The annual surge in gym memberships, fitness app downloads, and health food purchases every January is as predictable as the summer heat. For investors, this cyclical behaviour is more than a cultural curiosity; it's a multi-billion-dollar market pulse, driven by intention but often defined by attrition. Understanding the gap between resolution and reality isn't just about human psychology—it's about identifying sustainable business models, separating fad-driven revenue from recurring income, and spotting the companies built to last beyond February's motivational slump. The Australian fitness and wellness sector, valued in the billions, hinges on this very tension.

The Australian Resolution Landscape: A Data-Driven Snapshot

Australians are prolific resolution-makers. A 2023 study by the University of Sydney's Charles Perkins Centre found that over 60% of Australian adults set a New Year's resolution, with health and fitness goals dominating the list. However, the same research indicates that fewer than 10% maintain these changes beyond six months. This creates a stark economic dichotomy: a massive Q1 revenue spike for the industry, followed by a steep decline in user engagement and retention.

From an investment perspective, this pattern is critical. It separates companies with a transactional, resolution-dependent model from those with a genuine engagement engine. Drawing on my experience in the Australian market, I've observed that businesses which thrive are those that architect their customer journey around this predictable drop-off, using behavioural science and community-building to create 'stickiness' where others see churn.

Where Most Fitness Brands Go Wrong

The fundamental error many companies make is conflating a surge in sign-ups with sustainable growth. They build financial projections on January numbers, only to face a cash flow crunch by mid-year. This strategic misstep is often rooted in several flawed assumptions.

- Myth: "New customers in January are just as valuable as those acquired in July."

- Reality: January cohorts typically have significantly higher acquisition costs (due to competitive marketing) and lower lifetime values. They are often price-sensitive 'resolutioners' rather than committed lifestyle adopters. A 2024 report by fitness industry analysts, IBISWorld, noted that customer acquisition costs for Australian gyms can spike by up to 40% in Q1, while the retention rate for this cohort is 30-50% lower than for other quarters.

- Myth: "A great product alone will ensure retention."

- Reality: Habit formation is the product. The most successful companies invest not just in equipment or content, but in systems that foster routine—automated check-ins, milestone celebrations, and social accountability features. Based on my work with Australian SMEs in the wellness tech space, the key differentiator for the successful ones was a relentless focus on reducing 'friction' in the user's daily routine, not just adding more features.

- Myth: "The market is saturated; growth is only possible by stealing market share."

- Reality: The real growth frontier is increasing the lifetime value of the existing, committed user base through vertical integration—offering nutrition planning, recovery services, or connected apparel. This transforms a gym membership or app subscription into a holistic health ecosystem.

Case Study: The Transformation of a Traditional Gym Chain

Case Study: Plus Fitness – Pivoting from Access to Community

Problem: Plus Fitness, a large Australian franchise gym chain with a low-cost, 24/7 model, faced the industry-standard resolution rollercoaster. Their model was built on high volume and predictable attrition, with many January joiners cancelling after 3-4 months. This led to revenue volatility and constant pressure on marketing spend to refill the funnel.

Action: Instead of just accepting the churn, the company strategically invested in building digital community infrastructure. They launched a member-exclusive app that went beyond booking. It included:

- On-demand workout classes for at-home continuity.

- Challenges and leaderboards connecting members across different franchise locations.

- Direct messaging with trainers for form checks and motivation.

- Integration with wearable devices to bring external health data into the community ecosystem.

Result: This shift from being a 'space provider' to a 'community and content hub' had a measurable impact:

- Member retention rates increased by an estimated 22% year-on-year for cohorts post-implementation.

- The app increased engagement touchpoints from once or twice a week (gym visits) to near-daily interactions.

- It created a defensible moat; members were no longer just paying for equipment, but for a connected social fitness network, reducing price sensitivity.

Takeaway: For investors, this case underscores that in a low-differentiation market, technology deployed to enhance human connection and habit formation is a powerful lever for value creation. The asset is not the treadmill; it's the engaged community using it. Australian businesses in any service sector can learn from this: leveraging digital tools to deepen, rather than replace, human-centric engagement is a sustainable growth strategy.

The Investment Lens: Pros & Cons of the Fitness & Wellness Sector

Evaluating companies in this space requires a clear-eyed view of its structural dynamics.

✅ Pros:

- Recurring Revenue Model: Subscription-based memberships (gyms, apps) provide predictable, high-margin cash flow from a committed base.

- Megatrend Alignment: Permanently anchored to the long-term, non-cyclical trends of health consciousness, preventative care, and an ageing population seeking active longevity.

- High Margin Potential: Once initial infrastructure (studio, app platform) is built, scaling digital content or adding members has low marginal cost.

- Data-Rich Environment: Successful companies generate valuable first-party data on consumer health habits, enabling personalisation and potential new revenue streams.

❌ Cons:

- Extreme Cyclicality: Revenue and marketing efficiency are highly seasonal, making quarterly comparisons misleading and demanding strong cash flow management.

- High Churn & Customer Acquisition Cost (CAC): The "resolution effect" forces continuous investment in marketing to replace lapsed users, threatening unit economics if lifetime value (LTV) isn't sufficiently high.

- Regulatory Scrutiny: From my experience supporting Australian companies, the ACCC maintains a close watch on the fitness industry, particularly regarding contract transparency, cancellation terms, and direct debit practices. Regulatory risk is a constant factor.

- Low Barriers to Entry (in some segments): The rise of at-home fitness (post-pandemic) and influencer-led programs increases competition and fragments the market.

The Future of Fitness Investment: Beyond the Resolution Cycle

The forward-looking investor must focus on companies innovating to flatten the resolution curve and build perennial engagement. Key trends include:

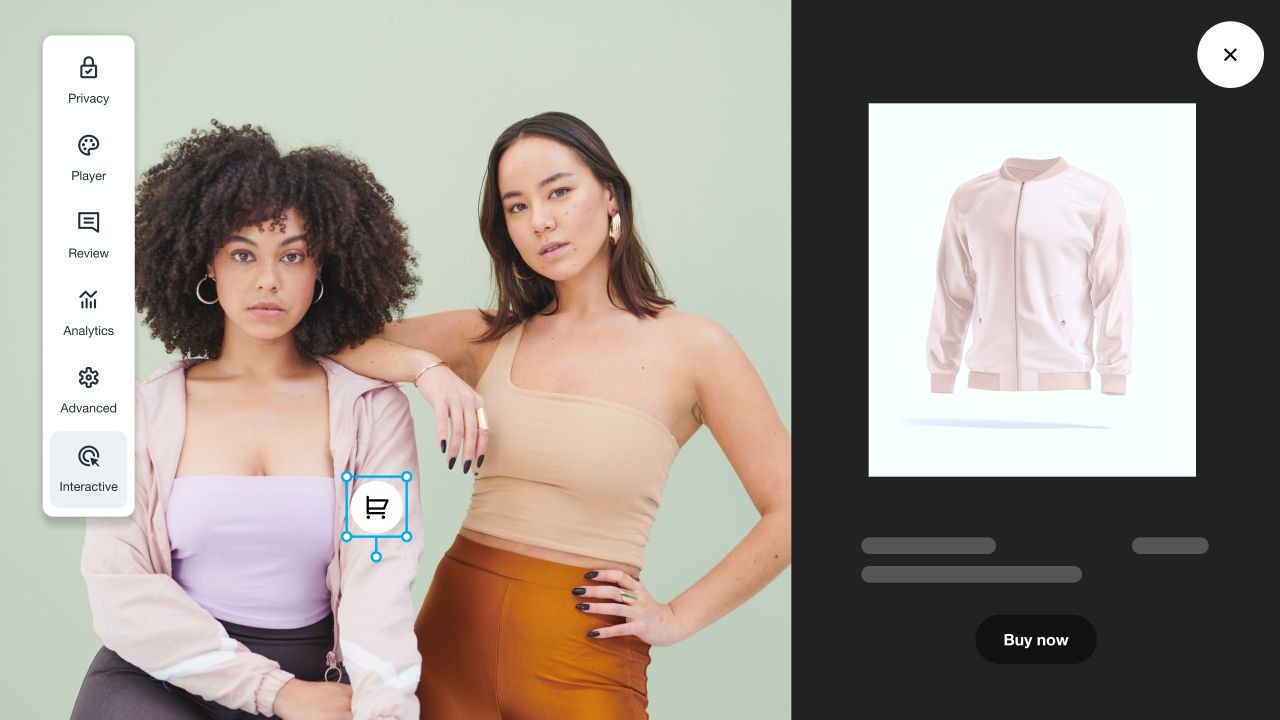

- Hybridisation as Standard: The winning model is no longer purely physical or digital. It's a seamless omnichannel experience. Expect growth in platforms that integrate in-studio classes with at-home streaming, wearable data, and nutrition tracking—all on a single subscription.

- Precision Health Integration: The next frontier is the merger of fitness with healthcare. Companies that can partner with corporate health programs, private health insurers, or GP networks to offer prescribed exercise will tap into a more stable, less cyclical funding source. The Australian Government's focus on preventative health, as outlined in the 2023-2033 National Preventive Health Strategy, creates a tailwind for this integration.

- Gamification and Social Capital: Advanced gamification—where workouts earn redeemable rewards, and social accountability is baked into the product—will be a key retention tool. The value shifts from physical outcomes to social and experiential rewards.

- AI-Powered Personalisation: Static workout plans are obsolete. The future lies in adaptive AI coaches that adjust routines daily based on sleep data, recovery metrics, and personal goals, making the service uniquely valuable and 'sticky'.

Actionable Insights for the Australian Investor

When analysing a potential investment in this sector, move beyond top-line membership numbers. Conduct deep due diligence on:

- Cohort Analysis: Demand to see retention curves broken down by acquisition month. A company with strong December or July cohort retention is inherently more valuable than one reliant on January spikes.

- LTV:CAC Ratio: Insist on a clear calculation. A sustainable model in this industry typically requires an LTV that is at least 3x the CAC. Be wary of companies spending heavily on Q1 marketing without the retention metrics to justify it.

- Community Metrics: Ask for data on community engagement—app open rates, social feature usage, completion rates for challenges. These are leading indicators of retention, whereas financials are lagging indicators.

- Regulatory Posture: In practice, with Australia-based teams I’ve advised, a proactive approach to ACCC compliance is a sign of mature management. Review their terms of service, cancellation policies, and complaint history.

People Also Ask (PAA)

What is the most successful type of New Year's resolution? Data consistently shows that specific, measurable, and socially-supported goals have the highest success rate. For businesses, this translates to products that facilitate tracking, milestone setting, and community accountability, rather than offering vague "get fit" promises.

How does the Australian fitness market compare globally? Australia has one of the highest gym membership penetrations per capita globally, but also experiences intense competition and price pressure. The market is advanced in adopting digital integration, making it a leading indicator for hybrid fitness trends that will emerge elsewhere.

What are the biggest mistakes investors make in the wellness sector? The primary mistake is overvaluing user growth and undervaluing user depth. Investing in a company with 500,000 highly engaged users is often superior to one with 5 million passive subscribers, as the former has greater pricing power, lower churn, and more potential for revenue expansion.

Final Takeaway & Call to Action

The narrative of failed New Year's resolutions is not a story of consumer weakness, but a map of market inefficiency. For the astute investor, the significant opportunity lies not in capturing the January surge, but in funding the companies that solve for the February fade. The winners will be those that architect for habit, build communities, and leverage data to transition users from motivated resolutioners to ingrained practitioners. Look for businesses with the metrics that prove they've broken the cycle—where customer lifetime value is built on daily engagement, not annual intention.

Your due diligence starts now: Pick one ASX-listed or private company in the health and wellness space. Analyse their public statements or, if possible, their metrics through the lens of cohort retention and community engagement. Does their growth story rely on the perpetual new year, or have they built a model for every day thereafter? Share your analysis and insights in the comments below.

Related Search Queries

- Australian fitness industry statistics 2024

- Gym membership retention rates Australia

- Best performing ASX health and wellness stocks

- ACCC gym membership contract rules

- Future of hybrid fitness models

- How to calculate LTV for subscription business

- Australian preventative health strategy investment

- Top fitness apps for user engagement Australia

For the full context and strategies on How Many Australians Actually Stick to Their New Year’s Fitness Resolutions? – What It Could Mean for Everyday Australians, see our main guide: Fossil Fuel Mining Videos Australia.