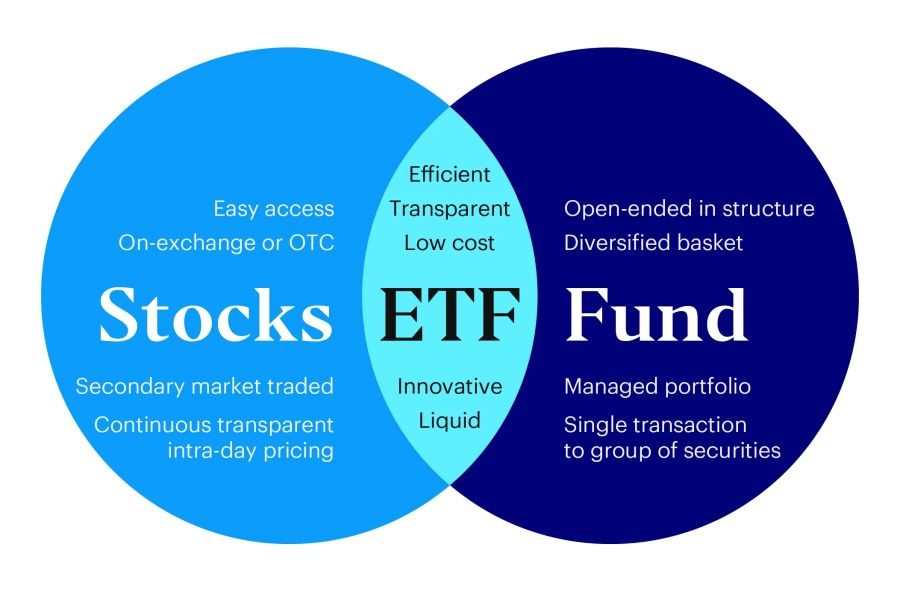

Exchange-Traded Funds (ETFs) have increasingly become a staple in the portfolios of Australian investors, offering a flexible and cost-effective alternative to traditional investment vehicles. With the dynamic nature of financial markets, particularly in Australia, understanding the unique advantages of ETFs can empower investors to make informed decisions. This article delves into why ETFs are revolutionizing the investment landscape in Australia, supported by data-driven insights and expert analyses.

The Rise of ETFs in Australia

As of 2023, the Australian ETF market has witnessed a remarkable growth trajectory, with assets under management surpassing AUD 150 billion, according to data from the Australian Securities and Investments Commission (ASIC). This surge reflects a growing investor preference for diversified exposure with minimal management fees. ETFs offer a broad spectrum of investment opportunities, from sectors like technology and healthcare to comprehensive indexes, allowing investors to tailor their portfolios to specific financial goals.

1. Cost-Efficiency and Accessibility

One of the primary reasons ETFs have gained traction in Australia is their cost-effectiveness. Unlike mutual funds, which often carry high management fees, ETFs typically have lower expense ratios. This affordability makes them accessible to a broader range of investors, including those entering the market for the first time. The Australian Securities Exchange (ASX) emphasizes that the average management fee for ETFs is under 0.5%, significantly lower than traditional managed funds.

2. Diversification with Ease

ETFs provide instant diversification across various asset classes and sectors. For instance, investors can gain exposure to the entire Australian stock market through a single ETF, such as the ASX 200 ETF, which mirrors the performance of the top 200 companies listed on the ASX. This diversification mitigates the risk associated with investing in individual stocks, offering a balanced approach to risk management.

3. Liquidity and Flexibility

ETFs are traded on the stock exchange, similar to individual stocks, granting investors the flexibility to buy and sell throughout the trading day. This liquidity is crucial for investors looking to capitalize on market movements or quickly adjust their portfolios in response to economic changes. The Reserve Bank of Australia (RBA) highlights that liquidity and ease of trading make ETFs an attractive option for both short-term traders and long-term investors.

Real-World Case Study: Success with ETFs

In 2022, an Australian investment firm, BetaShares, launched a thematic ETF focused on global cybersecurity companies. This ETF quickly gained popularity, attracting AUD 500 million within its first year. The success was driven by rising global cybersecurity concerns and the increasing adoption of digital solutions in Australia. BetaShares' strategic focus on a high-growth sector demonstrates the potential for thematic ETFs to deliver strong returns.

4. Transparency and Ease of Management

ETFs offer transparency, with holdings disclosed daily, allowing investors to know exactly what they own. This transparency is particularly appealing to investors in Australia, where regulatory scrutiny from bodies like the Australian Competition and Consumer Commission (ACCC) is stringent. Additionally, ETFs are passively managed, meaning they track an index rather than relying on a fund manager's active decisions, reducing the risk of human error.

5. Tax Efficiency

In Australia, ETFs are often more tax-efficient than mutual funds. This efficiency is due to their structure, which typically results in fewer taxable events. The Australian Taxation Office (ATO) notes that ETFs can provide tax advantages, especially for long-term investors, by minimizing capital gains distributions.

Pros and Cons of Investing in ETFs

Pros:

- Cost-Effective: Lower management fees compared to traditional funds.

- Diversification: Access to a wide range of asset classes through a single investment.

- Liquidity: Easy to trade on the stock exchange, providing flexibility.

- Transparency: Daily disclosure of holdings ensures clarity.

- Tax Efficiency: Potential for fewer taxable events, benefiting long-term investors.

Cons:

- Market Volatility: ETFs can be subject to market fluctuations.

- Limited Active Management: Lack of active decision-making may not suit all investors.

- Complexity: Understanding different types of ETFs can be challenging for beginners.

- Liquidity Mismatch: Some niche ETFs may face liquidity issues.

Common Myths about ETFs

Myth: ETFs are only for experienced investors. Reality: ETFs are accessible to all levels of investors, offering a simple way to diversify.

Myth: All ETFs have the same risk. Reality: Risks vary significantly depending on the ETF's underlying assets and investment strategy.

Myth: ETFs are tax-inefficient. Reality: ETFs often provide tax advantages due to their structure and low turnover.

Conclusion

ETFs have undeniably transformed the investment landscape in Australia, offering a versatile and efficient way to diversify portfolios while minimizing costs. As the market continues to evolve, understanding the nuances and potential of ETFs will be crucial for investors aiming to optimize their strategies. Whether you're a seasoned investor or just starting, leveraging the advantages of ETFs could be a game-changer for your investment portfolio.

People Also Ask

- How do ETFs benefit Australian investors?ETFs offer diversified exposure, cost-efficiency, and tax benefits, making them attractive for Australian investors seeking flexible investment options.

- What are the risks of investing in ETFs?While offering diversification, ETFs are subject to market volatility and liquidity risks, depending on their focus and management style.

- How do I start investing in ETFs in Australia?Begin by researching different ETFs on the ASX, considering your investment goals, and consulting with a financial advisor to tailor your portfolio.

Related Search Queries

- What are ETFs and how do they work?

- Best ETFs to invest in Australia 2023

- Tax efficiency of ETFs in Australia

- ETFs vs mutual funds in Australia

- How to buy ETFs on ASX

susieodh7288

5 months ago