The dream of homeownership in New Zealand has long been a cornerstone of the national identity, a tangible symbol of security and success. Yet, for a generation of Kiwis, that dream has morphed into a source of profound anxiety and financial exclusion. The soaring peaks of house prices, particularly in our main centres, have created a chasm between aspiration and reality, leaving many to feel like permanent spectators in a market that favours the already-properited. In response, successive governments have deployed a suite of deposit assistance schemes and policy levers, framing them as benevolent bridges across this chasm. But a critical examination reveals a more complex, and often contradictory, narrative. These interventions are not merely financial tools; they are cultural artefacts, reflecting deep-seated tensions between egalitarian ideals and market realities, between intergenerational equity and political expediency. To understand the true impact of the First Home Grant, the Kainga Ora First Home Loan, or the now-defunct First Home Partner scheme, one must look beyond the glossy brochures and into the structural pressures they both alleviate and exacerbate.

The Landscape of Assistance: A Toolkit Under Strain

New Zealand's deposit assistance framework is a patchwork of initiatives, each with its own eligibility criteria, philosophical underpinning, and unintended consequences. The two primary workhorses are the First Home Grant (a means-tested cash contribution towards a deposit) and the Kainga Ora First Home Loan (a government-guaranteed loan allowing for a deposit as low as 5%). On the surface, their purpose is unimpeachable: to lower the prohibitive upfront barrier to entry. Data from Kainga Ora itself indicates the scale of this intervention: in the 2022/23 financial year, over 5,600 First Home Grants and 2,800 First Home Loans were approved, injecting significant public capital into the private housing market.

However, drawing on my experience supporting Kiwi companies in the financial advisory sector, I've observed a recurring theme. These schemes often act as a demand-side stimulant in a supply-constrained environment. A prospective buyer in Auckland, armed with a $10,000 First Home Grant, is still competing in a market where the median house price sits near $1.1 million (REINZ, early 2024). The assistance simply increases their borrowing capacity, which, when multiplied across thousands of applicants, can contribute to upward price pressure at the more affordable end of the market. It's a cruel irony: a policy designed to enhance affordability can, in a tight market, subtly undermine it for the cohort just beyond the eligibility threshold. This creates a policy-induced cliff edge where earning $1 too much disqualifies you from support, potentially placing you in a worse competitive position than those who qualify.

Key Actions for Aspiring Kiwi Buyers

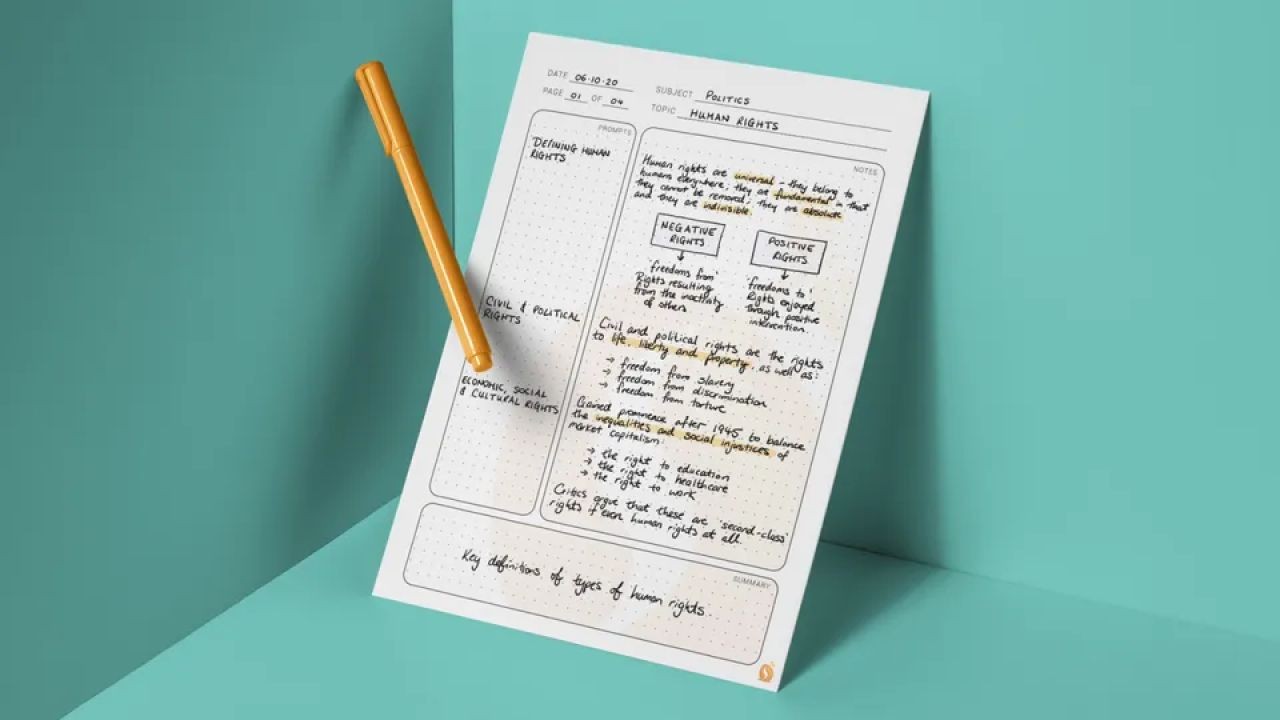

- Audit Your Eligibility Precisely: Don't rely on hearsay. Use the official Kainga Ora online tools to check your eligibility for the Grant and Loan based on your income, location, and the property price caps, which are updated regularly and vary by region.

- Factor in the Total Cost of "Affordability": A 5% deposit via a First Home Loan means a 95% mortgage. Calculate the higher interest rates typically applied to high-LVR (loan-to-value ratio) lending and the cost of mandatory Low Equity Premiums. The monthly repayment on a $950,000 loan is a different beast to one on a $900,000 loan.

- Engage a Financial Mentor Early: Organisations like FinCap provide free, independent financial mentoring. Before you commit to a government scheme, have a mentor stress-test your budget against potential interest rate rises and life changes.

The Great Debate: Empowerment or Inflation?

This leads us to the central, heated debate surrounding these policies. Are they a legitimate hand-up, or do they merely fuel the fire they claim to be extinguishing?

The Advocate Perspective: A Necessary Lifeline

Proponents argue that in the face of a market failure—where saving a 20% deposit requires Herculean sacrifice over a decade or more—targeted government intervention is not just beneficial but essential for social cohesion. They point to the over 140,000 first-home buyers who entered the market between 2020 and 2023, many undoubtedly aided by these schemes and the temporary removal of LVR restrictions. From this viewpoint, the schemes correct a market distortion caused by investor activity and insufficient supply, allowing "real" owner-occupiers to gain a foothold. The assistance is seen as restorative, helping to rebalance a system skewed towards capital gains over shelter.

The Critic Perspective: A Sugar-Hit on a Structural Problem

Critics, including many economists, contend that these policies are politically popular palliatives that ignore the disease to treat a symptom. The Reserve Bank of New Zealand has repeatedly warned that demand-side stimulants, without a corresponding surge in supply, lead to higher prices. The core issue, they argue, is a chronic shortage of well-located, affordable housing driven by restrictive planning laws (the RMA legacy), infrastructure funding challenges, and construction sector capacity limits. By boosting demand, deposit assistance can make it marginally easier for one individual to buy, but at the cohort level, it simply means buyers collectively bid more for the same limited stock. In practice, with NZ-based teams I’ve advised in the development sector, the consensus is that until zoning and infrastructure bottlenecks are decisively unlocked, demand-side tools will have limited long-term efficacy.

The Middle Ground: Conditionality and Supply Linkage

A emerging compromise suggests that the utility of deposit assistance is contingent on its design. Could grants be more impactful if tied to purchasing new builds, directly stimulating supply? The previous First Home Grant did offer higher caps for new builds. Furthermore, what if assistance was geographically weighted to encourage purchase in areas with greater development capacity, helping to catalyse growth in emerging hubs? This would require a more nuanced, place-based policy approach that connects the demand lever directly to a supply outcome.

Case Study: The First Home Partner – A Cautionary Tale in Shared Equity

Problem: In 2021, the government launched the First Home Partner scheme, a shared equity initiative where Kainga Ora would take a minority stake (up to 25%) in a property to reduce the buyer's required deposit and mortgage. The goal was to help low-to-middle income families into homeownership, particularly those struggling to save even with the existing grants. The scheme targeted a critical gap but faced immediate challenges of complexity, limited funding, and a fundamental tension: the government becoming a co-investor in an overheated market.

Action: Eligible applicants could secure a property with a 5% deposit, with Kainga Ora contributing an equity share. The buyer would then gradually buy out the government's share over time. The scheme was abruptly closed to new applicants in late 2023, just over two years after launch.

Result: While it helped several hundred families, the scheme's discontinuation highlights its pitfalls. The government cited "high demand" and the need to "manage its investment portfolio," but analysts pointed to the fiscal risk and administrative burden. For participants, the long-term implications of shared equity—such as how capital gains are split upon sale—were complex. The case study underscores how politically sensitive demand-side interventions can be: launched with fanfare as a bold solution, but often vulnerable to shifting fiscal priorities and market cycles.

Takeaway: Shared equity models are intellectually elegant but operationally fraught. For New Zealand, the experiment revealed a public appetite for innovative solutions but also the state's risk aversion as a direct market participant. Future models may need to involve the private sector or community housing providers to be scalable and sustainable.

Future Forecast: The Coming Recalibration

The trajectory of deposit assistance is inextricably linked to broader economic and political forces. We are moving into an era of recalibration.

First, the era of ultra-low interest rates that turbocharged borrowing capacity is over. The Reserve Bank's aggressive tightening cycle has fundamentally altered affordability calculations. A 2023 report from the NZ Productivity Commission starkly noted that housing affordability has deteriorated over decades due to both rising house prices and now rising interest rates. This new environment may see a shift in policy focus from deposit assistance towards mitigating mortgage stress, potentially through income-related supports or loan restructuring guidance.

Second, the political consensus is hardening around supply as the primary solution. The bipartisan support for medium-density zoning changes (MDRS) signals a recognition that land use reform is non-negotiable. The future of demand-side assistance will likely be judged on how well it complements this supply expansion. We may see a move towards "place-based" grants that incentivise purchasing in new growth areas or in specific types of housing (e.g., terraced houses, apartments) that the new zoning enables.

Finally, technology and data will enable more targeted, dynamic policies. Drawing on my experience in the NZ market, I foresee a move towards real-time eligibility systems that adjust price caps or income thresholds based on regional market data, making interventions more responsive and less distortionary.

Common Myths and Costly Mistakes

Navigating this landscape is riddled with misconceptions that can lead to financial missteps.

Myth 1: "The government grant is free money that gets me into the market." Reality: It is capital that increases your purchasing power, but without a comprehensive budget that includes rates, insurance, maintenance, and potential interest rate rises, it can facilitate entry into a situation of mortgage stress. A 2024 Consumer NZ survey highlighted that a significant portion of recent first-home buyers underestimated ongoing costs.

Myth 2: "Using a First Home Loan with a 5% deposit is always the smartest first step." Reality: The associated low-equity fees and higher interest rates can add tens of thousands to the cost of the loan over its life. In some cases, renting for an additional year to save a 10-15% deposit might lead to a lower total cost of ownership, despite rising prices.

Myth 3: "These schemes are only for young, single, first-time buyers." Reality: Eligibility extends to couples and families with dependents, with income thresholds adjusting accordingly. Furthermore, "second chancers" who have lost a home due to a relationship breakup or financial hardship may also qualify under specific conditions, a nuance often missed.

Biggest Mistakes to Avoid

- Maximising Your Borrowing Capacity: Just because a bank (aided by a government guarantee) will lend you $800,000, doesn't mean you should borrow it. Base your budget on a realistic assessment of future expenses, not a present-day stress test.

- Ignoring the Fine Print on New Builds: Using the grant for a new build off the plans seems ideal. But failing to have a sunset clause lawyer-review your contract can leave you exposed if construction is delayed and your pre-approval expires.

- Going it Alone: The process is complex. Not engaging a reputable mortgage broker who understands the intricacies of the Kainga Ora schemes can mean missing out on the best structure for your situation or even making an eligibility error that jeopardises your application.

A Controversial Take: The Quiet Subsidy to the Incumbent Market

Here is the uncomfortable, rarely stated truth: a significant portion of every First Home Grant and the risk covered by every First Home Loan guarantee ultimately transfers not just to the buyer, but to the vendor. In a negotiated sale, the knowledge that a buyer has a $10,000 grant or a 5% deposit loan can subtly inflate the final sale price. The vendor, often an existing homeowner or investor, captures a fraction of that public subsidy as capital gain. In this light, deposit assistance can be seen as a circuitous form of wealth transfer, using public funds to lubricate a transaction that, on aggregate, reinforces the existing wealth distribution tied to housing. It supports the entry of new players into the game, but also bolsters the winnings of those exiting. This is not an argument to abolish the schemes, but a critical lens through which to view their distributive justice. It forces the question: are we funding the dreams of first-home buyers, or are we underwriting the retirement plans of downsizers and the portfolios of investors? The answer, uncomfortably, is both.

Final Takeaways and Call to Action

- Fact: Deposit assistance schemes are vital lifelines for thousands but operate within a market where supply constraints limit their long-term affordability impact.

- Strategy: Use these schemes as a tool within a broader, patient financial plan. Prioritise understanding total loan costs over minimum deposit requirements.

- Mistake to Avoid: Viewing government assistance as a green light to stop due diligence. Your responsibility to research the property, the market, and your own finances is undiminished.

- Prediction: The next generation of housing policy will increasingly tie demand-side help to specific supply outcomes, such as purchases in new development zones or in "missing middle" housing typologies.

The path to homeownership in New Zealand is no longer a straightforward sprint but a complex navigational challenge requiring financial acuity, policy literacy, and tempered expectations. The state's deposit schemes are a map and a compass on this journey—essential tools, but not the terrain itself. The true destination—a stable, affordable, and equitable housing system—requires us to look beyond the immediate horizon of individual purchase and towards the structural reshaping of the landscape itself. The debate is not merely about finance; it is about the kind of society we wish to build and who gets to claim a foundational piece of it.

What's your experience? Have these schemes been a bridge or a mirage? Does the "quiet subsidy" critique resonate, or does it undervalue the genuine empowerment these policies provide? The conversation about New Zealand's housing future is one we must all own. Share your insights and continue the debate below.

People Also Ask (FAQ)

Can I use the First Home Grant and Loan together? Yes, they are designed to be complementary. The Grant can provide cash for part of your deposit, while the Loan can allow you to borrow the rest of the deposit to reach the minimum required. Your lender and a mortgage broker can structure this for you.

What happens if my income increases after I get a First Home Grant? Once the Grant is paid and the property is purchased, future income increases do not affect it. Eligibility is assessed at the time of application and pre-approval. However, you must intend to live in the home for at least six months.

Are there any government schemes for buying a section to build on? The First Home Grant can be used for a land-and-build package (a new home on a separate title) or for buying a section if you have a building contract in place to start within six months. The price caps for land are different and generally higher.

Related Search Queries

- Kainga Ora First Home Loan eligibility calculator 2024

- First Home Grant price caps Auckland Wellington Christchurch

- Pros and cons of First Home Loan vs saving 20% deposit

- New Zealand shared equity scheme alternatives

- How does the First Home Grant affect my mortgage approval?

- First home buyer schemes NZ 2024 income thresholds

- Can I use KiwiSaver for deposit with government grant?

- What replaced the First Home Partner scheme?

- First home buyer mistakes to avoid New Zealand

- Government housing affordability policy NZ 2024

For the full context and strategies on Deposit Schemes and Government Assistance for NZ Buyers Explained, see our main guide: Car Dealership Buyer Videos Nz.