The COVID-19 pandemic has reshaped economies across the globe, and New Zealand is no exception. As the country emerges from the public health crisis, the economic landscape is undergoing significant transformations. For investors, this period represents both challenges and unprecedented opportunities. Understanding where to allocate capital, which sectors are poised for growth, and how to manage risk has never been more critical.

This article explores post-pandemic recovery sectors in New Zealand, highlighting trends, opportunities, and strategies for investors seeking to participate in the nation’s economic resurgence. From infrastructure and tourism to renewable energy and technology, we examine each sector in detail, offering actionable insights for both institutional and individual investors.

The New Zealand Economic Context

The pandemic created a unique set of circumstances in New Zealand. Early border closures and strict public health policies successfully limited infections, but they also disrupted key economic sectors, particularly tourism, hospitality, and retail. Over the past two years, New Zealand has experienced a cautious recovery, characterized by uneven growth across industries.

Key features of the post-pandemic economy include:

Government Stimulus and Infrastructure Spending: The New Zealand government has prioritized capital investment in critical sectors such as healthcare, education, and transport infrastructure. This fiscal approach aims to stimulate growth while modernizing essential public services.

Digital Transformation: Businesses and public institutions accelerated digital adoption during lockdowns, creating long-term demand for technology, software solutions, and digital infrastructure.

Consumer Behavior Shifts: With pandemic restrictions altering how Kiwis live, work, and travel, sectors such as e-commerce, domestic tourism, and remote services have grown significantly.

Global Uncertainties: Despite recovery, global economic pressures, including inflationary trends, trade disruptions, and geopolitical tensions, continue to influence investment risk.

For investors, understanding these structural shifts is critical. Opportunities exist where long-term trends intersect with government support and changing consumer demand.

Post-Pandemic Recovery Sectors

1. Infrastructure Development

Overview: Infrastructure has always been a cornerstone of economic growth. In the post-pandemic context, the New Zealand government has increased spending to rebuild and modernize essential services. This includes hospitals, schools, transport networks, and energy systems.

Why it matters for investors:

Stable returns: Infrastructure investments often offer steady, predictable returns, supported by government contracts.

Long-term growth: Projects such as road expansion, hospital modernization, and urban development have timelines spanning decades, providing sustained investment opportunities.

Employment multiplier effect: Infrastructure spending stimulates job creation, increasing domestic demand and supporting related industries.

Opportunities include:

Public-private partnerships (PPPs) in hospital and school construction.

Urban redevelopment projects in major cities like Auckland and Wellington.

Transport infrastructure, including road networks, ports, and rail modernization.

Smart infrastructure investments incorporating renewable energy and IoT-enabled systems.

Investors who align with government priorities and emerging urban needs are well-positioned to benefit from these initiatives.

2. Renewable Energy and Cleantech

Overview: New Zealand has long been a global leader in renewable energy, with hydropower, geothermal, and wind energy playing significant roles. Post-pandemic recovery plans emphasize sustainability, energy security, and carbon reduction, making renewable energy and cleantech highly attractive sectors for investment.

Why it matters for investors:

Government incentives: Tax breaks, grants, and renewable energy targets support growth.

Global ESG trends: International investors increasingly prioritize environmental, social, and governance (ESG) considerations.

Technological innovation: Advancements in energy storage, smart grids, and green hydrogen create new opportunities beyond traditional renewables.

Opportunities include:

Expansion of solar and wind energy capacity.

Green hydrogen production and export initiatives.

Energy-efficient building solutions and sustainable construction materials.

Cleantech startups focusing on waste management, water conservation, and carbon reduction.

With global energy markets shifting toward sustainability, New Zealand’s renewable sector is poised to attract domestic and international investment.

3. Tourism and Hospitality

Overview: Tourism is one of New Zealand’s most important economic sectors, contributing significantly to GDP and employment. The pandemic severely disrupted this industry, but recovery is underway, supported by policy changes and domestic demand.

Why it matters for investors:

Pent-up demand: Domestic travel has surged, with Kiwis exploring regional destinations more than ever.

Government support: Policies aimed at stimulating inbound tourism, such as visa adjustments and tourism infrastructure investment, enhance recovery prospects.

Resilience: Post-pandemic, tourism operators are adopting more efficient, technology-driven business models, improving profitability.

Opportunities include:

Boutique hotels, lodges, and eco-tourism ventures in regional areas.

Experience-based tourism such as adventure sports, cultural tours, and luxury travel.

Digital marketing platforms and booking solutions supporting small-to-medium tourism businesses.

Ancillary services including transport, hospitality tech, and tourism supply chains.

Investing in tourism requires strategic foresight, focusing on long-term trends and sustainability. Businesses that integrate digital engagement, eco-friendly practices, and high-quality experiences are likely to outperform competitors.

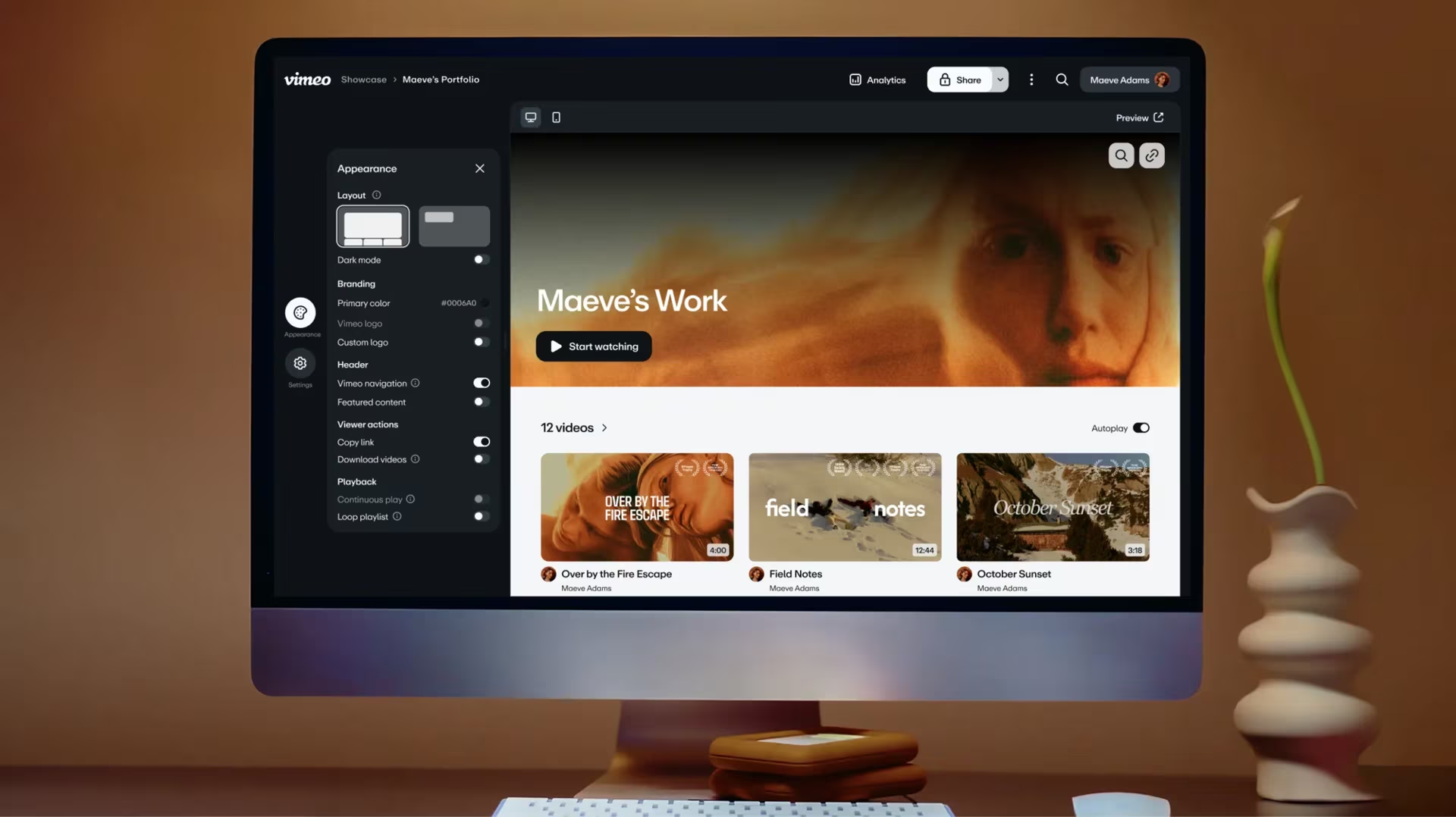

4. Technology and Digital Infrastructure

Overview: Digital transformation accelerated during the pandemic, creating sustained demand for technology services, software solutions, and broadband infrastructure. The Ultra-Fast Broadband initiative, for example, has expanded high-speed internet access to large portions of the population, enabling new business models and digital services.

Why it matters for investors:

Growing tech sector: Software development, fintech, healthtech, and cybersecurity are expanding rapidly.

Digital infrastructure demand: With more remote work, online learning, and e-commerce, robust broadband and data centers are critical.

Innovation hubs: Cities like Auckland and Wellington are fostering tech clusters, attracting talent and investment.

Opportunities include:

Investment in digital platforms enabling e-commerce, telehealth, and remote work.

Data center development and cloud computing infrastructure.

Software startups addressing niche needs in healthcare, education, and government services.

Cybersecurity solutions and IT consulting services supporting businesses in a post-pandemic economy.

Investors focusing on technology must balance growth potential with high competition, emphasizing companies with scalable solutions and strong market positioning.

5. Healthcare and Biotechnology

Overview: The pandemic underscored the importance of healthcare infrastructure and innovation. Investment in hospitals, medical devices, pharmaceuticals, and biotechnology is expected to grow significantly.

Why it matters for investors:

Government prioritization: Healthcare spending has increased to improve public services.

Innovation opportunities: Biotechnology, telemedicine, and digital health platforms present scalable investment avenues.

Global relevance: New Zealand’s biotech and medtech sectors attract international partnerships and export opportunities.

Opportunities include:

Hospital and clinic expansion through PPPs.

Telehealth platforms enabling remote patient care.

Biotechnology startups focused on vaccines, diagnostics, and therapeutics.

Medical device manufacturing and supply chain optimization.

The healthcare sector offers resilience and growth potential, combining societal impact with financial returns.

6. Agriculture and Agritech

Overview: Agriculture has historically been a backbone of New Zealand’s economy. Post-pandemic, innovation in agritech, sustainable farming, and food processing is reshaping the sector.

Why it matters for investors:

Global demand: International markets seek high-quality, sustainably produced food.

Sustainability trends: Climate-conscious practices and technology-driven solutions enhance productivity and reduce environmental impact.

Government support: Policies encouraging sustainable farming practices provide incentives for modernized agriculture.

Opportunities include:

Precision agriculture solutions improving yield and efficiency.

Sustainable livestock management and plant-based food alternatives.

Export-oriented agritech startups integrating IoT, AI, and automation.

Investment in irrigation, storage, and processing infrastructure to enhance value chains.

Agritech combines traditional resilience with innovation-driven growth, providing a unique entry point for forward-thinking investors.

Expert Investment Strategies

Investing in post-pandemic recovery sectors requires careful planning, due diligence, and strategic execution. Experts recommend the following best practices:

1. Diversify Across Sectors

Economic recovery is uneven, with some sectors rebounding faster than others. Diversification across multiple industries reduces risk and enhances portfolio stability. Combining stable investments, such as infrastructure and energy, with high-growth sectors like technology and tourism can balance returns and exposure.

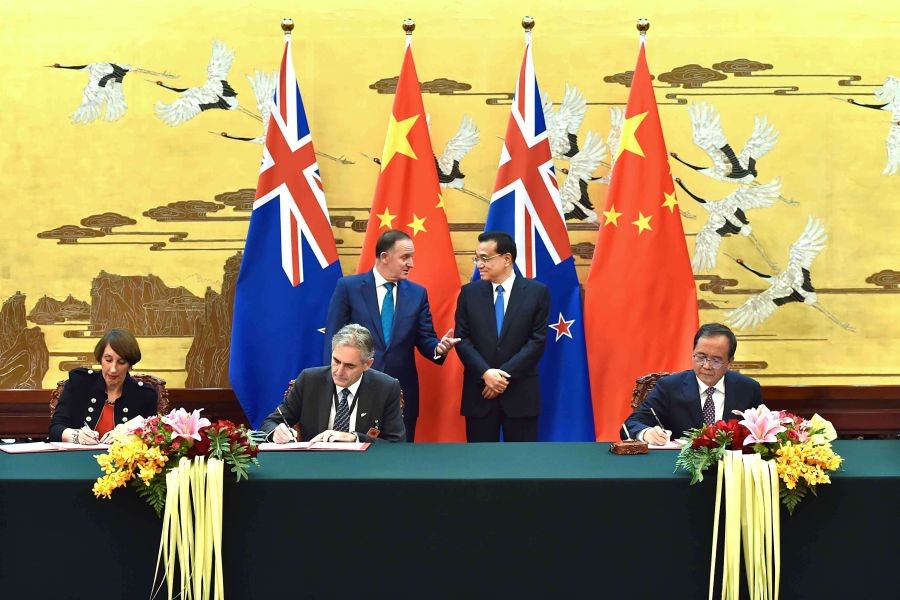

2. Align with Government Policies

Government priorities often signal profitable opportunities. Monitoring fiscal policies, stimulus packages, and strategic plans—such as infrastructure investment or renewable energy initiatives—can provide guidance for where capital is most likely to be rewarded.

3. Focus on Sustainability

Sustainability is no longer optional; it’s increasingly embedded in investment decisions. Companies and sectors adhering to ESG principles are more likely to attract long-term funding, achieve regulatory compliance, and maintain consumer trust. Investors should prioritize ventures contributing to renewable energy, sustainable tourism, and ethical agriculture.

4. Engage Local Expertise

New Zealand’s investment landscape is highly localized. Collaborating with local advisors, industry experts, and business networks ensures better understanding of regulatory frameworks, market dynamics, and emerging opportunities. On-the-ground insights often provide a competitive advantage over remote analysis.

5. Long-Term Perspective

Post-pandemic recovery is a multi-year process. Investments in infrastructure, technology, and healthcare may take time to realize returns. A patient, long-term perspective ensures investors can capitalize on growth while weathering short-term volatility.

6. Risk Management

Volatility remains a feature of the post-pandemic economy. Investors should conduct rigorous risk assessment, evaluate sector-specific challenges, and implement strategies such as hedging, portfolio diversification, and staged investments to mitigate potential losses.

Case Study: Infrastructure and Tourism Synergy

Consider a hypothetical investor focusing on regional development in New Zealand. By combining infrastructure and tourism investments, they can capture both direct and indirect growth:

Infrastructure Investment: Upgrading a regional airport improves accessibility and increases the potential for tourism.

Tourism Investment: Launching boutique eco-lodges in nearby areas benefits from the improved infrastructure, generating higher occupancy rates and revenue growth.

This approach demonstrates how strategic alignment across sectors amplifies returns and reduces reliance on a single economic driver.

Post-Pandemic Investment Pitfalls to Avoid

Even with promising opportunities, investors must exercise caution. Common pitfalls include:

Overestimating Short-Term Recovery: Some sectors, such as international tourism, may take longer to reach pre-pandemic levels.

Ignoring Regulatory Complexity: Infrastructure, healthcare, and energy sectors often involve stringent regulations. Non-compliance can delay projects and reduce profitability.

Neglecting Market Signals: Consumer behavior has changed significantly. Failure to adapt products or services can reduce demand.

Focusing Solely on Hype Sectors: While technology and cleantech are exciting, over-concentration without due diligence can result in high risk exposure.

By proactively addressing these pitfalls, investors can navigate the post-pandemic landscape more effectively.

Conclusion: Positioning for Success

New Zealand’s post-pandemic recovery presents a unique moment for investors. With sectors such as infrastructure, renewable energy, tourism, technology, healthcare, and agritech demonstrating significant growth potential, well-informed investments can yield both financial returns and societal impact.

Key takeaways for investors:

Diversify across stable and high-growth sectors.

Prioritize sustainability and ESG-aligned investments.

Engage local expertise to navigate regulatory and market complexities.

By strategically allocating capital, understanding sector-specific dynamics, and implementing risk management practices, investors can not only benefit from New Zealand’s economic recovery but also contribute to the country’s sustainable growth.

The post-pandemic era is an opportunity to invest with foresight, innovation, and impact. For those who approach it with informed strategy and discipline, New Zealand’s evolving economic landscape offers both promise and potential for exceptional investment outcomes.