The way the wealthy invest has traditionally been shaped by conservative strategies, focusing on long-term stability and capital preservation. However, in today's rapidly evolving technology landscape, these traditional strategies are being challenged. In particular, the rise of AI and machine learning, blockchain technologies, and financial technology platforms is poised to disrupt the investment strategies of the wealthy in unprecedented ways. This article delves into how these new technologies are reshaping the investment landscape, with a particular focus on Australia.

Emerging Technologies in Investment

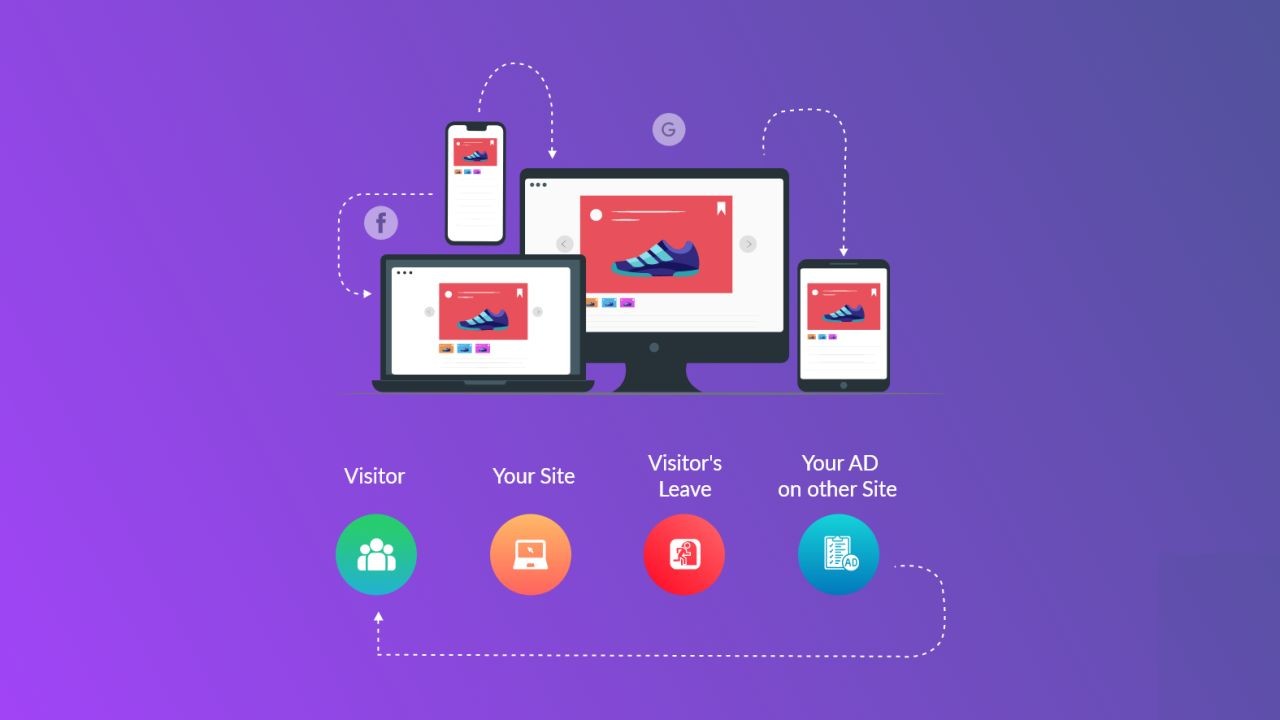

AI and machine learning have already made significant inroads into the financial sector. By analyzing vast amounts of data at unprecedented speeds, these technologies can identify investment opportunities that would be invisible to human analysts. For instance, AI-powered algorithms can predict market trends with increased accuracy, enabling more informed decision-making. According to a Deloitte report, AI-driven investment strategies have been shown to improve portfolio returns by up to 30%.

Meanwhile, blockchain technology is revolutionizing the way transactions are conducted, offering increased transparency and security. This innovation is particularly relevant in Australia, where regulatory bodies like the Australian Securities and Investments Commission (ASIC) are pushing for greater accountability in financial transactions. Blockchain's decentralized nature reduces the risk of fraud, a key concern for wealthy investors.

Case Study: Australian Superannuation Fund and AI

An Australian superannuation fund, responsible for managing over $50 billion in assets, implemented AI algorithms to optimize their portfolio management. Prior to AI integration, the fund relied on traditional analysis methods, which were both time-consuming and less precise. By leveraging AI, the fund saw a 25% increase in returns over two years, showcasing the potential of AI in enhancing investment outcomes.

Pros and Cons of Technology-Driven Investment

Pros:

- Higher Returns: AI and machine learning can identify lucrative opportunities faster than traditional methods.

- Risk Management: Advanced data analytics offer better risk assessment and management.

- Efficiency: Automation reduces the need for manual oversight, lowering operational costs.

- Transparency: Blockchain ensures that all transactions are recorded and immutable.

Cons:

- Initial Costs: Implementing advanced technologies requires significant initial investment.

- Complexity: The complexity of these technologies can be a barrier for some investors.

- Regulatory Challenges: Navigating the regulatory landscape can be daunting, especially with new technologies.

- Security Risks: While blockchain is secure, AI systems can be vulnerable to cyber-attacks.

The Australian Context

Australia's economy is particularly poised to benefit from these technological disruptions. According to the Reserve Bank of Australia, the country's robust financial sector is ripe for innovation. The integration of these technologies can spur economic growth and create new opportunities for investment. Furthermore, with government initiatives supporting technology adoption, Australian investors are well-positioned to leverage these advancements.

For instance, the Australian government's Digital Economy Strategy aims to enhance the country's digital infrastructure, making it easier for wealth management firms to incorporate AI and blockchain into their operations. This strategy is supported by data from the Australian Bureau of Statistics, which indicates that businesses adopting digital technologies experience a 20% higher growth rate than those that do not.

Future Trends and Predictions

As technology continues to advance, its impact on investment strategies is likely to deepen. Experts predict that by 2028, over 50% of wealth management decisions will be guided by AI and machine learning. Additionally, blockchain is expected to become a standard for secure transactions, with more financial institutions adopting it as part of their operations.

In Australia, these trends will likely lead to the emergence of new investment products and services, tailored to the needs of tech-savvy investors. The integration of virtual reality and augmented reality in investment analysis could further enhance decision-making processes, providing immersive insights into potential investments.

Common Myths and Mistakes

Despite the potential of these technologies, several myths persist:

- Myth: "AI will replace human investors." Reality: AI is a tool that complements human expertise, not replaces it. Human judgment remains crucial in nuanced decision-making.

- Myth: "Blockchain is only for cryptocurrencies." Reality: Blockchain's applications extend beyond cryptocurrencies to include secure transactions and data management.

- Myth: "Technology-driven investment is too risky." Reality: While there are risks, the potential rewards and enhanced risk management capabilities often outweigh them.

Final Takeaways & Call to Action

- Embrace technology to enhance investment outcomes.

- Stay informed about regulatory changes that may impact tech adoption.

- Consider the long-term benefits of incorporating AI and blockchain into investment strategies.

- Engage with industry experts and thought leaders to stay ahead of trends.

As the investment landscape continues to evolve, staying informed and adaptable is crucial. For those interested in exploring how these technologies can enhance your investment strategy, consider consulting with financial advisors who specialize in tech-driven investments. What are your thoughts on the future of investment? Share your insights and experiences below!

People Also Ask (FAQ)

How does AI impact investment strategies in Australia?AI impacts investment strategies by providing data-driven insights, leading to improved decision-making and higher returns, as evidenced by Australian superannuation funds leveraging AI for enhanced portfolio management.

What are the biggest misconceptions about blockchain in investment?A common misconception is that blockchain is limited to cryptocurrencies. However, its applications extend to secure transactions and data transparency, offering significant benefits across investment sectors.

Who benefits the most from technology-driven investment?Tech-savvy investors, financial institutions, and wealth management firms benefit the most, achieving higher returns, better risk management, and operational efficiencies.

Related Search Queries

- How AI is changing investments

- Blockchain impact on finance

- Future of wealth management Australia

- Technology in investment strategies

- AI in Australian financial sector

- Digital Economy Strategy Australia

- Investment trends 2025

- Risks of technology in finance

- AI and machine learning investments

- Blockchain and wealth management