For over two decades, New Zealand’s film and television production sector has been a remarkable economic and creative success story, often viewed through the prism of a single, world-changing franchise. However, to perceive the current landscape as merely the legacy of "The Lord of the Rings" is to misunderstand a far more complex and strategically evolving industry. Today, the sector operates as a sophisticated, high-value export engine, navigating a volatile global market, intense international competition for footloose capital, and the profound technological shifts of the digital era. Based on my work with NZ SMEs and service providers within this ecosystem, the boom presents not just glittering opportunities but also significant, under-discussed vulnerabilities that demand a cautious, strategic approach from investors, policymakers, and ancillary businesses seeking to engage.

Deconstructing the Engine: How New Zealand's Production Boom Actually Works

The sector's resilience is not accidental; it is the product of a deliberate, multi-layered strategy. Understanding this framework is crucial for any entity considering exposure to this market.

The Strategic Pillars of Sustained Growth

- The 20% Uplift & International Footloose Production (IFP): The cornerstone is the New Zealand Screen Production Grant (NZSPG), offering a 20% cash rebate on qualifying expenditure for large-budget international productions. This is a direct, competitive response to incentives offered by the UK, Canada, Australia, and others. The goal is to attract "footloose" capital—projects with no inherent geographical tether that will go where the financial and logistical equation is most favourable. Data from the Ministry for Business, Innovation and Employment (MBIE) underscores its impact: in the 2022/23 year, the grant supported 32 projects with $324 million in grants, generating an estimated $1.7 billion in total production expenditure.

- The Infrastructure & Expertise Flywheel: Success begets capability. Major productions have driven investment in world-class physical infrastructure—from Peter Jackson’s Park Road Post Production and Wētā FX to numerous independent sound stages and specialist workshops. Critically, it has cultivated a deep, experienced talent pool across all crafts, from VFX artists and armourers to line producers and location managers. This creates a self-reinforcing cycle: incentives attract projects, which build infrastructure and skills, which in turn make the country more attractive for future, often more complex, projects.

- The Indigenous & Local Storytelling Counterweight: Alongside the IFP stream, significant public funding via NZ On Air and the NZSPG’s local component fuels domestic television and film. This is not merely cultural policy; it is a strategic risk mitigation. In my experience supporting Kiwi companies in the creative sector, a robust local industry provides baseline employment, retains talent during gaps between mega-projects, and fosters the creative innovation that occasionally erupts into global phenomena like "Taika Waititi’s *Boy*" or "Jane Campion’s *The Power of the Dog*."

A Critical, Data-Backed Industry Insight: The Concentration Risk

Here lies the most significant, yet seldom highlighted, vulnerability. The industry’s health is disproportionately tied to a very small number of extremely high-value decisions. MBIE’s own data reveals this stark reality: in 2022/23, a single large-budget feature film project can account for over 40% of the total annual qualifying expenditure for the entire international grant. This creates a "feast or famine" dynamic. A decision by a Hollywood studio to delay or relocate a single $200M+ production can instantly wipe hundreds of millions from forecast GDP and place thousands of contractors in precarious positions. Drawing on my experience in the NZ market, this concentration risk is the single largest strategic challenge facing the sector, making it highly sensitive to global currency fluctuations, competing subsidy wars, and the shifting priorities of a handful of studio executives.

Actionable Framework for NZ Businesses: The Ancillary Opportunity Matrix

For New Zealand businesses outside the core creative fields, the boom presents adjacent opportunities. A cautious evaluation using a simple 2x2 matrix can clarify strategic fit:

- High-Directness, High-Volatility (Proceed with Extreme Caution): Direct service provision to productions (e.g., specialist transport, high-end catering, construction). High revenue potential but directly exposed to production stop/starts and payment cycles tied to offshore financing.

- High-Directness, Lower-Volatility (Strategic Partnership): Providing essential, recurring services to the permanent infrastructure (e.g., IT support for post-production houses, waste management for studio complexes). More stable, but requires deep industry relationships.

- Lower-Directness, High-Volatility (Speculative): Tourism ventures purely linked to film locations. Highly susceptible to the "pop culture" lifecycle of individual franchises.

- Lower-Directness, Lower-Volatility (Most Sustainable): Leveraging the sector’s global brand for broader economic benefit. Examples include education exports (film schools), selling premium NZ products (food & beverage, apparel) into production supply chains, or using the "NZ-made" creative excellence story to bolster other export sectors.

Next steps for Kiwi businesses: Conduct a rigorous audit to place your offering within this matrix. For most SMEs, targeting the lower-left quadrant (leveraging the brand) or forming stable partnerships with infrastructure players (upper-right) offers a more sustainable path than direct, volatile service provision.

Future Forecast & Navigating the Coming Disruption

The next five years will be defined by three intersecting forces that will test the sector’s current model.

1. The Global Subsidy War Escalation

The 20% rebate is no longer a unique advantage. Multiple jurisdictions now offer 25-30% or more. New Zealand cannot, and arguably should not, compete in a race to the bottom on pure fiscal terms. The future advantage must be sold on total value: unparalleled scenery, a cohesive and experienced crew base, streamlined permitting, and political stability. From consulting with local businesses in New Zealand, I observe that this requires a "Team NZ" approach, where regional film offices, infrastructure providers, and guilds collaborate seamlessly to reduce production friction—a tangible value that can offset a marginally lower rebate.

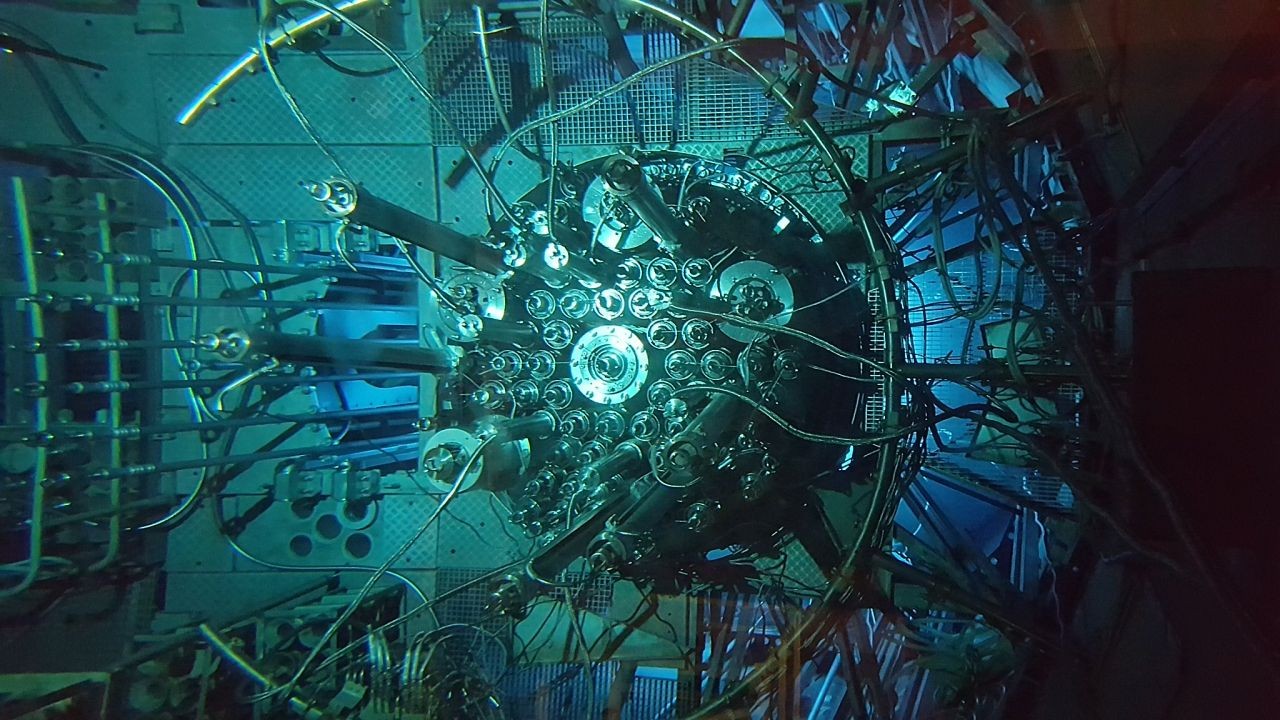

2. The Generative AI Revolution in Post-Production

This is the sector’s existential technological shift. Generative AI threatens to disrupt the core value proposition of large-scale VFX and post-production houses, including national champions like Wētā FX. While AI can drive down costs and time for certain tasks, it commoditises elements of the craft and could redistribute work globally. The strategic response must be twofold: first, a relentless focus on the high-end, creative-director-led work that AI cannot replicate (the "artist in the loop" model); second, aggressive investment in developing and owning proprietary AI toolsets. The recent establishment of the New Zealand Screen Alliance’s "Future of Work" group is a positive, but urgent, step.

3. The Demand Shift: Streaming Plateau & Content Recalibration

The streaming gold rush that fuelled the "Peak TV" era is cooling. Major platforms are prioritising profitability over subscriber growth at any cost, leading to more selective, often lower-budget, greenlights. This pressures the mid-budget international project—a staple for NZ. The counter-trend is the continued health of mega-budget "tentpole" franchises (e.g., Marvel, Avatar) and the enduring appeal of high-quality, distinct local stories for global audiences. New Zealand’s strategy must therefore be bifurcated: fiercely compete for the ever-larger tentpoles while doubling down on developing and financing unique intellectual property (IP) that can cut through the global noise.

Key actions for strategic readers: Monitor MBIE’s periodic reviews of the NZSPG for any adjustment to the rebate rate or qualifying thresholds. For investors, prioritise companies with strong IP ownership and AI R&D strategies over pure service providers.

A Cautious Evaluation: The Inherent Pros and Cons

A balanced strategic assessment requires a clear-eyed view of the sector’s inherent characteristics.

✅ Significant Advantages (Pros)

- High-Value Export Earnings: Generates foreign exchange with a high GDP multiplier effect. Every dollar of the rebate pulls in approximately $5.25 in total spend, according to MBIE evaluations.

- Employment & Skill Development: Creates high-skill, well-paid jobs across both technical and creative fields, fostering a "smart" economy.

- Brand Amplification for New Zealand: Provides an immeasurably valuable global marketing platform for tourism, trade, and talent attraction, far beyond the direct economic return.

- Cluster Development: Has successfully created a globally competitive innovation cluster in screen technology and production.

❌ Material Risks & Drawbacks (Cons)

- Extreme Volatility & Concentration Risk: As outlined, the sector is vulnerable to a few key decisions, leading to boom-bust cycles that strain the workforce and service businesses.

- Subsidy Dependence: The model is fundamentally built on a government-funded incentive. This creates ongoing fiscal liability and exposure to political policy shifts.

- Footloose Capital: The international production attracted is inherently transient. It builds local skills but can depart suddenly, with limited long-term IP retention for New Zealand.

- Infrastructure & Social Pressure: Concentrated production can strain local infrastructure (housing, traffic) and create location-specific community disruption, risking the "social license" to operate.

- Wage & Cost Inflation: Can drive up costs (e.g., accommodation, skilled labour) for other local industries, creating economic distortion.

Common Strategic Myths and Costly Misconceptions

Several persistent beliefs can lead to poor investment and policy decisions.

Myth 1: "The sector is now self-sustaining and the public subsidy can be wound back." Reality: This is the most dangerous assumption. The global market for mobile production is a pure monopsony. With dozens of competing jurisdictions offering incentives, removing or significantly reducing the NZSPG would result in a rapid exodus of major projects, as witnessed in other countries that tried to pull back support. The subsidy is not a starter motor; it is the ongoing fuel in a highly competitive race.

Myth 2: "Success is measured by the number of blockbusters filmed here." Reality: A healthier metric is the diversity and sustainability of the production slate. An ecosystem reliant on one $500M film is far riskier than one hosting five $100M films and a steady stream of local drama. Resilience lies in a balanced portfolio. In practice, with NZ-based teams I’ve advised, we stress the importance of tracking the ratio of international to local expenditure as a key health indicator.

Myth 3: "All economic spillover is positive and automatic." Reality: Spillover must be actively managed. Without deliberate strategies—like structured work placements, local supplier development programs, and IP co-investment—the benefits can remain narrowly confined to a core group of practitioners and leave little lasting legacy. The recent "Hiring New Zealanders" and supplier development initiatives within the NZSPG are direct responses to this challenge.

The Controversial Take: Is the "Hobbit Law" Legacy a Strategic Weakness?

A lingering, contentious element of the sector’s structure is the classification of many screen production workers as independent contractors rather than employees, stemming from the 2010 "Hobbit law" negotiations. Proponents argue this flexibility is essential for the project-based nature of the work and keeps New Zealand competitive. However, a critical analysis suggests this creates a significant long-term strategic vulnerability.

It transfers substantial risk—income volatility, lack of sick pay or training investment, and retirement planning burdens—onto individuals. This can deter new entrants, exacerbate skill shortages during booms, and lead to talent burnout or attrition to more stable industries (or countries with stronger worker protections). For a sector whose true asset is its human capital, a model that systematically undermines the financial security and career longevity of that capital is fraught with risk. The middle ground may lie in industry-led solutions, such as portable benefits schemes or collective bargaining agreements that provide stability without sacrificing all flexibility, ensuring New Zealand retains its most precious resource: its people.

Final Strategic Takeaways for Decision-Makers

- Fact: The screen sector is a valuable but volatile export industry, contributing approximately $3.3 billion to GDP (Stats NZ, 2023), not a guaranteed cultural right.

- Strategy: Diversification is the paramount strategic objective—across project size, genre, and source market—to mitigate concentration risk.

- Mistake to Avoid: Underestimating the existential threat and opportunity of Generative AI. This requires proactive R&D investment, not reactive adaptation.

- Pro Tip: For ancillary businesses, build your model around the sector’s permanent infrastructure and global brand, not the fleeting presence of any single production.

Conclusion: A Call for Strategic Stewardship, Not Complacency

New Zealand’s film and television production boom is a formidable achievement, but it is not a permanent state. It is a dynamic, high-stakes enterprise that requires continuous, strategic stewardship. The path forward demands a cautious balance: defending competitive advantages while boldly investing in future capabilities; welcoming global capital while deepening local IP ownership; and celebrating creative success while building a more resilient and equitable ecosystem for the workforce that powers it. The question for executives and policymakers is not how to rest on past laurels, but how to strategically de-risk and future-proof this critical industry for the next act.

What’s your strategic view on the sector’s biggest vulnerability? Is it the subsidy dependence, the concentration risk, or the technological disruption? We welcome your insights below.

People Also Ask (PAA)

How does the film boom impact New Zealand's broader economy? It acts as a high-value export, with MBIE estimating a $5.25 GDP return per $1 of incentive. It drives tourism, supports hundreds of SMEs in service supply chains, and elevates the "NZ Inc." brand globally, though benefits require active management to ensure wide distribution.

What is the biggest threat to New Zealand's film production sector? The greatest threat is a combination of extreme concentration risk (reliance on a few mega-projects) and escalating global subsidy wars. A decision by one major studio to film elsewhere, or a competing country raising its rebate, can instantly create a significant economic downturn within the sector.

Can New Zealand develop its own sustainable film industry beyond big-budget imports? Yes, but it requires a dual strategy. It involves using the revenue and skills from international projects to strategically invest in local IP development and co-productions, while ensuring public funding for local content is robust and focused on commercial potential as well as cultural value.

Related Search Queries

- New Zealand Screen Production Grant 2024 application

- Economic impact of film industry New Zealand statistics

- Wētā FX AI technology future

- New Zealand film crew jobs demand forecast

- Comparing film subsidies NZ vs Australia vs Canada

- New Zealand film industry challenges 2024

- How to invest in New Zealand film projects

- Impact of streaming services on NZ production

- New Zealand film location tourism trends

- MBIE screen sector report latest data

For the full context and strategies on 10. Exploring New Zealand's Film and TV Production Boom. – How It’s Shaping New Zealand’s Future, see our main guide: Why Vidude.