For the astute investor, risk is not an abstract concept; it is a quantifiable variable to be managed, hedged, or exploited. In New Zealand, one of the most profound and persistent risks is not found on a balance sheet or in a market report, but in the very ground beneath our feet and the skies above. The seismic reality of our location on the Pacific Ring of Fire, coupled with increasingly volatile weather patterns, makes natural disasters a first-order financial consideration, not a peripheral 'act of God' footnote. To ignore this is to fundamentally misprice risk across entire asset classes, from direct property holdings to equity positions in locally exposed businesses. This guide moves beyond generic emergency kits to a strategic framework for assessing, pricing, and building resilience against geological and climatic shocks into your investment thesis.

The Investor's Calculus: Why Disaster Resilience is an Alpha Generator

Conventional wisdom often frames disaster preparedness as a cost centre—insurance premiums, retrofitting, redundant systems—all eroding bottom-line returns. This is a critical error in judgement. In practice, with NZ-based teams I’ve advised, I've observed that resilience is a potent source of competitive advantage and value preservation. A 2020 report from the Reserve Bank of New Zealand estimated that a major alpine fault earthquake could reduce GDP by 10% and collapse commercial property values by 40%. This isn't a hypothetical; it's a severe tail risk with a measurable probability. The investor who factors this in identifies assets with inherent resilience (or the potential for it) that the market may have undervalued. You are not just buying a building or a company; you are underwriting its continuity. This creates a tangible moat: tenants will pay a premium for demonstrably secure spaces, supply chains with proven redundancy attract better contracts, and companies that can operate through disruption capture market share from crippled competitors.

Key Actions for the NZ Investor Today

- Demand the Data: For any property or infrastructure investment, require a detailed seismic assessment (IL3 or IL4) and flood hazard report from the local council. Do not rely on superficial due diligence.

- Scrutinise Business Continuity Plans (BCPs): When evaluating a company, especially in logistics, agriculture, or tourism, request their BCP. A vague plan is a red flag for operational risk.

- Map Concentrated Exposure: Audit your portfolio for geographic concentration. Are you over-exposed to Wellington's seismic risk or Northland's flood plains? Diversify regionally as a hedge.

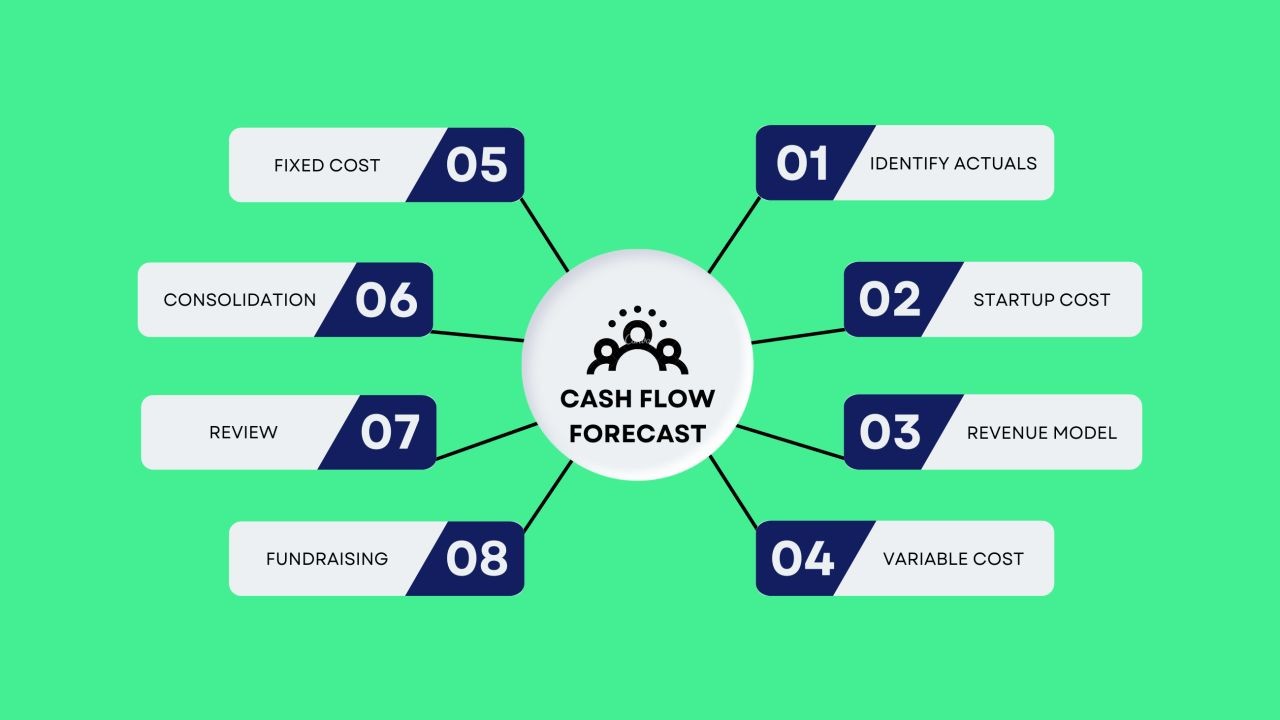

A Step-by-Step Guide to Disaster-Proofing Your Investment Portfolio

This is a systematic process, moving from macro-assessment to micro-specific actions. It applies whether you hold a single rental property or a diversified fund.

Step 1: The Macro-Geographic Risk Audit

Begin with a portfolio-wide lens. Utilise New Zealand's publicly available hazard tools. The GNS Science seismic hazard model and local council Flood Hazard Maps (under the National Policy Statement for Freshwater Management) are non-negotiable starting points. Overlay your asset locations. From consulting with local businesses in New Zealand, I've seen too many operations set up in high-flood zones because "it's never happened before." Historical data is insufficient; you need probabilistic modelling. This audit will immediately flag high-risk concentrations.

Step 2: Asset-Level Resilience Assessment

Drill down into each asset. For physical assets (property, infrastructure), this means engineering reports. For commercial equity, it means analysing the company's operational resilience. Key questions include:

- Physical Integrity: What is the building's New Building Standard (NBS) percentage? Below 67% is considered earthquake-prone and a major liability.

- Supply Chain Vulnerability: How many single points of failure exist? A manufacturer reliant on a single bridge for logistics is a high-risk bet.

- Insurance Landscape: Is insurance obtainable, and at what cost? Rising premiums in coastal areas are a leading indicator of long-term value erosion.

Step 3: The Resilience Investment Decision

Here, you quantify the cost of inaction versus the investment in mitigation. For a property, calculate the net present value (NPV) of retrofitting to a higher NBS standard versus the potential loss of rental income, asset value, and liability in a quake. For a business, model the cost of implementing cloud-based data redundancy and secondary suppliers against the projected revenue loss from a weeks-long disruption. Drawing on my experience in the NZ market, the ROI on resilience investments often becomes positive when you model a realistic disaster scenario over a 10-year horizon.

Step 4: Continuous Monitoring and Stress Testing

Disaster risk is dynamic. Climate change is altering flood plains and storm intensity. New construction can change local seismic responses. Your assessment cannot be a one-time tick-box exercise. Implement an annual review cycle that re-evaluates hazard data, insurance renewals, and the state of local infrastructure critical to your assets.

Case Study: The Resilience Premium in Action – Port of Tauranga vs. Theoretical Disruption

Problem: As New Zealand's largest port, handling over 35% of the country's total trade, the Port of Tauranga is a critical, concentrated asset. Its operational continuity is paramount to the national economy. A major seismic event on the nearby Kerepehi Fault, or a severe cyclone disrupting shipping lanes, could halt a significant portion of NZ's import/export capacity, with catastrophic ripple effects.

Action: The Port's strategy has been multi-layered resilience. This includes significant investment in wharf strengthening to high seismic standards, diversified landside transport links (rail and road), and sophisticated weather monitoring and vessel traffic systems. Furthermore, its business model as a hub port with "MetroPort" facilities in Auckland creates inherent redundancy. Based on my work with NZ SMEs in the logistics sector, this level of investment is atypical but defines market leadership.

Result: While a direct disaster has not struck, the resilience premium is observable. The Port maintains its license to operate and secure insurance in a challenging market. It attracts long-term contracts from major exporters who prioritise supply chain certainty. Financially, it has consistently delivered strong returns and robust valuations, partly because the market prices in its systemic importance and reduced operational risk. The takeaway for investors is that in infrastructure and logistics, resilience translates directly into lower risk premiums and stronger competitive moats.

The Great Debate: Insurance as a Hedge vs. Resilience as an Investment

A fundamental tension exists in disaster risk strategy. Let's contrast the two dominant philosophies.

✅ The Insurance-Centric View (The Hedge)

Advocate Perspective: This traditional view holds that insurance is the most efficient tool for transferring catastrophic risk. The argument is that pooling risk across a large portfolio allows insurers to provide coverage at a cost lower than the potential ruinous loss for an individual investor. The capital required for major resilience upgrades (e.g., lifting a building's NBS from 34% to 100%) is better deployed elsewhere in the portfolio for higher returns. The investor's job is simply to secure comprehensive, well-structured cover at a competitive price.

❌ The Resilience-Centric View (The Investment)

Critic Perspective: This school argues that insurance is becoming a broken hedge in New Zealand. Premiums for disaster coverage are skyrocketing, deductibles are increasing, and some risks (like certain flood zones) are becoming uninsurable. Relying solely on insurance leaves you exposed to liquidity crunches post-event (claim delays) and long-term value destruction even if a claim is paid. A building that collapses loses its tenants permanently, regardless of the insurance payout. The critic sees insurance as a complement to, not a replacement for, physical and operational resilience.

⚖️ The Pragmatic Middle Ground

The sophisticated investor adopts a blended model. Use insurance for the true 'tail risk'—the catastrophic, high-severity, low-probability event. Simultaneously, invest in resilience for the 'high-probability, medium-severity' events that are more likely to occur within your investment horizon (e.g., a moderate quake causing 3-6 months of downtime). This approach reduces insurance premiums (by lowering the insurer's expected loss), protects asset income streams, and preserves long-term capital value. It is a direct investment in the asset's enduring cash-flow-generating capability.

Common Myths and Costly Mistakes in Disaster Risk Assessment

Misconceptions here are not just academic; they lead to direct financial loss.

Myth 1: "My investment is safe because it's modern / built to code." Reality: Building codes are minimum standards for life safety, not property preservation. A building built to the 1992 code may not collapse in a quake (protecting lives), but it could be so badly damaged it's uneconomic to repair. The NBS percentage is the critical metric, not the year of construction.

Myth 2: "The EQC cover of $150,000 plus my insurance will make me whole." Reality: EQCover is for residential land and dwellings, not commercial assets. For commercial property, complex co-insurance clauses, under-insurance due to rising rebuild costs, and lengthy settlement processes can leave a massive funding gap. A 2023 report from the Insurance Council of New Zealand highlighted that under-insurance is endemic, with many businesses covered for less than 80% of their true replacement value.

Myth 3: "Disaster risk is only relevant for direct property investors." Reality: Equity investors are equally exposed. A listed retailer with all its distribution centres in one seismically active area, or a tourism operator reliant on a single fragile access route, carries embedded disaster risk that is rarely fully priced by the market. This is an opportunity for diligent fundamental analysis.

Biggest Mistakes to Avoid

- ❌ Relying on Anecdote Over Data: "It hasn't flooded in 50 years" is a recipe for disaster. Use the official hazard maps, which are based on probabilistic modelling, not historical records alone.

- ❌ Treating Insurance as a Set-and-Forget Cost: Annually review your sum insured, policy exclusions (e.g., storm surge vs. rainfall flooding), and the financial health of your insurer.

- ❌ Ignoring Indirect Exposure: Your warehouse may be safe, but if your key supplier's factory is in a liquefaction zone, your investment is still at high risk. Map your entire value chain.

The Future of Disaster Investing: Climate Adaptation and New Asset Classes

The landscape is evolving from risk mitigation to opportunity capture. The MBIE's National Climate Change Risk Assessment lays bare the fiscal exposure. This drives several investable trends:

- Adaptation Infrastructure: Significant public and private capital will flow into sea walls, managed retreat projects, resilient water and transport networks. Companies specialising in climate-adaptive engineering and construction will see tailwinds.

- Parametric Insurance: Watch for growth in instruments that pay out based on a triggering event (e.g., earthquake magnitude at a specific location) rather than assessed loss, providing faster liquidity. This is a developing field in NZ's capital markets.

- Resilience as a Service: From my experience supporting Kiwi companies, we will see the rise of firms offering "resilience audits," cloud-based continuity platforms, and disaster recovery-as-a-service, creating a new tech sub-sector.

Prediction: By 2030, a standard part of equity analyst reports on NZX-listed companies will include a "Resilience Score" assessing their exposure and preparedness for natural hazards, directly impacting valuations.

Final Takeaways: The Resilient Investor's Checklist

- ✅ Reframe Resilience: Treat it not as a cost, but as a capital-preserving, cash-flow-protecting investment that builds competitive moats.

- ✅ Quantify Everything: Move from qualitative worry to quantitative analysis. Use NBS ratings, flood maps, and probabilistic loss modelling.

- ✅ Adopt the Blended Model: Hedge tail risk with insurance, but invest in resilience for probable events. This optimises long-term ROI.

- ✅ Think Systemically: Your asset's risk is defined by its own resilience and that of its critical dependencies—power, water, suppliers, transport links.

- ✅ Look for the Mispricing: The market often under-prices embedded disaster risk. Your diligence in uncovering and mitigating it is a direct source of alpha.

People Also Ask (FAQ)

How does climate change specifically alter disaster risk for NZ investors? Climate change intensifies hydrological risks—more severe rainfall events causing flooding, and sea-level rise exacerbating coastal erosion and storm surge. This is materially devaluing exposed coastal property and infrastructure, a trend already reflected in rising insurance premiums and stricter lending criteria from banks like ANZ and Westpac.

What is the single most important document to review for a property investment in NZ? The Land Information Memorandum (LIM) from the local council is critical. It will detail known hazards, including seismic, flood, and landslide risks, as well as the building's compliance history. Never purchase commercial or significant residential property without a current LIM.

Are there any NZ-focused funds or ETFs that specialise in resilient infrastructure? While no pure-play ETF exists yet, investors can look to listed entities with resilient asset portfolios, such as Infratil (which invests in digital infrastructure, renewable energy, and airports) or companies within the utilities and regulated infrastructure sectors that are mandated to invest in climate adaptation.

Related Search Queries

- NZ earthquake prone building register commercial

- How to calculate NBS rating for investment property

- Climate change adaptation investment opportunities New Zealand

- Business continuity plan template NZ SME

- Port of Tauranga seismic resilience strategy

- Insurance Council NZ underinsurance report 2024

- GNS Science seismic hazard model investor guide

- Resilient infrastructure stocks NZX

- Cost benefit analysis seismic retrofit commercial building

- MBIE National Climate Change Risk Assessment for investors

For the full context and strategies on Natural disaster preparedness and recovery (e.g. – What Smart New Zealanders Are Doing Differently, see our main guide: Virtual Open Homes Walkthroughs Videos Nz.