In the ever-evolving landscape of New Zealand's property market, sustainability advocates are increasingly seeking ways to maximize their return on investment while ensuring eco-friendly practices. The push towards a more sustainable future, coupled with the complexities of New Zealand’s unique property landscape, presents both opportunities and challenges for investors. This article delves into strategic approaches and actionable insights to help you navigate this dynamic environment, focusing on sustainable investment practices that align with New Zealand's economic and environmental goals.

The Significance of Sustainable Investments in New Zealand

New Zealand's commitment to sustainability is evident in its policies and societal values. With the government aiming for a net-zero carbon economy by 2050, as outlined by the Ministry for the Environment, sustainable investments are not just ethical but increasingly financially prudent. The property market, being a significant contributor to carbon emissions, is under scrutiny to adopt greener practices. As a sustainability advocate, aligning your investments with these objectives not only supports environmental goals but also taps into the growing market demand for sustainable properties.

Understanding New Zealand’s property market Dynamics

The New Zealand property market is characterized by its distinct regional variations and regulatory landscape. Recent data from Stats NZ indicates a significant rise in property prices, with a 27% increase over the past year. This surge is driven by limited housing supply and increased demand in urban areas like Auckland and Wellington. However, this growth presents challenges for investors seeking affordable entry points while maintaining sustainability commitments.

Case Study: The Green Building Council’s Impact on Property Investments

Problem: The New Zealand Green Building Council (NZGBC) identified that traditional buildings contributed significantly to the nation’s carbon footprint, leading to increased scrutiny and demand for sustainable building practices.

- The NZGBC faced the challenge of encouraging developers to adopt green building standards amid concerns about upfront costs.

- Research showed that buildings meeting green standards could potentially command higher market value and rental returns.

Action: The NZGBC implemented the Homestar rating system, incentivizing developers with benefits such as reduced compliance costs and increased marketability.

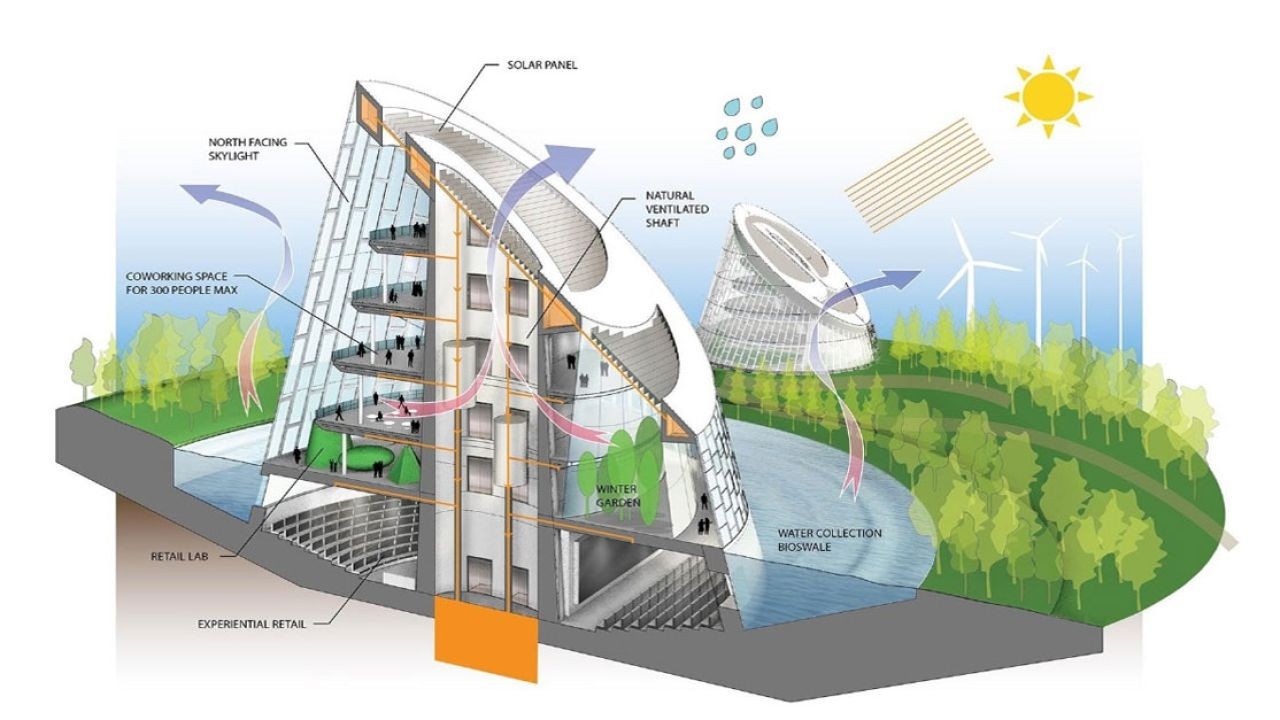

- Developers were encouraged to use eco-friendly materials and designs that reduce energy consumption and emissions.

- The system was coupled with educational programs to highlight the long-term financial benefits of green buildings.

Result: Properties with Homestar ratings saw a significant appreciation in value and attracted tenants at premium rates.

- Average property values increased by 15%, according to an NZGBC report.

- Rental yields for green-rated buildings were higher compared to traditional properties.

Takeaway: This case study underscores the value of investing in sustainable properties, which aligns with both environmental goals and financial returns. It highlights the growing trend among New Zealand investors to prioritize eco-friendly developments.

Data-Driven Insights: The Financial Benefits of Sustainable Properties

Investing in sustainable properties offers tangible financial benefits. According to the Reserve Bank of New Zealand, properties with green certifications experience lower vacancy rates and higher tenant retention. Moreover, a report by MBIE suggests that energy-efficient homes can reduce operational costs by up to 30%, providing significant savings over time.

Pros and Cons of Sustainable Investments

✅ Pros:

- Higher ROI: Sustainable properties often yield higher returns due to increased demand and reduced operational costs.

- Regulatory Support: Favorable government policies and incentives for green buildings.

- Market Demand: Growing consumer preference for eco-friendly living spaces.

- Long-Term Viability: Future-proof investments in line with global and national environmental goals.

❌ Cons:

- Initial Costs: Higher upfront investment for sustainable materials and technologies.

- Regulatory Challenges: Navigating compliance with evolving sustainability standards.

- Market Maturity: Limited availability of green properties in certain regions.

- Knowledge Gap: Need for expertise in sustainable construction and management practices.

Strategic Approaches for Maximizing ROI in Sustainable Properties

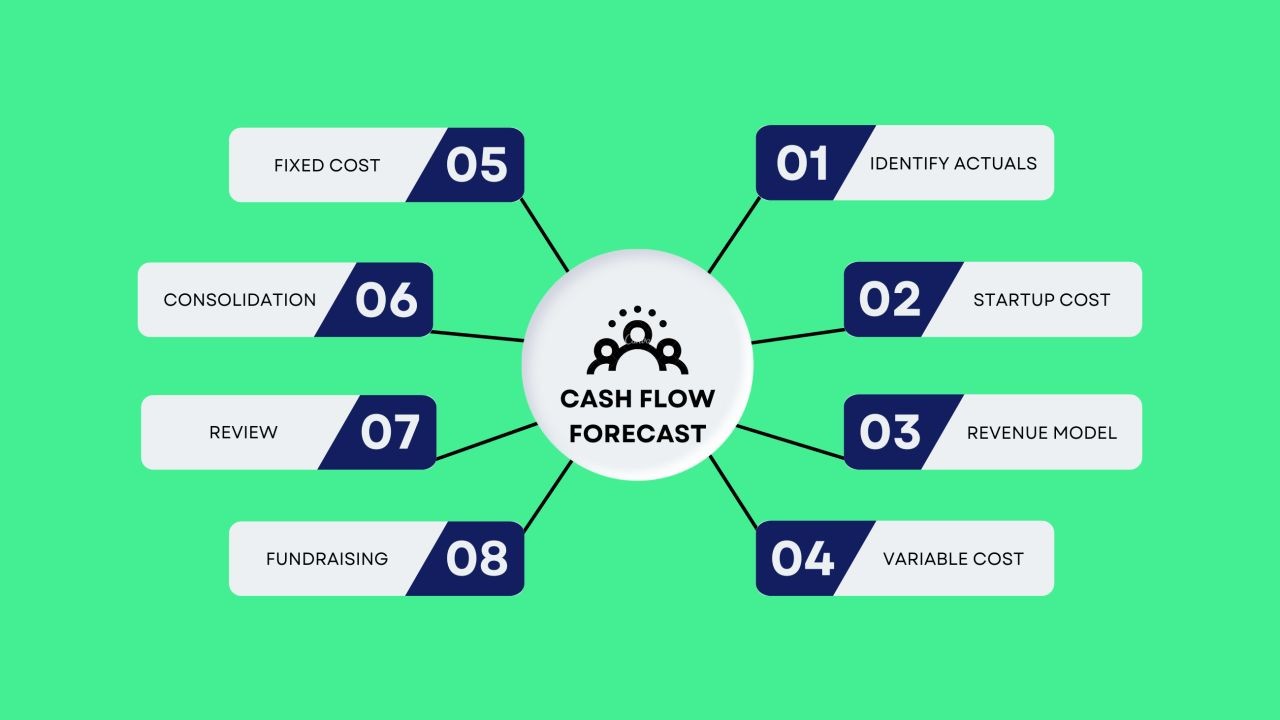

To maximize ROI in New Zealand’s property market, investors should consider the following strategies:

1. Leverage Government Incentives

The New Zealand government offers various incentives for sustainable property investments, such as tax breaks and grants for energy-efficient renovations. Engaging with programs like the Energy Efficiency and Conservation Authority (EECA) can provide financial support and expert guidance on implementing sustainable practices.

2. Focus on Location and Infrastructure

Invest in regions with robust infrastructure and growth potential. Areas well-serviced by public transport and amenities are more attractive to tenants and buyers. For instance, Wellington's recent investments in public transport have made it a prime location for sustainable property investments.

3. Partner with Sustainability Experts

Collaborate with architects and builders specializing in eco-friendly designs to ensure your property meets sustainability standards. This partnership can enhance property value and marketability, attracting environmentally-conscious tenants and buyers.

Common Myths and Mistakes in Sustainable Property Investments

Myth vs. Reality

- Myth: Sustainable properties are too expensive to invest in.

- Reality: While upfront costs may be higher, the long-term savings and increased property value often outweigh initial investments. A study by the University of Auckland found that green-certified buildings can reduce energy costs by 25% annually.

Biggest Mistakes to Avoid

- Mistake: Ignoring Government Regulations

- Solution: Stay informed about local sustainability regulations and incentives. Utilize resources from MBIE and consult with legal experts to ensure compliance.

- Mistake: Overlooking Tenant Preferences

- Solution: Conduct market research to understand the demand for sustainable features in rental properties. Tailor your investments to meet these preferences and enhance tenant satisfaction and retention.

Future Trends: The Next Frontier of Sustainable Property Investments

The future of New Zealand’s property market is set to embrace advanced technologies and innovative practices to enhance sustainability. According to a report by NZTech, emerging trends such as smart home technologies and renewable energy systems will redefine property investments. By 2030, it is predicted that 70% of new developments will incorporate these technologies, significantly reducing carbon footprints and increasing property values.

Conclusion

As sustainability becomes a central focus in New Zealand's property market, investors have a unique opportunity to align financial goals with environmental responsibility. By leveraging government incentives, focusing on strategic locations, and partnering with experts, you can maximize your return on investment while contributing to a sustainable future. The time to act is now—embrace the shift towards eco-friendly investments and be at the forefront of New Zealand's sustainable property movement.

Final Takeaway & Call to Action

Are you ready to invest in New Zealand's sustainable property market? Start by researching green-certified properties and consulting with sustainability experts to make informed decisions. Share your thoughts and experiences in the comments below, and join our newsletter for the latest insights on sustainable investments in New Zealand!

People Also Ask (FAQ)

- How does investing in sustainable properties impact return on investment? Sustainable properties can offer higher ROI due to reduced operational costs and increased market demand, as shown by MBIE reports indicating energy savings of up to 30%.

- What are common misconceptions about sustainable property investments? A common myth is that sustainable properties are too costly. However, research from the University of Auckland shows long-term savings and value appreciation.

- What strategies are best for investing in New Zealand's property market? Focus on leveraging government incentives, choosing strategic locations, and collaborating with sustainability experts for optimal returns.

Related Search Queries

- New Zealand sustainable property investment strategies

- Green building incentives in New Zealand

- ROI on eco-friendly properties in NZ

- Future trends in NZ property market

- Sustainability in real estate investments

Diamond Engagement Rings Dayton

6 months ago