In recent years, New Zealand’s housing market has become an intriguing intersection of local dynamics and global influences. As international buyers eye the picturesque landscapes and stable economy of New Zealand, Kiwis are left to ponder the impact on property values, availability, and the broader economic landscape. This article delves into the multifaceted ways global buyers shape the housing market in New Zealand, offering comprehensive insights backed by data and expert analysis.

The Global Influence on New Zealand's Housing Market: A Case Study

To illustrate the impact of global buyers on New Zealand's housing market, consider the case of Auckland, the country's largest city. Auckland has long been a hotspot for international investors, particularly from China and the United States. A report by Stats NZ highlighted that non-resident buyers accounted for approximately 3% of all property transfers in 2019. While this might seem modest, the concentration of these purchases in high-demand areas like Auckland has had a pronounced effect on property values.

Problem: Local buyers face increased competition and rising prices, making homeownership elusive for many. According to the Reserve Bank of New Zealand, house prices in Auckland rose by 27% between 2020 and 2024, partly due to international investments.

Action: In response, the New Zealand government introduced measures such as the Overseas Investment Amendment Act 2018, which restricts foreign buyers from purchasing existing homes, aiming to curb the influence of international investments on property prices.

Result: While the legislation has helped stabilize the market to some extent, experts argue that the demand from global buyers still affects the overall housing landscape, particularly in terms of new developments targeting international investors.

Takeaway: The case of Auckland underscores the need for balanced regulatory measures that protect local buyers while accommodating beneficial foreign investments. This balance is crucial as New Zealand positions itself in the global real estate market.

Understanding the Mechanisms: How Global Buyers Impact the Market

The influence of global buyers on New Zealand's housing market operates through several mechanisms:

- Increased Demand: Global buyers add to the demand, especially in high-value areas, driving up prices. This demand often outpaces local supply, exacerbating the affordability crisis for domestic buyers.

- Market Perception: The presence of international investors can inflate market perceptions, leading to speculative buying and selling, further driving up prices.

- Development Trends: Developers may focus on luxury projects targeting international investors, potentially neglecting affordable housing solutions for locals.

These factors create a complex interplay that challenges policymakers and stakeholders to find solutions that balance local needs with global economic benefits.

Data-Driven Insights: The New Zealand Context

Statistics from the Ministry of Business, Innovation, and Employment (MBIE) reveal that the construction sector in New Zealand has seen a 15% growth in new residential building consents since 2020. This surge is linked to both domestic demand and the attraction of foreign capital. However, the affordability index indicates a growing gap between average wages and property prices, highlighting the challenges faced by local buyers.

In a recent study by the Reserve Bank of New Zealand, it was noted that international buyers are often attracted to New Zealand's stable political environment and robust legal system. This makes the country an appealing destination for investment, despite the government's efforts to regulate foreign ownership.

Pros vs. Cons of Global Influence on the Housing Market

Pros:

- Economic Growth: Foreign investments contribute to economic growth, supporting jobs in construction and real estate.

- Infrastructure Development: Increased demand leads to better infrastructure as cities expand to accommodate new housing developments.

- Global Connectivity: New Zealand's integration into global markets fosters international relationships and economic partnerships.

Cons:

- Affordability Crisis: Rising property prices outpace wage growth, making it difficult for average Kiwis to afford homes.

- Market Volatility: Dependence on international buyers can lead to market instability if global economic conditions change.

- Community Impact: The focus on high-value developments can alter the social fabric of communities, affecting local culture and cohesion.

Common Myths About Global Buyers in New Zealand's Housing Market

Myth: "Foreign buyers dominate the New Zealand housing market." Reality: While international buyers have a significant impact, they represent a small percentage of total transactions. The focus is often on high-value properties, which can skew perceptions.

Myth: "Restricting foreign buyers will solve the housing crisis." Reality: While restrictions can help stabilize prices, comprehensive solutions must address issues like supply constraints and wage stagnation.

Future Trends: Where Is the Market Heading?

Looking ahead, the New Zealand housing market is poised for further evolution. By 2028, experts from NZ Property Investors’ Federation predict a shift towards more sustainable and community-focused developments. This is driven by both domestic demand for affordable housing and international interest in eco-friendly living solutions.

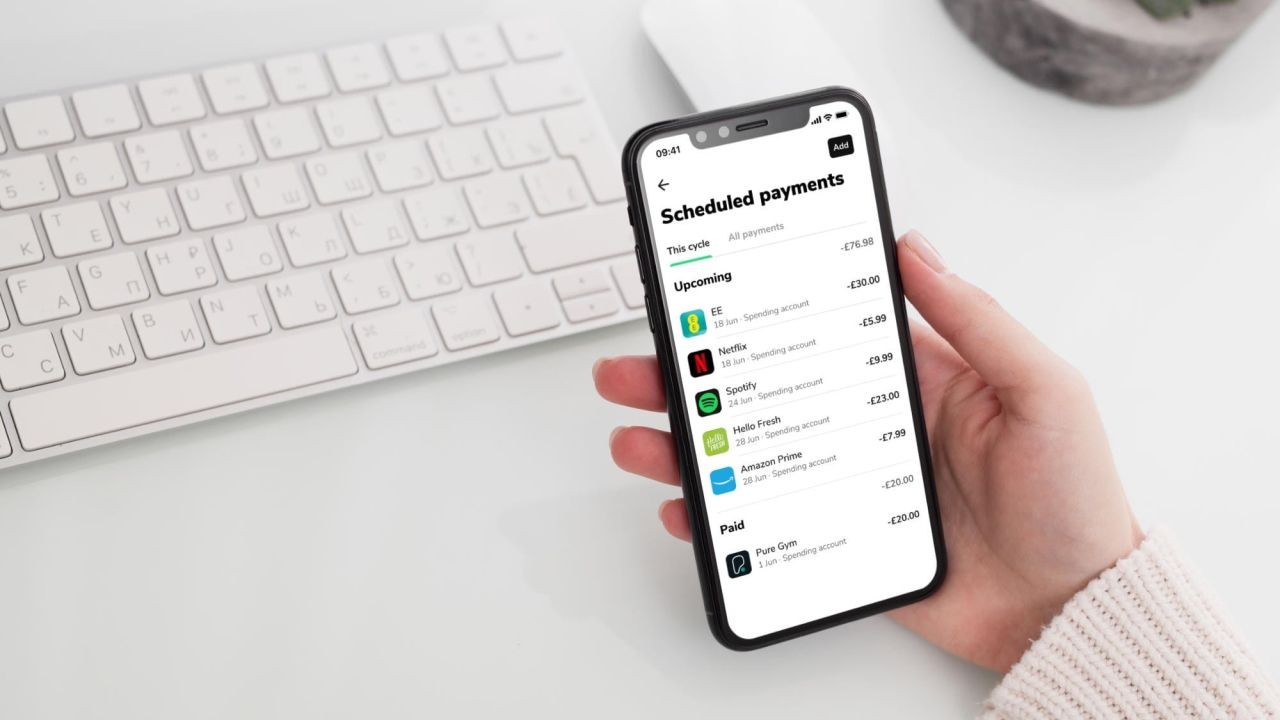

Moreover, technological advancements in real estate transactions, such as blockchain for secure property transfers, are expected to increase efficiency and transparency, attracting more global investors who prioritize secure and transparent dealings.

Final Takeaways & Call to Action

- Stay Informed: Understanding the dynamics of global influence is crucial for both buyers and policymakers.

- Advocate for Balance: Support policies that protect local buyers while fostering beneficial foreign investments.

- Adapt to Trends: Embrace technological advancements in real estate to stay competitive and secure.

As New Zealand navigates the complexities of a globalized real estate market, staying informed and adaptable will be key to ensuring sustainable growth and housing affordability. What’s your take on the impact of global buyers in New Zealand's housing market? Join the conversation and share your insights!

People Also Ask

- How do global buyers impact New Zealand's housing market? Global buyers increase demand, drive up prices, and influence development trends, affecting affordability and local housing dynamics.

- What are the biggest misconceptions about foreign investment in NZ real estate? A common myth is that foreign buyers dominate the market, but they actually represent a small percentage of transactions.

- What strategies can New Zealand implement to balance foreign investment? Policies that regulate foreign ownership, support local buyers, and encourage sustainable development can create a balanced market.

- How could future trends affect New Zealand's housing market? By 2028, sustainable developments and technological advancements like blockchain could reshape the market landscape.

Related Search Queries

- New Zealand housing market trends 2024

- Impact of foreign buyers on NZ real estate

- New Zealand property investment opportunities

- How to buy property in New Zealand as a foreigner

- NZ housing affordability crisis

Jewish Dating NYC

1 month ago