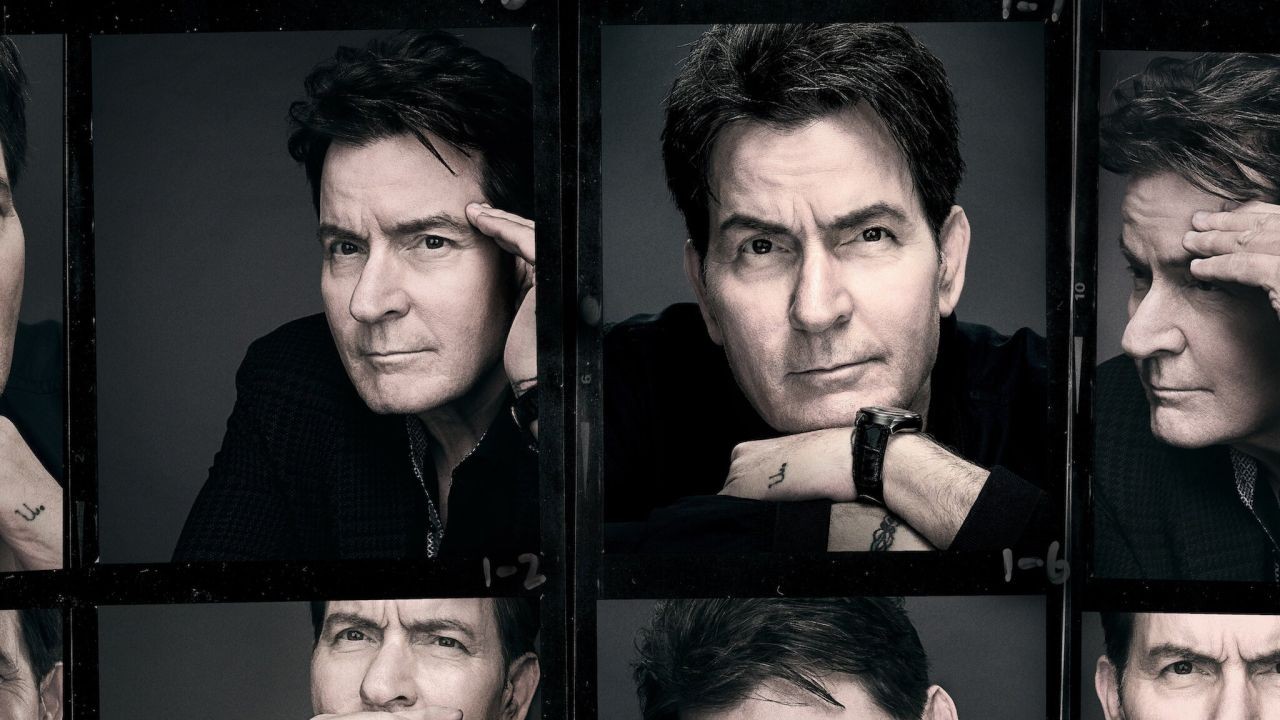

The public narrative of a celebrity's downfall and redemption is a well-worn script, often packaged as a cautionary tale or a triumph of the human spirit. But for the strategic mind, particularly one attuned to the principles of sustainability and systems thinking, such a narrative presents a far richer case study. It is a stark examination of a deeply unsustainable system: the unchecked consumption of personal capital—be it financial, social, or reputational—and the complex, costly process of regeneration. When a figure like Charlie Sheen declares he is "ready to tell you everything," we are not merely being offered salacious gossip. We are being handed a forensic audit of a personal ecosystem pushed to collapse, and the subsequent, painful efforts at remediation. For New Zealand businesses and consultants operating in an era defined by ESG (Environmental, Social, and Governance) imperatives and stakeholder capitalism, this is not entertainment; it is a masterclass in risk management, brand resilience, and the non-negotiable economics of sustainable practice.

Deconstructing the Collapse: A Systems Failure Analysis

True sustainability consulting moves beyond simple cause-and-effect. It requires a holistic analysis of interconnected systems and feedback loops. Applying this lens to a high-profile personal brand meltdown reveals predictable, catastrophic patterns.

The Unsustainable Input-Output Model

Every entity, corporate or individual, operates on an input-output model. Sustainable systems ensure outputs (products, waste, reputation) do not irreparably damage the capacity for future inputs (resources, trust, social license). The Sheen case, at its peak crisis, was a textbook example of this model in violent disequilibrium.

- Input Overexploitation: The primary input was a unique, bankable brand of chaotic, hedonistic charisma. This was extracted at an unsustainable rate, far beyond its natural regeneration cycle, to feed a media machine and a lifestyle.

- Toxic Outputs & Externalities: The outputs—public scandals, broken contracts, vitriolic media appearances—created severe negative externalities. These were not contained; they polluted the entire "ecosystem" around the individual, damaging co-stars, production companies, network brand value, and family structures. The social and reputational pollution was profound.

- Feedback Loops Ignored: In a healthy system, negative feedback (declining job offers, public concern, legal penalties) triggers corrective action. Here, these signals were either ignored or perversely monetized, accelerating the crash. This mirrors companies that, facing declining brand trust, double down on greenwashing or aggressive litigation rather than addressing core operational failures.

The New Zealand Parallel: Lessons from Corporate Governance

While seemingly worlds apart, the core failure mode is identical to corporate scandals that have shaken New Zealand's business community. Consider the case of a once-venerated NZX-listed firm that consistently prioritised short-term shareholder returns over investment in R&D, staff well-being, and environmental compliance. The negative outputs—staff burnout, environmental incidents, product stagnation—were ignored until a catastrophic event triggered a total collapse in market capitalisation and a complete loss of social license. The 2023 MBIE Business Operations Survey highlights that while 56% of New Zealand businesses have a formal sustainability strategy, only 29% have integrated it into core financial decision-making. This disconnect between stated values and operational input-output models is the seed of systemic risk.

The Costly Road to Regeneration: Reputational Remediation vs. Greenwashing

After a collapse, the path to sustainability is neither quick nor cheap. It requires authentic, verifiable, and often painful transformation. "Telling everything" is not a PR strategy; it is the first, raw step in a lifecycle assessment of one's own failures.

Case Study: Patagonia – The Regeneration Benchmark

Problem: While Patagonia was a respected outdoor brand, its very existence relied on global supply chains and consumption patterns contributing to the environmental crisis it advocated against. This was a fundamental values contradiction—a reputational liability waiting to crystallise.

Action: The company undertook a radical, multi-decade process of internal regeneration. It mapped its entire supply chain, invested in regenerative organic agriculture for its materials, implemented the "1% for the Planet" model, and most decisively, in 2022, transformed its ownership structure. Founders Yvon and Chouinard transferred all company ownership to a specially designed trust and non-profit, ensuring all profits would fund environmental conservation.

Result: This was not a rebranding exercise; it was a constitutional redesign.

- Brand Equity & Loyalty: Achieved near-mythic status as the world's most credible sustainable brand.

- Financial Performance: Revenue has consistently grown, demonstrating that deep sustainability is commercially viable.

- Influence: Set a new, almost unmatchable standard for corporate environmental action, influencing stakeholders globally.

Takeaway for NZ: For New Zealand businesses, especially in agriculture, tourism, and export-focused sectors, the lesson is profound. Authentic regeneration requires structural change, not marketing. A winery moving to full organic certification and biodynamic practices (like Central Otago's Felton Road) is engaging in genuine remediation. A dairy co-op launching a "sustainable" milk line while its core herd intensity continues to rise is engaging in a form of corporate greenwashing—the equivalent of a superficial apology without behavioural change.

The Strategic Framework: From Personal Meltdown to Corporate Resilience

We can distil this analysis into a actionable framework for sustainability consultants and New Zealand executives. This is a diagnostic and prescriptive model for assessing and building resilient capital.

The Five Capitals Resilience Audit

Adapted from the Forum for the Future's model, this audit forces a holistic balance sheet review beyond finances.

- Financial Capital: Is profit pursued at a rate that degrades other capitals? (e.g., cost-cutting that increases staff turnover).

- Manufactured Capital: Are assets & infrastructure maintained and invested in for the long-term, or milked for short-term gain?

- Human Capital: What is the rate of staff burnout? Is knowledge being hoarded or shared? Are well-being metrics part of executive KPIs?

- Social Capital: What is the depth of trust with community, iwi, and regulators? Is the social license to operate being nurtured or exploited?

- Natural Capital: Are environmental inputs (water, air, soil) and waste outputs being managed within regenerative limits?

A high-risk entity, like a pre-collapse personal brand or a polluting factory, will show massive deficits in Social, Human, and Natural Capital, masked by a temporary surplus in Financial Capital. The audit makes this visible.

The Great Debate: Radical Transparency vs. Managed Narrative

This brings us to the core strategic dilemma highlighted by "telling everything."

✅ The Advocate View (Radical Transparency):

Proponents argue that in a digital age, secrets are liabilities. Full disclosure, however painful, is the only credible foundation for rebuilding trust. It disarms critics, aligns with consumer demand for authenticity, and creates a clean slate. This is the Patagonia model applied to personal failings. Data from the 2024 Edelman Trust Barometer shows that 78% of New Zealanders trust "my employer" to do what is right, significantly higher than trust in government or media. This trust is built on perceived transparency and ethical conduct.

❌ The Critic View (Managed Narrative):

Skeptics counter that total transparency is a strategic folly. Not all information is material, and uncontrolled disclosure can create new, unforeseen risks—legal repercussions, misinterpretation, or the perpetuation of a damaging narrative. Stakeholders, they argue, need clarity and assurance, not a confessional. A managed, forward-looking narrative that acknowledges past errors while focusing on current actions is more effective and less risky.

⚖️ The Sustainable Middle Ground: Material Disclosure & Verifiable Action

The consultant's resolution is neither full confession nor opaque spin. It is the principle of material disclosure paired with verifiable action. Disclose what is materially relevant to stakeholders' assessments of your sustainability and risk. For a NZ fishery, this means publishing bycatch data and conservation partnerships, not every internal memo. For a recovering individual, it means acknowledging the core failures that harmed others, not every private detail. Crucially, disclosure must be inextricably linked to demonstrable, third-party-verified change in operations and outcomes. This is the GRI (Global Reporting Initiative) standard applied to personal and corporate brand repair.

Common Myths & Costly Mistakes in Sustainability Strategy

Navigating this terrain requires dispelling pervasive myths that lead to wasted investment and heightened risk.

Myth 1: "Sustainability is a cost centre and a PR function." Reality: It is a risk mitigation and innovation engine. A 2023 Reserve Bank of New Zealand financial stability report explicitly categorises climate change as a "systemic risk" to the financial system. Firms treating sustainability as mere PR are under-pricing existential risk and missing opportunities for efficiency and new market creation (e.g., plant-based proteins, circular economy services).

Myth 2: "We can offset our way to sustainability." Reality: Offsetting is a last resort for unavoidable emissions, not a substitute for systemic operational transformation. Over-reliance on offsets is the corporate equivalent of apologising without changing behaviour—it is ultimately seen as inauthentic. The primary focus must be on radically reducing negative outputs at source.

Myth 3: "Our customers won't pay a premium for sustainable practices." Reality: This is increasingly false, especially in key NZ export markets. A 2024 study by NZTE highlighted that over 60% of consumers in the EU and UK actively seek provenance and environmental credentials, with many willing to pay a 10-15% premium for verifiably sustainable products. The mistake is expecting a premium for a basic expectation; the advantage goes to those who integrate it so efficiently it doesn't require one.

❌ Biggest Mistakes to Avoid:

- Siloed Sustainability Teams: Embedding experts in a corner of marketing or HR guarantees failure. Sustainability must be a KPI for the CFO, COO, and CEO.

- Setting Vague "Net-Zero by 2050" Goals: These are seen as kicking the can. Set interim, science-based targets for 2025 and 2030 with clear accountability. The Climate Change Commission's emissions budgets provide the framework for this in NZ.

- Ignoring Social Capital: Failing to genuinely engage with iwi, local communities, and employees in transition planning builds opposition and destroys the social license needed to operate.

The Future of Capital: Integrated Reporting and Stakeholder Primacy

The trajectory is clear. The era of defining value solely by financial capital is over. The future belongs to entities that can demonstrably maintain and grow all five capitals.

- Regulatory Force: New Zealand's mandatory climate-related financial disclosures (effective 2024) are just the beginning. We will see this expand to mandatory reporting on social and human capital impacts within the decade.

- Capital Allocation: Investment will increasingly flow via integrated reports. Funds like the NZ Super Fund already employ rigorous ESG screening. Entities with poor sustainability metrics will face a higher cost of capital—a direct financial penalty for unsustainable practice.

- The Authenticity Premium: Brands that can provide verified, blockchain-secured data on their full supply chain impact (from greenhouse gas emissions to fair wages) will command unparalleled trust and market share. For New Zealand's "clean, green" export economy, this is both an existential challenge and a monumental opportunity.

Final Takeaways & Call to Action

The spectacle of a fallen celebrity's comeback attempt is far more than tabloid fodder. It is a concentrated, public experiment in systems collapse and the arduous quest for sustainability. The lessons are directly transferable to the boardrooms of Auckland, the farms of Canterbury, and the tourism operators of Queenstown.

- 🔍 Audit All Your Capitals: Conduct a rigorous Five Capitals Resilience Audit. Identify your largest deficits before they trigger a crisis.

- 📈 Embrace Material Transparency: Proactively disclose what matters to your stakeholders' assessment of your long-term viability, and back it with verified action.

- 🔄 Design for Regeneration, Not Just Reduction: Move beyond "doing less harm." How do your operations actively improve social and natural systems? This is the Patagonia imperative.

- ⚖️ Price Your Risks Realistically: Internalise the true cost of your negative externalities. The market and regulators will soon force you to do so anyway.

For New Zealand, a nation trading heavily on its reputation, the stakes could not be higher. The choice is not between business and sustainability. The choice is between short-term extraction followed by inevitable collapse, or the disciplined, regenerative management of all forms of capital for enduring resilience and value.

Your move, New Zealand. Will you wait for a crisis to force transparency, or will you lead with it? The next chapter of our economic story depends on the answer.

People Also Ask (PAA)

How does personal brand sustainability apply to NZ businesses? The principles are identical: a brand built on a single, exploitative attribute (e.g., "cheapest") is unsustainable. Resilient brands, like Allbirds or Icebreaker, are built on authentic, multi-capital value (innovation, natural materials, ethics) that can withstand market shocks and shifting consumer values.

What is the biggest regulatory change affecting sustainability in NZ? The mandatory climate-related financial disclosures (CRFD) regime is the most significant. It forces large financial institutions and listed companies to publicly report climate risks and strategies, moving sustainability from voluntary reporting to core governance. This will cascade through supply chains.

Can small-to-medium enterprises (SMEs) afford a robust sustainability strategy? They cannot afford *not* to. For SMEs, it starts with efficiency (reducing waste, energy use), which saves money. It then becomes a point of differentiation with larger competitors and a requirement for supplying to larger, regulated firms. Resources from MBIE and the Sustainable Business Network provide accessible, scalable frameworks.

Related Search Queries

- ESG reporting framework New Zealand 2024

- Cost of greenwashing for brands

- Regenerative agriculture business case NZ

- Social license to operate examples New Zealand

- Integrated reporting five capitals model

- Climate Change Commission emissions budget compliance

- Building resilient supply chains NZ

- Stakeholder capitalism vs shareholder primacy

- MBIE sustainability grants and support

- Reputational risk management strategy

For the full context and strategies on Charlie Sheen is ready to tell you everything – The Best Guide You’ll Ever Read, see our main guide: Property Development Videos New Zealand.