In the high-stakes arena of international business and geopolitics, reputation is a currency more valuable than gold. The recent diplomatic incident involving an Australian citizen facing severe legal consequences abroad, and the Prime Minister's firm declaration that Australia "has not abandoned" them, is not merely a news headline. For Australian executives and strategic leaders, it is a powerful case study in national brand management, stakeholder trust, and the intricate dance of sovereign risk. This moment crystallizes a critical business truth: how a nation—or a corporation—stands by its people in crisis defines its credibility for decades. The strategic implications for Australian businesses operating globally are profound, directly impacting talent mobility, investment security, and the very perception of the 'Australian' brand on the world stage.

The Strategic Calculus of Sovereign Support: A 2x2 Risk Matrix

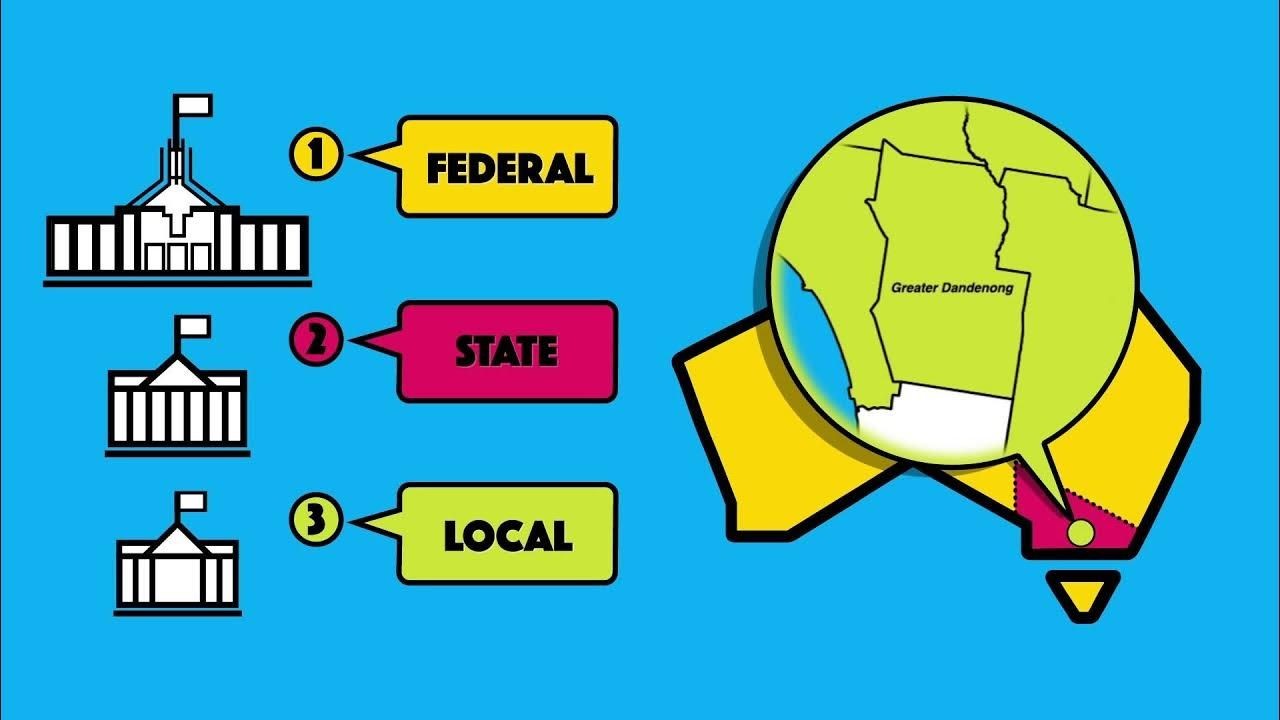

When a citizen faces legal peril internationally, a government's response is a high-velocity signal to multiple stakeholders. We can model this using a 2x2 Sovereign Support Matrix, plotting Diplomatic Assertiveness against Perceived Commitment to Citizen Welfare.

- High Assertiveness / High Commitment (The Trust Anchor): This quadrant, where clear, firm diplomatic action is paired with unwavering public support for the individual, builds immense national brand equity. It signals to businesses, expatriates, and investors that operating under that nation's flag carries a tangible layer of security. This is the quadrant of long-term trust.

- High Assertiveness / Low Commitment (The Transactional Player): Here, diplomacy may be vigorous, but the narrative centers on state interests over the individual. This creates a cold, calculative brand, potentially deterring top talent who seek assurance of personal backup.

- Low Assertiveness / High Commitment (The Sympathetic Bystander): While expressing concern, a lack of decisive action projects weakness. It undermines the nation's negotiating power and can embolden adverse actions against its citizens and businesses elsewhere.

- Low Assertiveness / Low Commitment (The Abandonment Zone): The most damaging position, eroding trust catastrophically. For businesses, this dramatically increases the perceived risk premium of international operations.

The Prime Minister's statement is a deliberate move to anchor Australia in the first quadrant. From consulting with local businesses across Australia, I've seen how this perception directly influences decisions. An Australian mining executive in Southeast Asia or a fintech startup founder in Silicon Valley inherently weighs the 'consular support factor' into their personal risk assessment. A strong sovereign backstop becomes a competitive advantage in attracting the bold, globally mobile talent that drives innovation.

Reality Check for Australian Businesses: Beyond the Headlines

While the government manages the macro-diplomatic front, Australian enterprises cannot be passive observers. There is a dangerous misconception that sovereign risk is exclusively a concern for governments and large resource companies. The reality is far more granular.

Myth: "Consular support is a government issue; our HR policies cover employee safety abroad." Reality: Standard travel insurance and generic risk protocols are woefully inadequate for complex legal-political crises. They address medical emergencies, not 15-year judicial processes. Businesses have a duty of care that extends into the diplomatic realm, requiring proactive strategies.

Myth: "This only affects individuals in high-risk jurisdictions." Reality: Geopolitical tensions are fluid. A nation considered stable for investment today can rapidly change its posture. The 2023 Australian Department of Foreign Affairs and Trade (DFAT) Consular State of Play report highlights that consular cases are rising in traditionally 'low-risk' countries due to shifting legal landscapes and political tensions. Complacency is a direct liability.

Drawing on my experience in the Australian market, I've advised companies whose employees have been detained over intellectual property disputes in Europe and faced arbitrary taxation penalties in Africa. The common thread was an initial lack of preparedness for the non-physical threats that can immobilize key personnel and operations.

A Proactive Framework for Corporate Sovereign Risk Mitigation

Australian businesses must institutionalize geopolitical and sovereign risk into their core strategy. Here is a four-pillar actionable framework:

Pillar 1: Pre-Deployment Intelligence & Training

- Conduct Hyper-Local Legal Audits: Beyond standard travel briefs, engage local counsel in the operational jurisdiction to provide specific briefings on laws that can ensnare foreign businesspeople (e.g., digital data laws, financial reporting, employment regulations).

- Mandatory 'Crisis Drill' Training: Employees slated for international roles should undergo training that includes a simulated detention or legal challenge scenario. Who do they call first? What should they *not* say? This reduces panic and ensures protocol adherence.

Pillar 2: Embedded Government & Expert Networks

- Formalize DFAT & Austrade Engagement: Don't just rely on public advisories. Proactively brief Australian government trade and diplomatic posts about your company's operations and key personnel in their region. This establishes a prior relationship that is invaluable in a crisis.

- Retain Specialized Crisis Firms: Have contracts in place with firms specializing in international legal crisis management and extraction. Their response time in the first 48 hours is critical.

Pillar 3: Robust Insurance & Financial Logistics

- Secure Specialized Risk Insurance: Invest in policies that cover legal defence costs, bail bonds, and family support logistics for employees facing foreign legal proceedings—coverage that standard policies exclude.

- Establish a Rapid-Response Fund: Maintain an accessible fund to cover immediate legal retainers and logistical costs without waiting for internal procurement processes.

Pillar 4: Strategic Communication Protocol

- Develop a Tiered Communication Plan: Define clear messaging protocols for internal stakeholders, the media, and government partners. Coordinate tightly with DFAT to ensure public and private messaging are aligned and constructive, avoiding narratives that could complicate delicate negotiations.

The Broader Economic Imperative: Safeguarding Australia's Global Brand

This is not just about individual welfare; it's about protecting a key national economic asset. The 'Australian brand' internationally is built on trust, fairness, and reliability. According to the Australian Bureau of Statistics, in 2023-24, over 1 million Australian residents travelled overseas for business purposes, underscoring the scale of our global footprint. Each of these individuals is a brand ambassador, and their safety is paramount to continued economic engagement.

When the government demonstrates steadfast support, it reinforces that Australia is a serious and reliable partner that looks after its own. This reduces the risk premium for foreign partners engaging with us and makes Australian companies more attractive joint-venture partners abroad. In practice, with Australia-based teams I’ve advised, we've leveraged this strong national reputation as a competitive differentiator in contract negotiations, explicitly linking our country's stable governance and rule-of-law ethos to project delivery security.

Future Trends & The Evolving Risk Landscape

The nature of sovereign risk is evolving rapidly, and Australian businesses must look ahead:

- The Rise of 'Lawfare': The use of legal systems as instruments of geopolitical pressure will increase. Businesses may be targeted through their employees to gain economic or intellectual property leverage.

- Digital Sovereignty Conflicts: Employees could face liability under conflicting data localization and cyber laws between their home country and operation country. This requires new layers of legal clarity.

- Proactive Government-Business Partnerships: We will likely see the development of more formalized, pre-crisis briefing sessions between DFAT and peak industry bodies, moving from reactive consular support to proactive risk mitigation partnerships.

Final Takeaway & Call to Action

The Prime Minister's statement is a powerful reaffirmation of a national strategic asset: trust. For Australian executives, the mandate is clear. Sovereign risk can no longer be an afterthought in boardroom discussions about international expansion. It must be a central pillar of your ESG (Environmental, Social, and Governance) framework, your talent strategy, and your operational risk models.

Your Immediate Action Plan:

- Audit: Review your current international deployment protocols. Do they address complex legal-political crises?

- Integrate: Schedule a briefing with DFAT's business engagement unit to understand the support landscape for your key markets.

- Invest: Allocate budget for specialized insurance and pre-vetted crisis response partners.

- Train: Implement mandatory crisis simulation training for all employees with international responsibilities.

In an uncertain world, the businesses that thrive will be those that prepare for the improbable. Protecting your people is the ultimate demonstration of strategic leadership and the surest way to safeguard your global ambitions. The nation has signaled its stance; the question for every Australian boardroom is: have you?

People Also Ask

How does sovereign risk impact Australian SMEs going global? SMEs are often most vulnerable, lacking the large legal departments of corporates. A legal crisis abroad can consume capital and leadership focus, potentially bankrupting the business. Proactive, scaled risk mitigation is essential for sustainable international growth.

What are the first steps a company should take if an employee is detained overseas? Immediately contact the 24/7 Consular Emergency Centre (DFAT) and follow their guidance. Simultaneously, activate your pre-arranged crisis management firm. Ensure all internal communication is controlled and coordinated with official advice to avoid escalating the situation.

Is this type of risk covered under Directors' and Officers' (D&O) insurance? Typically, no. Standard D&O insurance covers wrongful acts in managing the company, not personal legal issues of employees abroad. This gap underscores the need for the specialized insurance outlined in the corporate framework.

Related Search Queries

- Australian consular support for business travellers

- Managing geopolitical risk for Australian companies

- DFAT business engagement and risk mitigation

- International employee duty of care Australia

- Sovereign risk insurance Australia

- Global mobility risk management framework

- Australia's international business reputation

- Legal crisis management firms Australia

For the full context and strategies on Albanese insists Australia 'has not abandoned' Australian fighter facing 15-year jail term – Why It’s Making Headlines Across the Country, see our main guide: Digital Media Content Videos Australia.