In the vibrant landscape of Australian startups, the journey from inception to securing funding can often resemble a thrilling yet daunting rollercoaster ride. Yet, despite the country's reputation for innovation and entrepreneurship, many startups find themselves struggling to secure the financial backing they need to thrive. Understanding the underlying causes of these challenges is crucial for entrepreneurs and investors alike, and it offers insights into the broader economic environment in Australia.

The Funding Conundrum: A Closer Look

Meet Emily, a tech entrepreneur from Sydney with a groundbreaking idea for a sustainable energy solution. Despite her startup's potential to transform the energy sector, she faces an uphill battle in securing the necessary funds to bring her vision to life. Emily's story is not unique; it is reflective of a broader trend in Australia, where startups often encounter hurdles in accessing capital.

According to the Australian Bureau of Statistics, only about 30% of startups in Australia successfully secure venture capital funding. This statistic sheds light on the challenging landscape for entrepreneurs like Emily, who must navigate a complex web of investor expectations, regulatory requirements, and market dynamics.

Factors Influencing Startup Funding in Australia

- Risk Aversion: Australian investors tend to be more risk-averse compared to their counterparts in the US or Europe. This cautious approach can hinder startups, particularly those in nascent industries or with unproven business models.

- Regulatory Hurdles: The regulatory environment, overseen by bodies like the Australian Securities and Investments Commission (ASIC), can be daunting for startups, especially those in fintech or biotechnology sectors. Navigating these regulations requires time and resources that many startups lack.

- Market Size: Australia's relatively small market size limits the scale at which startups can grow domestically before needing to expand internationally. This limitation can make it challenging for startups to attract large-scale investment.

Case Study: Canva – Navigating the Funding Landscape

One of Australia's success stories in overcoming these barriers is Canva, the graphic design platform that has become a household name worldwide. Founded in 2012 by Melanie Perkins, Canva faced initial challenges in securing investment due to the saturated nature of the tech industry and investor skepticism about its long-term viability. However, through a combination of strategic partnerships, a compelling value proposition, and perseverance, Canva successfully secured $3 million in seed funding from local investors, including Blackbird Ventures.

Today, Canva's valuation exceeds $40 billion, demonstrating that with the right approach, Australian startups can indeed break through funding barriers. Perkins’ story highlights the importance of aligning with investors who understand the unique challenges and opportunities within the Australian market.

Lessons from Canva's Success

- Strong Value Proposition: Canva's focus on simplicity and accessibility resonated with users, attracting early adopters and investors.

- Strategic Partnerships: Partnering with local investors and leveraging their networks helped Canva expand its reach and credibility.

- Global Outlook: By targeting international markets early, Canva was able to scale rapidly and attract global investors.

Common Myths About Startup Funding

Several misconceptions persist about what it takes to secure funding in Australia:

- Myth: "Only tech startups can secure funding."Reality: While tech startups often dominate headlines, industries like agriculture and healthcare are also attracting significant investment, particularly with innovations in agtech and medtech.

- Myth: "venture capital is the only path to growth."Reality: Many startups successfully leverage alternative funding sources such as government grants, crowdfunding, and angel investors.

- Myth: "Investors only care about profits."Reality: Increasingly, investors are looking for startups that not only promise high returns but also align with ethical and sustainable practices.

Biggest Mistakes to Avoid

- Overlooking Due Diligence: Startups that fail to conduct thorough market research often struggle to convince investors of their potential. Utilizing tools like the Australian Business Insights platform can provide valuable data.

- Ignoring Regulatory Compliance: Non-compliance with ASIC regulations can lead to legal challenges and deter investment. Startups should prioritize understanding and adhering to these regulations from the outset.

- Focusing Solely on Local Markets: Startups that do not consider international expansion may limit their growth potential. Drawing lessons from global markets can provide new opportunities for scale.

Future Trends and Predictions

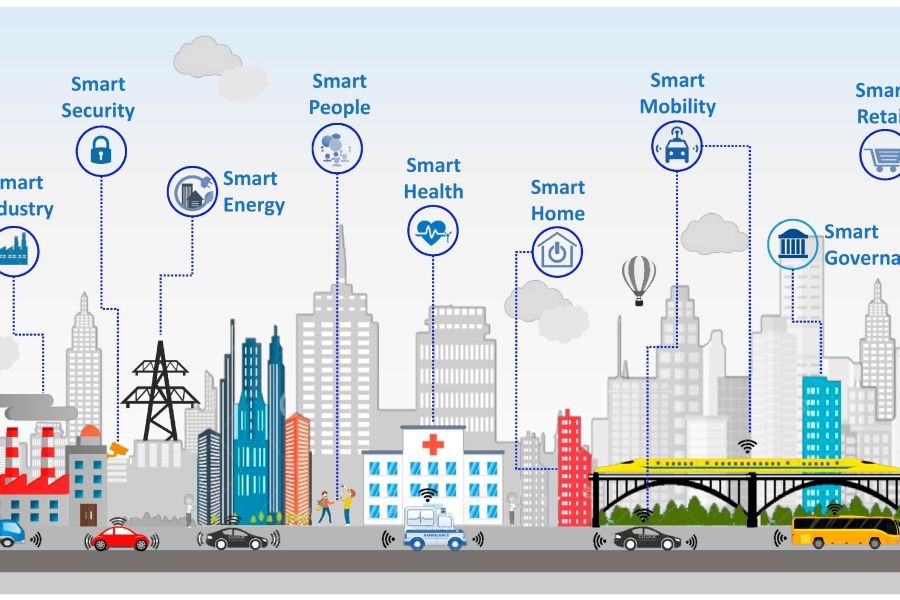

Looking ahead, the Australian startup ecosystem is poised for dynamic changes. The Reserve Bank of Australia predicts that digital transformation will drive a significant increase in technology-related investments. Moreover, as sustainability becomes a focal point for investors, startups focusing on green technology and sustainable practices will likely see increased funding opportunities.

In the next five years, we can expect a shift towards more diverse funding sources, including increased public-private partnerships and a greater emphasis on impact investing. This evolution will create a more inclusive funding landscape, enabling a broader range of startups to thrive.

Final Takeaways

- Understanding the unique challenges and opportunities within Australia’s startup ecosystem is crucial for securing funding.

- Learning from successful examples like Canva can provide valuable insights into strategic positioning and investor relations.

- Debunking common myths and avoiding critical mistakes can enhance a startup's chances of attracting investment.

- Embracing global perspectives and regulatory compliance will be key drivers of success in the evolving funding landscape.

What strategies have worked for your business in Australia? Share your insights below!

People Also Ask

How does startup funding impact businesses in Australia?AU businesses leveraging diverse funding strategies report improved scalability and innovation, according to the Australian Bureau of Statistics. By diversifying funding sources, startups can enhance resilience and growth potential.

What are the biggest misconceptions about startup funding in Australia?One common myth is that only tech startups can secure funding. However, research from Blackbird Ventures shows that industries like agriculture and healthcare are also attracting significant investment.

What are the best strategies for securing startup funding?Experts recommend starting with a strong value proposition, followed by strategic partnerships, and ensuring a global outlook for long-term success.

Related Search Queries

- Australian startup funding challenges

- How to secure venture capital in Australia

- Best funding options for startups in Australia

- Regulatory hurdles for Australian startups

- Success stories of Australian startups

- Impact of risk aversion on Australian startups

- Future trends in Australian startup funding

- Sustainability-focused startups in Australia

- Canva funding journey

- Australian investor expectations for startups