For decades, New Zealand’s economic narrative was one of comfortable distance. We were a remote, agrarian nation trading with distant European partners, with Asia viewed as a secondary, albeit growing, market. That era is conclusively over. The seismic shift in our economic gravity towards Asia is not merely a trade statistic; it is a fundamental re-wiring of our national balance sheet, capital flows, and risk profile. For the investment banking community, this is not a passive trend to observe but a dynamic, multi-asset class opportunity fraught with both asymmetric returns and hidden systemic risks. The conventional wisdom celebrates export growth—yet the most profound and unexpected impacts lie beneath the surface, in capital markets, currency dynamics, and the very structure of our corporate sector.

Deconstructing the Dependency: Beyond Commodity Exports

The headline figures are compelling, yet they tell only a superficial story. Yes, China is our largest trading partner, with two-way trade reaching NZ$38.7 billion for the year ended June 2023, according to Stats NZ. Yes, over 50% of our goods exports now flow to Asia. However, fixating on log, milk powder, and meat shipments is a myopic view. The critical, bankable insight is how this trade relationship is morphing from a simple buyer-seller dynamic into deep financial integration. Asian capital is no longer just paying for commodities; it is seeking ownership of the entire value chain—from farmland and processing plants to logistics hubs and consumer brands. This represents a fundamental shift from trade surplus to capital account dependency, a nuance many local analysts dangerously overlook.

The Capital Inflow Conundrum: Funding Growth or Forgoing Control?

Asian investment in New Zealand has evolved through distinct, increasingly sophisticated waves. The initial wave targeted hard assets—forestry and farmland. The current wave is targeting strategic infrastructure, technology, and premium consumer goods. The pending acquisition of New Zealand’s largest independent retirement village operator, Oceania Healthcare, by a Japanese consortium in a NZ$1.1 billion deal is a prime example. This isn't passive capital; it's strategic, long-horizon investment seeking stable, demographic-driven returns unavailable in Asia's aging but yield-starved markets.

This capital is a double-edged sword for investment bankers advising clients:

- Pros: It provides essential liquidity for shareholders, funds expansion without over-leveraging local balance sheets, and brings global operational expertise. It validates New Zealand assets as a premium, safe-haven destination within the Asian capital ecosystem.

- Cons: It raises complex questions about strategic national assets, profit repatriation, and long-term economic sovereignty. It can inflate asset valuations beyond local capacity to compete, potentially crowding out domestic investors and creating a two-tiered market.

Case Study: A2 Milk Company – From NZ Niche to Asian Consumer Phenomenon

Problem: A2 Milk Company, founded in New Zealand, possessed a unique scientific proposition with its A2 beta-casein protein milk. However, by the early 2010s, its growth in traditional Western markets was maturing. The company faced the classic Kiwi scale-up challenge: how to transcend its niche status and achieve global, billion-dollar revenue without the marketing war chest of multinational rivals.

Action: A2 Milk didn't just export to China; it engineered its entire strategy around the Asian consumer. It formed a deep, strategic daigou (informal cross-border shopping) and regulatory partnership with China State Farm, ensuring supply chain integrity crucial for Chinese parents. It invested heavily in marketing that resonated with Asia's health-conscious, premium-seeking middle class, positioning its product not as a commodity but as a superior nutritional choice for infants and adults.

Result: The transformation was staggering. At its peak in 2020, over 70% of A2 Milk's total revenue derived from the Asia Pacific region, primarily China. Its market capitalization soared to over NZ$20 billion, making it one of NZX's largest companies. This success, however, also exposed its vulnerability to shifting Chinese regulatory policies and demographic trends, which later impacted its valuation—a critical lesson in concentration risk.

Takeaway: For investment bankers, A2 Milk is the archetype of the Asia-premium valuation model. It demonstrated that deep, strategic alignment with Asian consumer trends could command valuation multiples disconnected from traditional dairy sector metrics. The lesson for other New Zealand consumer goods, health, and wellness companies is clear: access to Asia is not a sales channel; it is a fundamental value driver that must be embedded in corporate strategy and capital allocation from the outset.

The Hidden Currency and Interest Rate Vulnerability

Here lies the most underappreciated and systemic risk. Our economic cycle is now disproportionately influenced by Asian demand, particularly China's. When China stimulates its economy, our commodity prices rise, the New Zealand dollar (NZD) appreciates, and the Reserve Bank of New Zealand (RBNZ) faces imported inflation. This dynamic directly constrains monetary policy independence. Data from the RBNZ shows a historically strong correlation between the NZD/USD exchange rate and the Global Dairy Trade price index, a proxy for Chinese demand.

The critical insight for fixed-income and currency traders is this: New Zealand's interest rate decisions are increasingly a derivative of Beijing's policy moves, not just Wellington's. An economic slowdown in China doesn't just reduce export volumes; it triggers a dual shock of lower export receipts and a depreciating NZD, which can exacerbate inflation if the RBNZ is forced to keep rates higher for longer to support the currency and curb imported price rises. This creates a volatile feedback loop that sophisticated macro funds are beginning to trade aggressively.

Debate Angle: Strategic Partner or Strategic Vulnerability?

Side 1 (The Integration Advocate): Proponents argue that deep Asian integration is an irreversible and net-positive force. It provides a perpetual growth engine, diversifies our economic base beyond traditional partners, and attracts smart capital that upgrades our infrastructure and business practices. The success of sectors like tourism (pre-pandemic), education exports, and premium food & beverage is entirely tied to Asia. They point to Singapore's model of open, strategic capital inflows as a blueprint for prosperity.

Side 2 (The Sovereignty Critic): Critics warn of dangerous over-dependence. They highlight the fragility of supply chains exposed to geopolitical tensions, as seen in recent trade disruptions. They argue that selling strategic assets and becoming a satellite economy erodes long-term resilience and control. The concentration risk in a single region makes New Zealand uniquely vulnerable to a regional recession or political dispute, with limited ability to pivot quickly.

The Middle Ground (The Hedged Pragmatist): The prudent path, from a banking and policy perspective, is neither full retreat nor unfettered embrace. It involves actively diversifying *within* Asia (e.g., deepening ties with ASEAN, India, and Japan to reduce China concentration) while using the capital inflows from Asia to fund productivity-enhancing investments in technology and skills at home. The goal should be to build a more sophisticated, value-added economy that engages with Asia from a position of strength and innovation, not just resource dependency.

Common Myths and Costly Mistakes for Investors

Myth 1: "Strong Asian exports automatically translate to a stronger NZ economy and stock market." Reality: This is a dangerous simplification. While export revenues boost GDP, the benefits can be narrowly concentrated. If the profits are largely repatriated by foreign-owned processors or if the currency appreciation hurts other export sectors (like tourism or technology), the net effect on broader equity market performance can be muted or even negative. The NZX 50's performance has often diverged from commodity price cycles.

Myth 2: "Asian investment is a monolithic, state-directed force." Reality: This view is outdated. Capital flows are increasingly diverse, encompassing private equity from Singapore, venture capital from Japan, family offices from Hong Kong, and corporate strategic investors from South Korea. Each has different return expectations, time horizons, and operational approaches. A Japanese pension fund's investment thesis is worlds apart from a Chinese conglomerate's.

Mistake to Avoid: Underestimating Geopolitical Risk in Valuation Models. A 2023 report by the New Zealand Institute of Economic Research (NZIER) highlighted that most local corporate valuations inadequately price in geopolitical tail risks related to Asia. The solution is to incorporate scenario analysis and stress-testing that includes specific supply chain disruption, regulatory change, or diplomatic friction events, adjusting discount rates or adding risk premiums accordingly.

Future Trends: The Next Wave of Financial Integration

The next five years will see the integration move decisively into financial services and digital assets. We predict:

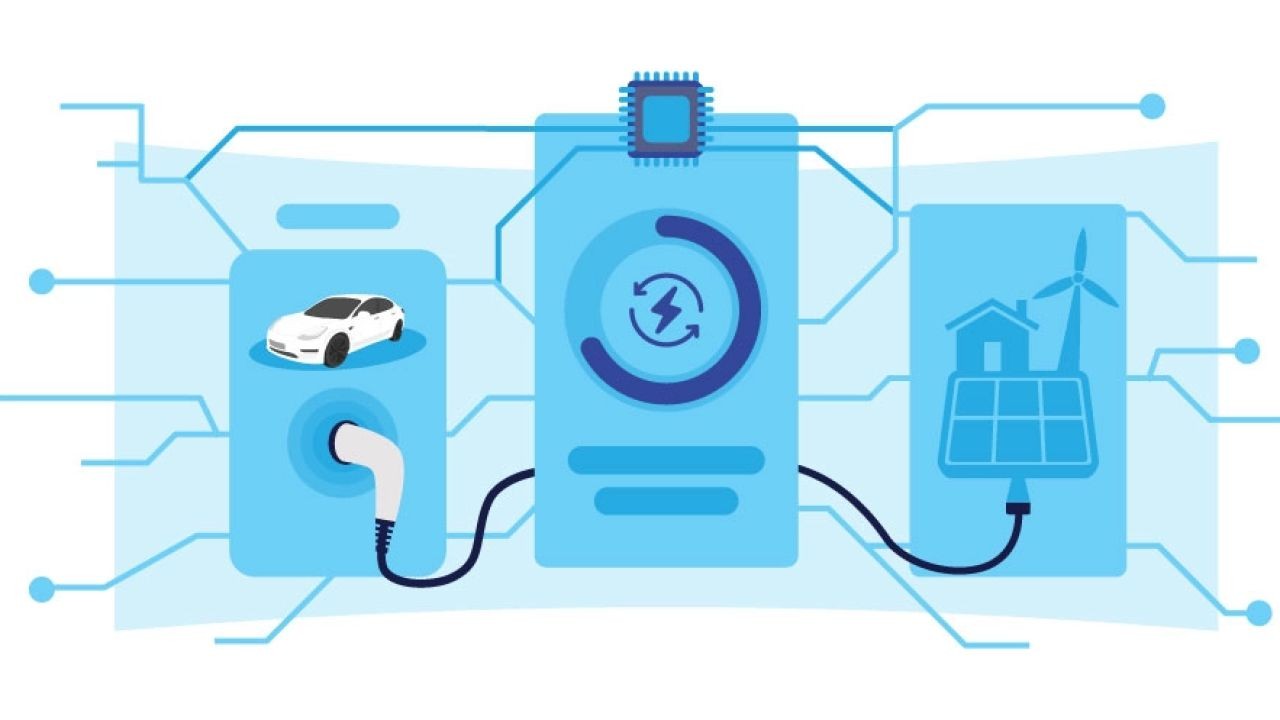

- Dual Listings & Capital Market Linkages: Expect more New Zealand fintech and agri-tech firms to pursue dual primary listings on the NZX and ASX, with a secondary listing or CHESS Depository Interest (CDI) structure in Singapore or Hong Kong to tap Asian liquidity directly.

- Green Finance Convergence: Asia's massive demand for high-integrity carbon credits and sustainable food will see New Zealand's pastoral and forestry sectors become central to green bond and ESG-linked loan structures originated in Tokyo and Singapore.

- Private Capital Dominance: Large-scale infrastructure and mid-market company acquisitions will be increasingly funded by Asian private capital, bypassing public markets altogether. Investment banks will need to build dedicated teams to navigate these bilateral, off-market deals.

Final Takeaways & Strategic Call to Action

- Fact: Asia now dictates New Zealand's terms of trade, currency trajectory, and monetary policy headwinds more than any other region.

- Strategy: Position portfolios to be long New Zealand's unique, premium, ESG-compliant assets that Asian capital craves (water rights, carbon-negative agriculture, niche tech), while hedging the concentrated geopolitical and currency risks.

- Mistake to Avoid: Applying 20th-century, commodity-cycle investment frameworks to a 21st-century economy defined by financial integration and strategic capital flows.

- Pro Tip: The most lucrative opportunities lie in facilitating the capital flow itself—structuring inbound investments, advising on cross-border M&A, and developing new financial products that bridge the NZ-Asia capital gap.

Final Takeaway & Call to Action: The Asian century for New Zealand is not coming; it is here, and its second-order financial effects are only beginning to unfold. The role of the investment banker is no longer that of a passive intermediary but of a critical architect, building the frameworks that channel this capital productively while insulating the economy from its inherent volatilities. The question is no longer *if* you are engaged with Asia, but *how strategically*. Review your firm's Asia capability today—is it a sideline export desk, or a core, integrated function across M&A, debt capital markets, and sales & trading? The gap between those two answers defines your future relevance in the New Zealand market.

People Also Ask (PAA)

How does New Zealand's reliance on Asia impact its monetary policy? It significantly reduces the RBNZ's independence. Strong Asian demand boosts export prices and the NZD, importing inflation and forcing potential rate hikes out of sync with the domestic cycle, creating a persistent policy dilemma.

What are the biggest investment opportunities arising from NZ-Asia ties? Beyond primary exports, opportunities exist in infrastructure co-investment, financial technology enabling cross-border payments, and companies that "productise" NZ's clean, green brand for the Asian premium consumer in sectors like health, wellness, and sustainable living.

Is New Zealand selling too many assets to Asian investors? The debate centers on strategic assets. The critical distinction is between passive capital providing liquidity and strategic control of supply chains or critical infrastructure. A nuanced, sector-by-sector foreign investment policy is essential to balance capital needs with national interest.

Related Search Queries

- New Zealand China trade statistics 2024

- Asian investment in NZ property market

- Impact of Chinese economy on NZ dollar

- NZ export diversification away from China

- RBNZ interest rates and Asian demand

- New Zealand ASEAN trade agreement benefits

- Buying a business in New Zealand as an Asian investor

- NZX companies with high Asian revenue exposure

- Geopolitical risk for New Zealand economy

- Future of NZ dairy exports to Asia

For the full context and strategies on The Unexpected Impact of New Zealand’s Economic Ties with Asia – The Kiwi Blueprint to Success, see our main guide: Transparency Trust Vidudes Promise To New Zealand.