trends

- Foreign investment in Australian real estate

- Real estate market correction predictions

JaniZ89355

9 months ago